Market Movement

Venezuela's turmoil intensifies

Venezuela's beleaguered President Hugo Chavez last week authorized the military to commandeer private ships, trucks, and planes to distribute fuel and food as a general strike to oust him approached its third week.

That strike, which began Dec. 2, involves most employees of state oil company Petroleos de Venezuela SA and at presstime last week had choked off PDVSA's oil production to 370,000 b/d, less than 15% of normal levels of some 3 million b/d. PDVSA officials said that production level is unlikely to fall further because they do not want to cut off basic electric power services in that country.

Meanwhile, oil inventory capacity is nearly full, since virtually all refining and export operations are at a standstill. More than 40 tankers are moored near inactive Venezuelan ports.

PDVSA Pres. Alí Rodríguez Araque is attempting to manage the state oil company through special powers given to him by Chavez. He has tried to use retired oil workers, military personnel, and even foreign workers to break the strike. But with PDVSA strikers holding firm, soldiers have failed to restart oil industry operations because they cannot operate the sophisticated equipment.

Oil accounts for nearly a third of Venezuela's gross domestic product, half of the government income, and 80% of the country's exports, primarily to the US.

Mexico and Venezuela are the two dominant suppliers of imported heavy crude to US Gulf refineries that are geared to process that grade of oil. As a result, refiners unable to obtain new supplies are being forced to reduce runs.

The US and others are urging Chavez and his opponents to negotiate a deal on elections before the strikes escalates into all-out violence or possibly civil war. Talks between the two sides, mediated by Organization of American States Sec. Gen. Cesar Gaviria, have been unsuccessful, but are continuing.

US gas prices head higher

There is "a very high probability that US natural gas prices will move well above $5/Mcf in the next 6-8 weeks," said J. Marshall Adkins, managing director of energy research and senior oil field service equity analyst in the Houston office of Raymond James & Associates Inc. In a Dec. 2 report, he said, "This means $7-8/Mcf is likely, and double-digit gas prices are not out of the question."

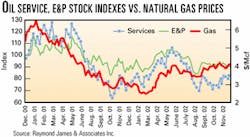

That's good news for upstream companies, since "significant moves in natural gas prices usually translate to significant moves in both oil service and E&P stocks," Adkins said (see graph).

Adkins's optimism is based on a gas supply-demand model that "is screaming that decreasing US natural gas supply is rapidly careening towards a train wreck with increasing weather-driven gas demand," he said.

He sees "an unprecedented convergence of bullish gas fundamentals that should hit the gas markets in the next 2 months."

These include:

An unprecedented annual decline of 5-6% in US gas supplies. "The biggest difference in the gas markets today relative to any other time in history is the fact that US gas supply is falling at an unprecedented rate," said Adkins.

A likely sharp increase in weather-related demand for gas. Based on analysis of historical residential and commercial winter consumption of gas, Adkins concluded that "extremely warmer-than-normal" weather last winter dampened US gas demand by more than 1 tcf. This year, he said, "if the weather actually turns out to be anywhere near the 30-year normal, then we see a high probability this higher weather-driven demand will shock and overwhelm the US natural gas system (see p. 7)."

Much of the economy-related gas demand has already been squeezed out. "Because this 'low-hanging fruit' has already been picked out of the industrial gas system, the price threshold needed to kill additional industrial-related gas demand will be much higher this year," Adkins said. "In other words, the natural gas crisis that we foresee this winter will be much more difficult to solve."

