Refiners face continued uncertainty in 2003

During the past few years, refiners throughout the world have been subject to the vagaries of crude and product markets. Many analysts feel that this trend will continue in 2003; those companies that continue to own and operate refineries face an uncertain future, especially regarding profit margins.

Refiners will have to face this unclear future with the certainty that they will have to invest in new units and upgrades in order to produce cleaner fuels.

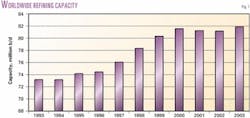

Worldwide refining capacity, however, is at an all-time high (Fig. 1). The fact that refiners are actively adding capacity, whether through grassroots units or capacity creep, points to a subdued optimism that profitability could improve in 2003 and further into the future.

A look back

Last year was tough for refiners. The combination of stagnating product demand, crude supply fluctuations, and feedstock and product price volatility created an environment of tremendous swings in profit margins (Fig. 2).

According to Calvin Cobb, vice-president and general manager of the global hydrocarbons practice, Invensys Process Systems, refiners do not control most of the factors that affect margins.

"Under normal situations, some of the factors are aligned on the side of lower margins and some are on the opposite side," he said. "However, in some years, the factors all align on one side or the other, yielding either a very positive or very negative environment for margins. This situation occurred in 2002.

"Still, after all the rationalization and low margins since decontrol in 1981, refinery production capability is slightly greater than products demand, on average," Cobb continued. "This has tended to reduce refining margins as the competitive environment has been difficult for most of the past 20 years."

Supply, demand

On the demand side, 2002 was especially tough on US refiners. The American Petroleum Institute (API) reported that US gasoline demand in 2002 was strong but that demand for all other petroleum products was much lower than previous years (OGJ, Feb. 10, 2003, p. 26).

Gasoline demand increased 2.7% in 2002 compared with the previous year, its strongest growth in 4 years, according to API.

Fig. 3 shows that the increased demand helped raise gasoline prices throughout 2002. In fact, recent gasoline spot prices have nearly doubled from year-ago levels. Other factors, including political situations in Iraq and Venezuela placed upward price pressure on gasoline.

Compared with 2001, kerosine and jet fuel deliveries decreased 2.5% in 2002, with little indication yet of revived air passenger demand.

Distillate fuel oil demand fell by 2.2%, its first decline in more than a decade, API said. This decline was primarily due to an uncharacteristically mild winter in 2001-02.

US residual demand was down 21.2% at 639,000 b/d, the lowest demand in more than 30 years.

Overall refining processing in the US declined by 1.4% in 2002, which reflected the weak product demand.

null

Coupled with decline in product demand, the over-expansion of refinery capacity and new processing units to meet clean fuels standards have also exerted downward pressure on margins.

"In past years when clean fuels requirements demanded refinery construction for new processing, refiners increased crude processing capacity beyond the usual capacity creep of around 1%," Cobb said. "These increases put pressure on margins by making more supply available."

In terms of supply, the US—the largest consumer of crude oil—has become more dependent on imports. Table 1 shows that the US now imports nearly 58% of crude oil charged to refineries, up from about 46% in 1989.

Fig. 4 shows a recent trend in crude spot prices, which reflects recent events in Iraq and Venezuela. Many refiners in the US and Caribbean had crude supply agreements with Venezuela. In the absence of this dedicated supply source, some refiners would have to purchase crude on the open market or cut back on refinery throughput.

Worldwide refining

Refining in different areas of the world fall into three categories:

- Mature markets such as North America, Europe, and Japan.

- High-growth regions like China and Southeast Asia.

- Growth areas such as Latin America.

According to Cobb, "the business environments in each region drive refiners toward different strategies."

Refiners in mature areas continue to consolidate operations, rationalize capacity, and try to increase performance of existing facilities.

In growth areas, refiners are building capacity to match product-demand slates that are different than in mature markets. "Principally, growth areas have smaller gasoline to diesel product demand ratios and require different refinery configurations," Cobb said. "The growth areas typically have significant demand growth for petrochemicals, leading to the building of petrochemical refineries."

Different regions have also built up different degrees of conversion capacity depending on the regional product slates and type of crudes processed.

US

The US has the most mature refining industry compared to other regions. It also processes some of the heaviest crudes to produce some of the lightest products.

Naturally, the region has the mo high-severity conversion capacity.

The US is also a competitive environment for refiners. The US has a "very polarized refinery ownership structure with a few large companies controlling much of the total capacity," Cobb noted. "In some of these companies, the refineries are the conduit that takes crude oil to the market and this makes for a very competitive market environment for the refining sector."

Near term inventory levels are at relatively low levels in the US, which could create a situation of even higher product prices and perhaps even shortages.

The US Department of Energy (DOE) recently reported that oil product inventories are 30 million bbl below normal (OGJ, Feb. 10, 2003, p. 5).

US distillate demand, meanwhile, posted a record level of nearly 5 million b/d in January. Refiners responding to that market demand could delay the production of gasoline for the summer driving season.

In fact, the DOE numbers show that gasoline stocks are at their lowest level since 1997. And according to Paul Horsnell, head of energy research for JP Morgan Chase & Co., London, "With widespread refinery maintenance through early spring, tighter European and Caribbean supplies, and the impending transition to summer gasoline specifications, we would not expect to witness a marked rise in gasoline stocks over the next few months."

