OGJ Newsletter

Market Movement

IEA reports 'wall of crude' supplies

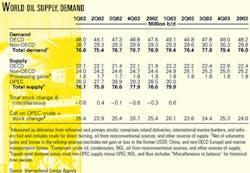

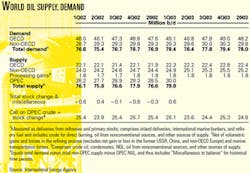

Despite oil supply disruptions in some key countries, other oil exporters have increased output to assure consumers will be adequately supplied. This, said the International Energy Agency in its latest Oil Market Report, has placed a "wall of crude" on the water waiting to arrive in key consuming regions. Exporters have been positioning crude in these regions to mitigate the potential impact of a prolonged supply disruption.

Meanwhile, industry crude stocks in Organization for Economic Cooperation and Development countries are low, and product stocks are trending sideways. Amid heightened geopolitical uncertainty, refiners—prepared to pay a premium for short-haul supply to avoid longer-term commitments—have limited their purchases of long-haul crude. Although the market is in backwardation—with the futures price lower in distant delivery months than in near delivery months—due to uncertainties, prompt supply is increasingly available.

Production

IEA estimated worldwide oil production increased 740,000 b/d in March following a 2.25 million b/d increase in February. Higher output from Venezuela, Saudi Arabia, and Kuwait offset declines in Nigeria and Iraq, boosting total output from the Organization of Petroleum Exporting Countries by 95,000 b/d. Spare capacity within OPEC, excluding Iraq and Venezuela, fell to 1.23 million b/d in March, down from 1.67 million b/d a month earlier. Non-OPEC supply was up 240,000 b/d.

During March, war in Iraq suppressed production by a little more than 1 million b/d, and ethnic violence in Nigeria eroded output by 200,000 b/d. IEA reported that Venezuela, whose production is still recovering from the recent 63-day strike, saw a 490,000 b/d increase in conventional crude output and a 293,000 b/d boost in nonconventional crude output. Production increased 450,000 b/d in Saudi Arabia and 245,000 b/d in Kuwait.

March OPEC output excluding Iraq was pegged at 1.4 million b/d above current targets. When the organization met Mar. 11, it left quotas unchanged, although there has been speculation that targets would be lowered for the second quarter, when demand traditionally dips. If output were to be cut while OECD stocks are low and concerns persist over summer gasoline supply, the industry's ability to replenish stocks could be hit. "Industry stocks need to be rebuilt from current tight levels, and demand itself will begin to rise again from second quarter lows, potentially gaining nearly 3 million b/d by yearend. With spare capacity limited, any prolonged disruption in Iraq, Nigeria, or elsewhere would only highlight the near impossibility of sustained and effective seasonal market management," the agency said.

OECD inventories

OECD commercial oil stocks fell 34 million bbl in February, ending the month down 229 million bbl from a year earlier. Forward demand cover stood at 50 days, 6 days off year-ago levels and only marginally higher than at the end of January.

OECD industry crude stocks ended February down only 1 million bbl, and North American inventories fell due to a draw in Mexico. With peak maintenance under way in the US, crude demand fell, reducing the need to build inventory. OECD product stocks fell 35 million bbl during February to 125 million bbl below year-earlier levels. Draws were centered on distillate fuels, falling in all OECD regions. Other main product categories were little changed. In Europe, gasoline stocks built on larger refinery throughputs and contracting demand.

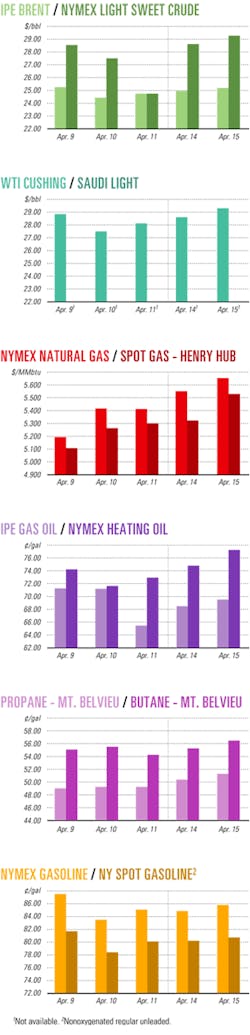

Industry Scoreboard

null

null

null

Industry Trends

THE US NATURAL GAS resource base, including proved reserves, was 1,311 tcf at the end of 2002.

