Market Movement

Oil futures prices waffle in indecisive market

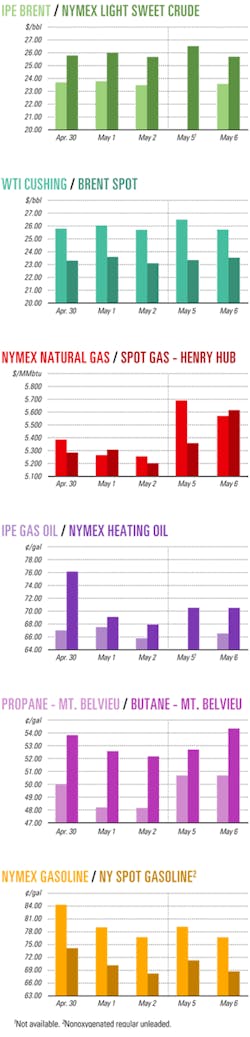

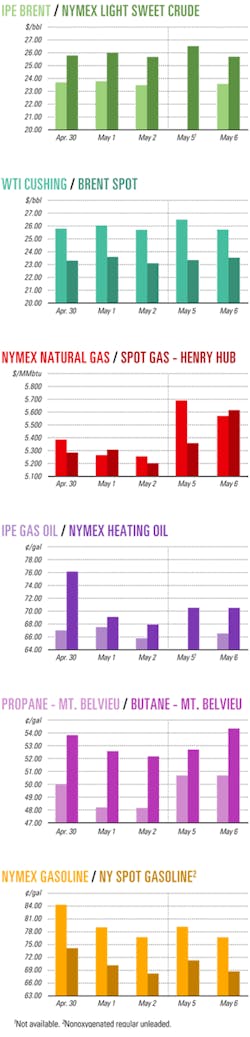

Futures prices for crude and petroleum products seesawed early last week, culminating in a midweek uptick when a big build in US oil inventories, anticipated by traders, failed to materialize.

Instead, the US Energy Information Administration said US crude stocks declined by 800,000 bbl to 287.2 million bbl during the week ended May 2. The American Petroleum Institute reported a fall of 2.4 million bbl to 286.2 million bbl for the same period. API said US gasoline stocks increased by 1.5 million bbl to 208.2 million bbl and that distillates were up 1.1 million bbl to 97.6 million bbl. EIA pegged the rise in gasoline stocks at 2.2 million bbl to 207.8 million bbl, with distillates increasing 1.4 million bbl to 97.3 million bbl.

"This week's [EIA] report continues the short-term bearish trend for refined products in particular," said Tyler Dann, Houston-based analyst with Banc of America Securities LLC, in a May 7 report. "We expect that [the Organization of Petroleum Exporting Countries] will continue to have a difficult time supporting crude prices as Iraq comes back online in a seasonally low demand environment with fundamentals generally weakening, as evidenced this week by the [reported] increases in light product inventories in the US."

However, Paul Horsnell at J.P. Morgan Securities Inc. in London claimed, "The numbers may not look like it at first glance, but they are extremely bullish data when compared with normal seasonal patterns. The problem is that total oil inventories have fallen at a time when they should be showing a rapid seasonal rise."

EIA reported total US commercial inventories declined by 700,000 bbl to 905.2 million bbl during the week ended May 2. But that, said Horsnell, "is a fall of 6.8 million bbl [nearly 1 million b/d] relative to the 5-year average. As a result, the deficit from the 5-year average has shot back up to 92 million bbl, meaning that all of the headroom gained by the inventory builds of 2 weeks ago has now been eroded."

Furthermore, he said, "Tightness is continuing to move out of crude oil and into oil products. Within oil products, only the gasoline figures are looking better. However, 1.8 million bbl of this week's 2.2 million bbl build occurred on the West Coast, an isolated market in terms of oil market logistics, and is thus less than exciting."

Horsnell said, "The market has been expecting large crude oil inventory builds over the last 2 weeks and has been disappointed. Imports are still running at high levels but are only enough to prevent the sharp acceleration in crude oil usage in refineries from pushing inventories further down."

Natural gas

Spurred by forecasts of above-normal temperatures in the eastern US and reports of reactor vessel problems at nuclear power plants in the southern US, the June natural gas contract jumped by 43.4¢ to $5.69/Mcf in light trading May 5 on the New York Mercantile Exchange.

