Special Report-Leap in Worldwide Pipeline Construction Plans Lag Industry Downturn

Pipeline operators in first half 2001 anticipated increases in oil and gas production and ignored slowing demand growth through much of the last half of the year. The result as 2002 got under way was a leap in planned pipeline construction for this year and after 2002.

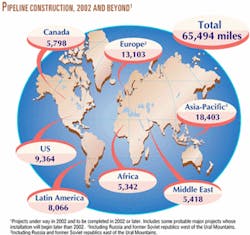

Operators announced plans throughout 2001 to install more than 65,000 miles of crude oil, product, and natural gas pipeline beginning this year and extending into the next decade. And those operators were equally bullish for the short term, planning to lay more than 17,700 miles in 2002 alone (Fig. 1).

These trends are revealed in the latest Oil & Gas Journal pipeline construction data derived from a survey of world pipeline operators, industry sources, and published information.

Whither demand?

It remains to be seen if the US economic recession, which we now know began at or near the start of second quarter 2001 and accelerated after Sept. 11, will dampen those plans.

In the world's largest energy market, there were some encouraging signs as 2002 began that its recession might be short-lived. And recovery in the US could pull other of the world's regions, some of which have been in recession for several years, out of theirs or at least hold out to them the promise of greater demand for exports.

More specifically, however, continuation of the flat or declining energy prices evident in late 2001 will depress energy production and may cause pipeline operators to reevaluate and cancel or delay planned construction.

Crude oil prices worldwide appeared to be firming after Jan. 1, bolstered by renewed production discipline from the world's major crude oil producers. Natural gas prices, however, remained weak with ample storage in Europe and the US to meet the so-far mild winter weather.

And the volatility of the energy markets remained some concern, as noted at yearend 2001 by the US Energy Information Administration (EIA) as it announced its annual energy outlook.

EIA stated nevertheless that its report focuses on the long-term energy picture: "supplies and prices of fossil fuels, the development of US electricity markets, technology improvement, and the impact of economic growth on projected energy demand and carbon dioxide emissions through 2020."

And it is in these long-term projections that pipeline operators may find some rationale for holding to their planned construction.

The agency believes that, despite the economic slowdown in the US in 2001, the long-term US economy, measured by gross domestic product, will grow at an average 3%/year from 2000 to 2020, similar to the 2.9%/year projected by the EIA at yearend 2001.

EIA believes the average world oil price dropped to nearly $22.50/bbl in 2001, from $27.72/bbl in 2000, and will begin a gradual increase after 2002. By 2020, the price will reach $24.68/bbl, pushed by higher world oil demand. That demand will increase to 118.9 million b/d in 2020, from 76 million b/d in 2000.

The wellhead price of natural gas, said EIA, will decline sharply-a trend already evident in fourth quarter 2001-from nearly $4/Mcf average in 2001. The price will reach $3.26/Mcf in 2020.

In the US, EIA's analysis projects demand for natural gas through 2020 will increase at a 2%/year, to 33.8 tcf from 22.8 tcf, due primarily to rapid growth in demand for electricity generation.

Total US energy consumption will increase to more than 130 quadrillion btu by 2020, an average of 1.4%/year. This trend primarily will result, it said, from higher demand in commercial and transportation sectors.

Commercial energy demand will grow at 1.7%/year, reaching 23.2 quadrillion btu in 2020. Industrial energy demand over the same period will grow a bit more slowly, only 1.1%/year, reaching 43.8 quadrillion btu in 2020.

Transportation energy demand will grow at a rate of 1.9%/year through 2020, to 39.6 quadrillion btu. Electricity demand for all energy sources will grow by 1.8%/year through 2020. "The most rapid growth is expected for computers, office equipment, and a variety of residential and commercial appliances and equipment," said the report.

Residential energy consumption will grow at 1%/year, "with the most rapid growth for computers, electronic equipment, and appliances." In 2020, residential demand will reach 24.3 quadrillion btu.

