Market Movement

Markets strip war premium from prices prior to attack

Traders began stripping the war premium from energy futures prices days before US bombs and missiles slammed a "target of opportunity" of "Iraqi leadership" in the predawn hours of Mar. 20 in Baghdad. The April contract for benchmark US light, sweet crudes lost $7.95 during five consecutive trading sessions on the New York Mercantile Exchange to $29.88/bbl on Mar. 19, based on traders' optimistic assumptions that a war with Iraq would be short, successful, and leave world oil supplies relatively undisturbed. Oil futures prices continued a steep decline in overnight trade Mar. 20 in Asian markets, despite a warning from President George W. Bush in a televised address that the war might be longer than some anticipated.

The basket price for the Organization of Petroleum Exporting Countries fell Mar. 18 to $27.69/bbl, back in the group's targeted range of $22-28/bbl for the first time since Dec. 16, 2002. It was down to $27.12/bbl the next day.

Too far, too fast

Officials at Boston-based Energy Security Analysis Inc. forecast oil prices would continue generally on a downward trend "absent one or more of the following developments:"

No terrorist attacks or use of chemical weapons were reported during the first hours of the war.

Meanwhile, ESAI officials said a slowdown in world demand for crude combined with high production among OPEC members above their official production quotas will produce a large surplus of oil. Immediately after the attack on Baghdad, OPEC officials reiterated promises to make up any shortfall of oil supplies.

Other risks

Before the attack, the United Nations withdrew personnel from Iraq, including officials overseeing the oil-for-aid program under which Iraq has been exporting 1.7 million b/d (OGJ Online, Mar. 14, 2003). Military action will likely knock out the additional 300,000 b/d of oil that Iraq supplies to Jordan and Syria. The head of Kuwait Oil Co. previously said all of Kuwait's northern oil fields would be shut down to protect workers if war occurred in Iraq. In February, Al Abdali and Al Ratqa fields were shut in because of their proximity to the Iraqi border (OGJ Online, Mar. 4, 2003).

Despite contrary government reports, independent analysts claim Venezuela probably is still 1 million b/d short of the 2.8 million b/d that it was producing in November before 90% of the employees of Petroleos de Venezuela SA went on strike Dec. 2, 2002, in an attempt to oust Venezuelan President Hugo Chávez. He subsequently fired and called for criminal prosecution of 9,000 PDVSA managers and technicians for their participation in the strike.

In Nigeria, Royal Dutch/Shell Group shut in 76,000 b/d of production and was evacuating personnel as violence escalated prior to upcoming elections in that country, said Tyler Dann, an analyst in Banc of America Securities LLC's Houston office.

Dann reported US-led forces were pushing back Iraqi positions on the borders of Kuwait and Turkey "for at least a week" prior to the Baghdad attack.

Quoting "a trusted source," he said, "Coalition troops are experiencing more success in securing the fields in the southern no-fly zone, representing around 60% of Iraqi production." However, Dann said, securing fields in the north "will likely take more time," due to Turkey's refusal to allow the US to station attack troops there.

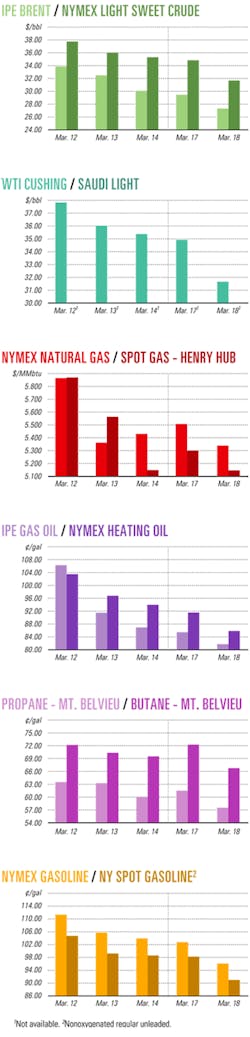

Industry Scoreboard

null

null

null

Industry Trends

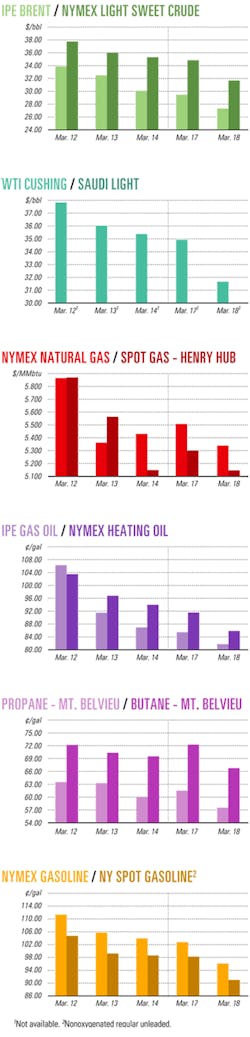

US OIL SERVICE fundamentals are improving.

