OGJ Newsletter

Market Movement

Worldwide oil production falls

IEA's initial estimates of worldwide oil production since output reduction pledges went into effect Jan. 1 show that it dropped 510,000 b/d last month from an average of 76.8 million b/d in December.

Excluding Iraq, OPEC production exceeded the organization's new 21.7 million b/d quota by 1.3 million b/d. Still, production by the 10 countries fell 640,000 b/d from the previous month.

Iraqi production, according to the Paris-based agency, increased 170,000 b/d in January to 2.17 million b/d. Exports, up 120,000 b/d from December, accounted for 1.47 million b/d of this volume. The remainder was allocated to domestic consumption and border trade.

Early estimates also show that the pledged output and export cuts by five non-OPEC producers-Russia, Norway, Mexico, Angola, and Oman-fell short of their intentions.

Crude and product exports from the former Soviet Union increased sharply in January. Exports jumped 760,000 b/d, but this was due to a recovery from low seaborne exports caused by stormy weather and from a scheduled shutdown of Russia's Sakhalin II project, both of which occurred in December.

Russian output in January rose by 60,000 b/d following a pledge by the government that it would decrease its crude exports 150,000 b/d in the first quarter from third quarter 2001 levels.

Meanwhile, IEA estimates that Norwegian output of crude and natural gas liquids declined 160,000 b/d in January to 3.39 million b/d. In December Norway an- nounced that it would lower crude production 150,000 b/d during the first half of the year. This would put the country's crude production at 3.02 million b/d for the period.

Mexico pledged to cut its crude exports during the first 6 months of this year by 100,000 b/d to a reported 1.66 million b/d. IEA estimates that the reduction was made in January, bringing average production of both crude and NGLs to 3.61 million b/d.

Although Angola and Oman also pledged production cuts in support of OPEC, IEA remains skeptical that either country actually will follow through with the reductions. Oman pledged to cut production 40,000 b/d, but the agency reports that January output remained un- changed from November and December. Angola announced a 22,500 b/d production cut. IEA not only doubts that this reduction will fail to come to fruition but also has revised upwards its estimate of 2002 Angolan production by 70,000 b/d following the December start-up of Girassol field.

Demand outlook weakening

Warm weather in North America and other OECD markets last month suppressed demand and has forced IEA to lower its forecast of global oil demand growth for 2002 by 60,000 b/d since its last report.

Europe's cool and dry weather in November led to lower hydroelectric power generation. Adding this to December's cold spell, demand in the fourth quarter of 2002 will be measured against a higher than normal benchmark.

Demand growth, then, will not be as strong compared with last year as would otherwise have been the case, IEA says.

The December cold spell hit Asia too, so year-on-year demand growth in the fourth quarter will likewise be deflated. Conversely, warm US weather late last year will make gains in North American fourth quarter demand appear steeper this year.

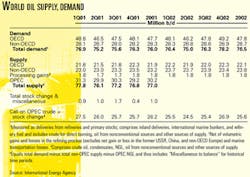

Industry Scoreboard

null

null

null

Industry Trends

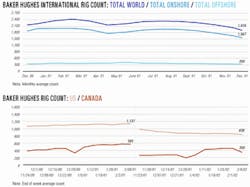

INDUSTRY CONSOLIDATIONS and the evolution of price rationalization over the past several years are having a positive impact on the US oil service and supply industry, says energy analyst Raymond James & Associates.

Unlike past cyclical downturns within the past 2 decades, RJA said today's strategy protects pricing over utilization in oil field service markets such as land and offshore drilling and supply boats. The same inference could be drawn in other oil field service and supply segments such as tubulars and workover rigs, RJA said.

Service pricing is holding up well. "Despite a 35% reduction in domestic drilling activity, average overall oil field service pricing has declined onlyellipse15-20%," RJA added, making today's oil field service pricing "20-200% higher for the same utilization experienced in past downturns."

The US land rig business clearly benefited from recent consolidations, the analyst said, with players having 20 or more rigs holding nearly two thirds of the rig fleet today. RJA estimates that the top five players hold more than 75% of the rigs that can drill 7,500 ft or more. They have been stacking rigs in recent months to create a stable land drilling rig pricing environment.

While land rig utilization in fourth quarter 2001 averaged 80%, average land rig day rates remained at levels 32% higher than the comparable 1998 utilization level. That trend is continuing in this quarter.

"While overall oil field pricing may not yet have hit bottom, we believe the ride there will be much more palatable than in previous times," the analyst said.

A NEW SAFETY TREND among energy firms will be the strengthening of security against terrorism at corporate headquarters, field sites, and travel routes, said a panel of safety specialists at IADC's annual health, safety, environment, and training conference Feb. 5-6 in Houston.

"Some of us will be victims [of terrorists] in one form or another over the next few years," said Ronald H. Relf of Pittsburgh-based Risk Mitigation Group.

