OGJ Newsletter

Market Movement

Signs of tightening market drive up oil futures prices

Energy futures prices rebounded early last week with reports of significant declines in US oil inventories and a call for a meeting of ministers from the Organization of Petroleum Exporting Countries to address the previous drop in crude prices.

OPEC Pres. Abdulla bin Hamad al-Attiyah called for an extraordinary meeting of ministers, tentatively slated for Apr. 24 (see related story, p. 32).

Ali I. Naimi, Saudi Arabia's energy minister, subsequently said that OPEC members were discussing a meeting within a few weeks. However, he said OPEC definitely would defend prices within the group's target range. Naimi denied an earlier report that Saudi Arabia planned to cut its production unilaterally.

Meanwhile, Alí Rodríguez Araque, president of Petroleos de Venezuela SA, called for a total reduction of 2 million b/d in world production, to be coordinated among OPEC and non-OPEC producers. OPEC Sec. Gen. Alvaro Silva Calderon, also from Venezuela, said that the market is more than well-supplied.

However, Obaid bin Saif Al-Nasseri, UAE energy minister, said last week that it is too early to speak of production cuts by OPEC.

US oil inventories

The US Department of Energy reported US oil inventories fell by 3.6 million bbl to 277.1 million bbl total during the week ended Apr. 4. The American Petroleum Institute put the week's decline at 2.5 million bbl to 278.3 million bbl.

"Despite incremental Middle East crudes being drawn into the US, due to attractive price differentials, and the recovery in Venezuelan volumes, total crude imports fell sharply (to 8.9 million b/d) vs. (the previous) week's record level (of 10.36 million b/d) as the DOE noted significantly less-than-normal Nigerian volumes arrived in the US," said Matthew Warburton at UBS Warburg LLC, New York, in an Apr. 10 report.

"Given the material downward revisions to OPEC-10 (excluding Iraq) tanker-tracking estimates (notably for Saudi Arabia) and the full impact of lost Iraqi and Nigerian barrels yet to be seen, we would not be surprised if imports averaged only seasonally normal levels (9.25 million b/d) in coming weeks," he said.

That may create problems for the US refinery system that requires "high, ratable feedstocks ahead of maximizing runs to meet peaking gasoline demand," Warburton said. "This week, the DOE estimated that US crude inventories fellUas crude imports fell and as refiners raised runs to 15.4 million b/d (94.5% of capacity), the highest level since August 2002."

It will be hard to sustain that level of output unless imports increase. "Consequently, we expect gasoline cracking margins and product imports to be well-supported," Warburton said.

According to DOE figures, US gasoline production edged upward to 8.1 million b/d for the week ended Apr. 4. However, Warburton said refiners' relatively low gasoline yield of 54% "remains puzzling, give the 13¢/gal premium" for gasoline vs. heating oil on the New York Mercantile Exchange. "In part, this could reflect the lost Nigerian import volumes with their rich naphtha composition," he said. "Nonetheless, gasoline inventories increased by 1.5 million bbl to 202.2 million bbl as (gasoline) imports surged to more than 1.1 million b/d. Going forward, the recovery of the Venezuelan refining industry should increase gasoline and blendstocks available to the US (including reformulated gasoline components); it is also likely to minimize demand for spot cargoes exported from the US Gulf Coast."

Venezuela remains a factor

"The disruptions in Venezuela (by the Dec. 2-Feb. 3 general strike) removed more oil from the world market than the (current) cessation of Iraqi exports and did much to push up oil prices and deplete US inventories. Barring further disruptions, we should see oil prices continue to ease as demand decreases with the end of the winter in the Northern Hemisphere and as large volumes of stepped-up production from other countries reaches our shores," said Daniel Yergin, chairman of Cambridge Energy Research Associates, in testimony at an Apr. 8 US Senate subcommittee hearing on energy security issues (OGJ Online, Apr. 9, 2003).

Rodríguez said last week that his company might lift the rest of its force majeure restrictions on petroleum product exports as soon as the 940,000 b/d Paraguana refinery complex facility's 60,000 b/d flexicoker unit is restarted, probably by Apr. 18. PDVSA has already lifted force majeure restrictions on crude oil and some products, according to reports by Petroleumworld, a Caracas-based online oil newsletter. It quoted Rodríguez as saying PDVSA's oil production likely will average 3.1 million b/d this year.

