OGJ Newsletter

Market Movement

Natural gas fundamentals improving

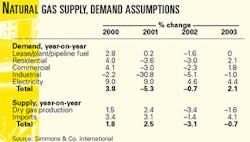

The outlook for the 2003 North American natural gas market hinges on storage because flat-to-declining supply coupled with power generation demand should tighten the gas market, Houston-based Simmons & Co. International said.

"The US natural gas production treadmill is more visible than ever, and with a lethargic rig count that continues to show no signs of recovery in the near term, we believe that 2003 production will likely decline 1.5%," said David Pursell of Simmons & Co. (see table).

"In fact, we forecast a market tight enough that industrial demand will not be able to grow, as the supply of natural gas will simply not be available, and industrial demand is the marginal consumer," he reported Nov. 8. "Thus, prices are likely to reach equilibrium at the level required to discourage growth in industrial demand for gas."

Simmons & Co. increased its 2003 Henry Hub natural gas price forecast to $3.80/Mcf from $3.30/Mcf, reflecting the gas market's improving fundamentals, Pursell said.

Supply and demand

Pursell forecast a US production decline of 800 MMcfd that could be partially offset by increased imports. "Our model indicates that US production will modestly decline, as 2003 drilling activity will likely be slow to ramp up from relatively subdued 2002 activity levels," Pursell said. He expects the US rig count to increase 14% to an average 943 rigs operating in 2003.

Meanwhile, he said, "Canadian production is at a zenith, and imports from Canada could decline next year while US natural gas exports to Mexico are on an increasing trajectory. Thus, the burden to increase US gas supply increasingly rests on the untested shoulders of LNG," Pursell said. He expects that increasing US gas exports to Mexico will offset increasing LNG imports. "As such, we are currently modeling 2003 net imports increasing slightly compared to 2002," he said.

Simmons & Co. expects flat industrial demand for gas in the US with a 0.4 bcfd increase in residential-commercial demand and 1 bcfd increase in power generation demand. "In total, we estimate that 2003 US natural gas demand will increase by 1 bcfd (or 2.1%) over 2002, driven by continued growth in the electricity sector," Pursell said.

Assuming an 8% warmer-than-normal winter, Simmons & Co. sees gas in storage on Mar. 31, 2003, approaching 1,200 bcf compared with 1,518 bcf on Mar. 31 of this year. "With low levels of storage entering the 2003 refill season, we do not see storage levels exceeding 2,700 bcf entering the 2003-04 winter (compared with approximately 3,200 bcf entering the current winter)," Pursell said.

A key element in Simmons & Co. supply and demand modeling is recognition that end-of-season storage levels have a tight range between full (3,250 bcf) and "minimum full" (2,700 bcf). "Even though theoretical (nameplate) working gas in storage is considered to be near 4,000 bcf, operational or practical full levels are near 3,250 bcf. As storage approaches this level, aggregate storage injectivity is diminished and, in some cases, not all the natural gas available for storage can be injected. This results in some forced production curtailments, which occurred towards the end of the injection season in both 1998 and 2001U, when working gas approached or exceeded 3,200 bcf," Pursell said.

Winter heating demand

Local natural gas utilities need to have adequate natural gas storage inventories before demand exceeds supply with the onset of winter heating demand.

"History shows that these utilities are price-insensitive buyers of gas in order to ensure they have the ability to meet the potential winter space heating demands of their residential customers," Pursell said.

The 550 bcf difference between full and minimum full storage "highlights the very slim margin between 'too much' and 'not enough.' Moreover, only slight changes in supply and demand can create a market that has 'too much gas' to one that is 'tight,'" Pursell said.