The Al Qaeda terrorist organization will be difficult to eradicate, because it's loosely organized and has connections to many other terrorist groups, said David Lattin, security operations director for the Americas at Control Risks Group.

Military security groups estimate that 10,000-70,000 terrorists have been trained by Al Qaeda and dispersed around the world. "Although it's now harder for them to operate, they have long-term programs and can surface 2-10 years down the road," Lattin said, urging the industry to "expect the unexpected."

Upstream oil and gas operations are especially vulnerable to terrorist attacks, the specialists said, because they usually are at isolated locations and frequently are in countries having political, economic, or social unrest.

"Reduce your vulnerability by introducing doubt into terrorists' planning," said Ross Johnson of Air Security International, Houston.

Planning and preparing for a crisis before it happens involves anticipating and analyzing all risks to employees and equipment at work sites and during travel, including potential evacuation arrangements and routes for both expatriate and local employees and their families, the security specialists said.

Government Developments

OIL INDUSTRY and ethanol interests are seeking a compromise as to how the US Congress should update the federal reformulated gasoline (RFG) program, said stakeholders and congressional sources Feb. 11 (see Editorial, p. 19). Senate Majority Leader Tom Daschle (D-SD) said last week that he would begin debate later in the week on a comprehensive energy bill, although congressional sources do not expect controversial provisions such as RFG to be seriously considered until later this month.

A proposal Daschle and Senate Energy and Natural Resources Committee Chairman Jeff Bingaman (D-NM) introduced includes an RFG provision that allows states to eliminate the 2 wt % oxygen mandate refiners now must follow in urban areas that violate US ground-level ozone levels.

Daschle instead wants a renewable fuels standard (RFS) that would require fuel suppliers to boost the level of ethanol and biodiesel supplies from today's 1.8 billion gal/year level to 5 billion gal/year by 2012. To support that legislation, ethanol supporters are pointing to a DOE-funded study that concluded "no major infrastructure barriers exist" for producing and using more than 5 billion gal/year of ethanol in the US.

The oil industry in the past has argued there is not enough ethanol production or infrastructure to support an RFS program.

But some environmental groups and congressional sources suggest major oil companies-represented by API-appear ready to embrace the ethanol industry's 5 billion gal/year target. In return, ethanol interests would agree to more flexibility on an MTBE ban, and they would support a nationwide RFS program that allows for expanded credit trading.

Ethanol groups also would not stand in the way of industry efforts to get broad liability relief for past and future groundwater problems associated with MTBE, sources said. No official deal has yet been struck between the stakeholders, however, according to API and the Renewable Fuels Association, which represents ethanol producers.

A spokesman for National Petrochemical & Refiners Association said that his group continues to oppose ethanol mandates and MTBE bans and is not part of any deal between industry and ethanol interests.

JOHNNIE BURTON, head of the Wyoming Department of Revenue, has been named director of the US Minerals Management Service effective Mar. 15. The post does not require Senate confirmation.

Before her Wyoming cabinet position, Burton was vice-president of TCF, an oil and gas exploration company based in Casper, Wyo. She also served in the state legislature and has held various positions with oil data publishing companies. Born in French Algeria, Burton emigrated to the US in 1963 and became an American citizen in 1968.

Secretary of the Interior Gale Norton said Burton's background provides a solid mix of experience in state government, the oil and gas industry, and education.

Quick Takes

KERR-MCGEE is rapidly ramping up deepwater oil production in the Gulf of Mexico.

Production began Jan. 28 from the first of three deepwater wells in Nansen field, said Kerr-McGee.

Nansen production is expected to peak at 40,000 b/d of oil and 80 MMcfd of natural gas in the fourth quarter as work is completed on nine dry-tree wells. Operator Kerr-McGee holds equal interest in the field with Ocean Energy.

Nansen is on East Breaks Blocks 601, 602, and 646 in 3,700 ft of water. It was developed with the world's first truss spar featuring an open truss structure. Kerr-McGee's use of the method has enabled production to start within 2 years of sanctioning development, the company said. Nansen's estimated reserves are 140-180 million boe.

The Nansen spar-named the Kerr-McGee Global Producer V-is designed for production of 40,000 b/d of oil and 200 MMcfd of gas. It has excess capacity to allow for production from satellite fields, as the field partners also are developing Navajo gas field on East Breaks 690 as a subsea tieback to Nansen spar. They expect first production from Navajo at midyear. The companies also are drilling a separate exploratory well at the West Navajo prospect, which, if successful, will tie back to Nansen as well.

The two companies have formed a joint venture to explore 181 undeveloped leases in the deepwater gulf (OGJ, May 21, 2001, Newsletter, p. 9).

