Ethylene margins decline, capacity additions slow in 2002

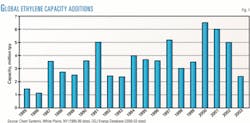

Global ethylene capacity growth experienced a significant slowdown in 2002. Last year saw only 2.4 million tonnes/year (tpy) of net additions, compared with an increase of 6.2 million tpy in 2001, according to the latest ethylene survey.

Fig. 1 shows that this is the lowest net addition of capacity since 1993.

Capacity as of Jan. 1, 2003, was 109.4 million tpy, an increase from a worldwide capacity of 107.0 million tpy as of Jan. 1, 2002.

About 2.9 million tpy of new capacity came online, and roughly 470,000 tpy of capacity shut down during 2002.

As in 2001, ethylene margins suffered from an overabundance of supply. Coupled with high feedstock prices, the excess capacity forced some producers to cut back on production.

In the US, operating rates recovered slightly from the 2001 level of 82%. According to Dan Lippe, president of Petral Worldwide, a Houston-based consulting company, the US ethylene operating rates averaged 85% in 2002.

Operating conditions during the current year, however, are not creating any more certainty for ethylene producers. Feedstock supply uncertainties and high prices continue to create a volatile environment for ethylene margins.

Many analysts feel that capacity additions will have to moderate, and feedstock prices decline, before sustained profitability returns.

New units

No new ethylene units are listed in this year's survey.

The Borogue joint venture of Abu Dhabi National Oil Co. and Borealis AS started up a 600,000-tpy ethylene complex in Ruwais, UAE, in January 2002, but its capacity was reflected in last year's survey.

Because the tables in the Mar. 11, 2002, report use Jan. 1 as a reference date, the additional capacity is reflected for the first time in the tables listed here.

Regional review

Table 1 shows rankings of the 10 largest ethylene production complexes in the world. Nova Chemical Corp.'s Joffre plant retains the top spot on the list. The facilities in the list are the same as last year, but a few changed positions due to capacity additions.

ExxonMobil Corp.'s Baytown, Tex., plant moved up one spot due to a debottlenecking project in 2002. Dow Chemical Co.'s Terneuzen, Netherlands, plant is now tied with Equistar Chemical LP's Channelview, Tex., plant at 1.75 million tpy of capacity.

Table 2 ranks ethylene production capacity by region. Asia-Pacific led the world with the largest capacity increase, 1.2 million tpy, followed by the Middle East-Africa and North America. The Middle East-Africa region saw the largest percentage increase of all the regions.

Table 3 ranks ethylene production capacity by country. The UAE reflected the largest absolute increase of capacity, 600,000 tpy, due to the January 2002 startup of a new ethylene complex. The US was second with 537,000 tpy of additional capacity, which resulted entirely from expansion and debottleneck projects. ExxonMobil Corp. expanded its Baton Rouge, La., and Baytown, Tex., plants by a combined 378,000 tpy.

Closed plants

The 2003 ethylene survey shows that three ethylene units were shut down during the past year.

Petroleos Mexicanos shut down its 182,000-tpy plant in Poza Rica, Veracruz, Mexico, reportedly due to limitations in ethane feed. Pemex also told OGJ that its 27,000-tpy plant in Reynosa, Tamaulipas state, was shut down in 2002.

Pemex, however, is planning to add roughly 200,000-tpy of ethylene capacity at its existing sites in Morelos, Veracruz, and La Cangrejera, Veracruz.

The other capacity closure occurred at Arpichem's Pitesti, Romania, ethylene plant. The unit can produce 100,000 tpy of ethylene.

Ownership, name changes

In June 2002, Saudi Basic Industries Corp. (SABIC) completed its acquisition of DSM NV's petrochemicals business. The $2-billion deal includes DSM's 1.4 million tpy ethylene complex in Geleen, Netherlands.

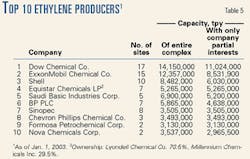

SABIC now operates 5.2 million tpy of ethylene production capacity (Table 5).