Bases, costs

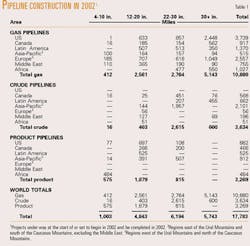

Table 1 shows that, in 2002 only, companies plan to complete more than 17,700 miles of oil and gas pipeline worldwide at a cost of nearly $25 billion. For 2001 only, companies had planned slightly more than 11,000 miles at a cost of nearly $17 billion.

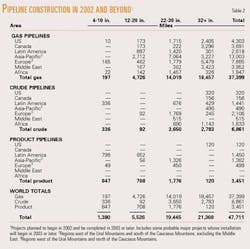

Table 2 indicates that, for projects completed after 2002, companies plan to lay more than 47,700 miles of line and spend more than $66 billion. When these companies looked beyond 2001 last year, they anticipated spending $63 billion to lay more than 41,500 miles of line.

- Projections for 2002 pipeline mileage reflect only projects likely to be completed by yearend 2002, including construction in progress at the start of the year or set to begin during it.

- Projections for mileage in 2002 and beyond include construction that might begin in 2002 and be completed in 2003 or later.

OGJ has also included a few long-term projects it judges as probable, even if they will not break ground until after 2003.

Mileage for a natural gas transportation system from Alaska's North Slope is an example, regardless of whether the route is south through Alaska to Alberta or north over to Mackenzie Delta then south. Also, these calculations include mileage to reflect a handful of major crude oil and natural gas projects in Asia that remain conceptual.

Cost estimates are based on US average costs-per-mile for onshore and offshore gas-pipeline construction as found in Table 4 of OGJ's most recent Pipeline Economics Report (OGJ, Sept. 3, 2001, p. 66).

These projections assume, based on historical analysis and a few exceptions and variations notwithstanding, that 90% of all construction will be onshore and 10% offshore and that pipelines 32 in. OD or larger are onshore projects.

Under these assumptions and with OGJ pipeline-cost data, here is a breakout of costs by line size:

- Total offshore construction (1,204 miles) for 2002 only will cost slightly more than $3 billion:

- $258 million for 4-10 in.

- $1.2 million for 12-20 in.

- $1.6 million for 22-30 in.

- Total onshore construction (45,000 miles) for beyond 2002 will cost more than $59 billion:

- $1.6 billion for 4-10 in.

- $6.5 billion for 12-20 in.

- $23.0 billion for 22-30 in.

- $28.1 billion for 32 in. and larger

- Total offshore construction (2,635 miles) for beyond 2002 will cost nearly $6.8 billion:

- $355 million for 4-10 in.

- $1.4 billion for 12-20 in.

- $5.0 billion for 22-30 in.

Activity

What follows is a partial review of many-but by no means all-of the world's pipeline projects in some of its most active regions. Given the country's dominance of the world's energy use, the US receives a disproportionately large share of this review.

Deepwater gulf; to Florida

Pipeline construction to develop several deepwater fields in the US Gulf of Mexico is in various stages at the beginning of 2002.

Off Texas, construction has been completed on East Breaks to carry production from deepwater spars Boomvang and Nansen via the 99 mile, 10 and 24-in. Seahawk gas line and the 41 mile, 16-in. Banjo oil pipeline.

Seahawk connects on Brazos 538 into the Central Texas gathering system and moves gas ashore to a new 300-MMcfd gas plant at Markham, Tex. Banjo can move as much as 80,000 b/d of oil to Galveston Addition 244.

Williams Cos. Inc. operates the new gas plant and the pipeline feeding it. Stolt Offshore Inc. and Coflexip Stena Offshore installed the pipeline systems (OGJ, Oct. 22, 2001, p. 58; Nov. 5, 2001, p. 96).

Meanwhile, construction continues on the Gulf of Mexico's deepest pipeline ever, the Canyon Express Pipeline System. Operator TotalFinaElf SA is laying a 55 mile, dual 12-in. line in more than 7,000 ft of water to connect the King's Peak, Aconcagua, and Camden Hills deepwater gas fields on Mississippi Canyon to the Canyon Station platform on East Main Pass 261.

