Iraq's massive oil and gas reserve potential ultimately could reach 330 billion bbl of oil and 324 tscf of gas, said UK-based investment analysts Bayphase Ltd. in a recent report.

Iraq also offers equally substantial investment opportunities. "An estimated $100-150 billion worth of investment is required in Iraq's oil and gas and infrastructure sectors to enable some of this potential to be unlocked" in the upstream, midstream, and downstream sectors, the firm reported.

"Iraq's oil and gas industry since nationalization in 1975 has suffered from a severe lack of investment and technology integration because of inadequate management, isolation, and lack of central funding due to the wars waged (during 1980-90) and to United Nations sanctions imposed from 1990 to date. Iraq, therefore, will sooner or later re-emerge as a major frontier for oil and gas investment," Bayphase said.

In the study, aimed at identifying the reserves and the investment potential in Iraq today, Bayphase reported that these opportunities in the near future would be open to international investors in a variety of ways.

In fact, despite UN sanctions, international activity in Iraq already is high, with companies from more than 30 countries—including the main European Union countries—pursuing deals. There have been 12 major agreements signed already that are awaiting the relaxation of sanctions.

Iraq, which itself "clearly recognizes the need for international investment, and has an initial program of 33 oil and gas field development and rehabilitation projects to be awarded," along with revised legislation covering terms and conditions for a new production and development contract. "Along with these projects, significant regional infrastructure upgrades and new builds are required in the refining, processing, and transportation sectors," Bayphase said.

Reserves assessment

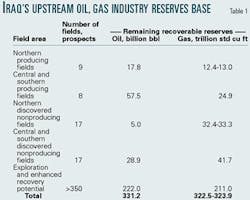

Overall, the status of Iraq's upstream oil industry is probably best expressed in terms of its reserves, which are classified into five categories: the northern producing fields, central and southern producing fields, northern discovered but nonproducing fields, central and southern discovered but nonproducing fields, and exploration and enhanced recovery potential (Table 1).

"While reserves available in Iraq's producing and nonproducing fields are 103.8-112.9 (billion bbl), these are stated as proven reserves and (based on Bayphase assessments) represent a conservative assessment of Iraq's reserves base. With investment, considerable improvements can be made in recovery," the analysts said.

In addition, Iraq has a significant number of world-class exploration opportunities available in each of its three primary hydrocarbon provinces. Iraq has the potential to add considerably to its reserves base through these routes, the analysts reported.

Investment assessment

Investment required should Iraq's published plans for its upstream, midstream, and downstream sectors come to fruition could amount to $97-153 billion (Table 2).

These are capital costs that will be encountered in the refurbishment and further development of Iraq's oil and gas industry and infrastructure. These opportunities are based "on an assessment on the known status of each facility and, where available, on published plans for expansion."