Drilling efficiencies learned, applied to Burgos basin development

As part of a 5-year investment program the Mexican government approved in early 2001, Petroleos Mexicanos (Pemex) is aggressively developing Mexico's hydrocarbon producing regions to meet the country's rising energy demand.

The Burgos basin in northeastern Mexico, one of the main regions being developed, has a substantial amount of undiscovered reserves according to a published report by the Gas Technology Institute, Arlington, Va. (OGJ, May 7, 2001, p. 70).

Extending into the US, the basin spans 50,000 sq miles and contains at least 100 discovered fields. To assist in development and production of this massive area, Pemex contracted out much of the work.

Early last year, the company received bids from oilfield service companies to drill at least 240 gas wells in the basin and was to award a contract on the basis of technical capability and the lowest market price.

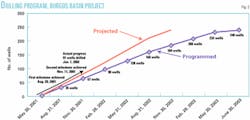

Pemex awarded a $270 million contract to PD Mexicana, a company formed jointly by Precision Drilling Corp., Calgary, and BJ Services Inc., Houston, to drill the wells in 11 gas fields (Fig. 1). The arrangement called for Precision Drilling to serve as project manager and lead drilling contractor.

Precision brought an integrated package to the deal, using several business units to supply equipment and services, including drilling rigs, directional drilling, measurement while drilling (MWD), openhole and cased-hole logging, slickline wireline services, production testing, polycrystalline diamond compact (PDC) drillbits, and completion products and services.

BJ Services agreed to provide cementing, stimulation, and coiled tubing services. To fulfill the contract, Precision subcontracted other services from suppliers such as drilling fluid service company Q'Max Solutions Inc., Calgary, operating as Q'Max Mexico.

With a third of the project now complete, the results indicate that PD Mexicana will be able to continue drilling beyond Pemex's target milestones, with an estimated project completion time that is at least 3 months ahead of schedule (Fig. 2).

Well designs

Pemex categorizes wells in the Burgos basin according to three types: A, B, and C.

Type A, lower pressure wells, have a depth of 900-1,500 m and have only two strings of casing: 7-in. surface casing and 31/2-in. production casing.

Type B wells have a depth of 1,500-2,100 m and normally have three strings of casing: 95/8 and 7-in. surface and intermediate casing and 31/2-in. production casing.

Less-common Type C wells have a depth of 2,100-2,700 m and use the same three-string casing design as Type B wells.

Type A wells have 81/2-in. surface hole sections, while Type B and C wells have 121/4-in. surface hole sections. The rigs use roller cone bits to drill the surface holes to a depth that covers fresh water aquifers and provides adequate well control capability.

Rigs drill the 81/2-in. intermediate hole sections of Type B and C wells, using PDC drillbits, which Precision Drilling's subsidiary, United Diamond, provided.

Company drilling operations also use PDC drillbits for the 61/8-in. production hole sections for all three of the well types.

Burgos operations

The Burgos project represents many firsts for the companies involved. For Precision Drilling, it's the company's first drilling project in Mexico.

While Precision has supplied multiple services to projects, this is the first one in which it is serving as project manager over all aspects of the drilling process. This includes managing the entire well construction-from obtaining land permits and constructing roads to drilling, completing, and tying in wells.

Drilling was to commence officially on May 17, 2001, less than 2 months from the March 20 project award date. The company worked quickly to mobilize the required equipment.

Ninety-four trucks transported four rigs, four wireline units, directional drilling and testing equipment, drillbits, and completion equipment from Canada. PD Mexicana imported a fifth rig from Precision Drilling's operations in Venezuela.

By May 12, PD Mexicana had spudded its first well and opened an office in Reynosa with a full crew to manage the program.

The company attributes the project's quick ramp-up time to assigning the most qualified people to the job, keeping a close eye on operations, coordinating the efforts of each business unit, and applying the most efficient drilling technologies to the turnkey contract.

Applying these strategies, PD Mexicana has reduced total drilling costs by minimizing downtime associated with rig moves and by efficiently managing operational issues.

The project demonstrated that having the ability to integrate the rigs and the majority of services required to drill and complete wells allows the team to mobilize more efficiently, engineer well designs more effectively, and operate as a unit focused toward common goals.

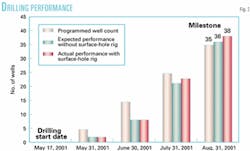

The contract calls for 98 wells to have been drilled by the end of February 2002. Having drilled 91 wells by early January, the company projects that it will have met the milestone 33 days ahead of schedule.

Three basic areas of drilling technology, rig applications, bottomhole assembly (BHA) configurations, and the mud systems, have proven to be of paramount importance in maximizing drilling efficiency.

