Special Worldwide Report: Worldwide refining capacity climbs to highest level ever

The worldwide refining industry added a significant amount of capacity in 2002, despite the fact that the total number of refineries decreased by 10.

This capacity increase reverses a downward trend during the past 2 years. Refinery capacity in 2002 is at its highest level ever.

Last year's refining report showed a worldwide capacity of 81.2 million b/cd as of Jan. 1, 2002. This year, OGJ's survey reflects a total capacity of 81.9 million b/cd, or an increase of 712,000 b/cd.

Capacity creep and expansions in existing refineries, along with the inclusion of a new refinery, fueled the increase in refinery capacity. Relatively few shutdowns and removals occurred in this year's survey.

North America and the Middle East showed the largest increases in refining capacity, 258,000 b/cd and 246,000 b/cd, respectively. The Middle East growth was due to refinery expansions in Kuwait and Qatar. North America growth was due to capacity creep and expansions in all three countries in the region.

South America was third with an increase of 160,000 b/cd. Western Europe, Asia Pacific, and Africa all had slight capacity increases.

Only Eastern Europe showed a decrease in capacity, 64,000 b/cd. This was primarily due to less capacity in Poland and Croatia.

The OGJ refinery survey had one new listing in 2002. Two refineries shut down since the last survey and three had shut down prior to last year's survey that were not yet recognized as such.

Additionally, the survey does not list five asphalt plants and two roofing plants due to a change in reporting methodology that began last year.

New crude capacity

Last year's survey listed Pak-Arab Refinery Ltd.'s (Parco) 95,000-b/cd facility for the first time. Although this refinery in Mahmood Kot, Punjab, Pakistan, started up in February 2001, it was not discussed in last year's article.

Parco is a joint venture of Pakistan, Abu Dhabi, and Austria, with the government of Pakistan holding 60% and Abu Dhabi Petroleum Investment and Austria's OMV AG sharing the remaining 40%.

Refinery closures

Primary crude refining capacity was shut down mainly in the US.

Premcor Inc., one of the largest independent refiners and marketers of unbranded transportation fuels and heating oil in the US, shut down its 70,000-b/cd Hartford, Ill., refinery in early October.

Premcor Refining Group Inc. also closed a 76,000-b/cd plant at Blue Island, Ill., last year.

According to the company, the Hartford refinery was shut down because "there was no economically viable method of reconfiguring the refinery to produce fuels meeting new specifications."

Premcor is currently operating the refinery as a terminal facility and is exploring the possibility of promoting the facility as a commercial hub for storage and distribution of ethanol.

Tricor Refining LLC reported to OGJ that it had shut down its 12,500-b/cd Bakersfield, Calif., refinery in December 2001.

In June 2002, Tricor had purchased the refinery from Golden Bear Oil Specialties Inc. Tricor is an acquisition entity formed by Ergon Inc. (50%), San Joaquin Refining Inc. (25%), and Tricor Energy LLC (25%).

Updates to this year's survey include shut downs that occurred before 2001 but were not yet reflected in the survey.

These include the 6,700-b/cd Berry Petroleum Corp. refinery in Stephens, Ark.; the 10,000-b/cd Iraqsoma Refinery Co. plant in Mogadishu, Somalia; and the 2,000-b/cd Nippon Mitsubishi Petroleum Refining Co. Ltd. plant in Niigata, Japan.

Other removals from the current survey include five asphalt plants, all in California, and two plants that primarily produce roofing products.

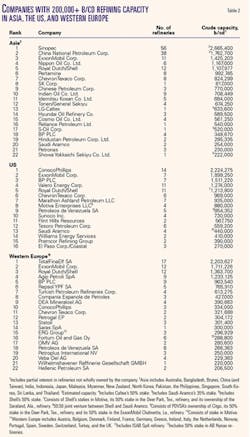

Largest refining companies

Table 1 lists the top 25 refining companies that own the most worldwide capacity. Table 2 lists companies with more than 200,000 b/cd of capacity in Asia, the US, and Europe. Capacities from Tables 1 and 2 include partial interests in refineries that the companies do not wholly own.

Significant changes from last year involve ChevronTexaco Corp., ConocoPhillips, Royal Dutch/Shell, and Valero Energy Corp.

Two mergers allowed their respective companies to make significant moves up Table 1.

ConocoPhillips, the third largest US-based integrated oil firm, was formed on Aug. 30 when Conoco Inc. and Phillips Petroleum Co. completed their $15 billion merger. Last year, Phillips was the 11th largest refiner and Conoco was the 20th. The merger was sufficient to move the company up to 6 on the list.

