Market Movement

Middle East terrorist attacks push up oil prices

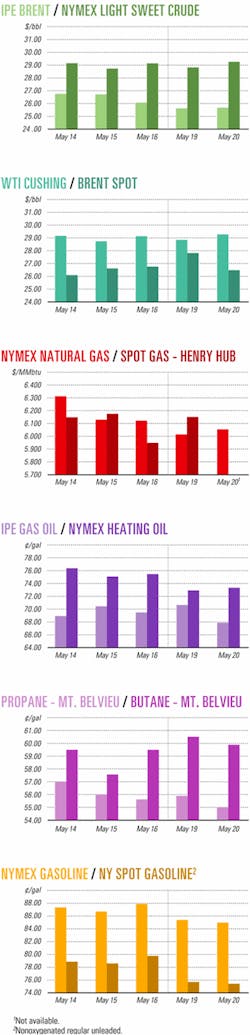

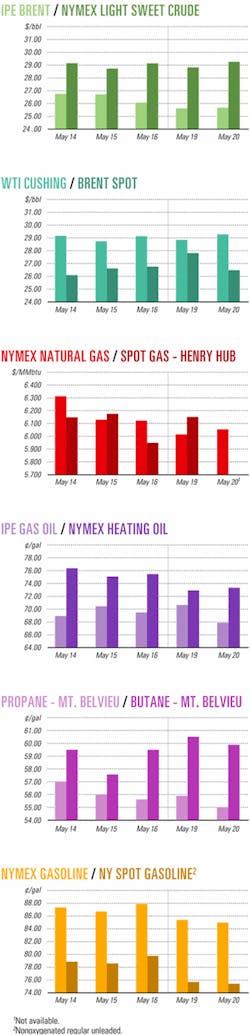

The recent surge in terrorist activities in the Middle East helped push up oil futures prices over the last 2 weeks, with jittery traders also worried by low US inventories of oil and petroleum products.

The White House last week raised the US terrorist alert level to orange, the second highest level of alert in the five-step alert system (OGJ Online, May 20, 2003).

Middle East bombings

The heightened alert was prompted by suicide bombings across the Middle East. Saudi Arabia Ambassador to Washington Prince Bandar bin Sultan suggested that the suicide bombers who targeted Riyadh could be planning a bigger operation.

The US and UK temporarily closed their embassies and consulates in Saudi Arabia because of "imminent" terrorist threats. Saudi and US officials said they had intelligence that Osama bin Laden's Al Qaeda group might attack the US or US interests overseas.

However, at a May 21 energy conference in Houston, former US Sec. of Energy James Schlesinger, now a senior advisor at Lehman Bros., New York, said that recent bombings in the Middle East are evidence that the US has broken Al Qaeda's former power. Because US officials have made it harder for terrorists to operate in the US, Schlesinger said, Al Qaeda is now hitting "soft" targets in the Middle East, where it has more support among Moslem residents.

OPEC outlook

The rise in oil prices also has been prodded in part by continued talk of another cut in production quotas among the 10 active members of the Organization of Petroleum Exporting Countries. Meanwhile, there are increasing signs that Iraq won't resume its prewar level of oil production as quickly as many had assumed.

Still, the Centre for Global Energy Studies in London said early last week that the 10 active OPEC members, minus Iraq, will need to cut their combined production by nearly 3 million b/d from some 27 million b/d "if they are to keep oil prices close to their target level" during the last half of this year.

Because of current low stocks of both crude and petroleum products among major oil-consuming countries, they said, the world can absorb 26.4 million b/d of OPEC oil through the second quarter of this year. However, they said, "The picture will look very different" in the third quarter. At their June meeting, analysts predict, OPEC members consequently will have to reduce their aggregate production to 24 million b/d, effective July 1.

Natural gas

Higher crude prices generally have added momentum to natural gas prices, "which have surged 16% over the past 2 weeks as concerns mount regarding the ability to refill US gas storage by next winter," said Robert S. Morris, an analyst at Banc of America Securities LLC, New York, in a May 19 report.

Meanwhile, a survey by Raymond James & Associates Inc., St. Petersburg, Fla., of 50 of the biggest US producers indicates that US gas production during the first quarter of this year increased from the fourth quarter of 2002, "breaking the trend of lower production in place for the previous 6 consecutive quarters," said J. Marshall Adkins, an RJA analyst in Houston. It also appears that first quarter production declined "only 2.3%" from the same period a year ago vs. a decrease of more than 6% "in late 2002."

