OGJ Newsletter

Market Movement

Effects of Venezuelan strike more evident in US

US effects of Venezuela's month-long strike, aimed at ousting President Hugo Chávez, became more evident last week as the American Petroleum Institute reported US oil stocks fell a whopping 9.1 million bbl to 277.5 million bbl total.

US imports of crude oil dropped by 1.1 million b/d to 7.7 million b/d, while imports of petroleum products were down 604,000 b/d to 2.3 million b/d, largely as a result of that strike.

Venezuela's oil exports, primarily to US refiners, averaged just over 230,000 b/d in December, down drastically from 2.7 million b/d in Novem- ber. Efforts by the Chávez administration to break the strike increased international exports to 520,000 b/d during the final days of December. But striking employees of Petroleos de Venezuela SA (PDVSA) claim exports again will fall sharply as the 8 million bbl of oil in storage is emptied.

With 90% of PDVSA employees participating in the strike, the national company's oil production has fallen to less than 200,000 b/d from around 3 million b/d previously. "The overall supply loss from Venezuela looks like about 70 million bbl, and the final total should easily clear 100 million bbl," said Paul Horsnell, JP Morgan Chase & Co., London, in a Dec. 27 report.

Oil price spike

As a result, Horsnell said, "We are in the middle of a fairly ferocious energy price spike."

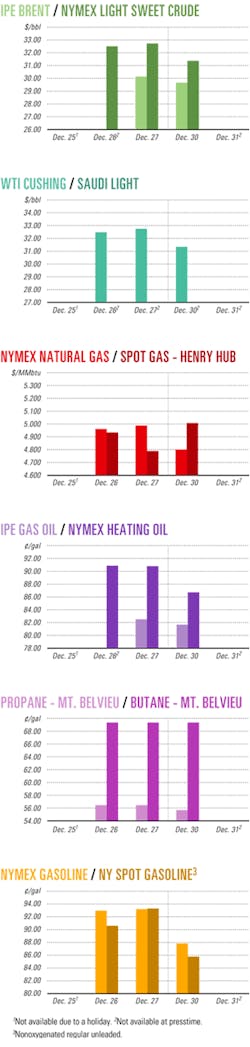

Oil prices hit a 2-year high of $33.65/bbl for February delivery of benchmark US light, sweet crudes early last week on the New York Mercantile Exchange. By New Year's Eve, however, profit-taking had dropped the same contract to $31.20/bbl.

"Everybody knows that prices are unsustainable at current levels," said Horsnell. "On the other hand, nobody knows how high the peak of the spike will be or when it will occur, and under these circumstances only the very brave or the foolhardy would want to run any significant short position."

The price spike could be blunted by PDVSA resuming normal operations or by the release of oil from the US Strategic Petroleum Reserves (SPR) stockpile. "However, the application of either of these brakes does not look particularly imminent," said Horsnell.

"The longer the Venezuelan disruption continues, the longer it will take to restore operations and the more likely it is that capacity will have been permanently impaired," he said. "Venezuela has over 14,000 oil wells. Some of those wells, particularly in the older fields, are highly unlikely to return to their pre-strike production levels due to falling reservoir pressures."

Although again claiming his administration is on the verge of breaking the general strike, Chávez warned Venezuelans in a televised nationwide speech on Dec. 31 to prepare for economic difficulties in coming months.

Government officials claimed last week that strikebreakers had increased PDVSA production to 600,000-700,000 b/d and would goose it up to 1.2 million b/d this week.

However, a leader of the striking PDVSA workers told a press conference that Venezuela's oil production is being maintained at 150,000 b/d. Unloaded tankers still are anchored at idled Venezuelan ports, and the PDVSA refineries are shut down.

Foreign oil companies have not been loading cargoes because vessels attended by uncertified crews would face insurance risks. Only ships chartered by PDVSA and its US refining and marketing affiliate, Citgo Petroleum Corp., have sailed.

Meanwhile, Venezuela reportedly is importing gasoline for its domestic market from Brazil and Trinidad and Tobago.

Strike leaders have said they won't go back to work unless Chávez agrees to call elections within 30 days if he loses a Feb. 2 nonbinding referendum on whether he should remain in office.