Separately, Kerr-McGee has selected FMC Energy Systems, a unit of FMC Technologies, to provide subsea trees and associated services for development of Gunnison field in the deepwater gulf. Gunnison-which lies in 3,100 ft of water on Garden Banks Blocks 667, 668, and 669-will be developed using a truss spar similar to that used to develop Nansen.

The Gunnison spar will be designed for production of 40,000 b/d of oil and 200 MMcfd of natural gas. Initial production from Gunnison is expected in early 2004.

FMC will produce the field's tree system in Houston, with tree delivery slated for fourth quarter.

Elsewhere on the production front, ExxonMobil has brought on stream Larut field, which is on Block PM5 about 125 miles off Terengganu, Malaysia. Peak production from Larut-the first development on PM5-is expected to reach 30,000 b/d of oil and 35 MMcfd of gas. Operator ExxonMobil holds equal interest with Petronas Carigali. Larut has an eight-legged steel jacket platform with slots for 36 wells. Production will flow into the existing Tapis oil and gas system through 125 miles of new pipelines. Production-when combined with ExxonMobil's development of six satellite fields and production from its Angsi facilities nearby-is expected to reach nearly 140,000 b/d of oil and 535 MMcfd of gas.

Over the next 25 years, ExxonMobil said, output from the three developments is expected to be more than 320 million bbl of oil and 1.5 tcf of gas. The $240 million satellite fields development (SFD) project began production in December from Seligi H, the first of five platforms (OGJ Online, Dec. 10, 2001). The other platforms are Raya B, Lawang A, Serudon A, and Irong Barat B. ExxonMobil operates the project with 78-80% working interest; Petronas Carigali holds the rest. Angsi field began production of 15,000 b/d of oil and 60 MMscfd of gas, also in December (OGJ Online, Dec. 26, 2001). At peak, Angsi is expected to produce 65,000 b/d of oil and 450 MMscfd of gas. ExxonMobil and operator Petronas Carigali each hold half of Angsi. The three projects cost an estimated $1.7 billion combined, said ExxonMobil. Both Larut and the SFD project were considered economically marginal until ExxonMobil developed new designs and development plans that saved money, the company said.

Canadian Natural Resources Ltd. (CNRL) started oil production from one well in Espoir field on CI-26 off Ivory Coast. Production of 8,500 b/d of oil is flowing to the Espoir Ivoirien floating production, storage, and offloading vessel and will increase to 30,000 b/d by the end of the third quarter as six more wells are completed from the East Espoir wellhead tower.Production of associated gas will rise to 30 MMcfd, said CNRL, which estimates the field's reserves at 93 million bbl of oil and 180 bcf of gas. Gas production will be sold for power generation in Abidjan. Field partners are studying a second phase of development that would include installing another wellhead tower and drilling in the western lobe of the reservoir. Also, CI-26 contains separate satellite prospects that could be tied into the 40,000 b/d capacity Espoir Ivoirien.

Halliburton International and Russia's Sibneft signed an agreement described as being valued at "tens of millions of dollars" for Halliburton to provide a full range of oil field services to Sibneft's upstream division, which is producing 400,000 b/d of oil. Sibneft plans to use Halliburton technologies to improve reservoir management, increase production from existing wells, and work over wells that still have production potential. Halliburton will begin work at Sibneft's fields starting this spring. The company will initially provide directional drilling, sidetracking, logging, and cementing services. The two companies will establish a joint engineering team to plan projects. Halliburton is a subcontractor for Sibneft's horizontal drilling project at Sugmut field and is providing its Sperry-Sun and Baroid product service line applications.

Development of Kristin field in the Norwegian Sea continues apace.

Statoil has awarded a 1 billion kroner ($110 million) letter of intent to Kværner to build a subsea production system for the 17 billion kroner project. Kværner Oilfield Products will conduct engineering, procurement, and construction of the system. It includes fabrication and assembly of four templates, wellheads with christmas trees and control systems, umbilicals, and associated installation equipment.

Templates will be delivered in early summer 2003, slightly ahead of planned drilling activity. Fabrication is scheduled to begin in the fall at the Kværner Egersund yard south of Stavanger.

Statoil said the template installation contract will be awarded this spring, with contracts for the platform living quarters and steel hull to be placed during the spring and early summer. Contracts for the drilling rig and for drilling and well services will also soon be awarded.

First production from Kristin is expected in October 2005.

Drilling equipment manufacturer Tesco has entered into a joint venture with Conoco to build three drilling rigs using Tesco's casing-drilling technology. Tesco will operate the rigs for Conoco under an exclusive 2-year contract in Conoco's South Texas Lobo natural gas trend.

The new rigs, Tesco said, would reduce drilling costs and speed well completions by drilling through conventional casing instead of through drill pipe. The first rig is slated for operation as early as Sept. 1, with the remaining two expected to be ready by yearend.

