IEA: Oil markets heading into period of heightened uncertainty

The oil market is heading into a period of heightened uncertainty with low stocks and limited spare production capacity, the International Energy Agency warned in its latest Oil Market Report. These factors reduce flexibility and limit the system's ability to respond rapidly to changing circumstances.

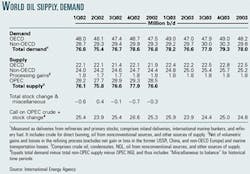

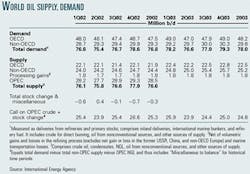

The Paris-based agency reported that worldwide crude oil production surged 1.96 million b/d in February. Members of the Organization of Petroleum Exporting Countries added 1.5 million b/d, as output from Venezuela rebounded another 850,000 b/d, and Saudi Arabia increased exports 330,000 b/d. This meant that OPEC spare capacity fell to 1.7 million b/d in February, and Iraqi output for February was 2.49 million b/d.

Addressing supply interruptions in light of sparse inventories, IEA commented, "Recent mergers and acquisitions may have increased the ability of refiners to test the limits of indicative minimum operating stocks. And Venezuela may yet surprise us with a sharper-than-expected increase in supply. But potential political turmoil in Nigeria cannot be forgotten."

The agency noted that some producers have positioned their stocks near water close to consuming markets, while others have land-based inventories capable of supplementing production. If they are available, these stocks could cushion a supply disruption.

Inventories

Industry oil stocks in member countries of the Organization for Economic Cooperation and Development are tight and trending around minimum operating levels in key markets, however. Forward demand cover by OECD oil stocks came to 50 days at the end of January, as storage volumes were down 211 million bbl from a year earlier. Crude stocks declined in the US but held flat in Europe during January. There were few incentives for regional refiners to purchase crude above operating requirements. Heavy refinery maintenance in the US eroded some crude demand, and although strong cracking margins for light sweet crude bolstered throughputs in Europe, backwardation in the paper markets limited inventory holdings, IEA said.

Stocks of gasoline in the OECD grew by 4 million bbl in January. The strongest gains occurred in Europe but were modest in light of waning demand, and exports to the US reached 2 million tonnes. US gasoline stocks slipped marginally despite strong demand.

Distillate stocks in North America plummeted as cold temperatures hit the northeastern US. Meanwhile, gas oil stocks in Europe fell not on domestic demand but on pull from US markets.

Refining margins surge

Product price increases outpaced crude oil price gains in February, strengthening margins substantially in the four major refining centers. Cracking margins showed greater improvements than hydroskimming margins in Rotterdam, the Mediterranean, and Singapore.

Cracking margins for both Brent and West Texas Intermediate crude increased on the US Gulf Coast. The monthly gains in average margins hide intra-month fluctuations, though. IEA reported that the US Gulf Coast cracking margin for WTI during February averaged $4.54/bbl, up from $1.93/bbl a month earlier. From late January through the second week of February, the margin improved dramatically and then fell steeply for 2 weeks before rising sharply at the end of the month. The poor mid-February margins rebounded as key product price gains—in heating oil and jet fuel—surpassed crude oil price gains at the end of the month.