Planning for success: profit vs. reserves

Nearly 20 years ago in a very entrepreneurial division of a major oil and gas company, a vice president defined the author's mission as being "to increase rate and maintain or increase reserves by working in and around production in producing basins." This mission statement has served the author well over the years, but it is incomplete. What is missing is a statement concerning low cost production.

In any commodity business the primary goal should be to become a low cost producer. Low cost producers will always be survivors during commodity price downturns. Low cost producers have an easier task when seeking funding. They also are always in better positions to capitalize on investment opportunities.

However, becoming a low cost producer is at odds with much of our economic evaluation training. Economic evaluation often focuses on present value. Reliance on present value forces managers to concentrate on reserve additions rather than the efficiency of investments. For example, large marginally economic exploration targets can have very large present values. Smaller projects often may have smaller present values, but at the same time they may be much more profitable.

Economic evaluation

Economic evaluation of oil and gas projects involves the determination of several financial criteria. However, some of these economic criteria are not well suited for the oil and gas business. Most basic financial management texts define these evaluation methods.

The payback period (payout) of an investment is the number of years needed to recover the investment. It was the first method used to evaluate capital budgeting allocations. Payback does not measure the return or efficiency of an investment. It does measure the liquidity and risk of a project. It is not a good project-ranking tool.

Present value (PV), commonly called net present value (NPV), is the total value of positive and negative project cash flows discounted back at a discount rate that represents the cost of capital. Where capital is unlimited, all projects with a positive PV should be accepted. Projects with a negative PV should be rejected. When capital is limited, PV is not always the best ranking tool.

Internal rate of return (IRR) is defined as the computed percentage discount rate at which the discounted positive cash flow equals the discounted negative cash flow. Projects with IRRs greater than the cost of capital should generally be accepted.

The IRR method is not well suited for investments with uneven payments or payment periods. This limits its usefulness in the oil and gas business. Also, IRR can have multiple solutions, is independent of cost of capital, and has other limitations. It is not a good ranking tool. Nevertheless it is commonly used in our business.

Modified internal rate of return (MIRR) assumes that all cash flows are reinvested at the cost of capital. It is a better indicator of profitability than IRR. MIRR is not useful for ranking projects of differing size or type. It should not be used as a project-ranking tool in our industry.

Profitability index (PI) or Investment Efficiency (IE) is a measure of the profitability of a project. It is the present value of the positive cash flows normalized to the present value of the costs. It is a good ranking tool for mutually exclusive projects. Higher IE projects are better than lower IE projects.

Capital budgeting

Consider a set of projects presented to a company for potential funding (Table 1).

The ranking of the projects for capital budgeting purposes is not readily apparent. Payback period, internal rate of return, and modified internal rate of return are not useful for this purpose.

Present value and investment efficiency are commonly used to rank projects. In academics, present value is always used to rank investments because there is an assumption of unlimited capital. Here, large PV projects are always favored over smaller ones because they maximize shareholder value.

This approach favors large projects and may cause management to focus on large reserve projects over projects with greater investment efficiency. In this way present value analysis may cause companies to favor reserves over profitability.

In the real world, investment efficiency is a much more useful way to maximize shareholder value.

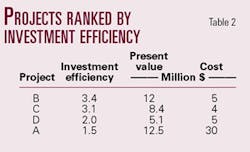

Now consider a ranking of the same projects by investment efficiency (Table 2). Note that a budget including the first three projects would have a higher return to investors at a smaller cost than the largest PV project. The sum of the present values of these three projects is larger than the present value of the largest project.

Strategic planning

Many oil and gas companies have made strategic (read uneconomic) decisions to focus on a particular segment of the business. Often management makes these decisions to pursue whatever it feels is hot at the time, without a good understanding of economic potential versus other decision paths.

Strategic planning should be done on the basis of comparative economics. Individual play types or regions should be analyzed in the same way as individual projects to determine comparative economics.

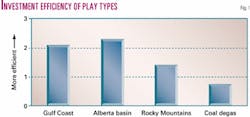

Consider a comparison and ranking of play types (Fig. 1). The values presented are not absolute and are presented for demonstration purposes only. Differences in such factors as costs, capital cost, timing, prospect inventory, and scientific competence will change the values and ranks of the plays depicted.

Methods of analysis have been presented in several of the author's previous papers. Application of financial evaluation to exploration plays has resulted in an exceptionally low finding and production cost.

Companies that focus on profitability rather than reserves will most likely be more profitable. These companies will be more likely to survive low commodity price environments as we expect in the future. They will be more likely to consume reserve- oriented companies during difficult times.

The bottom line: Focus on profitability and the reserves will take care of themselves.

Bibliography

Wilson, Dan L., "Full-cycle economics helps focus programs, financial performance," OGJ, July 1, 1991, p. 68.

Wilson, Dan L., "Knowing field size distribution crucial in estimating profitability," OGJ, Apr. 15, 1991, p. 92.

Wilson, Dan L., "Practically estimating field size, chance of success vital in U.S.," OGJ, Mar. 11, 1991, p. 99.

The author

Dan L. Wilson ([email protected]) is a geologist, management consultant, writer, and a former area and district geologist at a major oil company. His corporate background includes planning and evaluation experience. He received an MS degree in geology from Western Washington University and an MBA from the University of Colorado at Denver.