The lines, due for completion later this year, will be able to move 500 MMcfd of gas to the platform, which will be installed second quarter 2002.

Last year, Italy's Saipem Inc., contractor for TotalFinaElf, awarded Saibos CML, a 50-50 subsidiary of France's Bouygues Offshore Group and Saipem SPA, a $30 million contract to lay pipe for the project.

In October, Mariner sold its interests in the Aconcagua field, on Mississippi Canyon 305, and the Canyon Express pipeline to Nippon Oil Exploration USA Ltd. and Pioneer Natural Resources Co. for $51 million.

Meanwhile, planning advanced in late 2001 for development of the deepwater Devil's Tower field, 140 miles southeast of New Orleans in 5,610 ft of water on Mississippi Canyon 773.

Dominion Exploration & Production Inc. and Pioneer signed an agreement with Williams for the field's infrastructure. Williams will own the floating production facility as well as the gas and oil export pipelines. Dominion is operator of Devil's Tower with 75%; Pioneer has 25%.

Dominion had previously contracted with SparTEC, a subsidiary of J. Ray McDermott Inc., to provide the truss spar floating production facility. Under the more recent contract, Williams assumed responsibility for payments due under the SparTEC contract.

Williams will install the pipelines to produce Devil's Canyon:

- The 18-in. Mountaineer oil line will extend 120 miles from Mississippi Canyon 773 to Main Pass 34. It is a combination of 18-in. (70 miles, deepwater), 14-in. (6 miles, deepwater), and 20-in. (50 miles, shallow water) pipe. Total capacity is 150,000 b/d. The oil goes to an onshore terminal, says Williams.

- The Canyon Chief gas pipeline will include a 96-mile deepwater section from Mississippi Canyon 773 to Main Pass 261. It is a combination of 18-in. (90 miles, deepwater) and 14-in. (6 miles, deepwater) pipe. Total capacity is 350 MMcfd, and gas will flow into a lateral operated by Williams's Transcontinental Gas Pipeline Corp. for delivery to Williams' gas processing plant in Coden, Ala.

All facilities are scheduled to be in operation by mid-2003; total price tag is $400 million, says Williams.

Farther east in the gulf, construction of the 753-mile Gulfstream natural gas pipeline entered 2002 on its last legs, having completed in 2001 most of the pipelay and much of the compressor construction (Fig. 2).

At mid-December, offshore pipe laying was about 90% complete and was to be finished before yearend. Pipe burial was ongoing, according to the latest Gulfstream update at yearend 2001.

Onshore pipe laying was nearly 50% complete with 7 of 10 horizontal directional drills complete and meter-station construction under way. Compressor station construction was 40% complete with pipe fabrication ongoing.

The Gulfstream natural gas system is a $1.6 billion project to deliver gas for new electric-power generation capacity throughout Florida. The 753-mile pipeline originates near Pascagoula, Miss., and Mobile, Ala., and crosses the eastern Gulf of Mexico with 431 miles of 36-in. OD pipe to Manatee County, Fla.

Onshore, 306 miles of 16-36 in. OD pipe will reach across south and central Florida, ending in Palm Beach County. Also included are 16 miles of gathering pipeline in Mississippi and Alabama.

Upon completion this year, the project will provide Florida with 1.1 bcfd of additional natural gas, enough to generate electricity for 4.5 million Florida homes, says the company. Gulfstream also says it is the first new natural gas transportation system built exclusively to serve Florida in more than 40 years.

Gulfstream Natural Gas System LLC hired Anglo-Norwegian subsea contractor Stolt Offshore SA to install the offshore portion.

This same Florida market has prompted yet more plans, but not in the US Gulf of Mexico. On the Atlantic Ocean side of the state, two projects have been advanced to move gas from a planned LNG terminal via subsea pipelines to Florida.

