OGJ Newsletter

Market Movement

OPEC inaction, low stocks rock market

The Organization of Petroleum Exporting Countries' Mar. 11 decision to stand pat on its current oil production quota of 24.5 million b/d failed to prevent a same-day drop in oil futures prices, as OPEC Pres. Abdullah bin Hamad Al Attiyah reported that earlier suggestions the group might suspend quotas altogether were not even discussed during the 1-day meeting. Traders apparently were unmoved by what otherwise could be perceived as a bullish sign for oil prices: OPEC's refusal to formally endorse all-out production in the event of an Iraqi oil supply outage.

However, those losses were wiped out in a Mar. 12 buying spree after both the US Department of Energy and the American Petroleum Institute reported surprisingly large declines in US inventories of crude and products during the week ended Mar. 7. Traders had anticipated increased stocks from additional imports. The April contract for benchmark US light sweet crudes closed at $37.83/bbl midweek on the New York Mercantile Exchange.

Drawdown

DOE reported a 3.8 million bbl drawdown of US oil stocks to 269.8 million bbl in the week ended Mar. 7, vs. API's estimated decline of 1.7 million bbl to 267 million bbl. DOE reported a decline of 6.7 million bbl in total US crude and product inventories to 640 million bbl, "15% below their year-ago level and in line with API's estimate," said Matthew Warburton at UBS Warburg LLC.

Regarding US crude stocks, however, he said, "The DOE estimate appears more credible; yet given the marked decline in imports (week-to-week) and with refinery crude inputs rising modestly (up 400,000 b/d to 14.6 million b/d), we would have expected an even larger crude draw.

Despite increased supplies from Venezuela and arbitrage pricing that attracted incremental Middle East and West African crudes to the US, DOE reported US crude imports declined by 1.06 million b/d to 7.6 million b/d—"the lowest level in 4 weeks," Warburton noted. API said US oil imports were down 734,000 b/d to 7.9 million b/d.

Refiners pressured

"Refiners will ultimately need to procure more crude before they can raise their runs and maximize gasoline production. However, at this juncture, steep backwardation (in NYMEX futures) and fear of declining prices may be discouraging US refiners from nominating the additional barrels on offer," said Warburton.

DOE reported US gasoline inventories fell by 4.1 million bbl to 202 million bbl during the latest period. API put the decline at 4.9 million bbl to 202.7 million bbl. Robust demand averaging 8.8 million b/d over a 4-week period, up 3.3% from the previous year, outweighed incremental production and imports, Warburton said. "While total gasoline inventories currently stand 7% below the year-ago levels, they remain within their normal seasonal range, particularly given the pending switch to low (Reid vapor pressure summer grade) specifications. The same cannot be said for (reformulated gasoline) stocks, which are 24% below their year-ago levels," he said. Moreover, said Warburton, "The industry's flexibility to raise runs is limited due to secondary unit maintenance, low crude stocks, and logistical problems, in addition to the severe backwardation in product markets."

OPEC basket price

The 2003 average price for OPEC's basket of crudes through Mar. 7 was $31.08/bbl. That basket price has remained above OPEC's targeted level of $22-28/bbl since late last year, despite the group's previous pledge to take action if market prices moved above or below the target level for extended periods. After the OPEC meeting last week, Al Attiyah acknowledged that world oil prices are high. However, he said that stems from market speculation and not from any shortage of oil supplies. "We speak to our customers all the time, and they have not expressed any shortage to us," he said, adding that the organization is closely monitoring market supply and demand. He said OPEC ministers will meet again June 11 in Doha, Qatar, to reassess the situation. Meanwhile, OPEC members said they will keep at least 2 million b/d of extra production capacity ready for use in case of a world supply shortage. However, the International Energy Agency suggested last week that OPEC has spare production capacity of less than 1 million b/d.