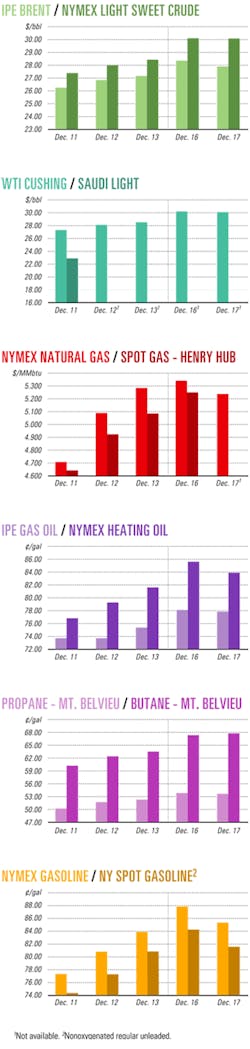

Industry Scoreboard

null

null

null

Industry Trends

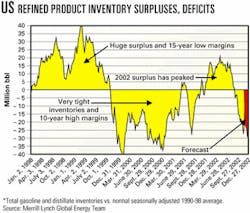

US REFINING margin spikes and upside earnings per share surprises have surfaced, reminding Merrill Lynch analyst Andrew Fairbanks of the strong refining environment of 2000-01.

"We continue to believe that the US downstream has seen the worst for this cycle," Fairbanks said in a Dec. 6 research note.

The overall industry inventory is much tighter now than it has been any time during the past year. Gasoline and distillate inventories stand at 20 million bbl below normal for this time of year vs. a 20 million bbl overhang in May.

"As such, we believe that even if supply increases from higher (gasoline) imports, the US can withstand even 10 million bbl of imports in excess of what can be absorbed by demand without margins falling back to below-average levels," Fairbanks said.

He anticipates that gasoline imports, although high this year, should be fully absorbed in similar quantities next year with only modest demand growth.

The fourth quarter of this year is the first quarter in more than a year in which consensus estimates are moving up instead of down, Fairbanks said of analysts' earnings per share estimates for refiners.

"We expect this process will continue into 2003 as the industry continues its recovery back to the tight conditions prevalent during much of 2000 and 2001," he said.

Assuming a modest rebound in global growth in 2003, he anticipates that the US downstream sector "will see a solid rebound next year, despite a rough ride in 2002."

A WEATHER FORECAST from Atmospheric and Environmen- tal Research Inc., Lexington, Mass., has predicted colder-than-average weather for the eastern US from December through Feb- ruary.

The forecast opposes the US National Weather Service's forecast of a warm winter for the northern US. Winter temperatures influence energy commodities prices and inventories.

Judah Cohen, AER staff scientist, developed a seasonal forecast model that considers four primary signals: El Niño, the global warming trend, Siberian snow cover, and North Atlantic Oscillation-Arctic Oscillation patterns.

Other forecasting organizations incorporate two factors in predicting seasonal climate: the standard models of El Niño and the global warming trend.

Government Developments

TRINIDAD AND TOBAGO'S security forces are on high alert following threats from an Islamic fundamentalist group to American and British energy interests in the Caribbean twin-island nation.

Reports out of the country's capital say its security forces have unearthed a plan by a group called Waajihatul Islaamiyyah (Islamic Front), led by Umar Abdullah, to attack US and British interests in Trinidad and Tobago. It is believed that the group has links with Al Qaeda. Officers from the UK's Secret Service along with the US Central Intelligence Agency and the US Federal Bureau of Investigation are on the island investigating the matter.

Firms from both the US and UK have invested billions of dollars in the Caribbean nation, most of which is in the energy sector. Numerous major oil and gas companies operate there, and it is a key country particularly for BP PLC and BG PLC.

It is understood that Trinidad and Tobago's intelligence officers intercepted a cellular telephone conversation in which Abdullah was heard planning to strike American interests on Dec. 22. Apart from energy interests, he allegedly discussed an attack on the US embassy in Port of Spain.

Frank Diaz, head of Trinidad's Special Branch, the security arm responsible for intelligence gathering, said that authorities have been following Abdullah for 3 years. Abdullah is known to US authorities who have assembled a dossier on his organizations.

Meanwhile, Prime Minister Patrick Manning, who also chairs his country's National Security Council, has refused to talk about the matter, saying he does not discuss national security matters publicly.

Trinidad and Tobago is a key supplier of natural gas to the US, particularly New England.