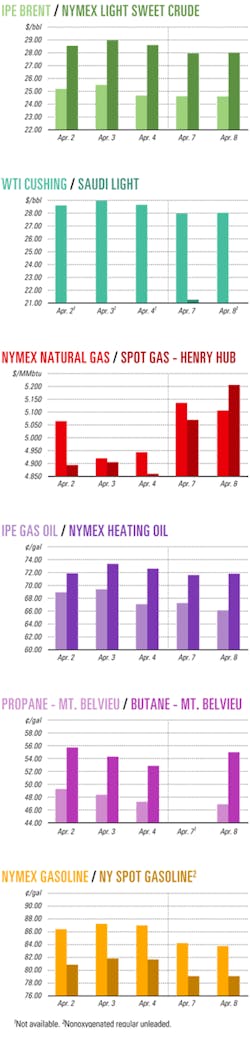

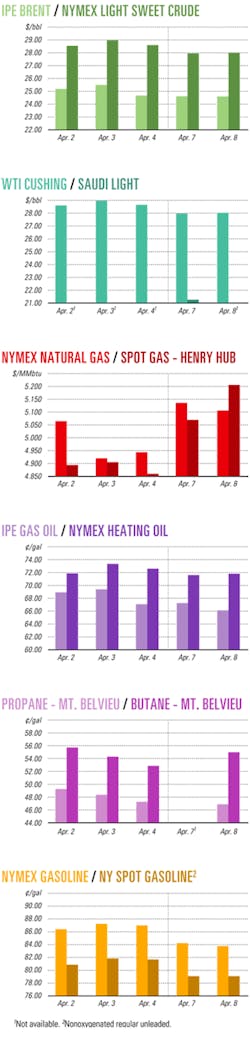

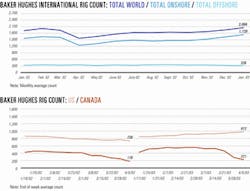

Industry Scoreboard

null

null

null

Industry Trends

THE PENDING formalization of the joint venture firm of TNK-BP emphasizes the strategic importance of Russian oil and gas assets to international oil companies.

Expected to be finalized later this year, TNK-BP will be a new holding company created through BP PLC's JV with Russian partners Alfa Group and Access-Renova (OGJ, Feb. 17, 2003, p. 34) (see Personnel Moves and Promotions, p. 36).

The deal "could well be the catalyst required to spur the foreign investment in Russia's oil and gas sector that was so clearly missing in the first decade of the post-Soviet era," said Edinburgh-based consultant Wood Mackenzie Ltd.

Although other international oil companies have yet to match the level of understanding that BP has developed in Russia, the deal nevertheless raises numerous issues relevant to future transactions, WoodMac said.

"BP's willingness to operate under the existing tax regime is a key signal," WoodMac said. Production-sharing agreements will have a role in the future for large infrastructure development projects, "but they will not be the backbone of the Russian tax system."

Significant opportunities in Russia remain with some of the best assets still being available, but major investment will be needed. BP's deal gained the Russian government's blessings, prompting other Russian companies to become more eager for international investment, WoodMac said.

BRAZIL demands more local content in its pipeline construction. Brazilian Mines and Energy Minister Dilma Rousseff said she will require more "national content"—amounting to 75% of goods, equipment, and services—from government contractors building and installing the natural gas pipeline grid in eastern Brazil. The grid will require investments of $850 million, she said.

Similar criteria for local content will be used for the construction of the P-51 and P-52 semisubmersible platforms ordered by Petroleo Brasileiro SA (Petrobras). Local content requirements also were increased for the upcoming fifth licensing round for oil and gas exploration and production to be conducted by the National Petroleum Agency. That round is slated for August.

The measure is part of the administration's new industrial policy aimed at creating more jobs in Brazil. Rousseff forecast 30,000 jobs would be created this year through that initiative. Brazil suffers from soaring unemployment.

"We will revive the role of economic developers and the role of job creators that government-controlled companies are supposed to have," Rousseff said.

THE PAKISTAN PEOPLE PARTY (PPP) also demands the hiring of local oil and gas workers by multinational energy companies doing business in Pakistan.

The PPP of former Prime Minister Benazir Bhutto, the current government's main opposition party, indicated last week plans to launch a campaign against multinational oil and gas exploration companies to protest against those companies' reluctance to hire local people.

PPP.official Rafique Ahmed Jamal charged that oil and gas exploration companies operating in Pakistan—including Lasmo Oil Pakistan Ltd., an affiliate of ENI SPA of Italy, and BHP Billiton Ltd., of Melbourne—have not been appointing local people for the past 7 years.

Government Developments

EUROPEAN UNION transport ministers voted to ban all transportation of heavy fuel oil by single-hull tankers of more than 5,000 tons capacity through EU ports starting this summer.