Rig applications

Pemex's first milestone was to complete the drilling of 35 wells by the end of August 2001. With the rapid deployment of equipment and the expeditious schedule, there was little time available for a learning curve.

To ensure that the first milestone was met, PD Mexicana added a surface-hole rig to drill and install the first string of casing, moving from location to location.

Due to increased efficiency provided by the surface-hole rig, the drilling pace began to exceed the pace at which permits could be obtained for new drilling locations.

Employed on 17 wells, the surface-hole rig saved an average of 1 day/well, and by the Aug. 31 deadline, PD Mexicana had exceeded Pemex's target by three wells, bringing the total number of wells drilled to 38 (Fig. 3).

The company is currently using three double rigs and two "super single" rigs to drill the remainder of the wells. The double rigs drill Type B and C wells, while the super singles drill both Type A and B wells.

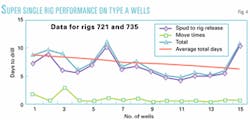

Super single rigs initially drilled the shallow Type A wells because the equipment can trip pipe and move from location to location faster than conventional single and double rigs (Fig. 4).

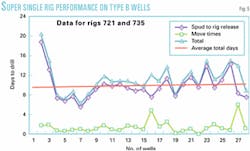

After the initial campaign of Type A wells, the super singles began drilling Type B wells and continued outperforming historical records for single joint rigs (Fig. 5).

The super single rig design is different in many aspects from conventional singles used typically throughout North America.

The rig's name was coined in the Canadian oil field, most notably due to the rig's use of API Range III (45-ft) single-jointed drill pipe as opposed to the more common 31-ft API Range II pipe (OGJ, Feb. 26, 2001, p. 86).

Maximizing tubular length reduces the number of connections made and broken while drilling and tripping.

The use of remote-controlled pipe-handling operation and hydraulic top-drives are other design features making the rig more efficient and increasing its application to wells in the Burgos basin.

The features enabled the rig to trip faster than a conventional single and even as fast as a conventional double.

Mounting the drawworks backwards made it easier to remove from the rig floor and facilitated rig moves.

The specially designed substructure trailers and the hydraulic system also minimized rig-up and rig-down time. Fewer truckloads-as few as 14-22-can transport the rigs compared with as many as 40 loads required to move one of the rigs currently owned by Pemex.

Designed with advanced automated systems, the super single rig also created a safer work environment for the rig crew.

For example, the hydraulic pipe handling arm and other remote-controlled features reduced the time required of personnel on the rig floor. Fewer injuries also contributed to savings in drilling time.

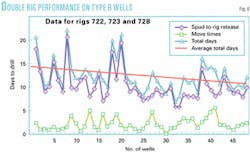

These and other features maximized drilling process efficiency and decreased rig move time dramatically. However, PD Mexicana's doubles have been able to match or exceed the super single rigs in drilling time from spud to rig release.

For example, the super single rig averages 10.2 days on vertical B wells, while a double rig averages 10.4 days for the same well type (Fig. 6).

For rig moves, the super single rig took an average of 1.4 days from rig release to spud, compared with 4 days for double rigs previously operating in Mexico and 2 days for double rigs provided by PD Mexicana.

In some cases, super single rig moves took as little as a quarter of a day, which meant that the same rig could move from one well and spud a new well in the same day.

This same-day occurrence was another first-time experience for Pemex. To date, PD Mexicana's record for a rig move in the basin is 6 hr from rig release to the spud of a new well.

Pemex is completing wells in the Burgos basin without tubing, enabling all completion and well stimulation without use of a service rig. Coiled tubing performs the required wellbore interventions.

BHAs

In the tertiary clastic province of the Burgos basin, gas reservoirs range in age from Paleocene through Miocene.

While much of the production has been in the Frio-Vicksburg sands of Oligocene age, Pemex has centered current activities on the older area of the Tertiary section.

The low-permeability sandstone and shale formation can create a challenging situation in selecting the right BHA and other downhole tools.

In this particular contract, Pemex specified that the bottomhole location must be within a 50-m radius of the surface location of the well.

PD Mexicana used a minimal number of stabilizers downhole in the first phase of drilling, however, making it difficult to keep the wells vertical.

Now, personnel routinely monitor drilling operations for wellbore deviation. If they anticipate that the wellbore trajectory in progress will lead to a TD outside of the 50-m radius, the rig pulls the drilling assembly and runs a steerable downhole motor to correct the wellbore deviation.

The company uses conventional packed-hole BHAs with PDC bits. Drilling personnel minimize corrections by monitoring wellbore deviation, varying the weight on bit, and regulating rotary rpm.

Mud systems

Drilling operations in the Burgos basin have traditionally used inverted emulsion muds, with only a few attempts made to drill with water-based fluids.