CANADA has agreed to accept the Kyoto Protocol on Climate Change.

Canadian Prime Minister Jean Chretien signed the ratification Dec. 17, and Environment Minister David Anderson was expected to deliver it to the United Nations in New York for formal registration.

The oil and natural gas industry now will focus upon issues about how Kyoto might be implemented. As a ratifying partner, Canada is required to reduce carbon dioxide emissions by 6% from 1990 levels by 2012. (OGJ Online, Dec. 10, 2002).

The uncertainty surrounding Kyoto, said Lehman Bros. Inc., would serve as a "risk and an overhang on the share price of companies with oil sands exposure.

"If Kyoto is implemented, sources close to discussions in Canada tell us that it will take 1-2 years before the industry is informed about the full details of implementation," Lehman Bros. said, adding, "This could potentially cause further delays in oil sands projects being developed, as companies are likely to maintain a 'wait and see' approach."

Quick Takes

PRODUCTION has begun from two important discoveries in Alaska.

ConocoPhillips Alaska Inc. and BP Exploration (Alaska) Inc. started production earlier this month in Kuparuk River field from its new Drill Site 3S, which is producing 16,000 b/d of oil from three Palm wells.

The Palm satellite discovery, which extended Kuparuk River field 3 miles to the northwest and lies in the Greater Kupuruk Area, is being developed as an extension of Kuparuk with production processed through existing Kuparuk field facilities. The oil accumulation, discovered in winter 2001, contains 35 million bbl of oil reserves, the companies said (OGJ Online, May 18, 2001).

ConocoPhillips said this development will help keep its Alaska production at 375,000-400,000 boe/d for the next several years.

Kuparuk, the second largest oil field in North America behind Prudhoe Bay, began production in 1981, and the Greater Kuparuk Area, which includes four satellite fields, currently produces about 210,000 bo/d.

Operator ConocoPhillips Alaska holds 55.17% interest in Kuparuk River field, and BP Exploration holds 39.19%. Unocal Alaska Resources, ExxonMobil Corp., and ChevronTexaco Corp. hold minor interests.

Forest Oil Corp. began producing oil Dec. 9 from its Redoubt Shoal field in Cook Inlet. Oil production is flowing to Forest's facilities at West McArthur River field at a rate exceeding 4,200 b/d from two of the four wells currently capable of production. Forest expects to maintain production at or near this rate until new onshore production facilities at Kustatan are completed.

Redoubt Shoal reserves could reach 220 million bbl ultimately, said Gary Carlson, senior vice-president, who estimates there are 30-100 million bbl of oil and 50-1,100 bcf gas accumulations yet to be found and developed in Cook Inlet (OGJ, Dec. 9, 2002, p. 24).

Forest CEO and Chairman Robert S. Boswell said the project "demonstrates that large oil fields can be found in North America that are not deepwater- related. We believe that Redoubt Shoal will have lower finding and development costs and a shorter development schedule than deepwater or international projects of similar reserve size."

Forest said other exploration prospects in the inlet fall within its 270,000 lease acres: Corsair, Raptor, Sabre, Tutna, and Valkyrie, several of which could be drilled in 2003.

After the company finalizes completion work on Nos. 3 and 4 Redoubt wells, Forest will resume drilling activity in the field.

BHP Billiton Ltd., Melbourne, has discovered natural gas on its Vortex prospect on Atwater Valley Block 261 in the deepwater Gulf of Mexico. The Deepwater Millennium rig spudded the Vortex-1 exploratory well Sept. 9 in 8,344 ft of water. A sidetrack was also drilled 2,900 ft west of Vortex-1 to 19,330 ft TD. BHP Billiton holds a one-third interest in the Vortex prospect and is operator. Partners are Kerr-McGee Corp., Oklahoma City, and Ocean Energy Inc., Houston, each holding a one-third interest. Earlier this month BHP Billiton also found hydrocarbons with its Shenzi well in the Western Atwater foldbelt area 125 miles off Louisiana on Green Canyon Block 654, where the company participated in the discovery of oil and natural gas at Mad Dog, Atlantis, and Neptune (OGJ, Nov. 5, 2001, p. 84). The Western Atwater foldbelt will become a core producing area for BHP Billiton starting in late 2004, a spokesman said (OGJ Dec. 2, 2002).

