Market Movement

OPEC production cut expected

Prior to the Apr. 24 meeting of Organization of Petroleum Exporting Countries in Vienna, analysts predicted OPEC ministers would agree to cut overproduction by at least 1.5 million b/d, with Saudi Arabia and Kuwait absorbing the bulk of any rollback.

It would be "a reaffirmation of the current 24.5 million b/d quota over the coming months, as well as a renewed commitment to OPEC's price band of $22-28/bbl," said Matthew Warburton, UBS Warburg LLC, New York. "While global inventories could accommodate a less-substantial reduction in OPEC volumes, given their current low levels, especially in the US, we believe OPEC will undertake a measured reduction in supply of 1.5 million b/d over the next 2-3 months. Such action...would overcome inherent market skepticism surrounding any reduction in (official) output when (actual) production exceeds quotas and also signal its determination to defend oil prices within its price band."

He said, "Over the last 4 years, the market has continually underestimated the cartel's determination to manage its production to adhere to the OPEC price band of $22-28/bbl (or $24-30/bbl for US benchmark West Texas Intermediate crude), and we believe that to do so now would also be a mistake."

In March, OPEC members, excluding Iraq, produced 26.5 million b/d vs. a 24.5 million b/d quota. However, Warburton said, tanker-tracking data suggest Saudi Arabia wasn't putting as much oil into world markets as some assumed.

"While overall Saudi production had increased to 9.2-9.5 million b/d," he said, "the increased volumes have not been exported but rather produced into domestic storage. Based on the difference of up to 750,000 b/d between production estimates and Saudi supply into world markets, this would imply volumes of 12-24 million bbl have been placed into domestic Saudi storage in March."

Iraq, Nigeria, Venezuela supplies

Meanwhile, US officials reported four wells in southern Iraq resumed production last week. Other wells in Iraq's northern fields were expected to be back on stream soon.

The timing for recovery of Iraq's oil production was among the issues that OPEC ministers discussed last week.

"Even though initial supplies (of Iraqi oil) to world markets could be made rapidly available from storage in Ceyhan, Turkey, uncertainties over the legal framework of any such sales or additional production volumes in excess of (Iraq's) internal requirements of 500,000 b/d are likely to complicate OPEC's decision-making at this week's meeting," said Warburton.

Concerns over Venezuelan and Nigerian supplies also persist.

With refineries in Venezuela operating "primarily to satisfy export opportunities to the US as the driving season commences," said Warburton, "external availability of Venezuelan crude is likely to remain static or even decline temporarily in coming months."

He said other OPEC members were not expected to grant Venezuela's request to set aside its production quota while it makes up the revenue lost during the long strike that crippled production there for months. OPEC also was unlikely to increase production quotas for Algeria and Nigeria.

Although recent elections in Nigeria proceeded with less turmoil than some anticipated, at least 300,000 b/d of production remains shut in, and Warburton noted the potential for continued civil unrest disrupting Nigerian supply.

Delays in production recovery in Iraq, Venezuela, and Nigeria at the same time other OPEC members are reducing their current overproduction "could further aggravate the already tight global inventory situation and take effect just at the time that OPEC should be increasing production (later this year) ahead of the seasonal uplift in winter demand," he said.

NL BULLETIN

US officials will proceed this week with naming indigenous and exiled Iraqi citizens to leadership posts in a transitional government. Using Iraqi citizens also will apply to the critical oil sector, US government sources said. Phillip Carroll, former Shell Oil Co. and Fluor Inc. chief, is expected to be the US military's top oil advisor, but how much authority he will have over how oil exports are managed remains a source of contention. US officials stressed that new anticorruption measures will be taken to ensure oil export revenues are used for all Iraqi citizens but would not elaborate on details. Speaking after talks with some of the country's prospective new leaders Apr. 24, retired US Gen. Jay Garner told a Baghdad news conference: "I think you'll begin to see the governmental process start next week, by the end of next week. It will have Iraqi faces on it. It will be governed by the Iraqis." He gave no details. Iraqi political groups were to meet US officials in Baghdad Apr. 28, following an initial meeting near An Nasiriya last week.

