OGJ Newsletter

Market Movement

Stage is set for another Russia-OPEC standoff

The stage is being set for another standoff between Russia and OPEC over production cuts. A bigger question might be whether any potential market share war will come before US military action against Iraq this year. That will determine the extent of a price collapse, if one occurs this year.

The loss of Iraqi oil supplies in the months to come seems increasingly likely. At the same time, the stars are aligning for excess market supplies in the second quarter. The upshot may very well be an oil price that both producers and consumers can live with while the global economy slowly recovers this year. The downside, of course, is worsening hostilities in the Middle East and what that may portend for the US-led campaign against terrorism.

It's pretty clear that Russia's pledge to cut oil exports by 150,000 b/d in the first quarter is shaping up to be a hollow gesture-a bone tossed to OPEC that lets the group cut its own output without losing face.

Even at that, OPEC's own pledges to cut output beginning in January have proven a bit thin.

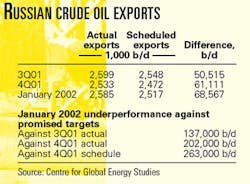

London-based Centre for Global Energy Studies notes that there's always been a great deal of uncertainty over the Russian pledge to cut exports, mainly because the starting point against which the cut was to be measured was never clearly defined-whether it was against actual exports in the third or fourth quarters of last year or the scheduled level of exports in the fourth quarter. But that may be moot, says CGES, because by any benchmark, Russia's oil exports cut failed to materialize last month. In fact, Russia's crude exports have continued to rise, rising 50,000 b/d in January from fourth quarter 2001 levels.

Depending on which benchmark is used, Russia's underperformance against pledged cuts was 137,000-263,000 b/d in January (see table).

Even with this non-OPEC "quota-busting," Russian oil companies still chafe against export constraints and have fed much of their oil into the domestic sector. This in turn, says CGES, has dominoed into a miniglut of refined products on the domestic market. Consequently, Russia's exports of refined products spiked up in January (also helped by strong weather-related demand). And the prospects are good for still further rises in exports this month and next, CGES notes. Sharp cuts are expected in export taxes on key products, coming on the heels of a crude oil export tax.

"With a 60% reduction in the crude oil export tax at the beginning of February, it appears unlikely that Russia will make any serious attempt to curb its oil exports in line with its pledge to OPEC," CGES said. "If pipeline exports to Europe remain unchanged from January, the February loading schedules for ports handling Russian crude suggest that Russia's crude oil exports could rise even further in February, reaching nearly 2.7 million b/d."

OPEC members to visit Moscow

The situation with Russian exports, of course, has caught OPEC's attention. According to various press reports, plans call for OPEC Sec. Gen. Alí Rodríguez Araque and OPEC Pres. Rilwanu Lukman to visit Moscow on Mar. 11-just 4 days before the next scheduled OPEC ministerial meeting-to gain "clarification" on Russia's commitment to cuts in oil exports.

The two OPEC leaders will try to encourage Moscow to extend the country's pledged 150,000 b/d cut in crude exports beyond the first quarter-the limit the Russians initially imposed-to the first half. Russian President Vladimir Putin has already indicated that's unlikely.

Meanwhile, OPEC's own recent track record on compliance has not been sterling, either. OPEC's monthly market report showed the group was over quota by 453,000 b/d in December.

"This will all be a build-up to the spring, when Russian crude exports will really pick up, just at the time when global product demand is at its weakest between the heating and the driving season," said Lisa Rothenberg, senior analyst at Energy Security Analysis Inc., Wakefield, Mass.

And that means another showdown with OPEC, which will have to either give up market share or fight for it.

But springtime also means the mandated review of sanctions against Iraq under an accord between the US and Russia that allowed the UN-brokered oil-for-aid oil sales to proceed last December. That may well prove to be the Bush administration's opportunity to set its anti-Saddam campaign into motion. And then the threat of market share war would disappear under the shadow of a real war.