If all of it is developed, it would amount to 65 years of supply at current production levels, the Potential Gas Committee (PGC) said in its biennial report issued Apr. 16.

Excluding proved gas reserves, the study estimated 958 tcf in traditional gas resources and 169 tcf in coalbed methane gas resources. Compared with the 2000 report, traditional gas resources increased 2.4% and CBM gas resources increased 8.8%.

Potential Gas Agency Director John B. Curtis said that the committee's figures "are baseline estimates in that they attempt to provide a reasonable appraisal of the total natural gas resource potential" of the US.

Estimates do not assume any schedule for the discovery or production of gas, he added.

The study used the US Department of Energy's estimate of 183 tcf of proved gas reserves in the US. Probable resources (current fields) had 210.5 tcf, possible resources (new fields) 325 tcf, and speculative resources (frontier) 422 tcf.

Probable CBM gas resources were 17.1 tcf, possible 56.7 tcf, and speculative 95 tcf.

PGC consists of 140 volunteers from industry, government, and academic institutions. It received assistance from the Colorado School of Mines, Golden, Colo. The agency is funded by the American Gas Association, the Gas Technology Institute, and other agencies.

THE US has a narrow margin of surplus natural gas capacity vs. anticipated gas production from the Lower 48 for this year. This means that maintaining or increasing gas well drilling is critical to maintaining or increasing gas productive capacity.

Late last month, the US Energy Information Administration released its estimate of available gas productive capacity for 2003. The estimates were compared with forecast natural gas demand in a report entitled "Natural Gas Productive Capacity For the Lower 48 States."

The analysis projected an average gas surplus capacity of 5.6 bcfd in 2003 compared with a projected 51.4 bcfd average gas production rate. The EIA noted this limits the available production response to any sudden demand increase or production decrease.

"Withdrawals of stored natural gas can normally respond to such problems, but gas storage levels are now at record lows. Therefore, the narrow surplus margin indicates a significant potential for short-term price increases in the event of such contingencies," the EIA said.

Wells producing for a year or less contribute 25-30% of total wellhead capacity. The two largest supply areas, Texas and the Gulf of Mexico, together produce 50% of the nation's total gas production. Those two areas also have the highest percentage (30%) of wellhead capacity from wells a year old or less.

Recent trends in productive capacity closely tracked the number of gas well completions, which were down 25% in 2002. A 34% increase in gas well completions was projected for 2003 with an associated increase in productive capacity, EIA said.

The Rocky Mountain area was projected to have the largest estimated surplus gas capacity at 1.4 bcfd followed by Texas with 1.3 bcf.

Government Developments

THE MINERALS MANAGMENT SERVICE wants to expand offshore royalty relief to increase deep natural gas production in the Gulf of Mexico.

MMS proposes royalty-suspension incentives when companies take the risk of exploring and developing deep gas deposits in shallow water areas already leased.

"American families have felt the pinch of higher natural gas prices in recent months because demand is outpacing supply," US Sec. of the Interior Gale Norton said. "We need to respond by encouraging production of deep gas resources that otherwise are financially risky for companies to explore and develop."

Under the rule, lessees would be eligible for royalty relief on existing leases if they were willing to drill for new prospects deeper than 15,000 ft below sea level. MMS estimates that undiscovered gas resources of as much as 20 tcf may underlie this "frontier" area. About 2,400 existing leases are expected to qualify for royalty relief under the proposed rule.

The National Ocean Industries Association praised the proposal, saying royalty relief will alleviate some of the enormous front-end costs and help to make marginal prospects economically viable.

"At a time when natural gas supplies are tight and prices are high, this kind of exploration incentive is a significant step in the right direction," NOIA said.

MMS cited statistics from the US Energy Information Administration that forecast natural gas demand as rising 30% over the next 15 years, with domestic supplies available to meet only 70% of this need.