"Typically, wells drilled with casing drilling can be drilled up to 30% faster than conventional wells, and [this] represents a major advance in oil and gas drilling technology," Tesco said.

Alaska Gov. Tony Knowles has announced a 5-year, 20-sale area-wide leasing program for state oil and gas lands.

Under area-wide leasing, the state offers all available state land within a geographic region. Through 2006, the state is proposing to hold five sales each in the Cook Inlet, Beaufort Sea, North Slope, and North Slope Foothills areas. The Cook Inlet and North Slope Foothills sales would be in May, and the North Slope and Beaufort Sea sales in October.

In 2001, the state leased 334 tracts in four sales for $26.5 million in bonus bids.

Knowles said that, for the first time in a decade, North Slope oil production will increase this year, as production begins from the Northstar project and from new developments on the North Slope.

Knowles again urged the federal government to approve drilling on the Arctic National Wildlife Refuge coastal plain and a pipeline to monetize Alaska's gas reserves.

"There's no other place in America with the huge quantity of oil our nation needs than beneath a small portion of the ANWR coastal plain," Knowles said.

In other exploration news, Apache made an oil discovery in the Carnarvon basin off Western Australia. The Double Island-1 well found 51 ft of net column of 51° gravity oil in the Lower Cretaceous Flag sand. Apache did not flow test the well, because the Flag sand's deliverability has been well established in nearby producing fields. The well is owned by the Harriet Joint Venture, which Apache operates with a 68.5% working interest. Partners are Kufpec Australia 19.3% and Tap Oil 12.2%. Apache said the Harriet complex is averaging 22,000 b/d of oil, 95% of which is from the Flag sand. Initial oil production from the JV's South Plato-Gibson Flag discoveries made last year is expected at midyear at the rate of 10,000 b/d. Preliminary plans call for connecting Double Island to the South Plato-Gibson facilities 4 miles away. The oil will then flow to Apache's processing facilities at the Harriet complex on Varanus Island.

PDVSA began a $375 million, 2-year exploration program in the Orinoco Delta-in an area that is next to Trinidad and Tobago productive acreage-155 miles off Delta Amacuro territory. PDVSA hopes to add natural gas reserves to meet internal and export needs. A mobile offshore drilling unit will drill a dozen exploration and delineation wells in 150-1,500 ft of water. PDVSA has set up logistical bases for the project in Guaraguao, Anzoátegui; Maturín, Monagas; Capure, Delta Amacuro; and Güiria, Sucre. PDVSA has studied best practices and safety and health issues for the project. It has conducted environmental impact studies and baseline measurement campaigns in the drilling areas. It also has signed mutual aid agreements with companies working in Trinidad. The company said that if the project is successful, it would be a first step toward the creation of a natural gas industrial center on Sucre's Paria Peninsula that would underpin the development of reserves in Venezuela's easternmost region.

Reversal of a 110.5 mile, 36-in. pipeline between Sisak, Croatia, and the port of Omisalj is all that is needed to enable Russia to export oil by yearend via an existing trans-Balkan pipeline network to the Adriatic Sea.

Transneft and Yukos Oil are anxious to have the $120 million reversal project completed by yearend.

London-based Centre for Global Energy Studies, in a recent advisory, cited the Russian publication Commersant regarding the development. Russian Urals blend would flow 1,987 miles west via the existing Druzhba and Adria pipeline systems. Capacity of the entire line would be 100,000 b/d, expandable to 200,000 b/d after 5 years and 300,000 b/d after 10 years.

The Omisalj oil terminal has two berths capable of handling 500,000 dwt tankers. CGES said the terminal has land available to add two berths and to build tankage to take storage capacity to 1.5 million cu m from the present 680,000 cu m.

CGES said use of larger tankers (VLCCs and ULCCs) to carry Russian crude would make exports more economic and would enable Russia to bypass Turkey's Bosporus Straits. In theory, CGES said, the Druzhba-Adria connection could also be used to export Caspian-area crude if a quality bank were used or crudes of differing qualities were batched to preserve their values.

Camisea LNG prospects continue to brighten.

Hunt Oil has signed an $8.5 million basic engineering and design contract for a Camisea gas liquefaction plant with Halliburton KBR.

The contract is part of a technical feasibility study led by Hunt to consider the selection of LNG or gas-to-liquids technology for exporting natural gas products from the Peruvian project when it comes on stream by August 2004 (OGJ Online, Sept. 4, 2001). The companies estimate the cost of the project at $1.6 billion-without the LNG or GTL operation, which would double the cost. Halliburton KBR is to complete the contract in March 2003.

Meanwhile, Pluspetrol, upstream operator for Camisea project, has begun shipping equipment for field development to the Camisea site in the jungle 500 km east of Lima. Authorities still must approve the environmental impact assessment for the gas pipeline to the coast.