Industrial sector to boost natural gas demand

The industrial sector may hold the key to the floodgates on natural gas demand in the US, which has ample gas supplies, according to ESAI.

Industrial demand will likely revive in the second quarter after falling off during mid-2000 when the economy began to weaken, ESAI said.

ESAI added it "expects that chemical and fertilizer producers, for whom natural gas is a raw material accounting for 75-90% of the cost of production, may intensify a trend begun last October and November of unshuttering production facilities to take advantage of low natural gas prices."

ESAI Senior Analyst Mary Menino said, "With current gas prices hovering around $2/MMbtu, US gas supplies should be competitive with foreign gas sources supplying overseas chemical and fertilizer capacity. "This should induce owners of US capacity to reopen their plants," she said. "If the economy revives by spring, we would expect general industrial gas demand to begin to expand."

Gas storage withdrawals make gains

Cold weather in much of the US in early February has ended a series of weeks of relatively small gas withdrawals from storage, said C.H. Guernsey & Co., Oklahoma City. According to the firm's models, cold weather during the first full week of February produced withdrawals that were "much higher" than the 5-year average.

"The Guernsey models estimated a net withdrawal of gas in storage of 133-145 bcf [for the week of Feb. 4], with 89 bcf coming from Eastern storage alone. The net withdrawal estimated by the American Gas Association was 95 bcf for the same period last year," Guernsey said.

The Guernsey models-which estimate gas use and price movements pegged to the weather in 15 cities-showed temperatures 56% lower than the previous week in significant northern cities, said Donald Murry, Guernsey vice-president. However, despite the recent strong drawdown, gas in storage remains close to 45% above the 5-year average, Murry added.

"The high gas-in-storage levels are still the major market influence, holding down current and even forward prices for summer gas," he said.

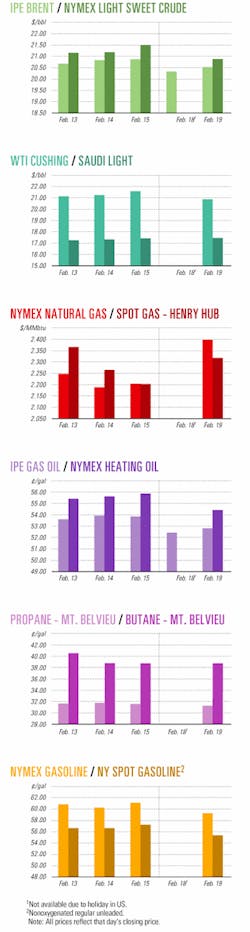

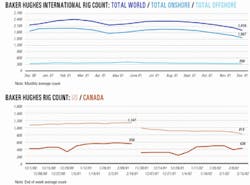

Industry Scoreboard

null

null

Industry Trends

US imports of LNG have plummeted since September with the collapse of domestic gas prices and increased security concerns about offloading such cargoes in the wake of the Sept. 11, 2001, terrorist attacks on the US.

"The US received only 12 LNG cargoes during the fourth quarter compared with 75 cargoes during the first three quarters of 2001," said Robert Morris, industry analyst at Solomon Smith Barney Inc., in a special report.

"Consequently, US LNG imports in 2001 were only 640 MMcfd compared with the roughly 750 MMcfd estimated in our April report and 600 MMcfd in 2000," he said. But despite recent developments that threaten proposed construction of some additional LNG terminals in North America, Morris said, there is still "longer-term interest in bringing remote 'stranded' natural gas reserves around the world into the US market as LNG."

Morris now projects US LNG imports will average only 550 MMcfd this year instead of the 1 bcfd predicted earlier. Imports are expected to increase to 800 MMcfd in 2003, with a projected composite spot price of $3/MMbtu.

"We still believe that LNG imports are set to play a key role in bridging the longer-term projected North American natural gas supply-demand imbalance," Morris said.

Asian Refiners are being placed in a squeeze, according to Boston-based Energy Security Analysis Inc. "The Asian crude oil markets are struggling with comparatively strong sour crudes, ample product supplies, and slow demand growth," ESAI said.