"Production from deep wells on existing leases in the shallow-water gulf is one of the most attractive sources of additional natural gas to help meet the near and midterm energy needs of the nation," MMS said.

MMS proposes to allow lessees to exercise an option to replace their existing deep-gas royalty terms on leases acquired after Jan. 1, 2001, with the terms in the final rule on this initiative. The rule provides for a 60-day comment period. MMS plans to hold a workshop during the comment period, the date of which will be announced shortly.

Fiscal incentives are needed in Brazil to make exploration and production commercially viable, at least one company suggests.

A predominance of heavy oil in the country's reservoirs creates this need, said John Haney, exploration director of Royal Dutch/Shell Group's Brazilian unit.

"Shell and the Brazilian Petroleum Institute are preparing a study, analyzing the difficulties faced by oil companies due to Brazil's cumbersome tax structure," Haney said. "The study is in its final phase and will be delivered to the mines and energy ministry."

Shell is pressing exploration of 14 blocks throughout Brazil either alone or in association with other companies.

Brazil lacks a policy for the production of different grades of oil. In addition, royalties and the Brazilian tax code do not take into account such issues as the water depth in which the production is located or the type of oil being produced, said a National Petroleum Agency official.

Quick Takes

CONOCOPHILLIPS unit Conoco Venezuela CA and its partners received approval Apr. 10 from Venezuela's Ministry of Energy and Mines and Petróleos de Venezuela SA (PDVSA) to proceed with Phase I of Corocoro field development in the Gulf of Paria west of Venezuela.

The consortium will invest $480 million over the next 3 years to produce an annual 55,000 b/d of 24.5° gravity oil beginning 21/2 years after development starts. Additional phases will be considered based on the success of Phase 1.

Partners are PDVSA subsidiary CVP, Italy's ENI SPA unit Agip Venezuela BV, and OPIC Karimun Corp., an affiliate of Taiwan's state-owned Chinese Petroleum Corp. unit Overseas Petroleum & Investment Corp.

THE US DEPARTMENT OF ENERGY is funding 80% of a $3.9 million field test in Hobbs, NM, to determine whether underground geologic formations can successfully entrap carbon gases and isolate them permanently from the atmosphere.

DOE-affiliated laboratories National Energy Technology Laboratory, Sandia National Laboratory, Los Alamos National Laboratory, and Strata Production Co. are cosponsoring the project.

About 2,100 tonnes of CO2 were injected into Strata Production Co.'s West Pearl Queen depleted reservoir to which researchers will monitor for a year to see if the gases stay within the formation and determine any changes in the mineralization of the reservoir rock. The data will also determine the accuracy of modeling and simulation tools that predict storage capacity.

The New Mexico project complements a larger sequestration field test under way at Weyburn oil field, a producing reservoir in southeastern Saskatchewan, where more than 15 worldwide government agencies, universities, and research institutions are monitoring the capacity, movement, and fate of the injected CO2 (OGJ, Mar. 3, 2003, p. 39).

Kazakhstan's Supreme Court has reduced a lower court's fine against Tengizchevroil (TCO) to $7 million from $70 million for ecological damages that the joint venture caused by storing millions of tons of sulfur at Tengiz field. The joint venture, led by ChevronTexaco Corp., appealed the ruling by Kazakhstan's Atyrau Oblast Court. Supreme Court Judge Sansyzbek Raimbayev said last month that the earlier court decision was null and void, Reuters News Wire reported. Earlier this year, ChevronTexaco confirmed that TCO partners resolved a dispute about funding arrangements, enabling TCO to move forward with expansion plans for second-generation production and sour gas injection projects (OGJ, Feb. 10, 2003, p. 7).

OPE INC. affiliates OPE International LP and OPE Offshore International Ltd. have received subcontracts to develop pipeline systems and five offshore loading stations off the oil ports of Arzew, Bejaia, and Skikda, Algeria. The project is for Algeria's national oil company Sonatrach.

OPE will be responsible for pipeline design, the supply and installation of onshore and offshore facilities valued at $120 million to transport crude oil and condensate from onshore facilities, and the installation of loading buoys and tanker mooring systems at each offshore site.