However, Adkins said the rise in first quarter production was the result of "one-time events," primarily the return of production in the Gulf of Mexico that was shut in by storms during fourth quarter 2002. "We estimate that these storms knocked out about 2%, or 1 bcfd, of US gas production for the fourth quarter," he said.

As the price for natural gas has risen, processing companies have stopped stripping out natural gas liquids to increase gas volumes and btu content. That probably increased gas production by 500 MMcfd for the quarter, or 1 bcfd, compared with a year ago, Adkins said.

"Much lower" gas storage levels and pipeline pressures also allowed more gas to flow into the system in 2003, he said.

"Even though (the) first quarter gas production data hint at an improving US gas supply situation, we remain more convinced than ever that the US is facing a supply-driven chronic gas shortage scenario for the next several years," Adkins reported.

With gas supplies still dwindling despite an uptick in drilling activity, he said, "The only solution is a market-induced 'rationing' of available natural gas through higher prices." As a result, RJA increased its 2004 gas price forecast to $6/Mcf from $5/Mcf previously.

Industry Scoreboard

null

null

null

Industry Trends

THE UK has regained first place in an international survey of countries favored by international oil companies for new exploration and production investment in 2003, said a recent survey by UK consultant Robertson Research International Ltd.

Despite a tax hike in 2002, the UK rose from second place in last year's survey to succeed Libya for the top slot in 2003, Robertson said. The International New Ventures Survey polled more than 200 oil companies in 147 countries outside North America.

After 3 years at the top, Libya placed third. Australia, with an infrastructure similar to the UK and equally stable terms, moved up from third position in 2002 to second place in 2003.

An aggressive promotional campaign, good infrastructure, and a relatively low tax environment make the UK an increasingly attractive global destination for new nentures explorers, Robertson said.

UK Energy Minister Brian Wilson said, "For the first time in 5 years, the UK continental shelf is now recognized, outside North America, as a global center for new ventures."

The Middle East remains the most popular region for new ventures despite recent political upheavals. Robertson noted opportunities remain restricted in the Middle East, and sanctions against Iraq currently make it difficult for outside companies to invest there.

"Qatar makes a staggering leap from No. 9 to fourth position overall: a rise that's even more remarkable when you consider that it wasn't even in the top 20 just 3 years ago," Robertson said.

INDEPENDENTS increasingly are making their presence known in the UK North Sea by buying the integrated oil companies' interests there.

Robert E. Patterson, a lawyer with Vinson & Elkins LLP's London office, expects this trend to continue for at least a year.

"Are the independents scavengers or mature field experts? It depends on whom you ask. There is a time in the life of every field when you need a different type of operator," Patterson said during a May 15 presentation at his company's Houston office.

Upstream consolidation has resulted in the majors trying to fulfill spiraling production growth goals. Consequently, many of them no long consider declining North Sea fields to be a good investment.

Meanwhile, Apache Corp., Houston, entered the North Sea with its purchase of 96.14% of the Forties oil field from BP PLC (OGJ, Jan. 20, 2003, p. 32), and UK independent Perenco PLC has bought North Sea properties from both BG Group PLC and BP (OGJ, May 19, 2003, p. 39).

Government Developments

US ENVIRONMENTAL PROTECTION AGENCY Administrator Christie Whitman has submitted her resignation, effective June 27, saying she wants to spend time with her family.

"As rewarding as the past 21/2 years have been for me professionally, it is time to return to my home and husband in New Jersey, which I love just as you do your home state of Texas," Whitman wrote in a May 21 resignation letter to President George W. Bush.

In order to accept the EPA job, Whitman had resigned as governor of New Jersey. Some environmental groups criticized her for reducing New Jersey's environmental budget and lowering fines for polluters.

Some environmentalists also criticized Whitman's leadership of the EPA, claiming she promoted the Bush administration's business policies that often conflicted with environmental protection goals.

Whitman said her work was guided "by the strong belief that environmental protection and economic prosperity can and must go hand-in-hand."

She noted the agency played a role in responding to the terrorist attacks of Sept. 11, 2001, and the subsequent anthrax scare. "We also have added significantly to efforts to reduce the vulnerabilityUto terrorist attack," she said.

During her confirmation hearing, Whitman promised to enforce existing EPA regulations. But she also pledged to review some recent EPA rules, such as reducing the sulfur content of diesel fuel.

"Our actions to reduce pollution from nonroad diesel engines represent, in the words of one major environmental organization, the 'biggest public health step' in more than 20 years," Whitman said in her resignation letter.