Citgo hard hit

Citgo, the fifth-largest retailer of gasoline in the US, has been hardest hit by the strike since it relies on Venezuela for about 50% of its crude under long-term contracts. So far, the company's requests to borrow oil from the SPR have been refused. Citgo has said it would need to find alternative supplies after this month to make up for its lost Venezuelan supplies.

The US Department of Energy previously has loaned SPR crude to companies to make up for emergency shortages. In June 2000, it lent Citgo 500,000 bbl of crude after a loading dock sank in southern Louisiana.

The Houston plant of Lyondell-Citgo Refining LP, which is 42% owned by Citgo, recently cut its production by half due to the lack of Venezuelan oil. Other companies, including ConocoPhillips and Amerada Hess Corp., have slowed production at refineries that rely on Venezuelan crude.

Industry Scoreboard

null

null

null

Industry Trends

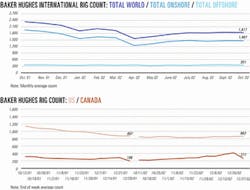

Reduced US refined product imports from Venezuela and tightening product inventories should help boost US refining margins going into the first quarter, Prudential Securities Inc. said.

The reduced imports and an anticipated heavy spring turnaround for US refineries could keep inventories near 5-year lows for a few months, analyst Andrew F. Rosenfeld said.

Improving demand should also trigger higher refining margins and better earnings for US independent refiners in 2003, he said.

"We have developed a model looking at (these) potential effects on US refined product inventories," Rosenfeld said, "(based on) the strike (in Venezuela) ending by early January and production and exports...fully restored by early February." He used these assumptions to estimate refined product inventory levels:

Refinery production at maximum weekly level adjusted downwards for maintenance and short-term rate reductions due to Venezuelan crude import shortfalls.

Refined product imports at maximum weekly level adjusted downward by Venezuela's share of 120,000 b/d, which is 8% of 2002's imports through September.

Refined product demand at maximum weekly level plus 1.7% growth, "per our 2003 demand growth forecast."

Rosenfeld said industry sources told him several US refiners have exported gasoline from the Gulf Coast and West Coast to the Caribbean and Central America regions to offset curtailed supplies there, but Prudential did not calculate those into its model. "If these exports...continue," he cautioned, "our...outlook could prove too conservative, and inventory levels could be lower.... If the strike is prolonged, (US) inventories could move towards their 5-year lows unless refining margins increase adequately to attract incremental production from other regions of the world or (US) refinery maintenance turnarounds are delayed."

Upward pressure on crude oil tanker rates is expected to continue for the next 3-6 months due to uncertainties surrounding geopolitical events, reported analysts at Poten & Partners Inc., New York, in a research note released last month.

"The first 9 months of (2002 was) a time of relative stability in the world of tankers. This has been shattered. We have moved into a time of instability punctuated with what appears to be an imminent invasion of Iraq. Wild cards, or unforeseeable events, are being dealt at a near-record pace. Rates will not fall until we see resolution of some of these issues," Poten & Partners said.

"Expect upward momentum in (very large crude carrier) rates to continue," the analysts said, and rates for Aframax tankers (80,000-120,000 dwt) to vary.

Government Developments

BRAZIL has a new energy minister.

Before the Jan. 1 inauguration, Brazil's President-elect Luiz Inácio Lula da Silva named Dilma Rousseff as the country's mines and energy minister.

Rousseff, an economist, said she is against privatizing state-owned electricity companies.

Brazil's congress in 1997 passed legislation that ended Petrobras's energy monopoly and brought 43 international oil companies into Brazil. Petrobras continues as a state-owned company; the government has 33% of equity bonds but controls a majority of votes on the board of directors.

Rousseff said she would consider the federal tax on fuel as a cushion against fluctuations in the price of international crude.

US PRODUCERS face a legal quagmire regarding drilling plans on public lands involving about one third of US national forests.

The 9th US Circuit Court of Appeals in San Francisco in November ordered a federal judge in Idaho to lift an injunction blocking the Clinton administration's "roadless" rule that restricted logging and road-building in certain areas.

Responding to the appellate court's decision, US Forest Service officials said they remain committed to "protecting and managing roadless values." But Bush administration officials also made it clear that the environmental review process for some public forests should be streamlined to allow development.

Both supporters and opponents of the "roadless" regulation predict that policymakers will reexamine the issue for years.

The Wilderness Society said the appeals court ruling "does not mean that the fight for national forest roadless protection is over. To date, the Bush administration has sought to undermine environmental protections for our national forests."