ALGERIA'S Sonatrach awarded a $240 million contract to FMC Sofec Floating Systems, a Houston-based unit of FMC Technologies Inc, to construct five offshore crude and condensate export terminals.

The project includes installation of two crude oil loading quays off the Mediterranean port of Arzew, two others in Skikda, and one in Bejaia. FMC Sofec will begin construction in 2003 for completion by 2005.

The project is expected to double Algeria's exports of liquid hydrocarbons to 220 million tonnes/year. Sonatrach officials said the new units are designed to receive 300,000 dwt large crude tankers, regardless of weather conditions, enabling Sonatrach to supply markets in the US and Asia. Algeria's Energy and Mines Minister Chakib Khelil said the country's oil production capacity would increase to 1.3 million b/d by yearend 2003 and to 1.5 million b/d in 2005.

At a meeting of the Organization of Petroleum Exporting Countries Dec. 12, Algeria's production quota was increased to 735,000 b/d, effective in January, from 693,000 b/d currently. However, Khelil said that Algeria would continue to push for a higher production quota to match its current 1.1 million b/d capacity.

ABB, Zurich, received a $34 million contract to supply control and safety systems for the proposed 1,760 km Baku-Tbilisi-Ceyhan (BTC) export pipeline from Azerbaijan to Turkey. BP PLC is operator for the BTC Pipeline Co. consortium.

ABB will supply, install, and commission integrated control and safety systems to provide operational control, emergency shutdown options, and fire and gas monitoring of the pipeline, a marine terminal, and two offshore production platforms. The work also includes remote-controlled subsystems to isolate sections of the pipeline for regular inspection and maintenance.

The pipeline will be linked over its entire length by a fiber optic telecommunications system, ABB said. The systems will enable BTC Pipeline Co. to control operations at both ends of the pipeline. Associated field instrumentation includes transmitters and ultrasonic flow metering for the terminal, valves, and pumping stations.

When commissioned, the $2.9 billion pipeline is expected to carry 1 million b/d of Azeri Caspian Sea crude oil from Sangachel on Azerbaijan's Caspian coast, through Georgia to a new marine terminal at Ceyhan on Turkey's southern Mediterranean coast. Construction is slated to start next year with completion in 2005.

In other pipeline news, BHP Billiton Ltd. and joint venture partner Esso Australia Resources Pty. Ltd. have started up the newly constructed Bream natural gas pipeline in the Bass Strait off Australia. The 200 MMscfd line, construction on which began in January, is the fourth gas pipeline extending from the existing Bream A offshore platform into the JV's Gippsland production network at the Longford processing facilities, the companies said. The 51 km, 14-in. line, which cost $200 million (Aus.) to build, extends 46 km offshore from the Bream A platform, across the Gippsland coast, then 5 km onshore to Longford. "Gippsland gas from Bass Strait now supplies Victoria, New South Wales, and Tasmania," said Terry White, vice-president, Bass Strait, "and from 2004 will flow into South Australia and the Australian Capital Territory."

Valkyrie Commissioning Services Inc. (VCS), Houston, received a letter of intent for pipeline commissioning services in support of Pioneer Natural Resources Co.'s multiwell Falcon deepwater project in the Gulf of Mexico. Falcon field is 100 miles east of Corpus Christi, Tex., in 3,400 ft of water on East Breaks Blocks 579 and 623 (OGJ Online, Oct. 24, 2001). Reserves are estimated at 175-240 bcfe. The 32.6 mile, 10-in. production pipeline is planned to transport untreated natural gas and condensate from two wells in Falcon field to an El Paso Energy Partners LP host platform, Falcon Nest, in shallow water on Mustang Island Block 103. Natural gas production from the field is expected to reach 175 MMcfed. Paris-based Technip-Coflexip was awarded the EPCI contract in June for design, procurement, commissioning, and installation of the pipeline system and umbilicals. VCS will provide filling, pigging, hydrostatic testing, and dewatering services after the pipeline is installed. The project is slated for completion by February 2003.