The rig count bottomed earlier in the year and has risen more seasonally than any time in the last 20 years, said Banc of America Securities LLC analyst James K. Wicklund.

"Commodity prices appear strong enough for the rise to continue," Wicklund noted. Baker Hughes Inc. reported Mar. 14 that the US had 927 rotary rigs working (OGJ Online, Mar. 14, 2003). That was up 82 rigs, or 10%, from the Jan. 17 tally of 845 rigs working in the US (OGJ Online, Jan. 17, 2003).

Jan. 17 was the seasonal bottom of the rig count so far this cycle, Wicklund said.

"It is too early to say how high the high count will go or how long the current drilling recovery will last. But generally, cyclical drilling recoveries have lasted about 2 years," he said.

Natural gas prices are expected to stay well above oil companies' reinvestment threshold for the next few years and will drive drilling activity in the US, Wicklund said. A 40% increase in drilling activity is needed to forestall the drop in US gas production, and that would take 2 years, he said.

Independent operators, who account for more than 65% of US natural gas drilling, say they need at least $3.30/Mcf in order to spend money on drilling activities.

"Currently, the natural gas futures strip shows prices staying above $4/Mcf until May 2005 and not going below $3.75 through 2008, though the liquidity of the futures market is not very representative that far out," Wicklund said.

Companies that do most of the drilling for natural gas in the US finance their drilling by using variable cash flow budgets rather than established capital budgets like the major and national oil companies, he noted.

"There is a great deal of concern over how high the oil field service stocks can go and how long a recovery can lastU. We expect 2003 US rig activity to be up from 2002," Wicklund said.

He also expects that 2004 US rig activity will be up from 2003 levels.

US AND CANADIAN drilling plans remain at lofty levels, but the trend is flattening for now.

Oil and natural gas companies are taking a short breather after a recent run-up in drilling and workovers, and drilling activity is expected to resume upward soon in the US and Canada, UBS Warburg LLC said in its monthly PatchWork Survey.

Drilling and workover activities remain at high levels, but no more so than in the past 2 months, said the March survey, which was taken in late February.

"We expect drilling activity to pause here and resume its upward trend relatively soon," said analyst James Stone in a Mar. 10 survey report.

The survey gauges near-term commodity prices, oil field activity, and oil field services and product pricing. Data came from oil company operating personnel.

Both 6 and 12-month sentiment indicators remained optimistic, although survey participants' expectations for outside the US and Canada dropped significantly.

Government Developments

On a 52-48 vote, the Senate narrowly approved last week an amendment that effectively stripped an Arctic National Wildlife Refuge leasing drilling proposal from a pending budget resolution.

"It's a big victory," said Sen. Barbara Boxer (D-Calif.), who led the fight against the ANWR budget plan.

"I do not assume it is over," Boxer said. "The fight is not over." She said there was still a possibility that ANWR drilling supporters would try to reinsert a leasing revenue provision when House and Senate lawmakers meet in conference to reconcile differences between the two bills.

The House is expected to include an ANWR leasing provision in its budget plan (OGJ Online, Mar. 17, 2003).

If Republican leaders, who control both chambers, do opt to reintroduce ANWR during a conference on the budget resolution, Boxer warned that she would "use every means at my disposal to stop that."

Nevertheless, she suggested, public opinion may discourage the White House and drilling supporters from reinserting it.

"With the country poised to go to war, I hope they would accept the will of the Senate," Boxer said.

ANWR drilling supporters have vowed they will not give up. Immediately before the vote, Sen. Ted Stevens (R-Alas.) urged colleagues to vote with him.

"This is my most important vote in my career in the Senate," said Stevens, chairman of the powerful Committee on Appropriations . "People voting against this are voting against me. I won't forget it."