Independent producers also expect additional legal challenges, and even though the new Congress is expected to encourage and endorse the White House's call to expand access to public lands, lawsuits threaten to restrict access to some oil-rich areas, especially in the Rocky Mountains. A study funded by the US Department of Energy in 2000 said an estimated 11.3 tcf of natural gas and 550 million bbl of oil could underlie inventoried roadless areas, primarily in the Rockies where the rule would shut in an estimated 9.4 tcf of gas (OGJ Online, Apr. 4, 2001). An updated 2002 study of the Powder River basin, however, found those numbers could be even higher (OGJ Online, Dec. 17, 2002).

NIGERIA is proposing new penalties for oil pollution.

Nigerian lawmakers are finalizing a bill to establish a national oil spill contingency plan and to implement penalties designed to discourage oil spills, OPEC News Agency reported.

Pollution in Nigeria's oil-producing areas has prompted protests by Niger Delta citizens, government officials said, adding that the protests hinder economic development and national unity.

Rilwan Lukman, Nigeria's presidential adviser on petroleum and energy and the former secretary general of the Organization of Petroleum Exporting Countries, said Nigeria has experienced an increased number of oil spills because of sabotage and equipment failures. "This (legislation) is intended to make our regulations dynamic and enforceable," he said.

Quick Takes

EL PASO GLOBAL LNG, a unit of Houston-based El Paso Corp., applied to the US Coast Guard for a license to construct and operate its EP Energy Bridge, an offshore deepwater mooring buoy for LNG carriers and natural gas delivery system in the Gulf of Mexico. The system is to be built on West Cameron Block 603 about 116 miles off Louisiana in 300 ft of water, El Paso said.

Earlier this year, the El Paso unit unveiled the concept, which featured a floating mooring buoy and LNG tankers that can regasify their LNG cargoes and deliver 400-500 MMcfd into pipelines from miles offshore (OGJ Online, May 8, 2002).

"This projectUopens the door to deliver regasified LNG directly into the pipeline grid and serve existing base load and peaking demand markets," said Greg Jenkins, president, El Paso Global Petroleum and LNG Group. El Paso said it will construct a submersible, offshore buoy and riser system that includes 8 miles of 20-in. pipeline connecting to two existing subsea pipeline systems to deliver natural gas to the main US gas pipeline grid. Advanced Production & Loading AS of Arundal, Norway, will construct the buoy.

"As the Energy Bridge ship arrives at the unloading site, the (submerged) buoy is pulled (up) into a receiving cone and connected to the ship," El Paso explained, adding, "The LNG is then regasified aboard the ship and the vaporous natural gas is discharged through the buoy into the subsea pipeline system."

The company plans the new system to be operational by yearend 2004. Three LNG carriers are already under contract, and El Paso has an option for a fourth vessel.

This is the second offshore LNG port to be announced recently for the Gulf of Mexico. ChevronTexaco applied to the Coast Guard in early December to build its Port Pelican offshore port 60 miles off Louisiana in more shallow water (OGJ Online, Dec. 3, 2002). That system, planned to be operational by 2006, features a permanent concrete port containing regasification facilities.

KINDER MORGAN ENERGY PARTNERS LP, through its subsidiary Kinder Morgan CO2 Co. LP, has signed a contract with Houston-based Natco Group Inc. for the expansion of Natco's 180 MMcfd carbon dioxide membrane separation facility in the Scurry Area Canyon Reef Operators Committee (SACROC) unit in Scurry County, Tex.

The expansion would more than double the plant's hydrocarbon recovery capacity to 40 MMcfd of hydrocarbon gas and 14,000 b/d of natural gas liquids. Kinder Morgan's net share of this gas and NGL production is close to 50%, Natco reported.

Natco's facility will increase its gas processing capability to 367 MMcfd following start-up of the expansion, which is slated for this fall.

Kinder Morgan last year increased oil production to more than 15,000 b/d of oil from 8,500 b/d of oil in 2000, when it purchased the field (OGJ Online, May 18, 2001). Kinder Morgan's net share of SACROC oil production is 70%.