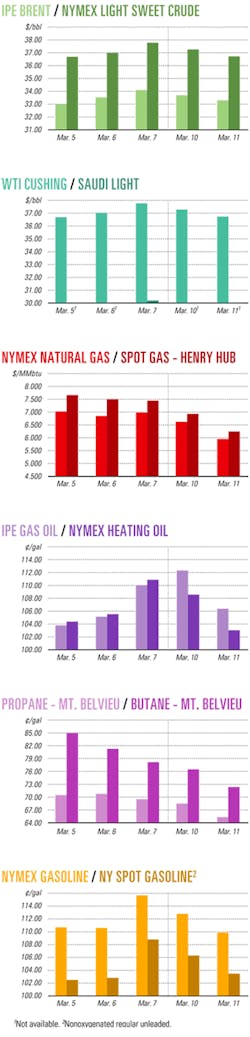

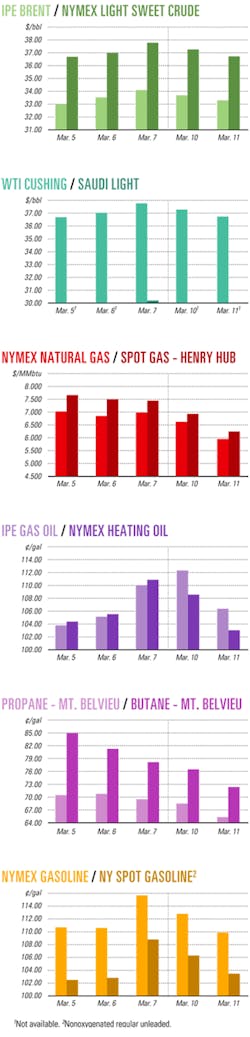

Jefferies & Co. Inc., New York, last week raised its 2003 price forecasts to an average $29/bbl for West Texas Intermediate and $5/MMbtu for Henry Hub natural gas. That's up from its earlier projections of $25/bbl and $4/MMbtu.

"The keys to our higher forecast include bullish US and worldwide crude inventory levels, our belief that OPEC will remain a cohesive unit for the foreseeable future, and the difficulties non-OPEC producers are experiencing expanding production," Jefferies reported.

Industry Scoreboard

null

null

null

Industry Trends

WORLDWIDE OFFSHORE DRILLING expenditures are expected to see robust growth, especially in the deepwater sector.

During the next 5 years, 14,626 offshore wells will be drilled worldwide at a cost of $170 billion, forecast energy consultant Douglas-Westwood Ltd. in its recent "World Offshore Drilling Report."

The Canterbury, England-based Douglas-Westwood estimated that 10,231 would be development wells, 2,665 exploration wells, and 1,730 appraisal wells.

Deepwater drilling expenditures are forecast to experience strong growth, with spending of $40 billion expected on 560 exploration, 330 appraisal, and 1,465 development wells over the next 5 years.

The deepwater share of total offshore drilling expenditures will increase to 31% by 2007 compared with 20% in 2002.

"The main drivers for this change appear to be an increasing shortage of shallow-water prospects, combined with innovations in drilling technology allowing deepwater drilling in more extreme conditions," said analyst Michael Smith.

Douglas-Westwood estimates that the total drilling and well completion expenditures in 2002 were $33.5 billion.

"Global spending levels are expected to be reasonably steady over the next 5 years; however, we expect significant changes in some regions. North America—where we expect 4,798 wells—will have the highest share of the total spend, increasing (compared with the previous 5-year period) by $2.4 billion, and growth of a similar magnitude is also expected in Africa, Latin America, and the Middle East," Smith said.

But Asia and Western Europe both are expected to see a spending decline.

Asia's forecast 5-year spending is $4.5 billion less than the previous period. Western Europe's forecast expenditure is >$5.2 billion less than the 1998-2002 level.

Smith forecast that water depth capabilities will continue to grow beyond the current drilling record of 2,965 m and that deepwater wells partly will offset declining activity in shallow waters.

The deepwater percentage of total wells drilled is expected to increase to 19% in 2007 compared with 12% by 2002.

"A decline in shallow-water activity is being driven by a global shortage of opportunities," he said. Some growth is possible in the (Persian) Gulf, "but this would depend on the controlling governments, primarily Iran and Saudi Arabia, encouraging investment to a much greater extent than they do now."

Consequently, industry is expected to direct most of its new drilling rig expenditures on upgrades of both jack ups and floating rigs.

"We expect steady, rather than dramatic, improvements to drilling equipment and services over the next 5 years, facilitating wells to be drilled in more extreme situations, in greater water depths and reservoir depths, at higher temperatures and pressures, and in areas prone to greater hazards. However, no radical new processes are expected to make a major impact on expenditure within the timescale of our forecast," Smith said.

Government Developments

THE US COURT OF APPEALS for the District of Columbia Circuit rejected a request by 10 Northeastern states to temporarily stop federal regulators from streamlining certain clean air rules that apply to refinery and power plant emissions.

The states argued that the changes violate federal clean air rules by effectively exempting numerous refineries, factories, and power plants from meeting emission targets.

The stay request involved both proposed and final revisions to the 1977 New Source Review provision of the Clean Air Act issued last year by the Environmental Protection Agency. NSR regulations typically require industrial facilities to upgrade pollution control equipment when major changes are made to a plant (OGJ, Dec. 2, 2002, p. 34).