After the defeat, a spokesman for Stevens said the senator would not rule out an effort by drilling supporters to insert the ANWR language in a conference report. And if that effort fails, drilling proponents have vowed to continue pressing for the measure.

Before the vote was cast, ANWR supporters had focused most of their efforts on freshmen senators Mark Pryor (D-Ark.) and Norm Coleman (R-Minn.), both of whom were considered "swing" voters.

Drilling opponents meanwhile are pressing for legislation sponsored by Sen. Joe Lieberman (D-Conn.) that would declare ANWR and its coastal plain a permanent wilderness, protecting it from development.

The White House's energy blueprint calls for leasing a portion of the ANWR coastal plain.

Speaking before the House Committee on Resources on the eve of the Senate vote, a top Bush administration official reiterated the president's support for leasing in the 1002 area.

"ANWR is by far the largest untapped source of domestic petroleum and would equal nearly 60 years of imports from Iraq," Assistant Secretary of the Interior Rebecca Watson said.

The current budget blueprint sets a ceiling of $784.5 billion for total discretionary budget authority in the fiscal year starting Oct. 1. Neither the Senate nor House plan estimates the cost of the war with Iraq, although the White House reportedly plans to ask Congress to appropriate up to $90 billion for reconstruction.

A House Budget Committee plan now before the full House calls for discretionary spending at $775.4 billion; the White House currently has issued a $782 billion request.

Quick Takes

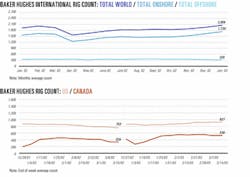

TWO UNOCAL CORP. subsidiaries propose to develop Moulavi Bazar natural gas field on Block 14 in Bangladesh's northeast Sylhet district, which could provide 100 MMcfd of gas for domestic consumption, Unocal said Mar. 10.

The company, which recently completed field appraisal studies, estimates that Moulavi Bazar contains a gross resource potential of more than 440 bcf of gas. Unocal Bangladesh Blocks 13 and 14 Ltd. is operator and, together with Unocal Bangladesh Ltd., has a 100% working interest in the production-sharing contract covering the field.

Total development cost, including two development wells, has been estimated at $42 million. Production would be delivered into the existing Bangladesh national gas network, Unocal said.

Under a separate PSC, Unocal subsidiaries also operate and hold a 100% working interest in Bibiyana gas field on Block 12. Under a proposal that Bangladesh is reviewing, Unocal would export natural gas by pipeline from Bibiyana to markets in India.

Royal Dutch/Shell Group cut back spending for oil development in Thailand this year by nearly 12% from 2002 levels, company officials said. Thai Shell Exploration & Production Co. earmarked $36.5 million to develop its S1 tract in northern Thailand this year. Thai Shell and its minority partner, PTT Exploration & Production PLC (PTTEP), will drill 17 new development wells this year, compared with 26 last year. Average crude oil production is expected to drop to 17,500 b/d from 20,602 b/d in 2002, and associated gas output to fall to 55 MMcfd from 56.2 MMcfd. However, average daily LPG production is expected to rise to 314 tonnes from 298 tonnes last year. Thai Shell will cancel the waterflood project planned to arrest the rapid decline in pressure in the main area of 21-year-old Sirikit field (OGJ Online, Dec. 28, 2001). Thai Shell believes there are 88 million bbl of crude and 304 bcf of gas remaining to be produced from Thai onshore acreage, largely in Kamphaeng Phet and Phitsanulok provinces. As of January, cumulative production was 143.5 million bbl of oil and 317 bcf of gas, with a total of 329 wells drilled.

GLOBALSANTAFE CORP. reported Mar. 13 the voluntary suspension of all six of its land rigs currently drilling in Kuwait due to "potentially imminent military conflict with Iraq." The rigs ceased operations Mar. 17 and will not resume work "until the political climate in the area stabilizes," the company said. The company employs 432 workers in the Middle Eastern country and said it would evacuate 386 nonresident employees by the idle date. Suspension of the rigs should not have a "material impact" on the company's first quarter financials, GlobalSantaFe said.