Such a high price for gas hasn't been seen since mid-April, analysts at Enerfax Daily said last week. "Several key nuclear power units experienced outages in Texas, Florida, and South Carolina. Although volatilities have been low recently, they will likely increase dramatically in the coming days," they said.

Furthermore, Enerfax analysts said, "Lack of market participants exaggerated the rally. Many [former] trading companies are no longer around, so funds and locals have a much bigger market impact."

"We believe US natural gas prices are sustainable in the $4-6[/Mcf] range throughout 2003 and well into 2004, mainly because we expect a prolonged period of supply shortfalls," said analysts at A.G. Edwards & Sons Inc., St. Louis. In a recent report, they listed three factors contributing to tight US gas markets this year:

"Gas storage injections are likely to be relatively high this spring, but our working gas-in-storage forecast for Nov. 1 is still a very low 2.6 tcf," they said.

Some of the May 5 gain was lost in the next NYMEX session as traders grabbed profits ahead of the next government report on US gas storage. But the price inched up to $5.66/Mcf by midweek.

Industry Trends

null

null

null

CANADIAN oil and gas royalty income trusts might look internationally for future acquisitions because of stiff competition for oil and gas assets within Canada.

Frank J.D. Sayer of Calgary-based Sayer Securities Ltd. said trusts are apt to seek acquisitions in politically stable countries where credit rating agencies say risk is minimal. "Countries or regions such as the US, Australia, and Western Europe could be ideal areas," he said.

Five trusts already trade units on US stock exchanges. "American investors may find an RIT more appealing if it has assets in their country," Sayer said.

In the last 3 years, the number of trusts in Canada has risen 77% and acquisition prices increased by 32%, he said.

This has caused "some RITs to search out every opportunity for assets that are more easily available and lower priced," Sayer said.

RITs' acquisition of public oil and gas companies has been a major driver behind the growth of trusts, Sayer noted. During 2000-02, RITs purchased $7.9 billion (Can.) in Canadian oil and gas assets and companies.

"As of the end of the first quarter of 2003, there was an estimated $2.6 billion in oil and gas assets and companies publicly available for sale in Canada. However, not all of these assets are the type that RITs prefer, long-life reserves with a predictable production profile," he said.

MOST CREDIT RATING actions for oil and gas companies worldwide were negative during the first quarter, Standard & Poor's Ratings Services reported.

That trend came despite strengthening commodity prices. Companies pursuing aggressive growth outweighed the number of companies moving to improve credit quality, said the report entitled "First-Quarter Global Oil and Gas Ratings Round-Up."

"This trend could reverse itself in 2003 if companies, particularly exploration and production firms, can maintain spending discipline" and reduce debt, said S&P credit analyst Paul B. Harvey.

The rating changes were triggered by a recent flurry of merger and acquisition activity, including various deals involving Russian assets (OGJ, May 5, 2003, p. 34).

"The ability of E&P companies in particular to lock in returns on acquisitions through hedging at robust commodity prices [especially natural gas], combined with low-cost debt, helped the increase in transactions. In addition, a lack of internal growth projects and a wealth of assets for sale should maintain an active level of M&A activity," Harvey said in the report.

Increased M&A activity is likely to continue, given anticipated strong commodity prices, especially natural gas prices, and the number of assets being divested recently by former energy traders and refiners, he said.

The E&P sector stands to benefit "with the potential for ratings improvement where surplus cash flows are used to reduce debt levels or improve business positions," Harvey said.

"Companies that use the excess cash flows for sustained balance sheet improvements are likely to see positive ratings actions. However, companies that are just preparing a war chest are less apt to see ratings improvement," Harvey said.

Government Developments

SAUDI ARABIA's Oil Minister Ali Ibrahim al-Naimi was reappointed for a third term, ending widespread speculation about his future.

Under Saudi law, cabinet members cannot serve more than one 4-year term unless reappointed by the Saudi king, Fahd Bin Abdul-Aziz al-Saud. Since Naimi was first appointed in 1995 and reappointed in 1999, King Fahd had been expected to choose a new successor.

One Saudi official earlier was quoted as saying the April meeting of the Organization of Petroleum Exporting Countries would be Naimi's last as the representative for the kingdom. "So he will pay farewell to his colleagues in the coming meeting of OPEC [in Vienna]," the official said last month on condition of anonymity.

Even Naimi had acknowledged that he might lose his position, saying, "Nobody lives forever," and that "I'll find out at the same time as everybody else."