"Asian refiners are at a turning point," said Sarah Emerson, ESAI managing director. "Margins can no longer be protected by Singapore cutting runs, and the big, partially protected refiners have to take their hit too, as seen by Japanese and [South] Korean run cuts and lower Chinese throughput," she said.

The Asia-Pacific refiner, however, may be "taking steps in the right direction," ESAI said. Emerson said, "We expect product demand to grow by as much as 350,000 b/d while crude demand remains relatively flat. This means product supplies should tighten up a bit."

The locus of the weakness in crude oil demand, ESAI said, is Japan and South Korea, and it warns "ellipseTo keep an eye out for more run cuts, product stock liquidations, and a slowdown in refining expansion plans." And "even if these developments begin to proliferate," ESAI said, "it is too early to tell if they are the seeds of an Asian refining recovery."

Profitability for light olefins will continue to fall this year, predicts Chemical Market Associates Inc.

In its 2002 World Light Olefins Analysis, CMAI said producers must contend with a significant build-up of surplus capacity in the midst of a global economic slowdown. The study covers world markets for ethylene and propylene and their major derivatives.

The group also suggested that reduced profitability will likely result in additional industry restructuring through more acquisitions or merger activity. It may also spur ethylene plant closures, especially small-scale, high-cost units that require significant capital investments to sustain their operation.

"The combination of economic recovery [leading to a strong recovery in ethylene and propylene demand] and capacity rationalization provides the basis for concluding that strong market conditions will begin to reappear in 2003 and will be very evident by 2004," CMAI said.

Government Developments

Iran is positioned to be a major factor in world energy markets over the next decade if it can develop the transportation infrastructure to deliver its oil and natural gas to market.

Iran has huge energy assets, including 9% of the world's conventional oil reserves and 15% of global natural gas deposits, Michael Ward Clegg from the UK office of Boston-based Cambridge Energy Research Associates, told a Tehran conference last week. He compared that to other Central Asian republics-basically the former Soviet Union, excluding Russia-whose reserves total 2% of world oil and 3.5% of world gas. But Iran has yet to establish itself as a player in international gas markets and has failed to attract foreign investments in oil pipelines to exploit its "ideal location" for East Asian trade, Clegg said.

The breakup of the Soviet Union and resulting establishment of its former republics as independent states has transformed the politics and economy of Central Asia, Clegg said. Nowhere has that change been as marked as in the oil and gas sector, with the area's enormous potential reserves tempting western producers and other foreign investors. Located on the periphery of that development, Iran has a long history of oil exports, good trading relations with buyers, and an "enviable" reserves base that can be exploited at competitive costs, he said.

Moreover, Clegg said, Iran's oil industry also would be a large consumer of natural gas for enhanced recovery of oil through pressure maintenance and gas-lift procedures.

Interstate natural gas pipeline operators would likely support the development of a gas pipeline integrity rule but are concerned about potentially having to conduct inspections under constrained timeframes, among other things.

These concerns and others surfaced in testimony given by William J. Haener, CMS Energy Corp. executive vice-president, natural gas, who testified earlier this month before the US House Transportation and Infrastructure Subcommittee on Highways and Transit. Haener spoke on behalf of the Interstate Natural Gas Association of America before the House subcommittee, which is now considering gas pipeline safety reauthorization legislation.

"We support the recent action taken by the Office of Pipeline Safety in releasing a notice of proposed rulemaking on the definition of 'high consequence areas' for the natural gas industry," Haener said. He testified, however, that while INGAA's members are committed to developing and implementing a pipeline integrity rule, they are "concerned about suggestions that pipelines should be required to use specific methods and to accomplish inspections over unrealistic time frames, such as 5 years." Citing a study commissioned by the Gas Technology Institute, Haener explained that a pipeline integrity reverification inspection interval of 15 years would be more desirable.