During a recent meeting in Brussels, the ministers also banned similar operations of single-hull tankers under the flag of any EU country in other parts of the world. The only exception is for smaller single-hull tankers of 600-5,000 tons, which are used for regional transport. Those vessels will be allowed to operate until 2008.

The ministers classified heavy fuel oil according to density and viscosity and included bitumen, tar bitumen, and tar. The proposed ban stems from the sinking of the tanker Erica off France in 1999 and with the recent sinking of the Prestige off Spain.

The ruling will be submitted to the EU Parliament, which has promised to ratify the measure in June for implementation in July.

The 15 EU ministers also accelerated the progressive elimination of single-hull tankers for other hydrocarbons. Single-hull tankers more than 23 years old and exceeding 20,000-30,000 tons will be banned in 2005.

Single-hull tankers built during 1982-96 with capacities of 5,000-20,000 tons will be banned by 2010. However, that ban will be pushed back to 2015 for tankers having reinforced hulls.

At presstime, the measures were expected to be submitted to the International Maritime Organization at its Apr. 11 meeting for possible extension to tankers operating under flags of other European countries.

THE BUSH ADMINISTRATION will not appeal to the US Supreme Court a legal dispute over 36 undeveloped oil leases in federal waters off California, which begs the questions of whether these leases can be developed and, if not, whether leaseholders then gain some compensation.

The Bush administration has said it will no longer contest the state of California's right to control expansion of oil and gas drilling in federal waters off its coast (OGJ Online, Apr. 3, 2003).

That gives California state officials increased authority to review any development plans, and California Gov. Gray Davis is adamantly against any new oil drilling, while buying back leases is mired over a fair price.

Oil companies paid a then-record $1.25 billion for 40 leases (four were canceled in 1999, but under litigation) acquired during 1968-84, plus at least $300 million for 39 exploratory wells and annual fees. The leases are primarily in the Santa Maria basin, north of the Santa Barbara Channel, and off the coast of Vandenberg Air Force Base.

The US Minerals Management Service estimates the 36 leases hold more than 1 billion bbl of oil and 500 bcf of gas. Oil companies' plans, revealed in 1999, indicated as much as 160,000 b/d of oil could be obtained from as many as four new platforms and extended-reach drilling from existing Offshore Continental Shelf platforms.

Affected oil companies already are negotiating lease buyouts in case they decide that some or all of the leases will be too difficult to develop, given California's antioil position.

Quick Takes

AUSTRALIA would gain a fourth offshore producing area if the Cliff Head oil discovery on WA-286-P in the Perth basin off Western Australia is declared commercial. Heretofore the Timor Sea, Northwest Shelf, and Bass Strait were Australia's only offshore producing theaters.

Operator Roc Oil Ltd., Sydney, estimates recoverable volumes at 20-30 million bbl of oil and said the commercial threshold is likely to be 15 million bbl at $17/bbl. Technical and commercial studies are under way, and results are expected in the third quarter.

OOIP is 66-99 million bbl. The field covers 6 sq km with 100 m maximum vertical relief (see map, OGJ, Feb. 19, 2003, p. 36).

The early 2003 five-well, $13 million drilling program included two cored appraisal wells, a production test, and three dry exploration wells. Recovery from one well was 3,000 b/d of crude oil. The oil is 30% paraffin and has 6-8 cp viscosity. Production could start by 2005 at 10,000-20,000 b/d initially. This would be Roc's first operated offshore project.

An 11 km insulated pipeline would transport raw production to shore, and separated produced water would be returned to the field for pressure maintenance. Development options include one or two small wellhead platforms and a single-buoy mooring.

Meanwhile, Kerr-McGee Corp. was awarded 100% interest in WA-337-P and is participating with 50% interest in Santos Ltd.-operated WA-339-P, both offshore in the northern Perth basin.

US AND INDUSTRY OFFICIALS, noting the role LNG will play in bridging the gap between future US natural gas demand and production, have formed the International LNG Alliance. ILNGA will focus on LNG policy and trade issues. David Sweet is its executive director.

The US Energy Association unveiled ILNGA's formation Apr. 1 at a Washington, DC, conference on LNG. During a Houston conference this September, ILNGA and USEA will outline worldwide LNG initiatives, including commercial opportunities.

