Russian firms, LNG suppliers top Energy 50 rankings

Russian firms, LNG suppliers top Energy 50 rankings

The yearend 2002 ranking of the world's 50 largest energy companies was shaped by some significant events:

- Russian oil and gas companies continued to scale the Energy 50 list for the second year in a row. These firms posted high returns for 2001 as well (OGJ, Feb 11, 2002, p. 32).

- While many international companies and traditional electric utilities performed well, energy merchant firms—many of which have dropped from the Energy 50 rankings—"failed to emerge from their slump."

- Certain energy firms took advantage of the distressed economic environment to acquire assets essential to supplying the US gas market, in expectation of supply shortfalls.

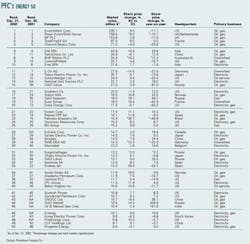

These were some of the key findings from the most recent Energy 50 ranking—a quarterly and yearend assessment based on energy companies' market capitalization—that was released earlier this year by PFC Energy (formerly Petroleum Finance Co.) of Washington, DC (see table).

Strong Russian presence

Regarding Russian oil and natural gas firms, PFC noted, "Strong gains made by the Russian oil sector boosted the overall performance of the PFC Energy 50, as did leading returns of other non-US oils"—among them the Chinese firms PetroChina, Sinopec, and CNOOC; European firms ENI SPA and Statoil ASA; Indian national oil firm Oil & Natural Gas Corp.; and Canada's EnCana Corp.

Overall, the share price performance for fourth quarter 2002 for the Energy 50 rankings increased 6.5%, PFC noted. "In the ranking's two subsectors, the oil and service companies were up 7.5% over the third quarter, and the gas and power companies were up 5% (over the third quarter)," the company said.

Despite the Russian oils' leading share-price growth in 2002, OAO Sibneft was the only Russian company among the oil and service companies in the PFC Energy 50 to post double-digit gains in fourth quarter of 2002, PFC noted.

"Having generated explosive share price growth over the past 2 years, the Russian oils may soon be leveling off to growth rates and returns that are more in line with the sector," the company said.

Merchant sector slump

PFC noted that the ailing energy merchant sector will have a large amount of debt that will mature in the coming year: "UThe potential exists for additional damage to the sector if the debt can't be serviced on time and credit ratings head further south." PFC added that a number of these companies are "retrenching" their international operations—"or already have"—and are "deemphasizing trading, and selling assets."

PFC noted, "While the merchant companies restructure their portfolios to strengthen their balance sheets and get back on a growth trajectory, other energy companies are taking advantage of the distressed environment to acquire assets, particularly assets integral to supplying the US gas market." Notably, examples of such companies include Royal Dutch/Shell Group, Statoil, Dominion Energy, and others. These companies "bought LNG assets or capacity in the US in 2002 to position themselves to fill anticipated supply shortages in the US gas market in the coming years," PFC contends.

"Although the merchant energy sector is on life support and most global equity markets closed 2002 on weak notes (marking the third consecutive bear year), energy companies ranking in the yearend PFC Energy 50 gained 8% in aggregate year-over-year," PFC Energy concluded.

PFC said it was worth noting that while other merchant energy firms were squeezed from the Energy 50 rankings, there were also first-time entrants, namely New Orleans-based Entergy.

"Entergy is the second-largest nuclear generator in the US and has much of its operations focused on the regulated electricity sector in the southeastern US," PFC said. "The company also sells power into markets in the northeast and has a marketing and trading joint venture (Entergy-Koch) with privately held Koch Industries (of Wichita, Kan.).

In contrast to most of the merchant energy sector, Entergy-Koch has weathered the tumultuous market fairly well, as evidenced by a still-strong credit rating assigned by Moody's."

LNG window of opportunity

"In the wake of (Enron Corp.'s) collapse, much of the energy industry has focused on staying afloat rather than capturing growth opportunities," PFC noted.

"But a handful of companies with large balance sheets are taking advantage of the distressed market to bolster their positions in what is expected to be a tight gas market. Several of the key LNG players are pinning portfolio growth on the development of a few large LNG projects in the Altantic-Mediterranean basin."

Some gas and electric power firms, including Houston-based El Paso Corp. and Tulsa-based Williams Cos. Inc., have been "forced" to divest themselves of certain assets—particularly LNG properties, capacity rights, and supply contracts—while working their best to restructure their portfolios in order to meet debt obligations, PFC noted. These sales have created opportunities for other companies to fill expected supply shortages in the US gas market.

PFC projects natural gas demand in the US to grow 2%/year until 2010, while domestic supply will unlikely be able to match demand growth.

"Even with sustained gas prices that make marginal drilling attractive, both Canadian and US producers have reported new wells flowing at lower rates and declining faster than older wellsU," the firm said. "The logical filler for flattening US production is Canadian imports. However, if Canadian imports grow substantially during the next few years, the potential exists to max out export capacity to the US by 2005."

The consultant contends that core Lower 48 and Western Canadian supply basins cannot satisfy US gas demand in the future, and new sources of gas will be essential, adding, that "two potential new sources are LNG imports and long-haul gas from Alaska and Canada."

PFC Energy foresees a window of opportunity for additional baseload LNG imports into the US opening in 2004-05 "Uand we believe that the risks for competing new-source gas are low.

"Alternative long-term supply options that pose limited risks to the medium-term viability of LNG imports include: new discoveries that reverse North American gas production trends, arctic gas arriving in the US market much sooner than currently expected, and very aggressive investment in Mexico to increase production and expand export pipeline capacity."