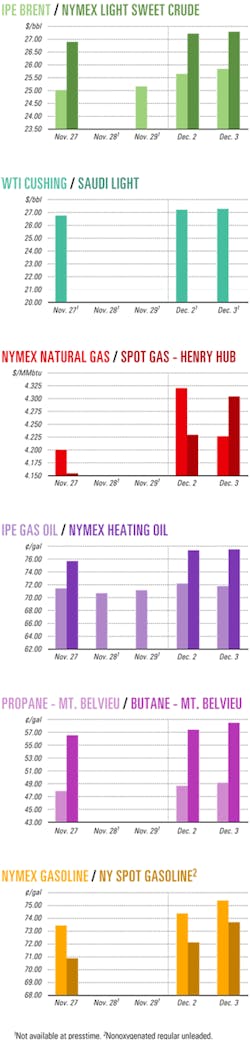

Industry Scoreboard

null

null

null

Industry Trends

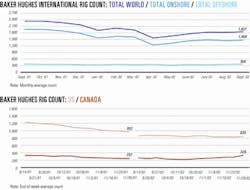

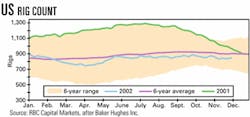

US DRILLING ACTIVITY remains sluggish, and oil field service analysts say future activity hinges upon exploration and production companies' capital expenditure plans.

"The near-term catalyst, in our opinion, will be 2003 budget announcements by exploration and production companies in early to mid-December," said RBC Capital Markets analyst Kurt Hallead of Austin. "The major impediment to our price target is a substantial weakening of commodity prices, resulting from global supply/demand imbalances that would cut short the cyclical recovery," he said.

Meanwhile, the trading band for service company stock prices has narrowed to 80-90 on the Philadelphia Oil Service Index (OSX) with stiff resistance at 90, which is its 200-day moving average. RBC Capital Markets' 12-month price target for the OSX is 105, Hallead said.

The number of rotary rigs working in the US and its waters for the week ended Nov. 22 was 826 units compared with 986 for the same period last year, Baker Hughes Inc. reported. The trend for the number of rigs drilling for gas has been down for several months despite a recent run-up in gas prices (see chart).

OIL and gas firms are likely to post lower 2002 capital expenditures and earnings.

In an October report, UBS Warburg LLC says oil field services companies likely will post a decline of 9% in upstream cash flow this year. The analyst defines "upstream cash flow" as the sum of upstream net income plus depreciation, depletion, and amortization expenses plus exploration expense.

This year's decline follows a 5% decrease posted in 2001. UBS Warburg's findings are based on exploration and development spending by more than 25 of the largest integrated and independent oil firms worldwide.

"Over the past several years, this group of companies has spent about $55 billion on (exploration and development), which represents about 50-55% of global expenditures," UBS Warburg analyst James Stone said.

In 2003, Stone estimates that oil and gas firms' upstream cash flow will increase by "a meager 3%." This forecast is based on 2003 oil and natural gas price assumptions of $23/bbl and $3.35/Mcf, respectively. Stone expects 2003 cash flow to rise by 11% for independents and by 2% for integrated firms.

Stone sees an emerging pattern among both integrated and independent firms in terms of how much cash flow is reinvested in exploration and production. He expects independents to reinvest more than 90% of cash flow for exploration and development this year. Integrated firms, meanwhile, will reinvest 66% of cash flow for E&D projects, Stone said.

Government Developments

THE US DEPARTMENT OF ENERGY said it plans to spend $1.8 million over a 3-year period on two new oil field technology projects. In the first project, DOE will cofund research with two Albuquerque, NM-based companies—independent producer Enerdyne LLC and service operator Pumping Solutions Inc.—to test a new submersible pump in New Mexico's San Juan basin. DOE is negotiating a project agreement that will fund about half of the $1.2 million demonstration cost.

Enerdyne projects that if the submersible pump succeeds in reducing production costs, an additional 780 million bbl of oil may be produced over the next 20 years from the Red Mountain reservoir. DOE said the reservoir is on the verge of being prematurely abandoned for lack of effective technology.

The second project, also with an independent company, will test new seismic surveying technology designed to find oil formations often invisible to conventional seismic.

DOE said these "subtle" formations could hold as much as 22 billion bbl of oil yet to be discovered. Vecta Exploration Inc., Dallas, along with the Texas Bureau of Economic Geology, will test the new technology while exploring for oil in the Williston basin of North and South Dakota. DOE plans to fund $1.2 million of the $2.9 million project cost.

TURKEY has restricted supertanker passage through its Bosporus and Dardanelles straits between the Black Sea and the Aegean Sea—and in the Sea of Marmara between the two straits.

A policy bans supertanker traffic through the straits and severely restricts the passage of smaller tankers carrying dangerous cargo, including chemicals, LPG, LNG, and explosives.