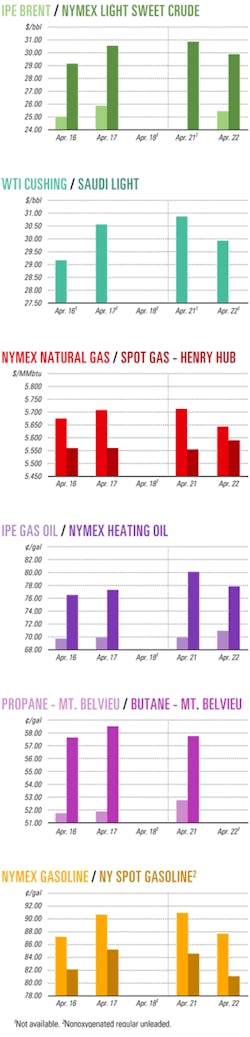

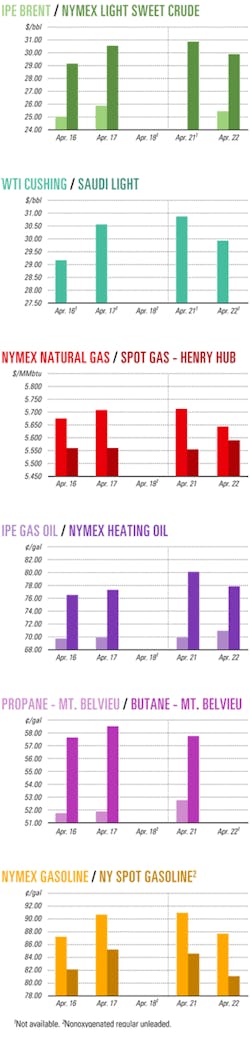

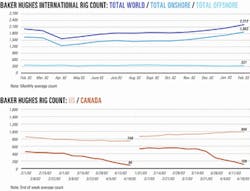

Industry Scoreboard

null

null

null

Industry Trends

US INTEGRATED oil companies' upcoming first quarter results are expected to mark the highest level of improvement for the sector in 3 years, UBS Warburg LLC said.

Analyst Matthew Warburton said the anticipated growth stems from significant increases in oil and natural gas prices as well as a substantial recovery in refining and marketing performance.

"We believe these factors should more than offset expectations for substantially weaker chemical earnings and poor US refining results experienced in January," he said in an Apr. 16 research note.

In a first quarter earnings preview, UBS Warburg forecast that adjusted net income is expected to increase 172% to $8.8 billion vs. first quarter 2002 for the eight US integrated oil companies in its coverage universe.

"We currently forecast a 46% year-over-year earnings increase in 2003. Thereafter, given our oil and natural gas price forecasts, normalized R&M margins, and a recovery in chemical fundamentals, we forecast sector earnings to decline 12% in 2004 and 6% in 2005," Warburton said.

Geopolitical tensions, particularly the war on Iraq, and market fundamentals strongly supported first quarter oil and gas prices, he noted.

"Although we estimate the sector's worldwide oil and gas production to decline by 4% (on a barrels of oil equivalent basis) year-over-year, this is expected to be more than offset by higher realizations, and we forecast the sector's first quarter 2003 (exploration and production) earnings to increase by 103% year-over-yearUto $8.4 billion," Warburton said.

Tight US product inventories and a high level of seasonal refinery maintenance helped drive a recovery in average first quarter refining margins across the US and international markets.

"In aggregate, we forecast the sector's first quarter 2003 R&M earnings to be $1.6 billion, reversing the $212 million loss sustained in first quarter 2002," Warburton said.

THE TANKER EQUITY MARKET outlook is promising due to improving oil demand coupled with low oil inventories, which should help stimulate increasing oil production and tanker demand, said Jefferies & Co. Inc., New York.

Analyst S. Magnus Fyhr said tanker shares remain attractive from a risk-reward perspective. He believes companies with modern tanker fleets are well-positioned to benefit from stricter chartering policies and escalating regulatory pressure.

Fyhr noted that Caribbean tanker rates have started to firm with the resumption of Venezuelan exports following a general strike in that country. He also sees more discrimination against single-hull vessels after the Prestige tanker sank off Spain (see p. 9).

"In additions, we believe the EU's recent proposal to ban all single-hull tankers above 3 years of age from trading oil and oil products into the European Union will serve as a positive catalyst for tanker shares, as older single-hull tonnage is likely to be forced into early retirement," he said (OGJ, Apr. 14, 2003, p. 7).

Government Developments

QATAR is progressing toward more privatization.

Minister of Finance Yousef Hussein Kamal plans to hire an international consultant to study means by which how the state can open more of its economy to the private sector.

A weekly newsletter published by the Qatar embassy in Washington, DC, reported that Kamal anticipates the sale of government stakes in petrochemicals, fertilizers, and steel. Kamal also said Qatar plans to establish a holding company for privatization.

Kamal foresees that investors will subscribe through an initial public offering in the company, which will hold the stakes.

"We have identified eight projects, which will be shared between the government and the private sector. We are also looking to use the Qatar Industrial Development Bank as a catalyst to bring the private sector into medium and small-scale industries," he said.