In other production news, production started Dec. 22 from the two Sigyn gas and condensate satellites in the North Sea, Statoil ASA reported. ExxonMobil Corp.'s Norwegian unit Esso Exploration & Production Norway AS is operator for the field, but Statoil, with a 50% interest, was responsible for drilling and subsea operations and for modification work on its Sleipner A platform. Esso holds 40% interest and Norsk Hydro AS 10%. Production is under way from one well in Sigyn East and two in Sigyn West, both drilled from the same subsea template on Block 16/7-4. The well stream travels through two flowlines 12 km to Sleipner A on Blocks 15/6 and 15/9 for processing and transportation to shore. Esso is responsible for reservoir management, with the satellites remotely operated from the platform. Sigyn reserves are estimated at 5.6 billion cu m of gas, 5.6 million cu m of condensate, and 20.5 million bbl of gas liquids (OGJ Online, June 29, 2001). The operators expect the Sigyn satellites to produce for 10 years, Statoil said.

Aberdeen-based Petrofac Production Services (PPS) inked a preoperatorship agreement with Paladin Expro Ltd.—a wholly owned unit of London-based Paladin Resources PLC—under which Petrofac will assume the operatorship of the Montrose and Arbroath production platforms in the central North Sea. If approved, the contract will mark the first time a facilities management company has taken on this role for fixed platforms in the North Sea, Petrofac said. Petrofac Ltd. recently acquired PPS (formerly PGS Production Services) from Petroleum Geo-Services ASA. Paladin Expro, meanwhile, signed a purchase and sale agreement to acquire a majority shareholding in Montrose, Arbroath, and Arkwright fields from BP PLC and Amerada Hess Corp., becoming the license operator, subject to approvals. Paladin entered into an alliance with Petrofac and Helix RDS Ltd., Aberdeen, to operate the fields. Under the agreement, Petrofac will oversee operation of production facilities, Helix RDS will provide a reservoir and well management, and Paladin will oversee control of all activity within the license area, the companies said.

CHEVRONTEXACO CORP.'s Angola-based affiliate, Cabinda Gulf Oil Co., has made the ninth significant discovery, Negage, on its 1,560 sq mile deepwater Block 14, off Angola's enclave of Cabinda. Negage was drilled in 4,738 ft of water 29 miles southwest of ChevronTexaco's recent Gabela discovery (OGJ Online, Aug. 5, 2002). The Negage well encountered a hydrocarbon column greater than 320 ft, producing more than 8,630 b/d of 33° gravity oil on test. Geologic and engineering studies will follow to assess the discovery's reserve potential.

Oil companies plan to spend $20 billion developing deep waters off Angola during the next 5 years, positioning Angola to be Africa's second largest oil producer, reported the Centre for Global Energy Studies last March. Angola currently ranks third behind Nigeria and Libya, and development plans suggest that Angola's production "will overtake that of Libya by 2006," CGES said (OGJ Online, Mar. 27, 2002).

Operator Cabinda holds a 31% interest in Block 14. Other partners are national oil company Sociedade Nacional de Combustiveis de Angola (Sonangol EP) 20%, Italy's Agip Angola Exploration BV 20%, France's Total Angola 20%, and Spain's Petrogal Exploration 9%.

Anadarko Petroleum Corp., Houston, and Warren Resources Inc., New York, agreed jointly to explore for coalbed methane in the fairway of the Atlantic Rim area of Washakie basin in southern Wyoming. The area covers 211,000 acres in Carbon County. Anadarko, which will serve as the project's operator, is buying an interest in 87,700 acres from Warren for $18 million. So far, significant coalbed methane development in the state has concentrated on northeastern Wyoming's Powder River basin. Anadarko said it was too early to comment on the significance of Washakie basin, a part of Green River basin. "Wyoming's Atlantic Rim is a very promising coalbed methane opportunity that has been validated by drilling and pilot test," said Mark Pease, Anadarko vice-president, US onshore and offshore.

THAI RIOT POLICE Dec. 20 prevented some 2,000 opponents of Trans Thai-Malasia (Thailand) Ltd.'s proposed Thai-Malaysia natural gas pipeline project from approaching a Haad Yai hotel where members of Thai and Malaysian cabinets were meeting.

Thai Prime Minister Thaksin Shinawatra said he fully supported the police actions, which resulted in injuries to 15 police officers and 38 protesters and the arrest of 12 protest leaders. Protesters claim the project would benefit only Malaysia and would damage the environment on the southern Thai province of Songkhla. Last May, Thaksin made a decision to proceed with the stalled pipeline and related gas separation plant. However, he said the proposed onshore section through Songkhla would be slightly rerouted to avoid the area where most of the opponents reside (OGJ Online, May 14, 2002).