The states participating in the stay motion were Connecticut, Maine, Maryland, Massachusetts, New Hampshire, New Jersey, New York, Pennsylvania, Rhode Island, and Vermont.

Those states sued EPA over proposed and final adjustments to the NSR program.

The lawsuit argues that exceptions to the NSR provision are beyond EPA's legal authority and are contrary to the law. The states called for the court to temporarily suspend the new rules because they feared a court ruling would take too long.

Environmental groups supporting the lawsuit said the court's action does not reflect the merits of the case. Frank O'Donnell, executive director of the Clean Air Trust noted that, while the court rejected a stay, it did call for an expedited review of the case.

Meanwhile, industry representatives supporting EPA's NSR updates praised the court action.

"By denying the request, the court has allowed the first step toward clarification of the NSR program to proceed. Ultimately, a clearer NSR program will allow for efficiency upgrades that protect the environment, safety, and consumer interests," said Scott Segal, director of the Electric Reliability Coordinating Council.

Segal noted that the decision did not deal with what he says industry thinks is the most significant NSR issue yet to be resolved: clarification of the definition of routine maintenance. "The time for taking action on routine maintenance is long overdue," he said.

EPA's proposed rule clarifies definitions for "routine repair and replacement." Comments originally were due Mar. 3 but interested parties now may file comments through May 2. The agency also has scheduled five public regional hearings (OGJ Online, Feb. 17, 2003).

A separate final rule that changes the way EPA measures actual emissions became official Mar. 3. It includes incentives that industry says will encourage manufacturers to undertake pollution control and prevention projects. Under that rule, they said, a refinery should be able to modernize without triggering a new permit review, provided it operates within site-wide emissions caps.

IRAQ APPOINTED former Oil Minister Amer Mohammed Rashid as the country's acting oil minister after he was relieved from the minister's post on Jan. 7, OPEC News Agency reported.

Iraq President Saddam Hussein signed the decree reappointing him, but the decree did not say why he was reappointed, OPECNA said. Prominent in Iraq's oil policy, Rashid served as Iraq's oil minister during 1995-2003.

Previously, ruling Baath party member Samir Abdulaziz Al-Najm had been named acting oil minister (OGJ, Jan. 13, 2003, p. 7).

Quick Takes

FOLLOWING FINAL APPROVAL from Trinidad and Tobago's Ministry of Energy, BHP Billiton Petroleum Pty. Ltd. and partners announced plans Mar. 12 to develop their Block 2c oil and gas discovery made in 2001 on the Greater Angostura structure 40 km off eastern Trinidad. Block 2c harbors the first major oil discovery made in Trinidad in more than 30 years.

BHP is the operator with a 45% interest, and partners are TotalFinaElf SA 30% and Talisman Energy Inc. 25%.

Phase 1, estimated to cost $726 million, will cover engineering, construction, and installation of offshore production and transportation facilities in 40 m of water.

BHP said Trinidad and Tobago will become a core development area for the company. Gross oil reserves are estimated at 90-300 million bbl with a midcase, or P50, volume of 160 million bbl. The range of gross recoverable gas volumes is 1-2.3 tcf, with a midcase volume of 1.75 tcf.

The discovery well and appraisal wells yielded strong flow rates (OGJ Online, Mar. 8, 2002).

The wells tapped extensive pay in the prolific Oligocene play that was believed to extend from the South American mainland to Trinidad, yet that previously never yielded hydrocarbons in the Caribbean twin-island nation.

The discovery is expected to add 75,000-80,000 b/d of oil to Trinidad's crude production, a sharp increase from this year's average output of just less than 150,000 b/d.

Development in Angostura field will include three satellite wellhead platforms tied into a central processing platform. First oil is expected by fourth quarter 2004.

BHP also operates the 150,000-acre Block 3a east of Block 2c with a 30% stake. Its Block 3a partners are BG Group PLC and Talisman, 30% each, and TotalFinaElf 10%.

The consortium signed exploration agreements covering Block 3a on Apr. 22, 2002, and since has acquired 981 sq km of 3D seismic data. Processing and interpretation likely will continue until midyear.

However, the consortium said that data from wells drilled by previous operator Conoco Inc. (now ConocoPhillips) are strong, so they expect to drill two exploratory wells on Block 3a before completing all data acquisition.

UNOCAL INDONESIA CO. has signed a $44 million drilling contract with Diamond Offshore Drilling Inc., Houston, for the Ocean Baroness semisubmersible rig to drill off Indonesia for 400 days.

Subject to final government approvals, Ocean Baroness will start operations after completing shipyard modifications under way in Singapore to permit surface stack operations.