Kamal said Qatar wants foreign companies to come into export-oriented projects as strategic partners, providing capital and technical expertise. On these projects, he envisions that the government and the foreign partner each would have 25% interest, with the remaining 50% vested in the private sector.

NIGERIA, meanwhile, has its own advocates pushing for privatization.

The Lagos Chamber of Commerce and Industry suggests that the private sector be allowed to supply domestic refined products, and the chamber also supports the eventual privatization of the state-run Nigerian National Petroleum Corp. (NNPC), according to press reports.

During a news conference in Lagos earlier this month, Chamber Pres. and Chief John Odeyemi suggested that the government license private-sector operators to refine petroleum products as well as import these for resale.

The chamber described as impractical NNPC's exclusive responsibility of supplying petroleum products for Nigeria.

Odeyemi suggested a transitional regime of dual pricing, saying, "NNPC could continue to fix its prices as it deems fit, while the private providers should be allowed to sell at prices dictated by their cost parameters."

NIGERIA also is seeking lasting resolution to Niger Delta tensions.

Specifically, the Nigerian government has established a presidential committee to recommend solutions for restoring peace to the Warri area.

Tensions in the oil-rich Niger Delta recently forced oil majors Chevron Nigeria Ltd. and Shell Nigeria Exploration & Production Co. Ltd. to shut in more than 40% of the country's oil output (OGJ Online, Mar. 24, 2003).

The committee, headed by Minister of Defense Lt. Gen. T.Y. Danjuma, has three representatives each from the Urhobo, Itsekiri, and Ijaw communities. They will submit recommendations for the resolution of long-standing issues that cause repeated violent upheaval in Warri.

Newly elected President Olusegun Obasanjo urged leaders of the three communities to tell their militant youths to refrain from violence while the committee works out a resolution that would be acceptable to all parties.

The community leaders gave Obasanjo a firm commitment to keep the peace and give the committee time to complete its work.

Quick Takes

RUSSIAN OFFICIALS await feasibility study results, due May 1, before deciding whether to build a major oil pipeline from Siberian oil fields to Japan or to China.

Japan's National Oil Corp. said that Japan would invest $1 billion in an oil export terminal and a refinery in Russia's Far East if a 4,000 km oil pipeline is built from Angarsk, the easternmost point of the Russian oil pipeline complex near Lake Baikal, to Nakhodka on the shores of the Sea of Japan. Japan also is considering extending low interest, long-term credits for the pipeline's construction.

Meanwhile, China's state-owned China National Petroleum Corp. has earmarked $700 million for a less-costly, 2,400 km pipeline linking Angarsk with refineries near China's top producing oil field complex at Daqing, while Russian companies said they would invest $1 billion in that project (OGJ Online, Apr. 2, 2002). x‡

Oil and gas ministers from Pakistan, Turkmenistan, and Afghanistan formally invited India on Apr. 9 to participate in their proposed Turkmenistan-Afghanistan-Pakistan natural gas pipeline project (OGJ Online, Feb. 27, 2003), reported OPEC News Agency. Participants said New Delhi's participation in the $2.5-3.2 billion project would make it more viable, providing significant gas markets. The pipeline, estimated at 1,300-1,600 km, would carry 20-30 billion cu m/year of natural gas and likely would be constructed to Pakistan's Sui field, from which existing infrastructure could be tapped to supply major local markets (OGJ, Oct. 7, 2002, p. 21).

ENGINEERING and procurement are under way on a fourth cryogenic processing train at a Williams Cos. Inc. gas plant in Opal, Wyo.

The new cryogenic turboexpander unit will be able to extract more than 7,000 b/d of natural gas liquids. Willbros Group Inc. is providing engineering, procurement, construction, and commissioning for the unit.

The 350 MMcfd train will boost the plant's gas processing capacity to more than 1.1 bcfd from 750 MMcfd and will increase to more than 50,000 b/d its ability to recover NGL products.

The unit will process 70 MMcfd of gas from Shell Exploration & Production Co. production from the Pinedale anticline in southwestern Wyoming.

STATOIL ASA is using foam-assisted water alternating gas (FAWAG) technology in its Statfjord field in the Norwegian North Sea to improve crude oil recovery. Such injections have been tested on Snorre in the same area, Statoil said, with one Snorre field well producing 1.5 million bbl of extra oil during the trial, at a cost of 10 million kroner. Snorre's reservoir properties are similar to those of Statfjord.

FAWAG technology involves adding a foaming agent to water injected into the field. The foam blocks the pores of the reservoir rock, forcing injected gas into new parts of the formation to displace oil toward production wells.