Earlier this year, speculation surfaced that Naimi might resign from the cabinet following disagreements over his handling of the $25 billion natural gas initiative with international oil companies (IOCs).

The Saudi Gas Initiative (SGI), formally launched in June 2001, is considered central to the long-term economic strategy developed by Crown Prince Abdullah to attract foreign investment.

But Naimi was said to have resisted the SGI, arguing that Saudi Arabia's state-run oil firm Saudi Aramco could match the work of IOCs, and that IOCs represented a potential threat that could result in Saudis losing control over key sectors of their own economy.

Western analysts have said conflicts between Naimi and IOCs over their unimpeded access to natural gas reserves are part of a wider struggle between modernists and conservatives in the Saudi regime about economic restructuring and foreign investors.

Naimi retained his ministerial post and denied rumors of his departure, saying, "Ministers don't resign in Saudi Arabia." He reportedly had the support of Defense Minister Prince Sultan and Interior Minister Prince Nayef, half brothers of Crown Prince Abdullah and claimants to the Saudi throne.

THE US GOVERNMENT is considering a rule change on pipeline rights-of-way, rights-of-use, and easements for oil and natural gas operations on the Outer Continental Shelf.

The US Minerals Management Service has proposed a rule change. Lessees would have to pay a rental fee when obtaining an easement, and pipeline right-of-way holders would have to pay more to obtain use of an area for purposes associated with pipelines. The rental charge for each of these would depend on the acreage involved.

Rights-of-use examples are when a company requires use of an area for a platform in connection with a pipeline or requires the use of an offlease area for purposes related to lease operations.

Currently, there is no charge for a right-of-use and easement, and the charge for an area associated with a pipeline right-of-way is a flat fee.

Deepwater operations have created situations where companies request the use of several square miles for purposes related to a lease or a pipeline.

Quick Takes

ANGOLA's state-owned Sonangol has given operator Total SA (formerly TotalFinaElf SA) a green light to develop Dalia field on Angola's deepwater Block 17, the site of 15 earlier discoveries. The field is due to come on stream in third quarter 2006.

Discovered in 1997, Dalia has an estimated 1 billion bbl of oil reserves. It lies 135 km off Angola in 1,200-1,500 m of water near Girassol field, which is thought to contain 725 million bbl of oil.

Block 17 acreage also includes Jasmim, a satellite due to start producing in the second half of this year through a tie-back to Girassol, which came on stream in 2001.

The $3.4 billion Dalia development involves installing a 240,000 b/d floating production, storage, and offloading vessel and drilling 34 production wells, 30 water injection wells, and 3 gas injection wells. The Dalia FPSO will have a storage capacity of 2 million bbl of oil—the same capacity as the Girassol FPSO, regarded as the world's largest. Although the two vessels will be in close proximity, the crudes they will produce differ and therefore require different processing equipment (OGJ Online, May 5, 2003.)

Plateau production from Dalia is anticipated at 225,000 b/d of oil, slightly higher than on Girassol.

Total holds a 40% interest in Block 17; ExxonMobil Corp. unit Esso Exploration Angola (Block 17) Ltd. has 20%, BP Exploration (Angola) Ltd. 16.67%, Statoil Angola Block 17 AS 13.33%, and Norsk Hydro AS 10%.

In other development news, Halliburton Co.'s construction and engineering division, KBR, is more than 6 months late delivering two FPSO units to Petroleo Brasileiro SA (Petrobras), a Petrobras source said. The delay, which the source said was caused partly by numerous modifications Petrobras requested, will cost Petrobras an additional 19% under a new Rio de Janeiro state excise tax. "This matter could end up in an international arbitration court," the source said. Each FPSO will have the capacity to process 150,000 b/d of crude. P-43 will operate in 815 m of water in Barracuda field and P-48 in 1,035 m of water in Caratinga field in the Campos basin, off Rio de Janeiro state. The FPSOs were contracted for $240 million each. Field development is expected to cost $2.5 billion, said Petrobras. The P-43 FPSO is under construction by Fels Setal in Angra dos Reis, Rio de Janeiro state, with start-up of production expected this year. The P-48 FPSO, meanwhile, is being revamped in Singapore at the Jurong shipyard. KBR is responsible for engineering, contracting, and installation of the two FPSOs. Enterprise Energy Ireland Ltd. and partners Statoil ASA and Marathon International Petroleum Hibernia are huddling to determine an alternate development scheme for Corrib field after local authorities in Ireland refused them permission to build an onshore terminal on the country's northwestern coast. Corrib field, which contains 25 billion cu m of gas, lies 70 km off Northwest Ireland in 350 m of water (OGJ Online, May 5, 2003). Several appraisal wells have been drilled on the structure since its October 1996 discovery. Operator Enterprise planned to use subsea production installations tied back by pipeline to an onshore terminal at Bellanaboy Bridge in County Mayo. Corrib initially was slated to come on stream in second half 2005.