The Caspian News Agency reported last month that Turkey has prevented supertankers from Russia and Kazakhstan from exporting oil through the straits, citing its new regulations limiting tankers to 200 m in length to pass through the narrow, 30 km long Bosporus and to 250 m in length for the Dardanelles.

Turkey's new regulations also prohibit loaded oil tankers from passing through the straits at night and in other instances when visibility is obscured. Regulations apply to vessels carrying cargo classified by the international agreements as dangerous, including petroleum and its derivative products. Turkey has been concerned about safety in the "critical straits" for years.

INDIA'S STATE OWNED Oil and Natural Gas Corp. (ONGC) has recommended that the government remove BG Group PLC as operator of the controversial Panna, Mukta, and Tapti oil and gas fields.

ONGC, BG, and Reliance Industries Ltd.—equity partners in the fields at a ratio of 40:30:30, respectively—have not agreed on any model for operating the fields, said Subir Raha, ONGC chairman and managing director.

Consequently, ONGC has asked authorities to invoke the termination clause since the passage of a Sept. 30 deadline for settlement of the dispute. Operatorship has been an issue of contention among the three partners ever since BG bought out troubled Enron Corp.'s 30% equity for $350 million earlier this year.

Quick Takes

CHEVRONTEXACO CORP. has applied to the US Coast Guard for a license to construct and operate a deepwater port off Louisiana at which it would site an LNG receiving terminal.

The development, called Port Pelican, would consist of an LNG ship receiving terminal, LNG storage and regasification facilities, and an interconnection to existing pipeline infrastructure for delivery as regasified natural gas into the US interstate gas pipeline network.

ChevronTexaco plans to construct Phase I of Port Pelican as an offshore facility initially designed to process 800 million MMscfd of natural gas. The first phase of the facility is planned to be operational by 2006. Phase II would expand the terminal to accommodate a total of 1.6 bcfd of natural gas.

The facility would connect to ChevronTexaco's existing offshore pipeline infrastructure to deliver natural gas from the Gulf of Mexico to the US Gulf Coast where it will be delivered to shippers via existing systems through the national pipeline grid. The design codes and standards applicable to Port Pelican construction and operations will meet or exceed the accepted industry practice, including US and European standards for offshore facilities, concrete construction, and LNG regasification, ChevronTexaco said.

ExxonMobil Corp., which signed a heads of agreement with Qatar General Petroleum Corp. to supply natural gas to the UK for 25 years beginning in 2006-07, is investigating British sites for a potential LNG import terminal. Harry Longwell, ExxonMobil director and executive vice-president, said the UK's indigenous gas supplies were expected to decline in the near future, and "by the end of this decade, a shortfall will have to be met from other sources, such as from LNG imports." Sites being considered include the Isle of Grain and Mill Haven, reported OPEC News Agency (OPECNA).

IRAQ AND JORDAN plan to start construction in 2003 on the first leg of an oil pipeline to transport Iraqi crude oil to Jordan, and they signed an accord in mid-November calling for Baghdad to provide all of Jordan's crude oil supplies in 2003, OPECNA reported.

The agreement stipulates that Iraq will supply Jordan with 4 million tonnes of crude oil and 1 million tonnes of oil products, OPECNA said.

Jordan's oil purchases from Iraq are exempt from United Nations economic sanctions, imposed in August 1990, that prevent Baghdad from exporting its oil other than under UN-approved deals. Since December 1996, Iraq has been allowed to sell oil to buy food and medicine.

Meanwhile, Iraq has been exporting oil to Jordan in tanker trucks (OGJ Online, Jan. 30, 2001). Iraqi Oil Minister Amer Mohammed Rasheed, who signed the accord with Jordanian Minister of Energy Mohammed Batayneh, said that the first section of the pipeline would extend from the Iraqi border to Jordan's 90,400 b/d refinery at Zarka, northeast of Amman.

First natural gas from Argentina through BG Group's $160 million Gasoducto Cruz del Sur (GCDS), or Southern Cross, pipeline began flowing to Uruguay Nov. 8. Uruguay's state electricity utility, UTE, primary customer for the gas, will fuel its power plant at Montevideo under a long-term gas supply agreement with Pan American Energy LLC and Wintershall AG. Later, the capital's local distribution company, Gazeba Uruguay SA, and Conecta SA, the distribution company for the rest of the country, are expected to become customers for the gas, thereby using less town gas and LPG. The 193 km, high-pressure GCDS system has the capacity to deliver 5 million cu m/day. The system includes 200 km of low-pressure laterals and 28 aboveground installations. A separate 40 km, 18-in. line—the "Link"—was completed in April. The $18 million Link connects the start of GCDS pipeline in Argentina with the Argentine national grid, operated by Transportadora de Gas del Sur. BG holds 40% interest in the system.