FMC Technologies Inc. unit FMC SOFEC Floating Systems is the project's main contractor.

Oman Gas Co.'s (OGC) 48 km, natural gas pipeline spur from the Fahud-Sohar pipeline at Mahdha, Oman, to Buraimi at the UAE border is moving ahead. Corinth Pipeworks SA of Greece received a $5 million contract to supply the 24-in. pipe by July 1, and construction is slated to begin soon thereafter. Oman Oil Co. is financing construction of the $18.6 million gas spur, while OGC will supervise construction, operation, and maintenance of the pipeline. It will link Oman to the regional gas grid planned by Abu Dhabi's Dolphin Energy Ltd. (DEL), tying into DEL's network at Al Ain in the UAE to deliver 135 MMcfd of Omani gas until 2006 through a 182 km, 24-in. pipeline to the 656 Mw Fujairah electric power plant and its associated 100 million gpd desalination plant, currently under development by Union Water & Electricity Co. at Qidfa. The bidirectional spur could later become an import pipeline if Oman chooses to source gas from abroad (OGJ Online, Jan. 22, 2003).

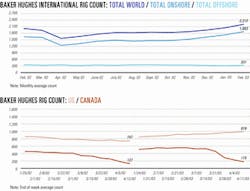

GLOBALSANTAFE CORP. Chief Operating Officer Jon Marshall said Apr. 11 that conditions in Kuwait have stabilized enough to allow rig operations to resume safely, and the company is preparing to resume drilling operations. Six rigs were placed on standby mode Mar. 17, and the first was expected to have resumed operations by Apr. 17F . A total of eight land rigs are expected to be fully operational by the end of April, including Rig 102 and Rig 155, which were not operating when the other units shut down (OGJ Online, Mar. 14, 2003).

THE BRAZILIAN SUBSIDIARY of Royal Dutch/Shell Group in July will become the first non-Brazilian firm to produce oil commercially off Brazil when it begins oil production of 70,000 b/d from its deepwater Bijupirá and Salema oil fields in the Campos basin.

The fields, in water 400-870 m deep, have reserves of 188 million bbl of 28-31° gravity oil and 62 bcf of gas. Operator Shell holds an 80% stake, while Petrobras owns 20%. Shell will produce from its Fluminense floating production, storage, and offloading vessel, slated to arrive in Brazil this month.

Fluminense has a processing capacity of 81,000 b/d of oil, a water injection capacity of 92,000 b/d, and storage capacity of 1.2 million bbl of oil. In addition, Shell is trying to overcome technical problems to guarantee commercial production on Block BC-10, also in the Campos basin 170 km northeast of Bijupira and Salema fields off Brazil. Shell is operator in partnership with Petrobras and ExxonMobil Corp. Block BC-10 covers 2,958 sq km on which the partners have invested more than $150 million, drilling eight wells, three of which did not encounter oil. The five discoveries in the region are in different reservoirs more than 25 km apart, and preliminary work indicates that the area holds reserves greater than 300 million bbl of heavy oil. However, the exploration deadline for the remaining area of Block BC-10 will expire in August. If commercial production does not start up before August, Shell must return the block to the National Petroleum Agency (ANP), which will put it up for tender again. Shell is working with ANP to overcome this problem.

In other production news, Shell Canada Ltd. resumed bitumen production Apr. 4 at its Muskeg River Mine 75 km north of Fort McMurray, Alta., following Train 1 repairs at a froth treatment plant damaged in a Jan. 6 fire. Train 2 repairs are expected to be completed by early May. (OGJ, Jan. 13, 2003, p. 8). Diluted bitumen deliveries have begun via the Corridor pipeline system to the Scotford upgrader near Fort Saskatchewan, with the line and associated tankage expected to be filled by Apr. 18, enabling the upgrader to begin processing bitumen. The Athabasca Oil Sands Project—a joint venture of Shell Canada 60%, Chevron Canada Ltd. 20%, and Western Oil Sands LP 20%—is expected to ramp up to 155,000 b/d of bitumen in the third quarter.