THE ALASKA LEGISLATURE is considering a state severance tax credit that would provide credit of up to 40% for the cost of certain new exploration wells in Cook Inlet. If implemented, the measure would pertain to wells begun from July 1, 2004, to July 1, 2007.

The Alaska Senate passed Senate Bill 195, sponsored by Rep. Sen. Tom Wagoner, R-Kenai-Soldotna. Gov. Frank Murkowski supports the measure, which now goes before the House of Representatives for its consideration.

Murkowski said the proposed tax credit would make exploration costs in Alaska more competitive with exploration costs elsewhere in the world (OGJ, Dec. 9, 2002, p. 18).

"In Azerbaijan, the cost of exploration is 5¢ on the dollar, because the government credits back 95¢. Here in Alaska, the only incentive we currently offer is the 35% federal tax credit. We have no comparable state incentive. So, at 65¢, we are among the highest cost, and least attractive, of all the oil provinces," Murkowski said.

The industry plans three or four exploration wells in Alaska this year, Murkowski noted. Meanwhile, industry drilled 2,524 exploration wells in Alberta last year. The proposed severance tax credit would provide a credit of 20% of the cost of wells drilled more than 3 miles from an existing well, and an additional 20% for wells drilled more than 25 miles from production facilities.

The credit could carry forward if not used by the company, and credit could be sold by a company that does not pay severance tax to one that does.

Quick Takes

INDIA has initiated New Exploration Licensing Policy IV (NELP IV), a new exploration program offering 24 blocks in both proven and highly prospective areas, including ultradeepwater blocks. Areas offered include 11 onshore blocks, 1 block offshore in shallow water, and 12 deepwater blocks.

The NELP IV road show kicked off in New Delhi May 20, to be followed by showings in London June 5-6, Calgary June 9-10, Houston June 11-12, and Perth June 26-27.

Under the NELP program, large deepwater gas discoveries have been made in the Krishna-Godavari basin in less than 3 years, with nine discoveries having initial in-place resources of more than 300 million tonnes of oil and oil-equivalent gas.

Tests by Vintage Petroleum Inc., Tulsa, of its second appraisal well—drilled to evaluate the subsalt Lam formation of its An Nagyah 2 discovery in Yemen—indicate the continuity of productive oil and gas sands over that structure and "the potential of a new exploration play in the Sab'atayn basin," company officials said. "Our focus will be to complete the technical and economic evaluation required to determine if sufficient reserves and long-term production rates exist to justify field development," said Vintage CEO S. Craig George. The An Nagyah 4 appraisal well, drilled to 5,074 ft TD, tested 45° gravity oil from the Upper Lam formation. Electric log and pressure analysis indicated a gas-bearing interval of 115 gross ft and an oil-bearing interval of 191 ft., officials said. A 99 ft interval in the Upper Lam was perforated at 3,385-493 ft and tested at a stabilized rate of 1,320 b/d of light, water-free oil and 800 Mcfd of gas, with 335 psi flowing tubing pressure. The Upper Lam interval tested in the appraisal well correlates to the interval in the discovery well that tested 1,091 b/d of oil, officials said (OGJ Online, Dec. 11, 2002). The appraisal well encountered the Lower Lam formation downdip and below the water-oil contact and therefore was not tested. The first appraisal well, An Nagyah 3, tested in the Lower Lam formation in a structural position above the water-oil contact at 205 b/d. Vintage is operator with 75% working interest in the 85,000 acre S-1 Damis Block. In other exploration activities, El Paso Production Co., Houston, has made a natural gas discovery with its No. 1 Mound Point prospect well on state Lease 340 off Louisiana. The deep shelf wildcat was drilled to 19,024 ft MD. Evaluation of logs and cores indicated three Middle Miocene sands containing a total of 111 ft of net natural gas pay, according to partner Noble Energy Inc., Houston. El Paso plans to commence production early in the fourth quarter.

Noble Energy recently spudded a well on a deep shelf prospet in the Gulf of Mexico. The well, on Eugene Island Block 317, will be drilled to 18,500 ft TD. Noble Energy is the operator with a 66.67% working interest, and Spinnaker Exploration Co., Houston, holds 33.33%. Statoil ASA and Royal Dutch/Shell have concluded an agreement whereby Statoil will acquire a 25% interest in Block BM-C-10 off Brazil. Shell will retain 40% of the block, and the German firm Wintershall AG holds 35%. The license, in a little-explored deepwater area in 2,900 m of water off Rio de Janeiro, covers 1,921 sq km and is close to the productive area of the Campos basin. The first wildcat on the block, 1-Shell-14-RJS, was spudded Apr. 25 and targets a potential oil prospect. The agreement is dependent on approval by Brazil's National Petroleum Agency.