CANADA'S NATIONAL ENERGY BOARD will hold a public hearing July 28 on an application by EnCana Ekwan Pipeline Inc., Calgary, to construct and operate a $55 million natural gas pipeline and associated facilities in western Canada.

The proposed 24-in. sweet gas line would extend 51 miles from EnCana Oil & Gas Partnership's Sierra Plant near Fort Nelson, BC, to a tie-in on Nova Gas Transmission Ltd.'s northwestern mainline 4 km east of the Alberta-British Columbia border near Rainbow Lake, Alta. Pending approval, construction would begin next winter for an anticipated in-service date of April 2004. Williams Cos. Inc. unit Transcontinental Gas Pipe Line Corp. has placed into service the first phase of its $189 million Momentum pipeline expansion. This phase, which increased capacity on Transco's natural gas system by 269 MMcfd, provides additional firm transportation capacity to Alabama, Georgia, and the Carolinas. Phase 2 construction, which will add 54 MMcfd of capacity, is scheduled to begin in spring 2004, and the line should be in service by May 2004. In total, the project will add 50 miles of new pipe and 45,000 hp of compression to Transco's system.

PERU STATE OIL COMPANY Petroleos del Peru SA (Petroperu) expects to hold international tenders during the second half of the year or in first quarter 2004 to upgrade its 62,000 b/d north coast Talara refinery. Petroperu needs to meet the fuel standards recommended by the World Bank for South American countries before 2005, said Petroperu Pres. Hector Taco.

Petroperu also needs to complete start-up of the Camisea natural gas project, scheduled to come on stream in August 2004.

Although a final decision has not been reached on the $250 million refinery upgrade, the current target is for Petroperu to seek private investment through a tender for a joint venture, a management contract, or a concession. Petroperu's engineering division is completing evaluation of a study completed by Foster Wheeler Ltd. before presentation to the energy and finance ministries and ProInvestment.

InterOil Corp., The Woodlands, Tex., last week shipped refinery process vessels, main heaters, and other major equipment to the site of a refinery it is building in Papua New Guinea. The 32,500 b/d refinery, the country's first, is expected to start up by yearend. Construction on the refinery jetty is nearing completion, and InterOil will offload the equipment directly at the refinery site. The current shipment is expected to arrive in Papua New Guinea June 5, and a final shipment, primarily process columns, is scheduled to depart Houston in June. InterOil is developing an integrated energy business on Papua New Guinea consisting of extensive exploration, the refinery, and retail assets. BP Singapore Pty. Ltd. will supply all crude oil to the refinery, and Shell Overseas Holdings Ltd., in contracts valued at $1.4 billion, will receive most of the refinery's output.

PERU'S PROINVESTMENT reported that Spain's Etevensa won a public auction last week to transfer to private investors the state's Electroperu contract to supply Camisea natural gas. Bidders qualified for the gas also include Belgium's Tractebel SA through its local Enersur generator, and the US firms General Electric and PSEG Global.

The investor in a first stage must complete a 250 Mw (minimum) simple-cycle, gas-fired power generating plant within 15 months, if an existing plant is to be converted to gas, or within 18 months if new plant is to be built. In a second stage of the project the investor must convert to a 125 Mw simple-cycle plant plus 187.5 Mw in combined cycle within 21 months.

The gas, produced in the Camisea gas fields on the eastern slope of the Andes, is due to reach the Peruvian coast by August 2004 via a pipeline now under construction (OGJ, Nov. 25, 2002, p. 20).

The consortium operating Camisea fields is comprised of Argentina's Pluspetrol Corp. Sucursal del Peru, US firm Hunt Oil Co. of Peru LLC Sucursal del Peru, South Korea's SK Corp. Sucursal Peruana, and Hidrocarburos Andinos SAC. About 62% of the upstream and downstream project has been completed.