Under the consent decree unanimously approved by US Federal Trade Commission (FTC) commissioners, the new ConocoPhillips must divest some assets. Among the divestitures will be Phillips' 25,000-b/d Woods Cross refinery just north of Salt Lake City and Conoco's 60,000-b/d refinery in Commerce City, Colo.

Neither refinery has been sold as of press time, therefore the current survey shows both refineries still owned by ConocoPhillips.

On Dec. 31, 2001, Valero Energy Corp. finalized its merger with Ultramar Diamond Shamrock Corp. The two companies were the 25th and 26th largest refining companies before the merger; the new company is now the 13th largest refiner.

To gain FTC approval for the merger, the company had to agree to divest its Golden Eagle, Calif., refinery. In May, the 168,000-b/d refinery was sold to Tesoro Petroleum Corp. for $1.075 billion.

Table 1 shows that ChevronTexaco Corp. moved from 4 to 8 because it sold its interests in Equilon Enterprises LLC and Motiva Enterprises LLC in February. The FTC required Texaco to divest the refining and marketing joint ventures as a condition of its $35 billion merger with Chevron Corp.

Shell Oil Co. and Saudi Refining Inc. (SRI), the other two companies that were part of the Equilon/Motiva venture, paid $2.26 billion in cash and assumed $1.6 billion in debt and other liabilities.

Shell and SRI now each own 50% of Motiva and Shell owns 100% of Equilon, which has been renamed Shell Oil Products US.

The additional capacity was sufficient to move Saudi Aramco, SRI's parent company, from 9 to 8 in Table 1.

In other transactions, BP PLC sold its 62,000-b/d Yorktown, Va., refinery to Giant Industries Inc. for $127.5 million.

Also, Shell finalized its acquisition of Sunoco Inc.'s 73,000-b/d Yabucoa, Puerto Rico, refinery. This sale was mentioned in last year's article (OGJ, Dec. 24, 2001, p. 70), but was not final at that time. This year's survey reflects the ownership change.

Williams Cos. has had its refineries on the sale block for some time, part of an extensive asset sale by the Tulsa energy company. Although not reflected in this year's survey, the company has found a buyer for its Memphis, Tenn., refinery.

On Nov. 26, Williams announced that it was selling the 175,000-b/cd refinery to Premcor for approximately $465 million. This ownership change will be reflected in next year's survey.

Williams also sold its 27% stake in the 263,000-b/cd Lithuanian refinery in August. A few other companies shifted positions due to minor expansions and losses in refining capacity.

Largest refineries

The world's largest refineries are listed in Table 3.

ExxonMobil's Baytown, Tex., refinery moved up one spot due to a slight expansion in crude capacity. New to the list is Kuwait National Petroleum Co.'s refinery in Nia Al-Ahmadi, which expanded capacity to 442,700 b/cd from 326,800 b/cd shown in last year's survey.

Other refineries in the table did not experience any capacity changes.

Regional crude capacities

Table 4 lists regional process capabilities as of Jan. 1, 2003. As previously mentioned, the largest increases in crude capacity occurred in North America and the Middle East.

Mexico experienced the biggest increase of the three North American countries. Petroleos Mexicanos (Pemex) reported to OGJ that its Madero refinery had expanded its crude capacity to 320,000 b/cd from 195,000 b/cd.

Smaller revamps and expansions in various refineries accounted for the rest of the increase in North America.

Increases in the Middle East were caused by expansions in Kuwait and Qatar. The Kuwait National Petroleum Co. told OGJ that its refinery in Mina Al-Ahmadi had increased capacity to 442,700 b/cd from 326,800 b/cd.

Eastern Europe showed a decrease of 64,000 b/cd, primarily attributable to changes in Poland and Croatia. The Industrija Nafte Zagreb d.d. (Ina) refinery in Rijeka, Croatia, restated its capacity at about 32,000 b/cd lower than last year's survey. Improved information from Poland lowered its capacity, also by 32,000 b/cd.

Processing capabilities

Figs. 1-3 show the processing capabilities of Asia, the European Union (EU), and the US. Processing capabilities are defined as conversion capacity (catalytic cracking and hydrocracking) and fuels producing processes (catalytic reforming and alkylation) divided by crude-distillation capacity (% on crude).

Countries in the EU include Belgium, Denmark, France, Germany, Greece, Ireland, Italy, the Netherlands, Portugal, Spain, and the UK.

Click here to view pdf 2002 Worldwide Refining Survey

Click here to view pdf Worldwide Refineries-Capacities as of January 1, 2003

Click here to view pdf US Refineries-State Capacities as of January 1, 2003

Click here to view pdf Worldwide Refining Company and Refinery Location