Villagers argue the route change makes no difference in terms of environmental and social impact. The pipeline is scheduled to be in commercial operation by the end of 2004.

PETROLEO BRASILEIRO SA (Petrobras) plans to invest 1.1 billion reals ($291.8 million) in Brazil's largest refinery, Paulinia, in São Paulo state, by 2005.

Petrobras will boost Paulinia's diesel treating and refining capacities, as well as set up a coking unit. Petrobras will provide 29% of the total investment, the rest to come from international funding, officials said.

With revenues projected at 17.8 billion reals in 2002, up 10% from 2001, the refinery is expected to boost its daily refining capacity to 60 million l. in 2005 from 54.2 million l. currently.

Cláudio Fonseca M. dos Santos, manager of fluid catalytic cracking, coking, and separation at Cenpes, Petrobras's research and development center, said six new delayed coking units (DCU) are expected to be completed at various refineries by 2010, to convert bottom-of-the-barrel oil into higher value products.

Petrobras currently has 4 DCU in operation: 2 at the Cubatão refinery, and 1 each at the Paulinia and Betim plants. It has completed the basic design for three more.

A recent study by Brazil's finance ministry concluded that Brazilian refineries in 3 years will be unable to cope with the volumes of oil that must be processed under the country's plans to become oil self-sufficient by 2005. The proposed Renor refinery at Ceará, with a refining capacity of 220,000 b/d of oil, could partially resolve the problem, ministry officials said, but it is stalled by lack of investor interest. Petrobras controls 98% of Brazil's refinery capacity, which totals more than 1.96 million b/d.

Meanwhile, Petrobras is contemplating reducing diesel imports and may quit importing LPG products, said the National Fuel Distributors Association (Sindicom). It said Brazil consumes 30 billion l./year of diesel, one quarter of which it imports.

Petrobras has stopped importing naphtha, leaving Brazilian petrochemical companies to make those purchases.

FIELD LICENSEES for Ormen Lange field on deepwater Block 6305/5-1 in the Norwegian Sea agreed Dec. 18 to develop the field using subsea production installations linked to a new onshore natural gas processing plant at Nyhamna, near Aukra, in Møre county, Norway.

Ormen Lange is the largest undeveloped natural gas development on the Norwegian Continental Shelf, with estimated gas reserves of 375 billion cu m of dry gas and 138 million bbl of condensate, said development phase operator Norsk Hydro AS (17.956%). It is 100 km off Møre and Romsdal counties, Nor- way, in 800-1,000 m of water. Other participants are production operator AS Norske Shell 17.2%, and majority interest holder Petoro AS (formerly state holdings group SDFI) 36%. Other interest holders are Statoil ASA 10.774%, BP PLC unit BP Amoco Norge AS 10.888%, and Esso Norge AS 7.182%.

The group plans to submit a formal plan for development and operation to the Norwegian authorities in October.

Development includes construction of the "largest pipeline on the Norwegian Continental Shelf," Norsk Hydro said. Gas will be exported to continental Europe via existing pipelines from Statoil's Sleipner R riser platform in Sleipner East field.

Total cost for offshore development and the gas trunkline from the treatment plant to Sleipner East is about 55 billion kroner. Also being considered is storage in the Sleipner area to cope with seasonal variations in demand, which would make the field important as a swing producer.

First gas from Ormen Lange is planned for October 2007. The field, expected to produce for 30-40 years, will produce at least 20 billion cu m/year during peak production, about 20% of total anticipated Norwegian gas production in 2010.

NOTICE

Due to a printer's error, the Newsletter section of the Dec. 16, 2002, issue of OGJ was reprinted in the Dec. 23 edition. Subscribers can read the actual Dec. 23 Newsletter on OGJ Online (www.ogjonline.com). On the left navigation bar of the home page under "Subscribers Only," click the "Dec. 23 Newsletter" link or click "Back Issues" and use the "Issue Browser" feature to find the Dec. 23, 2002, issue, then click "OGJ Newsletter."

CORRECTION

In an article by Bob Tippee (OGJ, Dec. 9, 2002, p. 30), the last word was inadvertently omitted. The sentence should have been: "The silver bullet for the short term," Matthews said, "is going to be nuclear."