The Ocean Baroness is a fifth-generation semisubmersible, one of Diamond Offshore's signature Victory-class upgrades designed for self-contained mooring operations in water as deep as 7,000 ft.

OMV AG, Vienna, has discovered an oil and gas field in the Vienna basin that it described as Austria's largest find in 25 years.

The Erdpress 1 exploration well in the Steinberg fault zone 35 km northeast of Vienna identified 500,000 tonnes of oil and 200 million cu m of gas in place, or a combined 4.5 million boe. Appraisal drilling could add an additional 3 million boe, OMV said.

Oil output at Erdpress, 7 km north of Matzen field, is expected to begin late this year and continue for 15-20 years, OMV said.

"Producible oil and natural gas accumulations were found in 12 sandstone horizons while drilling to a depth of 2,926 m.... OMV expects an initial...production rate of around 300 boed," the company said. It plans to drill the Erdpress 2 appraisal well in the second half of this year. Gas production will commence as development wells are drilled, starting in 2004.

The well cut six horizons in Badenian and six in Sarmatian (all Middle Miocene) at 1,300-2,500 m. The gas is sweet. Oil gravities vary from 24° in Sarmatian to 34° in the lower Badenian horizons, and sulfur content 0.14-0.17%.

The 3.5 million euro project cost includes drilling, start-up costs, surface equipment, and pipeline connections.

OMV said the Erdpress discovery well identified a resource equal to about a third of the group's Austrian production of 14 million boe/year. It attributed the find to the use of 3D seismic data and computer-aided interpretation methods.

Matzen, Europe's largest onshore oil field, was discovered in 1949 and peaked at 3.5 million tonnes/year in 1955.

OMV drilled 45 wells in the country the past 2 years, reaching the highest level of Austrian production in 20 years. It hopes to maintain Austria's output at a constant level, bucking the 8%/year decline.

The company met 10% of Austrian oil demand and 15% of gas demand in 2001. It said Austria produced 2 billion cu m of gas and 1 million tonnes of crude oil in 2002, of which OMV's share was 57% of gas and 90% of oil.

OMV holds more than 5,000 sq km in the Vienna basin, where it spends 50 million euros/year and plans an additional 16 million euros for purely exploratory purposes.

TOTALFINAELF is drilling three additional production wells in Balal field in the Persian Gulf off Iran, which are expected to start producing by mid-2003.

Meanwhile, production began in January from two wells in the field south of Lavan Island, following a $310 million development program (OGJ Online, Jan. 13, 2003). Those wells are producing 20,000 b/d of oil, which is being exported through subsea pipeline facilities to processing facilities operated by state-owned National Iranian Oil Co. on Lavan Island 100 km to the north.

Production is expected to increase to 40,000 b/d by March 2004 when a total of 10 wells will be on line.

TotalFinaElf, which operates the 390 million bbl field under a buy-back agreement with NIOC, has a 46.75% interest in the field. Other partners are Italy's ENI SPA 38.25% and Canada's Bow Valley Energy 15%. F

BP Exploration Co. (Colombia) Ltd. has awarded a 5-year contract to a unit of UK-based John Wood Group PLC to expand, operate, and maintain an intermediate processing facility in Floreña field in Colombia's Casanare region about 100 miles northeast of Bogota. The new facility, which comprises two processing plants—one established and the other under construction—will generate its own power and has the capacity to process 21,000 b/d of oil and 82 MMscfd of natural gas. Floreña field's oil is supplied to the Ecopetrol Araguaney pump station, but separated gas is reinjected into the reservoir to enhance oil production.

INTERNATIONAL LICENSEES of Azerbaijan's Shah Deniz gas and condensate field development project in the Caspian Sea 100 km off Baku and the associated 690 km South Caucasus gas pipeline (SCP) approved Phase 1 of the project Feb. 27, including the start of field development and construction of the pipeline, said major participant Statoil ASA. BP PLC will be technical operator for both the field and the pipeline.

Development (upstream and midstream) has an overall investment budget of $3.2 billion.

The development go-ahead opens the door for South Caucasus Pipeline Co. to begin construction next year on the SCP pipeline from Shah Deniz to Erzurum, Turkey, and its associated compression facilities. Operations are scheduled to begin in 2006.

The SCP line will follow the right-of-way of the Baku-Tbilisi-Ceyhan oil pipeline—already under construction—as far as Erzurum.

When complete, the pipeline will transport an estimated 8.4 billion cu m/year of gas from Shah Deniz through Baku and the Georgian capital Tbilisi to Erzurum.