DIAMOND OFFSHORE DRILLING INC., Houston, reported that its subsidiary Diamond Offshore Drilling Ltd. entered into an agreement to purchase the West Vanguard semisubmersible drilling rig from Stavanger-based Smedvig ASA, for $68.5 million. The companies expect to complete the sale before yearend.

The agreement provides that, upon closing, the rig will be "bare-boat" and will be chartered to a Smedvig affiliate for a period expected to expire during second quarter 2003.

The West Vanguard, currently operating off Norway, is a third-generation Bingo 3000 design rig constructed in 1982.

THREE GROUPS are still exploring the deep water off Trinidad and Tobago:

Shell Trinidad Ltd., operator for partners Agip Trinidad & Tobago Ltd. and Petroleum Co. of Trinidad & Tobago Ltd. (Petrotrin) plans to drill two more wells in deepwater Block 25a off Trinidad and Tobago.

Energized by BHP Billiton Ltd.'s discovery of 1 billion bbl of OOIP in Oligocene sands on Block 2c, 50 km west of Block 25a, Shell received an extension to February 2003 on its first-phase exploration and will restart exploratory efforts in the western part of Block 25a this month.

Shell will drill a $12 million well, Pepper Sauce, to be followed by Roti or Callaloo, "dependingUon the results we obtain," said Daniel Truempy, Shell's geologist and general manager. Pepper Sauce likely will take 25 days to drill to 2,000 m below mudline in water 1,050-1,100 m deep.

BP PLC, operator for partners Petroleo Brasileiro SA (Petrobras), Norsk Hydro AS, and Petrotrin, is evaluating its Catfish 1 well on Block 27. Peter Rattey, president of BPTT's exploration performance unit conceded that Block 27 has modest prospects. "UThere is a hydrocarbon system that is working. But it is unclear as to how good it is," he said. BPTT and 11 other companies are funding a 2D seismic survey in the ultradeep waters.

ExxonMobil, failing to find oil on Blocks 25b and 26, plugged and abandoned its dry holes. Pres. Mark Fincher said ExxonMobil is formulating proposals for future work and had not "given up on the deep water," although it is looking for a partner. He said, "We were seeking to farm out our interest in the two blocks, but no agreement is imminent."

Statoil ASA recently proved more oil and gas in its Tyrihans South discovery in the Norwegian Sea and has found oil in its Dolly prospect in the Tampen area of the North Sea. It also expects to find oil on Blåmeis prospect—also in the Norwegian Sea—where it spudded an exploration well Nov. 26, reported Knut Chr Grindstad, exploration vice-president. The Tyrihans South appraisal well, drilled by the Stena Don semisubmersible to 4,000 m TD, is currently being logged. A satellite of Statoil's producing Åsgard field, Tyrihans South could be tied in to Åsgard for development. The Deepsea Trym rig drilled the 34/10-47S wildcat on Dolly prospect 5 km north of Gullfaks satellites Gullveig and Rimfaks in the North Sea. A project team is evaluating results from the well, which encountered hydrocarbons, Statoil said. Hydrocarbons also were proven earlier this year in structures 3/9-8A Ole and 33/9-8S Dole. Stena Don spudded the first Blåmeis prospect exploration well, which is expected to reach its 2,000 m TD around Dec. 26. Blåmeis is east of Norne field in an area where Statoil has found oil in Stær, Falk, and Svale structures. Because none is large enough to support a stand-alone development, Statoil is considering developing technology to tie in the small finds back to Norne's floating production, storage, and offloading vessel.