ALEXANDRIA MINERAL OIL CO. (AMOC) has awarded a lump sum, turnkey contract to Technip-Coflexip for the construction of an acid gas treatment plant at Alexandria, Egypt.

Technip-Coflexip will provide detailed engineering, procurement, construction, precommissioning, commissioning, start up, and training.

The plant, which will have production capacity of 12 tonnes/day of sulfur, will be the first to be built using Thiopaq technology on an industrial scale, the companies said. Thiopaq process technology—developed by Dutch firm Paques BV and engineered for industrial applications by UOP LLC—converts acid gas from the desulfurization processes into elementary, water-soluble sulfur by a biological process. Plant start-up is slated for August 2003.

OMAN LNG Co.'s (OLNG) third LNG train, which will have a production capacity of 3.3 million tonnes/year, is expected to begin production by first quarter 2006, increasing the Omani firm's output to 10 million tonnes/year from 6.6 million tonnes/year.

A joint venture of Yokohama-based Chiyoda Corp. and Foster Wheeler Ltd. is developing the third train under a contract awarded by Royal Dutch/Shell Group. The train will adjoin OLNG's existing Qalhat facilities. Spanish power provider Union Fenosa SA, which has been aggressively increasing markets and securing gas supplies, signed a 20-year agreement with OLNG in May for LNG supply from the third train—its third OLNG supply contract. Meanwhile, Omani LNG production nearly tripled in 2002 as its second train ramped up production and, with the recent signing of its second supply contract with Union Fenosa, Oman LNG completely sold out its current capacity to long-term purchasers and spot buyers. OLNG will provide Fenosa with 1 billion cu m of LNG in 2004 and an additional 800 million cu m in 2005. OLNG is a consortium of the Government of Oman 51%, Shell 30%, and six minor stakeholders.

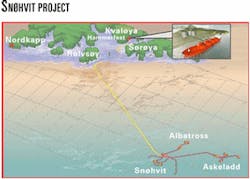

Costs associated with development of the Snøhvit LNG project in the Barents Sea and onshore Norway have soared to 45.3 billion kroner from 39.5 billion kroner ($5.3 billion), reported Statoil ASA, operator for the Snøhvit consortium. However, the project outlook remains satisfactorily profitable for the group, Statoil said, and remains viable, assuming a natural gas price corresponding to an oil price of $14.50/bbl (in 2000 money) over the life of the field's production. Natural gas from Snøhvit, Askeladd, and Albatross fields off northern Norway will be piped through a 160 km multiphase pipeline to Melkøya island, near Hammerfest, where an LNG liquefaction plant is being constructed (see map).

As many as 21 wells are expected to produce a total of 5.75 billion cu m/year of LNG (OGJ, Nov. 25, 2002, p. 38). Statoil Chief Executive Olav Fjell said the company conducted a detailed review of the project, which "has reduced uncertainty over costs and project execution, giving us now a good basis for implementing the development in accordance with updated plans." Following the review, Statoil said, it strengthened supervision of plant construction, which began this fall, focusing on both its own organization and that of the main contractor, Germany's Linde AG. "The main reason for the cost increase is that the plant's capacity was increased by 30% at an early stage," said Snøhvit Project Director Egil Gjesteland. "At the same time, the consequences of such (a large) expansion...were underestimated." Discussions with the Efta Surveillance Authority over the tax regime for the project also delayed the start of construction, adding to the costs, the company said. The cost increase corresponds to a nominal value of 0.04 kroner/share for the eight-member consortium after taxes, the company said. Statoil holds 22.29% interest in the project.