STATOIL ASA installed an 11,000 tonne topsides onto the Kvitebjørn platform in the North Sea May 16. The topsides are on a 220 m tall, two-section steel jacket, installed by the Saipem 7000 crane ship.

The drilling derrick and mud module will be lifted immediately, followed by an extra living quarters module, the flare boom, and several smaller modules before hook-up and completion.

Production from Kvitebjørn, which is estimated to contain 55 billion cu m of gas and 22 million cu m of condensate, is slated to start up Oct. 1, 2004.

DOW CHEMICAL CO. awarded a contract to Pasadena, Calif.-based Jacobs Engineering Group Inc. to provide engineering and procurement services for a new 385 million lb/year polyethylene terephthalate (PET) production chain at Dow's Buna Sow Leuna Olefinverbund GMBH site at Schkopau, Germany.

Jacobs said it would also undertake engineering services management of the project's three technology suppliers.

The PET chain, which is being added to Dow's existing PET plant at the site, is expected to go on stream by yearend 2004.

Dow and Kuwait Petroleum Corp.'s petrochemical arm Petrochemical Industries Co. (PIC) plan to construct Olefins II, a new ethylene and derivatives complex in Shuaiba, Kuwait. Dow said start-up is anticipated in early 2007. Olefins II will have an 850,000 tonne/year ethane cracker and a world-scale, 600,000 tonne/year ethylene oxide-ethylene glycol plant. Existing polyethylene capacity will be expanded to utilize the additional ethylene. PIC and Dow also expect to build a 300,000 tonne/year ethylbenzene-styrene unit supplied with ethylene from Olefins II and benzene from a PIC aromatics project, to be built simultaneously on the site.

OMAN has contracted Mitsui OSK Lines (MOL) of Japan to develop its ocean transport industry, particularly LNG shipping. In March, Oman, MOL, and Mitsui & Co. Ltd. signed a memorandum of understanding for the acquisition of the Muscat, a 145,000 cu m Moss-type LNG carrier to be constructed by Kawasaki Heavy Industries Ltd. (KHI), with delivery set for March 2004. The new vessel is to enter into a long-term time charter agreement with Oman.

In addition, Samsung Heavy Industries Co. Ltd. of South Korea and a Japanese consortium of Mitsubishi Heavy Industries Ltd. and KHI will design and construct two new LNG carriers for the Omani government, which retains the option of adding two more ships later.

The first vessel will be delivered December 2005, and the second, in third quarter 2006.

The vessels, costing just less than $150 million each, will serve Oman's LNG Train III currently being built at Qalhat in the Wilayat of Sur, adjacent the existing two-train Oman LNG facility.

The new train, expected to come on stream by yearend 2005, will add an additional 3.8 million tonnes/year (mty) of LNG to boost the plant's overall capacity to more than 10 mty of LNG.

Nigeria LNG Ltd. (NLNG) has stepped up its presence in the US spot LNG cargo market following an agreement to supply BG LNG Services (BGLS) with 3 billion cu m/year of LNG for 20 years. BGLS is the US arm of BG Group PLC. NLNG will ship LNG from Trains 4 and 5 at Finima, Bonny Island, to Lake Charles, La. Trains 4 and 5 are expected to come on stream in 2005. Each train has a capacity of more than 4 mty of LNG and 0.5 mty of LPG. The agreement also allows BGLS to lift, starting at yearend, excess volumes from Trains 1, 2, and 3 that are not taken by NLNG's existing long-term buyers. BGLS and NLNG expect to conclude a definitive sale and purchase agreement and obtain all relevant authorizations by the third quarter.

AMINEX PLC, London, let a contract to the Dafora Group of Romania for use of an F200 rig to drill two wells, with an option for two more wells to be drilled on the Nyuni license off Tanzania.

Nyuni 1 is to be spudded in August, and drilling on the first two wells will continue into early 2004. The wells, costing a total $10 million, will test separate structures. The Nyuni license is adjacent to coastal Songo Songo gas field, currently under development, which has 1 tcf of natural gas reserves (OGJ Online, Oct. 23, 2001).

Aminex took a farmout on 30% of the Nyuni license from Petrom SA last December.