Calypso Pipeline LLC, Houston, applied to the US Federal Energy Regulatory Commission in mid-2001 to build a 36 mile, 24-in. offshore pipeline and a 5.8 mile, 24-in. onshore Florida segment to bring gas from an LNG terminal and regasification plant planned for Freeport, Grand Bahama Island.

The 36-mile offshore segment is in US waters and would connect, at the boundary of the US Exclusive Economic Zone and the Bahamas EEZ, to a 54 mile, 24-in. offshore line running from Freeport.

The onshore portion would run from Port Everglades in Fort Lauderdale to an interconnection with Florida Gas Transmission Co.'s 24-in. Lauderdale Lateral in Broward County.

Anticipated capacity for the line is 832 MMcfd; cost was projected at $132 million for the US facilities.

Later in the year, Bahama Cay Pipeline System, Ltd., a Bahamian subsidiary of El Paso Corp., and ANR Southern Pipeline Co., a US subsidiary of El Paso, announced nonbinding open seasons during October to transport gas from the LNG terminal on Grand Bahama Island.

Bahama Cay Pipeline sought interest in transportation capacity on an international, 88-mile pipeline that will transport gas to the boundary of the US EEZ. ANR Southern Pipeline was gauging interest in transportation capacity on a 37-mile pipeline that would deliver gas from the interconnection at the boundary of the EEZ to onshore Florida near the Port of Palm Beach.

From there, it will extend to interconnect with the existing interstate pipeline system operated by Enron Corp.'s Florida Gas Transmission Corp. The majority of the domestic pipeline would be offshore and regulated by FERC, said the company. The proposed 24-in. pipelines will have the capacity to deliver up to 800 MMcfd of gas and would target in-service for summer 2004.

El Paso said the projects will help supply the fuel requirements of 11,000 Mw of new generating capacity by 2005. The capacity additions are based on 2001, 10-year plans filed by Florida's generation utilities.

This projected demand will require more than 2 bcfd of additional delivery capacity and gas supply. El Paso told OGJ last month that it plans to file to FERC for this project during second quarter 2002.

US Southeast, Mid-Atlantic

Growth of the Mobile, Ala., area into a natural gas hub and continuing development of natural gas-fired electric power generation are behind several developments in the US Southeast and Mid-Atlantic regions.

As 2001 closed, EnergySouth Inc. unit Bay Gas Storage Co. Ltd., McIntosh, Ala., completed an 18 mile, 24-in. pipeline, connecting Bay Gas to Gulf South Pipeline Co.'s 30-in. line near Whistler, Ala. Gulf South transports gas to Alabama Power's Barry power plant.

The 43-MMcfd pipeline is important, said Bay Gas, in "our strategy to develop storage hub services at Mobile Bay." The company is developing a second natural gas storage cavern that will more than double Bay Gas's capacity.

Early in 2001, the company had completed a second 20-in. interconnect with Florida Gas Transmission's mainline from Texas to Florida.

Growth in the US Southeast markets is also behind plans announced late last year by Duke Energy Gas Transmission's unit East Tennessee Natural Gas to build the Patriot project. Duke Energy Gas Transmission is a subsidiary of Duke Energy Corp., Charlotte, NC.

The Patriot Extension will consist of about 94 miles of pipeline from Virginia to North Carolina to bring gas for the first time to parts of Southwest Virginia and introduce a competitive supply to North Carolina from Appalachian and Gulf Coast producers, said the company.

A salt-cavern natural gas storage facility in Saltville, Va., being jointly developed by Duke Energy Gas Transmission and NUI Corp., Bedminster, NJ, will offer additional options to those contracting for transportation services, said the company in its filing with FERC.

The 24-in. Patriot Extension will originate from Duke's East Tennessee system in Wythe County, Va., cross Carroll, Patrick, and Henry counties in Virginia, and terminate in Rockingham County, NC. About 7 miles of a lateral line run from Rockingham County to Henry County, Va., said Duke.