In other production news, Suncor Energy Inc. plans to spend $3 billion to boost production capacity at its oil sands facility near Fort McMurray, Alta., to 330,000 b/d by late 2007 and to 500,000-550,000 b/d by 2012. Suncor will expand its oil sands upgrading facilities and will develop the Firebag in situ oil sands project. Construction of the $1.5 billion upgrader expansion is slated for early 2004. Suncor also will spend $1.5 billion to boost bitumen production at Firebag in three stages. Construction on the first stage is 80% complete. Other oil sands expansion projects are expected to increase production to 260,000 b/d in 2005 from the current 225,000 b/d. And in the "up and running" category, Petroleos de Venezuela SA (PDVSA) says that crude oil production in its eastern division, PDVSA Oriente Northern District, is now averaging 804,000 b/d.

PDVSA is utilizing both normal and secondary recovery methods, and production is being accomplished with 800 fewer workers than before the strike that curtailed production for monhs.

A RARE WILDCAT on the Great Australian Bight off south-central Australia is on tap. A group led by Woodside Petroleum (Pty.) Ltd. will drill Gnarlyknots-1 on Block EPP 29 in the Duntroon basin.

The GlobalSantaFe Corp. Jack Ryan ultradeepwater drillship will take the wildcat to 5,600 m in 1,315 m of water. The wellsite is 425 km west of Port Lincoln, on South Australia's Eyre Peninsula.

Woodside, which holds a 40% interest in 14.2 million acres on five blocks, ran seismic in 2000-01. Anadarko Australia Co. Pty. Ltd. and EnCana Corp. each hold 30%.

Only six wells have been drilled in the general area (OGJ, June 7, 1999, p. 37).

Gnarlyknots was to have been spudded on Apr. 15, for completion in mid to late June.

Acreage offerings in adjacent areas remain outstanding, so data from the well likely will be commercially sensitive, Woodside said.

In other exploration news, OMV (Pakistan) Exploration GMBH, a 100% subsidiary of OMV AG, said its Sawan 7 production well in Pakistan's Sawan gas field flowed on test at the rate of 101 MMscfd of gas. The well is expected to produce at a sustainable rate of 85 MMscfd, OMV said, and 255 MMscfd of gas will be produced from six other Sawan wells by yearend. The field is in the Middle Indus area of Sindh Province, 500 km north of Karachi. Sawan field's proved and probable gas reserves are 1.3 tcf. The company plans to develop Sawan in two stages: Phase 1 production of 170 MMscfd of gas is due to start in third quarter, and Phase 2, which will double the gas rate to 340 MMscfd, is expected to start by yearend. Sawan field partners include operator OMV 19.74%, Agip Exploration & Production Ltd. 23.68%, Moravske Naftove Doly AS 7.90%, Pakistan Petroleum Ltd. 26.18%, and Government Holdings Private Ltd. 22.50%. Elsewhere in the country, Oil & Gas Development Co. Ltd. reported a discovery with its Kunnar 6 well, 20 km from Hyderabad in Sindh Province. OGDC said that Kunnar field contains 7.2 million bbl of recoverable oil. The well was drilled to 1,955 m, targeting the Cretaceous Lower Goru Age, and on initial test it flowed 1,800 b/d of oil and 1.33 MMcfd of gas through a 1/2-in. choke. Installation of surface tie-ins to existing Kunnar facilities is under way and should be completed shortly, OGDC said. OGDC plans to recover 1,300 b/d of oil and 6 tonnes/day of NGLs from the well stream, adding to current production of 3,300 b/d and 12 tonnes/day of NGLs. Pakistan has granted an oil exploration license to Lasmo Oil Pakistan Ltd., a wholly owned subsidiary of ENI SPA of Italy, for Block 2667-6 (Gorakh) in Pakistan's prospectivity Zone II. The license covers 2,482.44 sq km in the Dadu, Lasbela, and Khuzdar districts of Sindh and Balochistan provinces. Lasmo will invest $720,000 the first 2 years and then an additional $1.6 million, contingent on the results of the initial 2 years.

Meanwhile, Statoil signed a letter intent valued at 700 million kroner for Transocean Sedco Forex Inc. to provide drilling and completion work on Snøhvit field in the Barents Sea of northern Norway. The contract covers drilling and commissioning of the 10 wells in the Phase I development of Snøhvit and Albatross fields. The Polar Pioneer rig will perform the work, due to start in autumn 2004 and expected to be completed in fall 2006.