The margin between pore pressure and fracture pressure can be as narrow as 0.4 g/cc in the Burgos basin. This low margin and the amount and type of shale to be drilled persuaded the mud engineers to default in the direction of inverted emulsion muds.

To ensure success, drilling operations used the mud supplier's inverted emulsion fluid during the start-up phase.

Oil-based drilling fluids, however, are more expensive, and in Mexico cuttings are classified as hazardous material that must be handled and transported to special containment areas.

The drilling fluid supplier, Q'Max Mexico performed a number of tests to support the decision to replace oil-based muds with a water-based system.

As drilling progressed, engineers identified three areas in the Burgos basin likely to be most sensitive to water-based drilling fluids and took samples every 50 m when drilling through the intermediate and main hole sections.

Personnel collected and prepared the samples and sent them for x-ray diffraction testing to determine the mineralogy.

Upon completion of initial testing at the University of Calgary, a testing regime was based on finding water-based drilling fluids that would equal oil-based drilling muds in their ability to stabilize the wellbore and be environmentally friendly.

Technicians at the drilling fluid supplier's laboratory in Calgary subjected cuttings samples to two standard tests to aid in the evaluation: the capillary suction timing test and a dispersion test.

Conclusions and recommendations were as follows:

- All samples were highly dispersible in fresh water. Inhibitory systems, whether water-based or oil-based, greatly reduce the dispersive tendencies.

- The potassium nitrate-potassium silicate muds and the highly concentrated glycol fluids had very low to nonexistent dispersive tendencies.

- The Viboritas area of the Burgos basin was found to have the highest Smectite concentration and therefore was the most likely susceptible to wellbore instability.

- Drilling operations should use very inhibitive mud on initial wells, switching to less inhibitive mud later if viable.

- Drilling fluid systems should keep dispersion low to limit drilled solids build-up.

- The Burgos area wells are drillable with inhibited water-based muds.

Technicians performed initial field-testing using the patented potassium silicate-potassium nitrate fluid system, which the supplier calls QM-12/QNK. The company obtained required governmental certification that the fluid and cuttings are environmentally acceptable.

Crews successfully drilled the first well to TD with use of the water-based, inhibitive-system drilling mud. Surveys found the hole to be in gauge and the wellbore remaining stable; however, the rate of penetration (ROP) required improvement.

On the next well, drilling operations employed a different bit design but used the same recovered drilling fluid through the 8.5-in. intermediate hole section.

During this trial, crews achieved the highest ROPs in the field to date, to a depth of 917 m. Past this depth, however, the ROP declined when the bit encountered a formation change. Drilling engineers are investigating the reasons for this ROP decline.

Technicians again tested the cuttings and fluid to ensure that they were environmentally acceptable; they were.

Technicians had also proven that with the water-based fluid, the margin between static mud density and equivalent circulating density was lower than with typical inverted emulsions used in the area.

Operational experiences

The Burgos basin project has provided a lesson in understanding the dynamics of the drilling environment. Knowing which technologies to apply and when to apply them yields the maximum amount of efficiency.

For Precision Drilling, operating in Mexico's environment is very different from operating in the company's native Canada.

The personnel involved experienced a rapid learning curve early in the project, with many lessons learned.

From PD Mexicana's experiences in the Burgos basin, so far, the following observations are evident:

- The super single rig concept saved considerable time and money with efficient drilling operations and short rig moves.

- The use of standard rotary BHAs with PDC bits effectively drilled the vertical wells within the specified target tolerance. WOB and rpm variations effectively control deviation tendencies.

- Water-based mud provides a viable alternative to oil-based mud for controlling shale swelling. Drilling operations have recorded low ROP with use of water-based muds in some formations; however, bit selection and modifying drilling parameters are expected to overcome the problems.

- The narrow margin between pore pressure and fracture gradient requires careful drilling fluid density control and fine tuning of the casing program to prevent well control problems and lost circulation.

Having gained a better understanding of the operating environment, PD Mexicana has been able to set new standards for the Burgos basin.

Acknowledgments

The author thanks Doug Gust, integrated services manager for Precision Drilling's technology services group, Norman Mahurin, drilling manager for PD Mexicana, and Q'Max Solutions Inc. for their contribution and assistance in preparation of this article.

The author

Larry Comeau is president of Precision Drilling's technology services group, which includes research and engineering facilities in Houston and Ft. Worth, along with various company subsidiaries. He has over 25 years of oilfield experience, most with what is now Halliburton's Sperry-Sun Drilling Services. He holds 22 patents, was three-time nominee for the Alberta Science and Technology (ASTech) Award, and was awarded the Outstanding Leadership in Alberta Technology Award.