SAUDI ARABIAN FERTILIZER CO. (Safco), an affiliate of Riyadh-based Saudi Basic Industries Corp. (SABIC), awarded a lump-sum, turnkey contract to German engineering firm Uhde GMBH for engineering, procurement, and construction of Safco 4. The world-class ammonia and urea plant complex is to be built at Al-Jubail Industrial City on Saudi Arabia's northeast coast.

The plant, scheduled for completion by late 2005, will have a capacity of 1 million tonnes/year of ammonia, and 1.1 million tonnes/year of urea.

STATOIL ASA signed a letter of intent valued at 700 million kroner for Transocean Sedco Forex Inc. to provide drilling and completion work on Snøhvit field in the Barents Sea. The contract award is subject to approval of the other Snøhvit license partners.

The contract covers drilling and commissioning of 10 wells in the Phase I development of Snøhvit and Albatross fields.

The Polar Pioneer rig will carry out the work, which is due to start in autumn 2004 and be completed in spring 2006, reported Thor Bensvik, manager for Snøhvit drilling and well operations.

NEWFIELD EXPLORATION CO. last week reported a deep shelf discovery on West Cameron Block 73 about 10 miles off Louisiana that it said could exceed a predrill reserves estimate of 50 bcfe.

The West Cameron 73 No. 1 well, drilled and evaluated with wireline logs to 16,082 ft TD, encountered more than 250 ft of net gas pay in two zones below 15,000 ft. Newfield expects first production in early 2004.

This discovery well is the first of 8-10 deep shelf exploration wells that Newfield expects to drill in 2003. It has drilled 6 successful deep shelf wells out of nine attempts to date.

Newfield operates West Cameron 73 with a 70% working interest. Westport Resources Corp. owns the remaining 30% interest.

Pakistan granted a petroleum exploration license Apr. 24 to Bahamas-based Paige Ltd. and its local joint venture partner RDC International (Pvt.) Ltd. for Block No. 3168-1 in the Zhob District of Balochistan Province. The block, which covers 1,120 sq km, falls in prospectivity Zone 1. Simultaneously, the parties executed a petroleum concession agreement whereby the JV will invest a minimum of $405,000 the first 3 years, with an additional contingent investment of $4.5 million based on the outcome of results of the first phase.

CONOCOPHILLIPS (UK) LTD. began natural gas production of 60-65 MMscfd Apr. 27 from McAdam gas field in the southern North Sea.

Of the five-field CMS III development, McAdam is the third on stream and uses the production and transportation facilities of the Caister Murdoch System. Murdoch K, Hawksley, and McAdam are producing a total of 300 MMscfd of gas.

ConocoPhillips will install a new compression module this summer to double compression capacity. Also drilling is under way on the fourth well, Boulton H1, which should be on production in the third quarter. Watt field will be the fifth to be developed.

ConocoPhillips operates CMS III with 59.5%, GDF Britain Ltd. holds 26.4%, and Tullow Oil UK Ltd. 14.1%.

K2 Energy Corp., Calgary, has completed its first phase gathering system and pipeline to accommodate production from Palmer gas field. It is now producing out of the Bow Island formation, a shallow, low-pressure gas reservoir on the Blackfeet Reservation in eastern Glacier County, Mont. Palmer field's initial production is averaging more than 250 Mcfd of natural gas. K2 Energy used a new drilling technology—reverse circulation drilling—and the development of specific completion techniques to drill, evaluate, and commence production from this previously underdeveloped resource (OGJ, Mar. 11, 2002, p. 43). In addition, the Bureau of Indian Affairs granted K2 Energy final approval to acquire rights to an additional 100,000 tribal mineral acres, with consent to lease an additional 100,000 acres of nontribal lands within a designated 200,000 acre land block on the reservation (OGJ Online, July 24, 2002). In another production start-up, Global Energy Development PLC, the international unit of Harken Energy Corp., Houston, expects to start production by May 15 from the Cajaro 1 well on its Cajaro Association Contract in Colombia. The wildcat is in Palo Blanco field in the Llanos basin east of giant Cusiana and Cupiagua oil and gas fields (OGJ Online, Feb. 14, 2003). Global perforated and tested the Upper Mirador zone at 8,263-8,267 ft, which contained about 20 ft of producible hydrocarbon thickness. The well tested at more than 700 gross b/d of 33° gravity oil. Global said it also tested the Upper Massive Ubaque formation of the well, which it found not commercially productive.