Oil import misconceptions

While trying to define a topic for this column, I was torn between discussing the current military conflict in Iraq or its related oil price volatility effects on the US. After review, it became apparent that the two topics dovetailed.

Some see the US-led campaign to oust the Iraqi regime as a bid to control the Iraqi reserves and production. Even though US dependence on Middle Eastern oil is important, most US citizens do not realize that more than two thirds of the oil that the country imports comes from outside that region.

After the US launched the military campaign, I found myself discussing the topic of oil and gasoline prices with friends and family. While only a few of these conversations actually led to the discussion of why the US-led coalition has launched an attack on Iraqi territory, many were enlightened to hear that the US is not so heavily dependent on oil imports from the Middle East. In fact, they were surprised to find that the country's neighbors to the north and south account for a large part of its oil supply.

US oil imports breakout

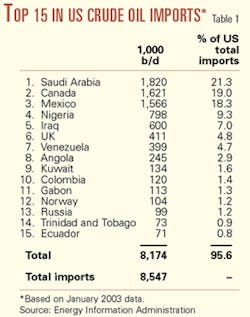

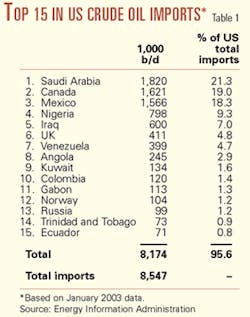

The US Energy Information Administration recently released its January 2003 statistics on US crude and product imports. The top three sources of US crude oil imports for that month were Saudi Arabia, Canada, and Mexico. As Table 1 shows, Saudi Arabia was the leading supplier for the US in January and at its highest volume level since December 2000. However, Table 1 also has Canada at the No. 2 slot, Mexico at No. 3, and shows that Venezuela fell to No. 7 after several months of severe curtailment of exports due to civil unrest there. This was the lowest level since February 1989. In the first 9 months of 2002, Venezuela ranked No. 5. Venezuela only recently began to approach its more-traditional levels of oil exports to the US.

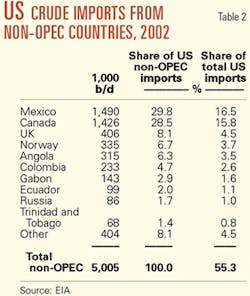

While the Organization of Petroleum Exporting Countries and Persian Gulf OPEC nations in particular are the dominant force in world oil markets, it is important to remember that 55% of US total oil imports comes from non-OPEC, non-Persian Gulf countries (Table 2). Put another way, about two fifths of US oil imports comes from OPEC overall and about one fifth from the Persian Gulf.

Another contributor to US oil imports outside of the Middle East is Nigeria. Nigeria supplied the US with 567,000 b/d of crude in 2002, vs. a peak of 1.137 million b/d in April 2001. Nigeria is also experiencing political violence disrupting oil production, with nearly half its output shut in as of last week. Just as Venezuela's crisis spiked oil prices higher earlier this year, Nigeria's woes late last month caused oil prices to jump after the runup to war in Iraq and started to pull them down.

Reminder needed

When discussing crude oil and gasoline prices in the US, the general public needs to be reminded of these facts.

Political upheavals (not just war), weather (such as hurricanes shutting in production in the Gulf of Mexico), supply and demand factors, and refinery and pipeline outages all can greatly influence what goes on at the trading floors on Wall Street and in other markets around the world.