Oman oil production relies heavily on ESPs

Electrical submersible pumps (ESPs) play an important role in Oman because the pumps lift about 46% of the 780,000 bo/d of oil and condensates produced in the country. And plans call for the number of ESPs installed to increase significantly over the next few years as secondary and tertiary oil recovery operations become even more dominant.

Petroleum Development Oman LLC (PDO) operates most of the oil production in Oman. PDO is a joint venture among the government of Oman, 60%, Royal Dutch/Shell Group, 34%, TotalSA, 4%, and Partex (Oman) Corp., 2%. Shell is the technical advisor.

Operations

Oman borders Saudi Arabia, Yeman, and UAE (Fig. 1) and is about the same size as the state of Kansas. It has about 2.5 million inhabitants and the population is growing at 3%/year. Oman derives more than 75% of its national income from hydrocarbons.

PDO produces about 720,000 bo/d and 60,000 b/d of condensate from more than 117 fields through 66 producing stations. The country has more than 3,000 active wells, of which about 800 have ESPs. Most fields are water flooded (Fig. 2).

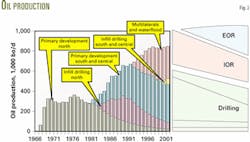

Estimates indicate that Oman contained about 50 billion bbl of original oil in place (Fig. 3). To date, about 13% of this volume has been produced. The country aspires to recover about 50% of the original oil in place by following a strategy that includes:

- Infill drilling.

- Well and reservoir management of existing wells.

- Improved oil recovery, mainly through waterflooding.

- Enhanced oil recovery through steam and miscible hydrocarbon floods.

All these activities require modern technology and a skilled workforce to limit development and production costs.

Oman also produces both associated and non-associated gas. PDO operates the gas production, although the government of Oman owns 100% of the gas produced. The country produces enough gas to supply domestic needs and to feed the existing LNG Trains 1 and 2. It also has enough gas for future expansions.

Oman has to live within its existing hydrocarbon portfolio and develop these resources to their greatest extent, unlike multinational companies that can grow through mergers and acquisitions.

Currently PDO focuses on:

- Delivering the 2003 production and reserve targets.

- Positioning for the future by implementing portfolio management, well and reservoir management, and waterflooding.

- Improving organization capabilities, mainly by ensuring that it has people with the right skills. PDO is keen on local staff playing a major role in the oil industry, and it has implemented a program that includes extensive classroom and on the job training.

Field development

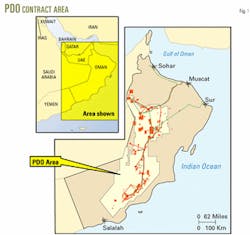

Oman began exporting oil in 1967. As in most countries, the first stage of field development involved primary oil recovery followed by infill drilling.

The fields in the north of the country were the first to be developed. This was followed by discoveries in south and central Oman in the 1980s. These fields also went through the primary oil recovery stage, followed by infill drilling.

The current stage involves drilling multilateral wells and waterflooding, with most wells having horizontal laterals.

Over the next 10 years, development plans call for:

- Continuation of infill drilling.

- Improved oil recovery mainly through waterflooding.

- Enhanced oil recovery in heavy oil areas. PDO has completed some pilots and has started initiating full-scale projects in two areas.

ESPs are in all areas of Oman.

North Oman has carbonate reservoirs at shallow depths of about 5,000 ft. Most wells in the fields are horizontals with some vertical wells.

Both sandstones and carbonates produce in central Oman. The area has many multilateral wells that in some cases include injectors with seven legs and producing-injection horizontal pairs.

South Oman mostly has sandstone reservoirs that are produced through horizontal wells.

ESPs

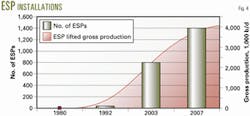

In 1980, PDO had only 2 ESPs installed in Oman. This has increased to about 800 ESPs currently and plans call for about 1,400 ESPs to be installed by 2007 (Fig. 4).

PDO drills about 250 wells/year and most new wells are completed with ESP's primarily because of the need to produce large gross fluid volumes with high efficiency. The pumps currently lift a gross volume of about 2 million b/d and this will double to about 4 million b/d in the near future.

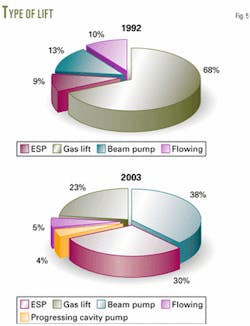

In 1992, most PDO wells were on gas lift because, at that time, gas was available and ESP designs provided limited gas handling capability and material selection.

PDO increased it use of ESPs as a result of technological improvements that made them cost effective for handling various well conditions, most recently in terms of sand, water, and gas handling. In 2003, about 32% of its wells have ESPs with only 18% being on gas lift (Fig. 5).

PDO also is investing in other artificial lift methods, especially beam pumps and lately progressing cavity pumps (PCPs and ESPCs), but only some have been installed.

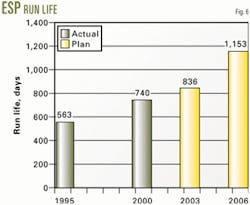

Together with its ESP partners, PDO is trying to increase the ESP run life that currently averages 2 years (Fig. 6). It believes that run life can increase to 3 years through joint efforts with vendors, service companies, universities, etc.

PDO's experience with ESPs can be divided into three components: operational, contractual, and technical.

Operationally, PDO has a dynamic environment that makes standardization difficult.

Because PDO is keen to improve well performance, one producing field may have a variety of different completion equipment. This sometimes appears chaotic but in reality it allows for quick improvements to be made.

PDO has limited data available in some wells because of its zeal in bringing horizontal wells to production. Data collection in horizontal wells also requires extra costs.

Because of the large number of artificial lift systems, PDO has formed a dedicated artificial lift group to provide added focus and improve life cycle management.

Contractually, PDO has moved towards lease contracts.

It leases about 80% of the units. The remaining 20% are in new fields in which it has not established benchmarks, although purchasing may not be the best option.

The lease contract is complex but PDO tries hard to simplify it to ensure that people are spending their time on increasing production rather than on managing the administrative part of the contract.

The lease contract to some extent has challenged the ESP partners, and they have had to make structural changes in their operations.

One problem still faced is to balance run life with maximum fluid production. This problem requires a win-win solution.

The ESP partners still primarily focus on their product but it is desired that they also balance this with maximizing fluid production.

The future in PDO depends on integrating the production system approach not only for artificial lift but services and solutions that are aligned in terms of ESP run life and obtaining maximum production at the lowest per barrel lifting cost. There is no room for selling pumps only.

Regarding the technical aspects, the majority of PDO wells are horizontals and PDO has started to aggressively collect well data.

It also has a focus on proactively pulling out of hole ESPs that have had long run times and for which reliability data analysis indicates a likelihood of failure.

This has been shown to be economic even in wells that produce more than 3,000 bo/d.

Training of local staff is critical to PDO. It now has a career path for ESP specialist, similar to that for rotating equipment specialist. PDO needs more ESP experts, but they are difficult to find.

Based on a presentation to the 20th Annual Electric Submersible Pump Workshop, Houston, Apr. 30-May 2, 2003.

The author

Saif H. Al-Hinai is oil director for Petroleum Development Oman LLC, with particular responsibility for the northern assets that produce 307,000 bo/d. Saif has more than 21 years experience in technical and managerial positions in the oil field. His experience includes working as a petroleum engineer for Shell Oil Co. in Bakersfield steamfloods and in West Texas CO2 floods. Al-Hinai has a BS in petroleum engineering from Imperial College, University of London.