ATLANTIC LNG CO. of Trinidad and Tobago awarded GE Oil & Gas, a Florence, Italy-based unit of GE Power Systems, a $28 million contract to revamp and upgrade LNG Train 1 at Atlantic LNG Co.'s facility in Point Fortin, Trinidad and Tobago.

GE will upgrade the train's gas turbines and centrifugal compressors. The upgrade will involve a September shutdown for the first three compressors and an April 2004 shutdown for the remaining three compressors.

GE Oil & Gas already has the contract service agreement for Train 1.

MARATHON OIL CORP.'s wholly owned subsidiary Marathon Petroleum Norge AS reported an oil discovery on its Kneler 25/4-7 well on production license (PL) 203, about 140 miles from Stavanger, Norway.

The Kneler well, in 390 ft of water 7.5 miles west of Heimdal platform, was drilled into the Heimdal formation to 7,425 ft TD below sea level. It encountered a 155 ft gross oil column. Marathon is analyzing downhole samples and wireline logs.

The discovery is the first part of a three-well program to evaluate the West Heimdal area, the company said. Marathon will drill the next exploration well on PL 088BS on the nearby Boa prospect into the same formation.

The PL203 group includes Marathon, operator with a 65% working interest, ConocoPhillips 20%, and Oslo-based DNO ASA 15%.

The Norwegian Oil and Energy Department has awarded Dansk Olie & Naturgas AS (DONG) operatorship of two new licenses in the southernmost sector of the Norwegian North Sea. The licenses are Blocks 4/1 and 4/2, which lie north of Nini field that DONG currently is developing, and Block 3/7, east of Trym and Lulita fields.

DONG holds a 40% working interest in Blocks 4/1 and 4/2, while Statoil ASA and London-based Paladin Resources PLC each have 30%. DONG has a 70% operating interest in Block 3/7, and Paladin Resources holds the remaining 30%.

Meanwhile, in the Gulf of Mexico, the Discoverer Spirit drillship is on site on the Champlain prospect on Atwater Valley Block 63 about 160 miles south of New Orleans, preparing to drill an appraisal well for Texaco Inc. and Agip Petroleum Exploration Inc. A delineation sidetrack well drilled in mid-2001 found 400 ft of net pay, extending the Champlain proven oil accumulation both laterally and downdip from initial discoveries in 2000.

Agip operates the sidetrack, while Texaco is the prospect operator for Block 63 with 50% interest (OGJ Online, June 20, 2001).

SHELL CANADA PRODUCTS, a wholly owned subsidiary of Shell Canada Ltd., officially started up low-sulfur gasoline hydrotreaters Apr. 4 at its refineries in Sarnia, Ont., and Montréal-East, Que., reducing sulfur in its gasoline by 9%. The $150 million gasoline hydrotreater projects were completed in December 2002.

Canadian regulations require refiners to produce gasoline with a cumulative average of 150 ppm of sulfur during July 1, 2002-Dec. 31, 2004, falling to an average of 30 ppm on Jan. 1, 2005. Shell says it is the first company to do so, adding that it supports the need to reduce sulfur in gasoline to be compatible with advanced emission-control systems in specialized-fuel vehicles expected in model year 2004.

PDVSA has resumed operations at its Cardon refinery in western Venezuela and is now processing 270,000 b/d of crude oil, OPEC News Agency reported. The Cardon facility, along with the Amuay refinery, is part of the Paraguana Refining Complex (CRP), the world's largest. PDVSA also started up the No. 2 hydrotreating unit and coking plant and, according to PDVSA, starting up the cat cracker has allowed the current production of 45,000 b/d of gasoline.

FALCON GAS STORAGE CO. INC., Houston, has announced an open season, until May 8, for capacity at its new MoBay natural gas storage hub in Mobile County, Ala, which is scheduled to be in service during fourth quarter 2004. Falcon is offering 20 bcf of working gas capacity and 450,000 MMcfd of injection and withdrawal capability.

The MoBay hub plans direct connections to Transcontinental Gas Pipe Line Corp.'s Mobile Bay lateral, Gulf South Pipeline Co. LP's Mobile Bay lateral, Gulfstream Natural Gas System LLC system at its Station 100, and Florida Gas Transmission Co.'s Mobile Bay lateral.