El Behera Natural Gas Liquefaction Co. SAE will use ConocoPhillips' proprietary liquefaction technology for Train I of its proposed $1.35 billion Egyptian LNG facility at Idku, east of Alexandria, with an option for using the technology for a second train, to begin production in mid-2006 (OGJ Online, Jan. 7, 2003). Train I is designed to produce 3.6 million tonnes/year, with first production scheduled for third quarter 2005. Bechtel Inc. is undertaking the $900 million engineering, procurement, and construction management for Train I. Both trains will share storage and marine facilities at the site, which can accommodate up to five trains. Train I Participants are BG Group PLC 35.5%, Edison International SPA 35.5%, Egyptian Natural Gas Holding Co. (EGAS) 12%, Egyptian General Petroleum Co. 12 %, and Gaz de France 5%.

PETROLEO BRASILEIRO SA (Petrobras) plans to invest $6.4 billion this year, primarily on exploration and refining—one third of its previously planned 2003 investment.

Petrobras Pres. José Eduarto Dutra said the government expects the company to generate a primary budget surplus of $2.1 billion this year (OGJ Online, Jan. 3, 2003). Dutra said Petrobras would focus primarily on exploration and refining this year.

In January and February, Petrobras outlays totaled $539 million, compared with $798 million for a group of 58 other federally controlled companies.

Separately, Petrobras is deliberating the location of a new 200,000 b/d refinery to be built in partnership with the private sector. A study by Portuguese oil company Petrogal SA has identified the northeastern Brazilian state of Pernambuco as the most suitable site for a refinery. Twelve Brazilian states want the refinery, which would create about 600 jobs.

Petrogal has considered investing in the refinery in partnership with Petrobras and Petroleos de Venezuela SA.

Dutra cautioned, however, that Petrobras might simply expand existing refining facilities, which would require $900 million vs. $2 billion for a new refinery.

The Paraguana Refining Complex (CRP) in northwestern Venezuela was expected to restart Amuay refinery exports this month with a shipment of 360,000 bbl of unleaded gasoline destined to reach the US Apr. 2, OPEC News Agency reported.

Quoting state news agency Venpres, OPECNA said CRP General Manager Ivan Hernandez called this the first export shipment from Amuay since the reactivation of production operations that were disrupted by Venezuela's general labor strike beginning Dec. 2. Two more export shipments are expected in April: one a shipment of 250,000 bbl and another of 300,000 bbl, he said. F Elsewhere in refining, Petroleos del Peru SA (Petroperu) plans to call for international bids by September to increase its 65,000-70,000 b/d Talara refinery capacity to 100,000-110,000 b/d, which would require a $250 million investment. The immediate goal is to increase refining capacity to 90,000 b/d, including heavy-grade oil that now is mainly exported. Petroperu also wants to adapt Talara to the fuel standards of the World Bank before 2005. Peru will import $700 million worth of crude oil this year, said Peru's Energy and Mines Minister Jaime Quijandria. But because Peru's oil production dropped in March to an average of 93,655 b/d from 98,578 b/d a year ago, Petroperu Pres. Hector Taco estimates that Peru will need to import an additional 10%. Petroperu imported $317 million worth of crude oil in 2002 to feed the refinery.

OMV AG, operator of the Miano lease in Pakistan's Sukkur district, has received approval from state-owned Pakistan Petroleum Ltd. (PPL) to award a 3D seismic survey contract to the Chinese firm Bureau of Geophysical Prospecting. BGP will undertake the survey over a 250 sq km area to delineate the 'B' sand reservoir on the prospect.

OMV spudded the development well Miano-7 Mar. 2, aiming at 3,429 m TD in the lower Goru B sand.

First gas from Miano begin in December 2001 following the upgrade of the Kadanwari gas processing plant, which currently processes 110 MMcfd of Miano gas (OGJ Online, Oct. 28, 2002).

OMV's Miano partners are PPL, Agip Exploration & Production Ltd., and Islamabad-based Oil & Gas Development Corp. Ltd.

THE GTL BOLIVIA SA group and Rentech Inc., Denver, have completed the technical portion of a joint study to determine the feasibility of building a 10,000 b/d gas-to-liquids plant near Santa Cruz, Bolivia.

The companies now are examining the project's marketing and economics and expect to complete the studies by May 31. Preliminary indications show favorable economics for the project, the companies said.

Under a licensing memorandum of understanding signed last year, the proposed plant primarily would use Rentech's patented GTL technology process to make sulfur-free fuels (OGJ, Oct. 7, 2002, p. 8).