"Another milestone has been achieved," Medjid Kerimov, Azerbaijan's minister of fuel and energy, said at the official approval ceremony in Baku, according to a press statement. "The scale of the project means that Azerbaijan is now firmly positioned to become a major gas exporter."

Shah Deniz, which was discovered in May 1999 (OGJ Online, July 15, 1999), has gas reserves estimated at 25-35 tcf (OGJ Aug. 21, 2000, p. 68).

Statoil, through the newly established Azerbaijan Gas Supply Co., was designated commercial operator covering gas sales, contract administration, and business development for Shah Deniz and the pipeline.

With the approval, Norway's Hydralift ASA and AS Nymo Mek. Verksted will deliver equipment and fabricated structures to Shah Deniz under contracts valued at $46 million. Offshore development in 50-500 m of water will consist of a fixed platform from which 10 wells will be drilled, and two 100-km offshore pipelines—a 26-in. gas line and a 12-in. liquids line—to Sangachal terminal where new gas processing and condensate stabilization facilities are planned.

BP will operate the plant and terminal (OGJ, Oct. 29, 2001, p. 64).

In addition to BP and Statoil, each of which holds a 25.5% interest in the project, Shah Deniz consortium shareholders are State Oil Co. of the Azerbaijan Republic, TotalFinaElf SA, Naftiran Intertrade Co. Ltd., and LukAgip NV—each holding 10%—and Turkiye Petrolleri Anonim Ortakligi with 9%.

TOTALFINAELF has awarded France's Technip-Coflexip a 50 million euro contract for the design and construction of a hydrotreating unit at its 109,013 b/cd refinery at Antwerp.

Construction completion is scheduled for late August 2004. The unit will have a capacity of 57,500 b/sd of gasoline and is expected to start up on Oct. 20, 2004.

Part of the "Clean Gasoline Project," the unit will hydrotreat gasoline from the FCC unit without lowering the octane rating.

It will enable production of gasoline with sulfur content below 10 ppm so that the Antwerp refinery can comply with 2008 European gasoline standards.

TWO AUSTRALIAN LNG projects marked progress with recent developments.

The newly independent East Timor last week signed the Timor Sea Treaty, enabling natural gas to be produced from Bayu-Undan field in the sea's Joint Petroleum Development Area shared by the two countries.

The move, along with the Mar. 6 signing of an International Unitization Agreement (IUA) for Greater Sunrise gas fields—Sunrise, Sunset, and Troubadour—paves the way for development of those fields along with Bayu-Undan.

Greater Sunrise, which has gas reserves of 9 tcf, is planned as the world's first floating LNG plant (OGJ, Mar. 10, 2003, p. 56), with produced LNG to be delivered to a proposed terminal to be sited somewhere in southern California or Mexico's Baja California peninsula, where it would be regasified and marketed.

Australian Resources Minister Ian Macfarlene, who signed the treaty, said he would assist with gas marketing during a planned trip to China, South Korea, and Japan.

Bayu-Undan JV partners are ConocoPhillips unit Phillips Petroleum (91-12) Pty. Ltd. (operator), Santos Ltd., ENI SPA unit Agip SPA, and Tokyo-based Inpex Corp.

Greater Sunrise partners are operator Woodside Petroleum Ltd., Oska Gas Corp., Shell Development (Australia) Pty. Ltd., and ConocoPhillips.

Darwin LNG Pty. Ltd., a Phillips Petroleum Co. (now ConocoPhillips) unit, last year signed a 17-year heads of agreement with Tokyo Electric Power Co. Inc. and Tokyo Gas Co. Ltd. for the sale of 3 million tonnes/year of LNG.

The LNG will be exported from a proposed liquefaction plant and export terminal at Darwin, Australia, fed by natural gas from Bayu-Undan field. Gas deliveries are expected to begin in late 2005, with fob shipments of the first LNG cargoes planned to start in January 2006.

The agreement commits nearly 100% of the field's 3.4 tcf of natural gas, Phillips said (OGJ, Mar. 18, 2002, p. 8). The field also has estimated reserves of 400 million bbl of condensate and NGL.

The Bayu-Undan gas project has been long delayed by governmental issues and earlier partner differences. In late 2001, Phillips approved construction of a $1.5 billion pipeline to carry gas from the field to northern Australia (OGJ, Jan. 7, 2002, p. 8).

Total development cost, including the pipeline and LNG plant construction, is expected to be $3 billion.

Gas reserves developed in the Greater Sunrise fields will be covered by a letter of intent Phillips and Houston-based El Paso Corp. signed about 2 years ago (OGJ, Apr. 9, 2001, p. 62).

El Paso agreed to purchase LNG from the Darwin plant under a long-term contract beginning in 2005.