Expansion of the existing East Tennessee line, primarily in Tennessee and part of Southwest Virginia, includes construction of about 85 miles of new 20 in. and 24-in. loops and about 25 miles of 24-in. pipeline relays to replace existing 8-in. pipeline.

Duke said strong customer response to the Patriot project resulted in East Tennessee's commitment to develop a project that will eventually transport 510 MMcfd of gas. Seven natural gas shippers, representing electric power generators, marketers, and local distribution companies, committed 87%, or 446 MMcfd, of delivery capacity under long-term contracts, more than double the 200 MMcfd envisioned when the project was announced in 2000.

Patriot consists of three phases: initially having the capacity to move 130 MMcfd, increasing to 310 MMcfd in November 2003, and transporting 510 MMcfd in January 2004.

East Tennessee hopes FERC will grant a final certificate by Mar. 27, 2002, to enable the company to begin construction in July 2002 and meet the initial May 1, 2003, in-service date.

Also in the Southeast, Piedmont Natural Gas Co., Charlotte, NC, late last year took a 33% interest in Dominion Resources Inc.'s Greenbrier pipeline, a 263-mile project linking multiple gas supply basins and storage to growing markets in the Southeast. Dominion describes Greenbrier as a $497 million project to deliver up to about 584 MMcfd into Appalachian and Piedmont markets.

Preliminary plans call for about 200 miles of 30-in. pipe from Dominion's existing Cornwell Station near Charleston, W.Va., to a point in Rockingham County, NC; about 44 miles of 24-in. pipe from Rockingham County to Person County, NC; and about 18 miles of 20-in. pipe from Person County to Granville County, NC.

The line will have a maximum allowable operating pressure of 1,250 psi and a minimum operating pressure of 600 psi. About 37,500 hp of compression will be required between two sites, the Cornwell Station and a new station in Rockingham County.

Gas supplies delivered from Dominion Transmission and Tennessee Gas Pipeline into Greenbrier near Charleston, W.Va., could come from the Appalachian, Canadian, Gulf Coast, and Midcontinent regions.

The company says a segment of Greenbrier could be ready for service by second quarter 2005 to meet power-generation requirements, with the remainder completed by fourth quarter 2005 to satisfy the market requirements of local natural gas utilities.

Greenbrier Pipeline Co. LLC plans to file with FERC during first quarter 2002.

Also, Williams's Transco unit told OGJ last month it expects a final order by April from FERC for its largest-ever pipeline expansion: 100 miles of 42-48 in. looping along the system from Station 65 in Louisiana to Station 165 in Virginia. New or additional compression will reach nearly 94,000 hp.

Dubbed the Momentum project, facilities will increase system capacity by nearly 526 MMcfd with in-service planned for May 2003. The company expects construction to begin in August on compressor station modifications and in September on the pipeline loops.

California supplies

It should surprise no one, following last winter's debacle of supply problems and pipeline bottlenecks for natural gas service to California, that there are several projects to move more gas into that market.

Williams's Kern River Gas Transmission Co., Salt Lake City, is at work on its 2002 expansion, the company told OGJ last month, increasing mainline capacity by about 10 MMcfd for in-service by May.

Construction at the Muddy Creek compressor station in Wyoming was ongoing with all major concrete pours completed. The Solar Mars 100 Turbine and associated compressor had been set and the building steel and siding installed. Work was on schedule for start of commissioning on Apr. 1, 2002.

Installation of the new Daggett, Calif., electric-drive compressor began last month as well. In-service for that station is July 1, 2002, to coincide with the expiration of the operating permit for the gas-fired Mars 100 installed during the California Action Project in July 2001.

In August 2001, Kern River Gas filed with FERC to expand by more than 885 MMcfd its transportation capacity from Opal, Wyo., to delivery points mainly in California. Service for what the company called its "Expansion 2003" project is to begin May 1, 2003.

The FERC application proposed:

- About 634 miles of 36-in. pipeline to loop Kern River's existing Opal Lateral in Wyoming and about 92% of Kern River's existing mainline (in 11 loops) from Wyoming, through Utah and Nevada, to California.