Another study, commissioned by the INGAA Foundation, that the unintended consumer and economic impacts of pipeline capacity shortfalls caused by inspection intervals as short as 5 years could cost consumers up to $17.85 billion due to fuel shortages, lost productivity, and potential plant shutdowns.

Quick Takes

DEEPWATER ACTION tops pipeline news.

BP PLC and others have outlined plans for construction of three crude oil pipelines that will carry oil production from major deepwater discoveries, including Crazy Horse field, which has been renamed Thunder Horse.

The large-diameter lines will transport oil from BP-operated Thunder Horse, Holstein, Mad Dog, and Atlantis fields. BP subsidiary Mardi Gras Transportation Inc. will operate the systems.

The first of these systems, Caesar oil pipeline, will span 120 miles and link Holstein, Mad Dog, and Atlantis fields with Ship Shoal Block 332. The main portion of this line will comprise 28-in. pipe, with laterals to the three fields tapering to 24-in. pipe. Ceasar, which will have initial capacity of 450,000 b/d, is the first of its size to be installed in water deeper than 5,000 ft in the gulf, BP said. Caesar will be owned by Caesar Oil Pipeline Co. LLC, which is owned by BP 56%, BHP Billiton Ltd. 25%, Equilon Pipeline Co. LLC 15%, and Unocal Corp. 4%. Caesar is slated to come on line in 2004.

The second system, Cameron Highway Offshore Pipeline System, will transport production from SS Block 332 to Texas landfall. The $450 million, 380 mile system is to be built by El Paso Energy Partners LP. It will deliver as much as 500,000 b/d of oil from the southern Green Canyon area of the gulf and the western gulf to Port Arthur and Texas City, Tex. (OGJ Online, Feb. 13, 2002). BP has inked transportation agreements with the El Paso Corp. unit for its production. Like Ceasar, Cameron is also slated for start-up in 2004, which is when Holstein field is expected to begin production.

The third system, which will consist of two large segments, will serve Thunder Horse field in the Mississippi Canyon area. Proteus oil pipeline-the 28-in. deepwater portion of the system-will extend 70 miles from the Thunder Horse platform to a booster station platform to be installed on South Pass Block 89. From there, Proteus will connect to Endymion oil pipeline, a 90 mile, 30-in. system extending to Clovelly, La., where it will connect with Louisiana Offshore Oil Port storage and offloading facilities.

Combined, Proteus and Endymion will have an initial capacity of 420,000 b/d. Both segments are slated for completion in early 2005, in line with Thunder Horse's intended start-up.

Elsewhere, Blue Stream Pipeline Co. BV-a 50-50 joint venture of Italy's ENI SPA and Russia's OAO Gazprom-completed laying two subsea lines of the Blue Stream natural gas pipeline, which will connect Russian gas fields to Turkey via the Black Sea. (OGJ Online, Dec. 21, 2000).

The two 380 km, 24-in. lines were laid by Saipem SPA's Saipem 7000 semisubmersible pipelaying vessel in waters as deep as 2,150 m. Later, these lines will be connected by Saipem's Castoro 8 vessel to an existing section of pipeline off Turkey, ENI said.

When completed and at full capacity, Blue Stream will transport 16 billion cu m/year of gas. The offshore section of the system will consist of these two lines and a compressor station at Beregovaya, Russia.

In other pipeline news, a New Mexico-California gas pipeline project-dubbed Sonoran Pipeline-has been dropped. Kinder Morgan Energy Partners LP, Houston, and San Jose, Calif.-based independent power producer Calpine Corp. abandoned plans to jointly develop a 1,160 mile, $1.7 billion pipeline that would have transported gas to California from New Mexico's San Juan basin (OGJ Online, May 2, 2001). "The Sonoran Pipeline was unable to secure sufficient binding commitments to make a successful project given market conditions," the companies said. The system was to have come on line in 2004.

UPSTREAM FACILITIES contracts have been awarded in the Dolphin project to supply gas from Qatar's giant offshore North field to Abu Dhabi and Dubai.