The wells will be the first drilled off Tanzania in 12 years, Aminex said. F

CONOCOPHILLIPS ALASKA and Anadarko Petroleum Corp. plan to increase oil production in Alpine field on Alaska's North Slope starting in late 2004.

The $60 million Phase I Alpine Capacity Expansion Project (ACX1) will boost the field's 100,000 b/d oil production by 5,000 b/d.

The project also will increase water and gas-handling capacities at the processing plant, and additional expansion opportunities are being studied.

NANA-Colt Engineering LLC, Anchorage, is performing ACX1 design engineering, after which truckable module fabrication bids will be requested. VECO Alaska Inc. will handle ACX1 North Slope construction.

PREMCOR INC., Old Greenwich, Conn., plans to enlarge its heavy crude oil refinery in Port Arthur, Tex., to increase oil throughput capacity to 325,000 b/d from 250,000 b/d.

About 80% of the oil the refinery currently processes is heavy, high-sulfur crude oil, with the remaining 20% medium-sulfur, medium-gravity crude. The project will enable Port Arthur to process 300,000 b/d of totally heavy, high-sulfur crude.

Premcor also will expand the refinery's coker unit to 105,000 b/d from its current capacity of 80,000 b/d.

The $200-220 million project is scheduled for completion in fourth quarter 2005.

JGC Corp. and partner Yokohama-based Chiyoda Corp. have signed an $875.48 million contract with Oman for the construction of a refinery at Sohar, 250 km northwest of Muscat. The refinery will have a 116,400 b/d crude unit and a 75,260 b/d residue fluid catalytic cracking unit. JGC will provide state-run Sohar Refining Co. (SRC) with design, equipment and material procurement, construction, and commissioning services. JGC earlier undertook the front-end engineering design for the project, while ABB Lummus is the project management consultant. Onsite construction is expected to start in the fourth quarter, with commercial start-up expected by second quarter 2006. Development of SRC will be closely linked to the Oman Refinery Co. (ORC), which will own both the refineries' feedstock and products. SRC propylene will be used as feedstock for the $200 million Oman Polypropylene project being developed adjacent the refinery. A planned 260 km, 24-in. pipeline will carry feedstock to the refinery. Engineering consultant ILF & Partner, Munich, will undertake the engineering design and route optimization studies for the $80-100 million pipeline and the design of a pumping station at Mina al Fahal and a booster pump, if necessary.

TEPPCO PARTNERS LP is planning to add 80 miles of pipeline loop on its mainline from Green River basin fields to Opal, Wyo., and on the Jonah gas gathering system in Pinedale and Jonah fields in southwestern Wyoming.

The $65 million Phase III expansion also calls for addition of 3,200 hp of compression to the system and construction of a new 250 MMcfd "Pioneer" gas processing plant near Opal.

Upon completion of the expansion in the fourth quarter, total system capacity will be 1.18 bcfd of gas.

Duke Energy Field Services LP is operator of the Jonah system.

Florida Gas Transmission Co. (FGT), having completed the final stage of its Phase V expansion project, now has construction under way on a $105 million Phase VI expansion—the addition of 121 MMcfd of capacity, with 33 miles of new pipeline and 18,600 hp of compression at existing compressor station sites on its Florida system. The project has planned phased in-service dates of June 1 and Nov. 1. By fall, FGT's total capacity will be increased to 2.1 bcfd. FGT's completed Phase V project—the addition of 166 miles of pipeline and 133,000 hp of compression—now provides 428 MMcfd of incremental firm gas transportation service. El Paso Corp. subsidiary Wyoming Interstate Co. Ltd. launched an open season earlier this month and said there is insufficient market interest for it to reverse flow and extend its natural gas pipeline in Wyoming to the Overthrust Pipeline at Kanda, Wyo., or to Kern River Pipeline. WIC said it would hold another open season later this summer.

VOPAK SHANGHAI LOGISTICS CO. LTD. has awarded a turnkey contract to Chicago Bridge & Iron Co. NV, The Woodlands, Tex., to design and build a liquid butane storage facility at the Shanghai Chemical Industrial Park in Caojing, Shanghai, China.

CB&I will supply a full-containment, double-wall, insulated steel tank to store 50,000 cu m of liquid butane at –4° C., including its design, fabrication, procurement, erection, painting, insulation, and commissioning. CB&I also will provide the facility's foundation, civil, structural, piping, mechanical, electrical, and instrumentation works, including an open-loop butane refrigeration system. It is to be completed within 18 months after award.