Houston-based Pogo Producing Co. reported natural gas discoveries with two wells in the central Gulf of Mexico. The first well, West Delta Block 54 No. 1, was drilled to 12,804 ft subsea and found a 33 ft hydrocarbon column in its primary objective below 12,600 ft. Pogo holds 100% working interest in the prospect, which lies in Louisiana state waters. The well was drilled on a 350 acre structure and flowed about 3 MMcfd of natural gas and 730 b/d of oil on test. "Development of this field will require only a caisson well protector, and it will flow through a 4.5-in. flowline to Pogo's production facilities at South Pass Block 24 field," Pogo said. Production from this structure should begin late in first quarter 2003. Main Pass Block 62 No. 3, the second well, is on a previously untested, 200 acre "G-pod" structure in the company's 100% owned Main Pass Blocks 61/62 field, Pogo said. The well found 40 ft of gas pay in its primary Miocene objective. Pogo plans to set a caisson well protector and will lay a 3 mile flowline to the company's production facilities in 61/62 field. The company has ordered a similar caisson to develop another gas discovery at the "E-pod" in Main Pass Block 61. Both of these gas discoveries should begin producing through the Main Pass Blocks 61/62 A-platform facilities by mid-year 2003, Pogo said. Two other exploratory wells currently are being drilled on other prospects in the Main Pass area of the central gulf, Van Wagenen said. Both are expected to reach their objective depth within 1-2 weeks.

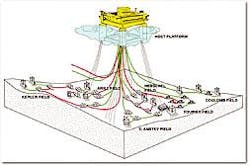

SHELL EXPLORATION & PRODUCTION CO. and BP are marking progress on their $1.26 billion Na Kika project to develop widely spaced oil and gas fields in the ultradeepwater Mississippi Canyon area of the Gulf of Mexico (OGJ, Oct. 9, 2000, p. 35).

Hyundai Heavy Industries Co. Ltd., which is fabricating the hull and topsides of a semisubmersible host production and development system, successfully mated the enormous topsides to the hull at its Ulsan, South Korea, yard in early October. Hyundai will transport the structure to the development site in 2003, when first production is expected.

The semisubmersible, in a first for the gulf, will be permanently moored 140 miles southeast of New Orleans on Mississippi Canyon Block 474, where it will serve as a host facility for six surrounding independent fields: Ariel on MC Block 429, Fourier on MC 522, Herschel on MC 520, and Kepler on MC 383—all owned 50:50 by Shell and BP—East Anstey on MC 607, owned 62.5% by BP and 37.5% by Shell; and Shell's wholly owned Coulomb field on MC 657, to be developed in 2005.

Development drilling began in September 2001 and ended in June when well completions began.

Peak rates from the fields are expected to reach 425 MMcfd of gas and 110,000 b/d of 25-29° gravity oil, with ultimate recovery expected to exceed 300 million boe. Oil and gas will be transported to shore via pipelines (OGJ Online, May 17, 2001).

By codeveloping the fields, Shell and BP can produce them profitably. Shell has responsibility for predevelopment activities such as design, fabrication, and installation of wells and facilities, and BP will assume postproduction responsibilities, operating the host and satellite facilities.

Kerr-McGee Oil & Gas Corp. has awarded a contract for the supply of a flexible flowline, jumper, and risers for Gunnison field's spar development project in the Gulf of Mexico to Wellstream, a unit of Halliburton Energy Services Group. Gunnison field, in 3,150 ft of water, was discovered in May 2000 on Garden Banks Block 668 about 155 miles southeast of Galveston, Tex. (OGJ Online, June 5, 2000). Kerr-McGee's Global Producer VII truss spar, which is being designed to produce 40,000 b/d of oil and 200 MMcfd of natural gas, will be used to develop the field. It is scheduled for delivery in third quarter 2003 (OGJ Online, Nov. 15, 2001), and first oil from the development is anticipated in first quarter 2004.

CSO Aker Maritime, a subsidiary of Technip-Coflexip Group, Paris, is responsible for the engineering, procurement, fabrication, and delivery of the hull, moorings, and riser system. Wellstream will manufacture the flowline, risers, and jumper at its Panama City, Fla., facility, where burst and dynamic testing will be performed. Items to be delivered in June include a 5.375-in. ID, 8,000 psi flowline; a 5.375-in. ID, 8,000 psi jumper; and three 5.375-in. ID, 8,000 psi risers. In addition to operator Kerr-McGee, which has a 50% working interest in Gunnison field, concession partners include Nexen Petroleum Offshore USA Inc., a wholly owned unit of Nexen Inc., Calgary, 30%, and Energy Resource Technology Inc., a unit of Cal Dive International Inc., Houston, 20%.