Dolphin Energy, which operates the $3.5 billion Dolphin gas project, awarded a joint venture of Bouygues Offshore SA unit Sofresid SA and Foster Wheeler Ltd. a $10 million front end engineering design (FEED) contract. Dolphin Energy is a consortium of UAE Offsets Group (UOG) and TotalFinaElf SA.

The FEED contract covers two offshore production platforms, two subsea pipelines from the platforms to the port of Ras Laffan in Qatar, an onshore gas processing facility in Ras Laffan, a gas compression facility in Ras Laffan, two gas receiving and metering stations, and telecommunications and control systems.

Enron Corp. previously held 24.5% of the project and would have operated the pipelines. Its stake-currently held by UOG-is up for bid (OGJ Online, Dec. 3, 2001). BP, Conoco Inc., ExxonMobil Corp., Occidental Petroleum Corp., and Royal Dutch/Shell Group are shortlisted for the stake.

In other development activity, Stolt Offshore completed a deepwater subsea-to-subsea installation for Shell Exploration & Production Co.'s Einset project in the Gulf of Mexico. The installation of a flowline and an umbilical tied a deepwater well to existing subsea infrastructure, also in deep water. During the installation, the Seaway Falcon multipurpose vessel achieved its deepest pipelay. Einset is in 3,463 ft of water on Viosca Knoll Block 872. The Seaway Falcon also installed 7.4 miles of umbilical from Einset in 1,500 ft of water. Shell's Southeast Tahoe well and the umbilical termination structure tie back to the Bud Lite platform on Main Pass Block 252 in 276 ft of water. Stolt installed the umbilical from a reel on Seaway Falcon's deck through the vessel's flexible lay system.

TWO COMPANIES have agreed to jointly further develop Zapadno-Malobalysk field in Western Siberia within the Khanty-Mansiysk Autonomous Region.

Russia's OAO NK Yukos and Hungarian company MOL PLC plan a joint venture in which they will invest $300-350 million in the project. The companies have contemplated joint exploitation of the field since 1999.

Zapadno-Malobalysk is near pipeline and other transportation infrastructure. Yukos said the field has estimated proven reserves of at least 20 million tonnes of crude oil. The field has been producing 10,000 b/d, and peak production of 55,000 b/d is expected by 2005.

Elsewhere on the production front, TotalFinaElf said it would end gas flaring at its oil production center in Nigeria by yearend in a plan that is in line with a gas monetization policy. The company also intends to end gas flaring offshore by the end of 2005. The move is part of a strategy to help Nigeria derive maximum revenue from its gas resources. TotalFinaElf has been supplying gas to the Nigerian Liquefied Natural Gas project's Trains 1 and 2 since 1999 from OML 58 off Nigeria and will continue to supply future phases of the project from OMLs 99, 100, and 102 offshore.

SOCO VIETNAM Ltd. has farmed out part of its interest in two blocks off Viet Nam to PTT Exploration & Production Co. Ltd., an affiliate of partially privatized Thai company PTT PLC (formerly Petroleum Authority of Thailand).

PTTEP will fund its own and SOCO's share of drilling four wells on Blocks 9-2 and 16-1, up to $50 million.

UK company SOCO International PLC owns 80% of SOCO Vietnam. Before the farmout, SOCO Vietnam controlled a 50% interest in Block 9-2 and a 30% interest in Block 16-1. After the farmout, SOCO Vietnam will retain 25% of Block 9-2 and 15% in Block 16-1.

State oil company Petrovietnam owns the rest of Block 9-2 and 41% of Block 16-1.

In other exploration news, Perenco PLC, London, has discovered oil in 21 m of water off Gabon.

On test, the discovery well, GSA-1, flowed 6,300 b/d of dry oil from a 110 m gross hydrocarbon column at a 910-1,020 m depth in the Ozouri formation.

The well was drilled to 1,084 m TD and was tested over 13 days. The discovery is 8 km from Gombe field, where Perenco has existing production and export facilities. The company said that the well could be brought rapidly into production.