In 2003, OGJ expects gasoline demand to increase by 1.4% (OGJ, Jan. 27, 2003, p. 68), with increases also expected for jet fuel and LPG. The residual market will continue to experience lower growth, and flat demand is expected for distillate and other products.

Overall, US refined product demand will increase less than 1%. A fall in domestic crude production means that the US will increase imports of crude by an expected 3.5% and refined products by 4.3%.

Europe, Russia

In the past few years, refiners in Europe have primarily built capacity to satisfy middle distillate demand—jet fuel, kerosine, and diesel—due to increases in diesel-fueled vehicles.

Europe is already short of gas oil and currently relies on Russia to supply this shortfall. European refiners have mainly focused on desulfurization capacity for the automotive diesel pool, so that these Russian imports have been used for heating oil. Additionally, most Russian gas oils cannot meet the European Union (EU) on-road diesel sulfur specifications.

Due to the dieselization of the automotive fleet in Europe, some European refineries have idle gasoline capacity.

According to Angelo Mario Taraborelli, deputy chief operating officer of ENI Refining & Marketing SPA, the gasoline surplus in Western Europe will increase to 21 million tonnes in 2010 from 14 million tonnes in 2001.

Speaking at the recent Cambridge Energy Research Associates (CERA) conference in Houston, Taraborelli reported that 9 million tonnes of the 2001 surplus was exported to the US.

In the future, some European refineries long on gasoline capacity could decide to maximize gasoline production for export to the US, depending on prices for US gasoline and European diesel.

This could create an opportunity for increased Russian middle distillate imports to Europe.

According to an article by James Harrison and Barry Curtis, two wildcard factors will affect the timing of downstream developments in Russia and Eastern Europe (OGJ, May 27, 2002, p. 69).

The first is the pace at which Eastern European countries attempt to join the EU and conform to its more stringent refined-product specifications. This would require massive capital infusions for the plant improvements needed to produce EU-quality products.

The second wildcard is the political stability of the Eastern European and Central Asian region.

Asia

Asia is currently in a state of overcapacity because the buildup of refinery capacity has surpassed product demand growth (Fig. 5). This led to low margins in 2002—gross refining margins based on cracking yield for Dubai crude decreased to $0.76/bbl in 2002 from $1.25/bbl in 2001 (OGJ, Mar. 10, 2003, p. 50).

Hassaan Vahidy, senior associate, FACTS Inc., feels that the upturn in margins in the last quarter of 2002 could mark a turning point for Asia refining margins. Cracking margins in fourth quarter 2002 improved to $2/bbl.

This upturn depends on improved demand growth in the short to medium term, and the pace and extent of deregulation in protected Asia markets in the long term.

Vahidy expects little substantial refinery capacity additions in Asia in the next 3-4 years and that "the war premium on crude prices will erode once the Iraq issue is resolved."

"We expect a slow recovery in refining margins," he said. "However, it will depend on revived oil demand growth and continued rationalization of refinery utilization rates."

Technology developments

To help maximize margins and produce cleaner fuels, refiners will invest in new catalysts, software, and process technology.

One challenge, according to Cobb, is for refiners to optimize the refining supply chain. Most refiners agree that the financial benefits from this optimization range from $0.25-0.50/bbl.

"A comprehensive solution to the refining and marketing supply chain has not been defined in a way that can be adopted easily by most companies," Cobb said. "Nonetheless, there are a number of refiners trying to address this problem because its solution has such a large payout."

Other software solutions are closer to actually being implemented. Cobb foresees advancements in the area of real-time enterprise management and refinery planning systems.

He thinks that these systems will eventually be able to "connect commercial information contained within the refinery automation systems with companies' enterprise resource planning systems.

The goal is better business decisions from the vast amount of existing data and information.

Refining outlook

Events in Iraq and Venezuela will have the biggest impact on future refinery profitability.

"A war in Iraq is the central defining element to refinery financial performance," Cobb said. "Currently, high crude prices are causing consumers to rethink some of their economic decisions. If prices rise even higher like they did during the Gulf War 12 years ago, it is possible for demand to decrease and for the global economic recovery to slow further.

"Overall, the product demand side is the most vulnerable to downside pressure," he said. "This doesn't necessarily mean refinery margins will be depressed because margins can be attractive when crude oil is expensive or cheap. However, lower product demand usually results in lower refining margins.

"In the absence of a war [in Iraq] or with a short war, refining margins should recover fairly quickly but remain in the lower end of the historical range," he said.

DOE's Energy Information Administration (EIA) is also predicting a recovery in margins compared to 2002. EIA predicts that, in 2004, the annual average pump price will decline by about 5¢/gal, falling in line with an expected decline in crude oil prices.

However, because crude oil prices are assumed to decrease by 9¢/gal, this forecast assumes a continued strengthening of refiner margins (OGJ, Jan. 27, 2003, p. 24).

A significant improvement could come as early as 2005, according to Carlos Cabrera, UOP LLC senior vice-president, refining and petrochemicals. Speaking earlier this year at a Houston conference, Cabrera said that an economic recovery in the next few years will require new grassroots refining capacity (OGJ Online, Jan. 28, 2003).

The impending phase-out of MTBE in the US would also add to market volatility and the increasing possibility of gasoline price spikes.

Additionally, US refiners are reluctant to invest additional capital in this uncertain economic and regulatory climate, especially if those assets are on the auction block.