In other gas processing news, Qatar Petroleum Co. (QP) and ExxonMobil Middle East Gas Marketing Ltd. launched Phase I of the $1.1 billion Al Khaleej Gas project (AKG-1). AKG will produce gas from Qatar's 900 tcf North field, recover associated condensate and natural gas liquids for sale, and market 1.75 bcfd of pipeline gas. AKG-1 will supply about 750 MMcfd to the Oryx gas-to-liquids plant—a joint venture of QP and Sasol Petroleum International (Pty.) Ltd.—the Ras Laffan electric power plant, and other Qatari industrial customers. First gas is scheduled for fourth quarter 2005. ExxonMobil awarded a $200 million contract Mar. 31 to a joint venture of Chiyoda Corp., Mitsui & Co. Ltd., and Snamprogetti SPA to proceed with AKG-1detailed engineering, procurement, and construction of the project's 750 MMscfd gas separation and treatment plant facilities. Scheduled for completion by the end of 2005, the plant will be built adjacent existing RasGas LNG trains in the Ras Laffan industrial city area. Three Abu Dhabi National Oil Corp. subsidiaries—Abu Dhabi Gas Liquefaction Co. Ltd. (Adgas), Abu Dhabi Marine Operations Co., and Adnoc Distribution—jointly are developing a project on Das Island to replace gasoline with compressed natural gas in vehicles by 2004 and to introduce CNG in Abu Dhabi City, OPEC News Agency reported. The three companies plan to share the costs and have agreed to conduct a full feasibility study of the CNG project. BC Gas International will develop a CNG development proposal.

ROYAL DUTCH/SHELl GROUP unit Shell Nigeria Exploration & Production Co. Ltd. said on Apr. 4 that it had restarted 18,000 b/d of crude oil production of the 320,000 b/d linked to the company's Forcados terminal in Nigeria. That production had been shut in because of widespread violence in the Niger Delta area (OGJ Online, Mar. 24, 2003).

The company in mid-March shut in 126,000 b/d of its 800,000 b/d Bonny and Forcados field production, declared force majeure, and evacuated personnel.

Shell said it expects to have 100,000 b/d of oil production back on line by Apr. 10-11.

ChevronTexaco unit Chevron Nigeria Ltd. on Apr. 4 also began evaluating its Niger Delta facilities—unmanned since a Mar. 23 shutdown—and making necessary repairs to ensure the safe resumption of operations at the Escravos oil terminal. The company planned to restart exports by Apr. 13-14 and to bring back 310,000 b/d of lost production by the end of April. But saboteurs on Apr. 5 blew up a major oil pipeline near Warri that supplies crude from the terminal to refineries in Warri and in Kaduna, 700 km to the north, partner Nigerian National Petroleum Corp. said. The explosion caused a fire that was still raging 2 days later, the Saudi News Agency reported. The blast came amid reports of renewed ethnic fighting between militants in the Niger Delta area that had forced Chevron to shut in production of 440,000 b/d of oil and 285 MMcfd of natural gas, impacting refinery operations and causing a shortage of petroleum products in Nigeria and natural gas supplies to Nigerian Gas Co. (OGJ Online, Mar. 24, 2003).

STATOIL ASA has secured a 10-year sales contract worth 300 million kroner/year, at 2003 prices, to supply ethane to Borealis AS and Norsk Hydro AS. Borealis is owned by Statoil 50%, Austria's OMV AG 25%, and Abu Dhabi's International Petroleum Investment Co. 25%.

The deal covers deliveries from the Kårstø processing complex north of Stavanger to the Noretyl ethylene plant, owned jointly by Borealis and Norsk Hydro, at Rafnes, south of Oslo.

To accommodate the sales, the Kårstø complex is undergoing a 500 million kroner expansion to process gas produced by Statoil's Kristin field development in the Norwegian Sea beginning Oct. 1, 2005.

It will increase ethane production capacity by more than 50%, to 950,000 tonnes/year from 620,000 tonnes/year. It is being financed by owner Etanor DA—a partnership of Statoil, Petoro AS, Norsk Hydro, Royal Dutch/Shell, ExxonMobil Corp. and ConocoPhillips.

Two vessels currently ship Kårstø production to petrochemical plants at Rafnes and Stenungsund in western Sweden, but a third vessel will be needed to ship the additional volumes, the company said.

PAKISTAN'S National Electric Power Regulatory Authority (NEPRA) has granted a license to TNB Power Dharki Ltd. unit TNB Liberty Power Ltd. for a 235 Mw, combined-cycle electric power plant at Ghotki in Sindh Province. The natural gas-fired plant also will be fitted to use diesel as an alternate fuel.

TNB is a wholly owned subsidiary of Tenego National Bhd., Malaysia's government-owned utility.

At the same time, NEPRA granted a license for electric power generation to El Paso Corp. affiliate Habibullah Coastal Power (Pvt.) Ltd. (HSPC) for a 140 Mw, gas-fired, thermal power plant at Quetta in Balochistan Province.