In July 2002, Shell Petroleum NV and Deutsche Shell GMBH, both subsidiaries of Royal Dutch/Shell Group, acquired RWE DEA AG's share of the joint venture Shell & DEA Oil GMBH.

Shell and RWE had been 50:50 owners in the joint venture, which operated a combined 588,000 tpy of ethylene capacity in Heide and Wesseling, Germany. The cash consideration was $1.35 billion and included other assets such as refining, supply, distribution, marketing, and other petrochemical activities.

Atofina, the chemicals branch of TotalFinaElf, purchased Enichem's 10% share in Qatar Petrochemical Co. in September 2002. Qatar Petrochemical operates a 525,000-tpy plant in Mesaieed.

The survey also reflects that a few companies changed names.

In Italy, Enichem SPA created a group named Polimeri Europa. It operates four of the ethylene units in Italy and is still a wholly owned subsidiary of Enichem.

Copene SA, which operates 1.2 million tpy of ethylene capacity in Brazil, changed its name to Braskem SA in August 2002.

Table 5 lists the top 10 owners of ethylene capacity worldwide. Shell, with its acquisition of DEA, jumped into third place on the list. Dow and ExxonMobil retained the top two spots, and both added some capacity in 2002.

Construction

Last year, OGJ forecast slightly more than 5 million tpy of new capacity. Of this, only 2.1 million tpy came to fruition. Many companies postponed projects due to market conditions.

According to OGJ's construction survey, 8.2 million tpy of new capacity will come on stream in 2003 (Table 4).

The survey reports that two world-scale crackers will start up in 2003. One is National Petrochemical Co.'s 1-million-tpy unit in Bandar Assaluyeh, Iran, and the other is a 1-million-tpy plant in Jose, Anzoategui, Venezuela, owned by Pequiven SA.

Other significant start-ups include an 850,000-tpy plant in China and a 750,000-tpy plant in Trinidad & Tobago.

Expected capacity additions drop off significantly in 2006-07 because many operators are unwilling to allocate capital to new projects given current market conditions.

Several Middle East ethylene projects that companies there are considering for 2005-06 start-up could be delayed by a year or more. This would be good news for the global ethylene markets.

Ethylene markets

As bad as 2001 was for the ethylene markets, 2002 was worse.

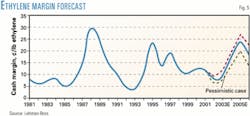

Fig. 2 shows that average cash margins on the US Gulf Coast in 2002 were lower, on average, than in 2001. Additionally, the margins were much more volatile due to wild swings in feedstock prices.

According to Lippe, the US had about 4 million tpy of excess capacity in 2002.

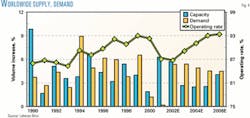

Fig. 3 shows expected supply and demand increases in North America. Demand increases will surpass capacity increases. Operating rates will increase as operators provide this extra demand with existing capacity.

Fig. 4 shows that this trend will manifest itself in the rest of the world. After 2002, demand will exceed capacity increases, leading to higher operating rates worldwide.

Margins will start to increase as operating rates rise. Fig. 5 shows that the capacity rationalization will have a positive effect on future margins. The resolution of the Iraq and Venezuela situations should help bring down feedstock prices in 2003.

A recent study from Business Communications Co. Inc. forecasts strong ethylene demand growth in Asia-Pacific (OGJ Online, Sept. 5, 2002). Ethylene demand is at 33.1 million tpy and is growing at an average rate of 7.1%/year. Demand in 2006 will reach 43.5 million tonnes.

The global supply market overall is shifting as different regions expand at different rates. According to a Lehman Bothers report, North America will see its share of the global ethylene market shrink to 29% in 2005 from 32% in 2000. The Middle East and Asia (except Japan) will increase its share of the global market to 28% in 2005 from 24% in 2000.

Click here to view Ethylene Expansions, 2003-07

Click here to view the International Survey of Ethylene from Steam Crakers - 2003.