Lehman: Increases slight for 2003 global E&P outlays

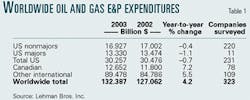

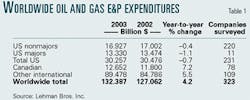

Worldwide exploration and production budgets are expected to increase by 4.2% to $132.4 billion in 2003 vs. those for 2002.

E&P expenditures outside the US and Canada are expected to remain "solid" in 2003, increasing by 5.5%, while E&P spending in the US is forecast to decline by 0.7% this year (Table 1). Canada, meanwhile, will be a "relative bright spot for 2003," with E&P outlays estimated to rise 7.2%.

These were some of the key findings of Lehman Bros. Inc.'s semiannual E&P spending survey, which polled 323 companies worldwide during Nov. 15-Dec. 10, 2002, including privately held US and Canadian independents and numerous state-owned oil and gas firms. Lehman released the survey Dec. 13.

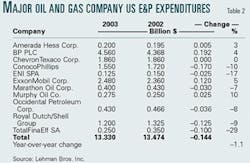

Major oil firms are implementing some of the largest spending cutbacks in the US, said James Crandell, oil services and drilling analyst for Lehman. The 11 major oil companies surveyed are expected to cut their US E&P outlays by an average of 1.1%, Crandell said (Table 2). This decline among the majors was due to a combination of cuts by companies such as ConocoPhillips, Royal Dutch/Shell Group, TotalFinaElf SA, Marathon Oil Corp., and Occidental Petroleum Corp.

Independents, meanwhile, are expected to spend 0.4% less in 2003 compared with 2002. The "disappointing results in the US" are being driven by several factors, Crandell noted. These include:

Major oil firms and larger independents are continuing to spend a higher budgetary percentage outside the US.

Independents continue to use "conservative oil and natural gas price forecasts" in figuring their budgets and "are looking at little upward change in cash flow," Crandell said.

Balance sheet limitations.

The lack of "quality prospects."

The companies surveyed based their 2003 budgets on an average West Texas Intermediate oil price expectation of $23.22/bbl. "Should (WTI) average $20/bbl through 2003U37% of the companies surveyed indicated that they would cut back spending," Crandell said.

"This (oil price expectation) is up 10.1% from last December's expectation of $21.09/bbl, however, 15% below the (then) current price," he added.

Those companies surveyed based their 2003 budgets on a Henry Hub natural gas price of $3.42/Mcf, with the most common forecast being $3/Mcf. This price is up from the $2.83/Mcf for 2002, Crandell said. Of the companies surveyed, 33% said that an average of $3/Mcf in 2003 would influence their E&P outlay plans negatively.

"The economics of drilling are seen as favorable to that of purchasing by 71% of companies operating in the US, 74% of the companies operating in Canada, and 88% of the companies operating outside (the US and Canada)," Crandell said.

Only 23% of E&P companies plan to spend more than their cash flow in 2003, Crandell said. Also, 3D and 4D seismic, horizontal and directional drilling, fracturing, and intelligent well completions were among the most frequently cited technologies that are influencing the E&P business, Crandell said.

Three quarters of the companies surveyed said that higher rig day rates would cause them to decrease spending in 2003. "As anticipated, demand for rigs continues to be price-elastic," Crandell said, with one quarter of those surveyed reckoning that "the economies of their drilling program can withstand a substantial price shock and remain profitable."

Spending outside US, Canada

The increase in spending outside the US and Canada was led by state-owned firms and European majors, Crandell said. Some of the greatest increases were seen by India's Oil & Natural Gas Corp., which was up by 152%, and by Trinidad and Tobago's state-owned oil company Petroleum Co. of Trinidad & Tobago Ltd., which rose 140%.

Among the "impressive gainers" based outside the US and Canada making significant increases in their E&P budgets in 2003 were: Petroleos Mexicanos, up 15% to $9.3 billion; Petroleo Brasileiro SA, up 10% to $4.4 billion; OAO Lukoil, up 10% to $1.65 billion; OAO Gazprom, up 33% to $2.3 billion; OAO Yukos, up 22% to $1.1 billion; Statoil ASA, up 13% to $1.8 billion; Norsk Hydro ASA, up 20% to $1.4 billion; Repsol-YPF SA, up 27% to $1.5 billion; and Pruessag Energie GMBH, up 32% to $185 million.

Among the supermajors, increases in spending outside the US and Canada for 2003 were led by ExxonMobil Corp., up 13% to $7.4 billion; BP PLC, up 4% to $4.9 billion; and ChevronTexaco Corp., up 3% to $4.2 billion. ConocoPhillips, meanwhile, remained flat at $2.7 billion, and Royal Dutch/ Shell Group was down 19% to $6.3 billion.

Other noteworthy budget cuts in E&P spending outside the US and Canada for 2003 were made by the following companies: BG PLC, down 29% to $1 billion; Chinese National Offshore Oil Corp., down 13% to $700 million; EnCana Corp., down 25% to $380 million; ENI SPA, down 15% to $4.1 billion; Kerr-McGee Corp., down 18% to $325 million; Nexen Inc., down 30% to $155 million; OAO Sibneft, down 11% to $625 million; and Talisman Energy Inc., down 4% to $790 million.

US, Canadian spending

Several major oil firms led the decline in E&P expenditure expectations within the US, Crandell noted. These included ConocoPhillips, down 10% to $1.6 billion; Royal Dutch/Shell, down 9% to $1.2 billion; TotalFinaElf, down 29% to $250 million; Marathon Oil, down 7% to $400 million; and Occidental Petroleum Corp., down 8% to $430 million.

Offsetting these declines were two majors that expected to increase E&P spending within the US: BP, up 4% to 4.6 billion, and ExxonMobil, up 5% to $2.5 billion.

Of the independents surveyed, those downscaling their US E&P outlays included Kerr-McGee, down 5% to $575 million; Unocal Corp., down 18% to $982 million; Noble Energy Inc., down 17% to $275 million; Nexen, down 31% to $275 million; J.M. Huber Corp., down 16% to $105 million; Pogo Producing Co., down 5% to $265 million; Spinnaker Exploration Co., down 17% to $270 million; and Swift Energy Co., down 17% to $100 million.

Among the independent firms that expected to increase their E&P spending within the US were: Burlington Resources Inc., up 43% to $392 million; Ocean Energy Inc., up 23% to $600 million; Pioneer Natural Resources Co., up 9% to $310 million; Apache Corp., up 7% to $440 million; and EOG Resources Inc., up 9% to $650 million.

Regarding Canadian E&P spending, Crandell said, "While companies in Canada are impacted by similar factors as those operating in the US, cash flows are generally up more due to the natural gas orientation of the region, and the geology is seen as more attractive, and more companies assess the economics of exploration as attractive."

Those firms planning increases in E&P spending in Canada in 2003 include Burlington Resources, up 14% to $547 million; Canadian Natural Resources Ltd., up 39% to $1.4 billion; EnCana, up 12% to $1.8 billion; ExxonMobil, up 5% to $725 million; Nexen, up 20% to $350 million; Penn West Petroleum Ltd., up 45% to $204 million; Petro-Canada, up 15% to $1.5 billion; and Shell Canada Ltd., up 5% to $310 million.

Those planning declines included ConocoPhillips, down 8% to $165 million; Forest Oil Corp., down 71% to $35 million; Murphy Oil Co., down 11% to $200 million; Paramount Resources Ltd., down 19% to $107 million; Unocal, down 16% to $142 million; and Vintage Petroleum Inc., down 18% to $50 million.