An Ensco International Inc. unit, Dallas, and Singapore-based Keppel Fels Ltd. jointly agreed to acquire, for $26.25 million in cash and project management services, a 25% ownership interest in a new, high-performance jack up that Keppel Fels will construct in Singapore. The Ensco 106 rig will be an enhanced KFELS Mod V (B) design, modified to Ensco specifications, and will be capable of handling demanding applications worldwide. The enhanced design will be designated as "Bigfoot." Rig construction will total $105 million. In addition to its initial 25% ownership, Ensco reserved an option to purchase the remaining 75% interest within 2 years after delivery. Delivery is expected in first quarter 2005, after which Ensco will market, manage, and operate the rig under charter from the joint venture.

DUBAI SHELL CHEMICALS opened a $1.2 million expansion to its Dubai terminal at the Jebel Ali Free Zone, doubling the terminal's capacity to 7,000-8,000 tonnes, reported OPEC News Agency.

Expansion facilities included new storage tanks for polyols and a manufacturing unit for onsite processing of a wide variety of polymeric polyol blends. The unit uses state-of-the-art technology adopted from Shell's plant at Pernis, the Netherlands, said Ghassan I. Ashqar, Shell Chemicals commercial and operations manager for the Middle East and Pakistan. He said this latest version of the technology, with Shell proprietary software, was the first of its kind in the Middle East. "The plant is fully computerized, and at the touch of a button, we can produceUwhichever polymeric polyol grades that customers want," Ashqar said.

THE US MINERALS MANAGEMENT SERVICE reported that apparent high bids of $315.5 million were offered for 561 offshore tracts at Lease Sale 185 for the central Gulf of Mexico during bidding in New Orleans on Mar. 19.

MMS officials received 793 bids totaling $414.7 million from 74 companies at the sale. That compared with 697 bids totaling $442.4 million from 69 companies during the last central gulf lease sale a year ago. A detailed sale analysis will appear in next week's issue. "Although interest in deepwater continues, two thirds of the bids in this sale are on the Continental Shelf. We believe this reflects definite industry interest in deep gas in shallow watersU," said MMS Director Johnnie Burton.

The latest sale encompassed 4,460 blocks covering 23.4 million acres off Louisiana, Mississippi, and Alabama. The blocks are 3-210 miles offshore in 4 m to more than 3,425 m of water.

MMS estimates undiscovered hydrocarbons in the sale area to be 270-650 million bbl of oil and 1.59-3.30 tcf of natural gas.

The sale's final notice included a continuation of recent royalty suspension measures designed to increase domestic natural gas and oil production.

BP Exploration (Angola) Ltd. plans to drill another well, Saturno, on ultradeepwater Block 31 off Angola before the end of March, a source told OGJ. The Leiv Eriksson semisubmersible rig will spud Saturno after rig maintenance, a safety stand-down, and prespud preparations have been completed. BP discovered Plutão field on Block 31 in third quarter 2002, and Saturno will mark the licensees' third well on the block, which BP operates on behalf of Angola's national oil company Sonangol EP and partners. BP holds 26.67% interest in the block (OGJ Online, Sept. 18, 2002). Partners are: ExxonMobil Corp. unit Esso Exploration & Production Angola 25%, Sonangol 20%, Statoil Angola AS 13.33%, Marathon Angola Petroleum Ltd. 10%, and TotalFinaElf SA unit EPA Ltd. 5%. The ultradeepwater area off Angola is believed to be one of the most prolific regions in the world for new, light oil discoveries. Oil in the area has an API gravity of 32-39.5°. Block 31, which is 248 miles northwest of Luanda and covers an area of 5,349 sq km in 4,922-8,203 ft of water, was awarded to the BP consortium in 1999. F In other exploration news, Pakistan issued an exploration license Mar. 3 for Block 2769-11 (New Block B), in Sindh and Punjab provinces, to a joint venture of Tullow Oil PLC subsidiary Tullow Pakistan (Developments) Ltd. (operator with 48.181% ownership interest) and partners Oil & Gas Development Co. Ltd. 30%, Pakistan Oilfields Ltd. 14.545%, and Attock Oil Co. 7.2731%. The block, in Prospectivity Zone III, covers an area of 770.29 sq km. The JV is obligated to carry out geological and geophysical studies, a 150 line km seismic acquisition, and a 60 sq km seismic acquisition over a 3-year term with a minimum expenditure of $2 million.