BHP BILLITON LTD. plans to drill two wells 0n Block 3a off Trinidad's east coast despite having acquired only 600 sq km of the 1,000 sq km of 3D seismic survey data it had planned before the December sinking of the M.V. CGG Mistral seismic research vessel. The company also is processing data from 3D and 2D seismic that previous block owners had shot (OGJ Online, Mar. 12, 2003) and plans to drill a total of six wells.

BHP said drilling the initial two wells now depends on the availability of the Cantalisa jack up, which will drill developmental wells in early May on Block 2c, where 300 million bbl of oil and as much as 2.3 tcf of gas were discovered.

BHP will monitor gas pressures in the field's western end when the company begins crude production in Kairie and Canteen sections of the structure to determine if there is communication between the eastern and western ends. If there is none, BHP could start commercializing the gas in Block 2c earlier, BHP said.

Block 3a wells will be drilled in the Greater Angostura project during May through October to meet a December 2004 deadline.

BHP is operator with a 30% stake in the 150,000 acre Block 3a, and its partners are BG Group PLC and Talisman Energy Inc. 30% each, and TotalFinaElf SA.10%.

REPSOL-YPF SA plans to begin work this summer to recover fuel oil contained within the tanker Prestige, which sank off northwestern Spain Nov. 19 (OGJ Online, Nov. 27, 2002).

Plans hinge upon developing robots capable of working in 4,000 m of water. On Feb. 14, the Spanish government contracted Repsol-YPF to recover oil from the wreck, which is lying in two pieces in 3,500 m of water. Divers and existing robots cannot operate at that depth.

"There will be an attempt with an initial pilot test through gravity extraction of the fuel by using shuttle bags and also a compilation of all the necessary data to carry out the definitive engineering solutions of extraction, pumping, and confining of the wreck. Environmental and safety issues will have a strong focus in the planning and execution of the project," Repsol-YPF said.

SAUDI ARABIAN OIL CO. (Saudi Aramco) awarded a turnkey contract to Snamprogetti SPA' s British subsidiary Snamprogetti Ltd. to build two new units at Aramco's Yanbu refinery in Saudi Arabia.

Snamprogetti will provide engineering design, procurement, and construction of a 40,000 b/d continuous catalyst regeneration unit and a 15,000 b/d light, straight-run, naphtha isomerization unit to enhance production of unleaded gasoline at the refinery.

The work is scheduled for completion by 2005.

DOMINION RESOURCES INC., Richmond, Va., agreed to pay $1.2 billion to improve air quality in Virginia, West Virginia, Connecticut, New Jersey, and New York. Dominion reached an agreement with the US Environmental Protection Agency and those states to resolve lawsuits and a June 2000 EPA notice of (environmental) violation (NOV).

The NOV and a New York lawsuit alleged that the Mt. Storm power station in West Virginia modified its generating units without obtaining proper permits, but Dominion claimed it conducted only routine maintenance.

Under the agreement, Dominion will install state-of-the-art emissions-control equipment on coal-fired generating units in Viriginia and West Virginia, reducing sulfur dioxide emissions by 64% and nitrogen oxide emissions by 66% over 2000 levels, and it will convert the Mt. Storm power station and Possum Point power station near Washington, DC, to natural gas-fired generation from coal-fired generation.

In addition, Dominion will pay a $5.3 million civil penalty, commit $14 million for major environmental programs or projects, and surrender 45,000 SO2 emissions allowances each year beginning in 2013.

QATAR LIQUEFIED GAS CO. (Qatargas) has begun initial, temporary shipments of 150 MMscfd of sweet natural gas to the Ras Laffan Power Co. at Ras Laffan, Qatar, where four gas turbines will begin electric power generation next month.

Qatargas completed work earlier this year on 1.4 km of 8-in. and 10-in. pipes and meters and valves to enable the supply of the volumes—about 85% of the plant's requirements.

Two steam turbines will be commissioned early next year at the plant, where total power capability will be 750 Mw.

The plant also will produce 30 million gpd of desalinated water starting next year.

The Al Khaleej gas expansion project (OGJ Online, Apr. 8, 2003), will supply gas to the new power plant on a permanent basis when completed in fourth quarter 2005.

TOTALFINAELF SA, in an agreement signed with Royal Dutch/Shell Group, will acquire 133 service stations in Germany from Shell unit Shell-DEA in exchange for seven of its own stations in France, 33 in the Czech Republic, and 70 in Hungary.

The agreement, TotalFinaElf said, will bring the company closer to its aim of owning 10% of Germany's market; currently the company owns 1,200 stations in that country.

Also, the transaction marks the exit of TotalFinaElf from the Czech Republic and Hungary, where it had less than 5% of the market. The company will, however, remain immersed in specialty products in Germany, namely in lube oils, LPG, bitumens, jet fuel, solvents, and paraffins.