Well data and 3D seismic indicate 85 million bbl OOIP. "Further appraisal drilling involving potentially 3 wells is planned this year to confirm the full height of the oil column and the northerly extent of the accumulation," Perenco said.

PLANT UPGRADES lead refinery news.

Peruvian state oil company Petroperu has awarded a $20 million contract for the upgrade of its 62,000 b/d Talara refinery to a consortium of Venezuelan company Otepi Consultores and Peruvian company Cosapi.

The work includes expanding capacity to 80,000 b/d and installing a desalination plant for heavy crudes.

The company said the Talara contract is one of three projects Petroperu considers necessary to improve its operations and work toward fulfilling the World Bank's 2005 fuel standards for South American countries.

In addition, Foster Wheeler Ltd. is studying a phase-out of lead in fuel for Petroperu. That study, arranged by the US Trade and Development Agency, should be completed at midyear.

Petroperu also plans a $6 million project to replace subsea pipelines that carry crude from tankers to a shore terminal, and to expand storage.

Also, Alberta Energy Co. Ltd. is studying using 30,000 b/d of idle capacity on the North Peruvian pipeline to transport oil from idle southeastern Ecuadorian fields.

Elsewhere, TotalFinaElf plans a 5-year, 70 million euro program to revamp its 114,000 b/d Feyzin refinery in the Rhône Valley in eastern France.

The work will be performed during two shutdowns. From Mar. 25 to Apr. 26, the Feyzin cat cracker capacity will be increased to 32,000 b/d from 30,000 b/d. Hydrodesulfuriza- tion units will be revamped and flaring reduced. A new control room will be installed. A 2003 shutdown will involve work at petrochemical units.

The Feyzin refinery had been considered a likely candidate for closure when the European refining industry had too much capacity. Jean-Paul Vettier, vice-president of TotalFinaElf's refining division, said all of the firm's refineries are now profitable.

The refinery produces very high octane unleaded gasoline, jet fuel, low-sulfur diesel and heating oil, heavy fuel oil, LPG, and bitumen. It also includes ethylene, propylene, butadiene, and aromatics units.

In other refinery happenings, Frontier Oil Corp. announced plans to boost capacity at its El Dorado, Kan., refinery from 110,000 b/d to 118,000 b/d and increase the plant's coker capacity to 2,200 b/d. The expansion will cost $25.9 million-$16 million for the crude unit and the remainder for the coker expansion. Frontier expects the expansion to reach completion by second quarter 2003, pending receipt of the required environmental permits. Frontier expects gasoline production to increase by 2,500 b/d and heavy crude oil runs to increase by an average 18,000 b/d In addition to the expansion, Frontier also said it would shut down by April its phenol and cumene petrochemical units at the plant. Frontier expects to save $8 million/year through the elimination of the chemical unit's high operating costs and said that the move would increase gasoline volumes by an average 5,000 b/d while allowing for outside marketing of benzene.

IN RETAIL marketing, BP began marketing sulfur-free unleaded fuel and sulfur-free diesel at 18 BP-branded retail stations in the Edinburgh area on Feb. 18.

BP said Edinburgh is the first city in the world to offer both of the fuels, which have sulfur content small enough to qualify as essentially sulfur-free. The maximum sulfur content of the fuel is 10 ppm.

Fuel will be produced at BP's Grangemouth refinery, which is the only plant in the UK with hydrocracking technology, BP said. Despite the higher cost to produce the new fuel, BP said it would market the fuel at the same price as its ultralow-sulfur fuels.

BP said, "The fuels will be the cleanest available anywhere in the UK and are 6 years ahead of the [European Union's] legislative requirements."

BP said use of the fuel will provide "immediate environmental benefits," including the reduction of both particulate and sulfur dioxide emissions.

In addition to the retail stations, BP also will supply the sulfur-free fuel for use by Edinburgh's 260-bus fleet.