Bayelsa is bound for NLNG's terminal at Bonny where it will load its first cargo Apr. 1. Production from NLNG's third train began last November, and the first shipment departed in December for Gas Natural SDG SA of Spain under a 22.5-year contract for 2.7 billion cu m/year. Transgas of Portugal will purchase the remaining 1 billion cu m/year from Train 3, also under a 22.5-year contract.

Bergesen said it would contract Daewoo Shipbuilding & Marine Engineering Co. Ltd. of South Korea to build four new 145,500 cu m vessels at a cost of $710 million, with delivery to take place in first, third, and fourth quarters 2005 and first quarter 2006.

NLNG Ltd. is a Nigerian joint venture company whose shareholders are the Nigerian National Petroleum Corp. 49%, Shell Gas BV 25.6%, TotalFinaElf LNG Nigeria Ltd. 15.0%, and Agip International NA 10.4%.

Snøhvit project operator Statoil ASA awarded an 800-850 million kroner contract to AFS-Pihl Group for civil works, foundations, and construction of various process buildings associated with the Snøhvit LNG processing plant. AFS-Pihl Group is a joint venture of Norway's AF Spesialprosjekt AS and E. Pihl & Son AS of Denmark. Construction is scheduled to begin in May and be completed in November 2005. Work will be carried out at the plant site on Melkøya Island outside Hammerfest in northern Norway. Licensees for the 45 billion kroner Snøhvit LNG export project are TotalFinaElf SA, Gaz de France, Norsk Hydro AS, Amerada Hess Corp., RWE-DEA AG, Svenska Petroleum Exploration AB, and Petoro AS.

LION OIL CO., El Dorado, Ark., will spend more than $22.3 million to upgrade its 58,000 b/d El Dorado, Ark., refinery and settle clean-air rule violations, the US Department of Justice and the Environmental Protection Agency said Mar. 11. Arkansas also joined in the settlement.

Lion pledged to reduce air emissions from its refinery by 1,380 tonnes/year through installing new pollution control technology to reduce emissions from the refinery's catalytic cracking unit.

The company also will pay a $348,000 civil penalty, which Arkansas will share, and spend more than $450,000 on supplemental environmental projects designed to reduce emissions from the refinery.

DOJ officials say that with the latest settlement, about 32% of industry is complying with NSR, and they hope to have at least 50% of the refining industry within NSR compliance by yearend.

NATURAL GAS PRODUCTION from Nam Phong, Thailand's first commercial gas field operated by a unit of ExxonMobil Corp., could last beyond 2010, albeit at declining rates.

Executives at Esso Exploration Khorat Inc. said there might be 150 bcf of recoverable gas reserves remaining in Nam Phong, which began production in December 1990. The field, in the northeastern province of Khon Kaen, originally was estimated to contain 1.5 tcf of gas, but subsequent studies put its total recoverable proved reserves at 440 bcf.

Nam Phong's production peaked at 125 MMcfd in 1998. Esso Khorat executives expect its production to fall to 50 MMcfd this year from seven wells currently producing. However, the company is looking at various ways—including reservoir acidization—to stimulate field productivity.

Beyond that, Esso Khorat officials said Nam Phong's highly complex geology might not justify additional spending. The company has spent more than $300 million on exploration and development in Thailand, mostly in the northeastern region.

AMP1 production platform en route to Nigeria

The 12,125-tonne Amenam-Kpono AMP1 production platform is en route from J. Ray McDermott SA's Jebel Ali fabrication facility in Dubai to Elf Petroleum Nigeria Ltd.'s Amenam field 19 miles off Nigeria. The platform will have a processing capacity of 130,000 b/d of oil, with 15 million cu m/day of gas injection and 12,500 cu m/day of water injection capability. McDermott fabricated the jacket and deck under a subcontract from the Saibos CML-led consortium that has the turnkey contract for engineering, procurement, construction, and installation of the platform (OGJ Online, Sept. 13, 2000). Elf expects initial production of 125,000 b/d by mid-2003, and production is expected to total 500 million bbl over 25 years. Reserves are estimated at more than 1 billion boe (OGJ Online, Mar. 26, 2001). Elf is operator on behalf of Nigerian National Petroleum Corp. and Mobil Producing Nigeria Unlimited, a subsidiary of ExxonMobil Corp. Photo courtesy Elf Petroleum Nigeria.