- About 82 miles of 42-in. pipeline to loop part of the existing mainline that Kern River jointly owns with Mojave Pipeline Co. in California.

- Three new mainline compressor stations, one each in Wyoming, Utah, and Nevada.

- Turbine-driven compressor unit additions, upgrades or modifications at four existing compressor stations, one each in Wyoming and Nevada and two in Utah.

- Replacement of the turbine-driven compressor units in Utah.

- About a mile extension of the existing 12-in. Anschutz Lateral to establish an additional mainline tie-in point on the suction side of the proposed Coyote Creek Compressor Station.

- Upgrades and modifications of five meter stations, one in Wyoming, two in San Bernardino County, Calif., and two in Kern County, Calif.

The company in its FERC filing said the compression additions, upgrades, replacements, and modifications would add more than 163,000 hp to its system and that the additional compression and pipeline loops would more than double Kern River's summer-day design capacity to more than 1.7 bcfd from about 845 MMcfd.

Kern River estimated the total cost of the 2003 expansion at about $1.26 billion.

But last month, the company told OGJ that the 2003 expansion involved 717 miles of 36 and 42-in. pipe and 164,700 hp. Increase in system capacity would be 906 MMcfd with in-service set for May 1, 2003. Williams has asked for the FERC certificate by May 2002.

The project is currently in the detailed design phase and soliciting construction bids. The compressor stations are being bid as a design-and-build package. Station bids were awarded late last month. Station construction encompasses three grassroots stations and compression additions at six existing stations. Construction work will begin in late June 2002 on the compressor stations.

Pipeline construction bids were to be awarded by today. The pipeline project has been divided into 10 construction spreads. The northern spreads (Spreads 1-6) will begin construction in June 2002 and conclude by November.

The southern spreads (Spreads 7-10) will begin construction on Nov. 1, 2002, and conclude by Apr. 1 of next year.

Also in the region, Questar Pipeline, subsidiary of Questar Corp., Salt Lake City, completed construction and placed into service its new Main Line 104. The 77-mile, $85 million pipeline, which went into service on Nov. 15, 2001, is moving 272 MMcfd of gas, all under contract.

The pipeline starts near Price, Utah, at the company's Oak Spring compressor station. As part of the project, the company installed two new compressors that provide 9,300 hp of additional compression. The first 59 miles of ML 104 runs between Price and Payson, Utah, parallel to an existing Questar pipeline. It then runs about 18 miles west and ties into Kern River near Elberta, Utah.

Also, El Paso Natural Gas Co., subsidiary of El Paso Corp., expected this quarter to get a nod from FERC to proceed with conversion of what used to be called the All American Pipeline, a 30-in. crude oil line running from near Santa Barbara, Calif., to McCamey, Tex.

In 2000, the company bought a 1,088-mile segment of the former 1,223 mile, west-to-east crude oil line for $129 million from Plains All American Pipeline LP and All American Pipeline LP.

El Paso's portion runs from McCamey to the Emidio pumping station near Bakersfield. The company is investing $75 million to convert the segment.

Last summer, El Paso Natural Gas held a binding open season for 320 MMcfd of pipeline capacity on the segment from West Texas to the California border. The open season closed Aug. 2 and followed a nonbinding open season earlier in the year.

With FERC approval, cleaning and minor construction to connect compressor stations to the main system could have the line in service in third quarter 2002.

El Paso has renamed the portion east of the California border as "Line 2000"; two segments within California and that are part of the original crude oil line have been dubbed Lines 1903 and 1904.

El Paso will add compression to its Line 2000 from the Keystone and Waha areas of the Permian basin near McCamey, to the border near Ehrenberg, Ariz. Delivery points will be Southern California Gas Co. and PG&E Corp.'s proposed North Baja pipeline; El Paso's bidirectional lateral Line 1903; any future incremental capacity into the SoCal Gas system; and any upstream points on El Paso's south mainline system with excess capacity, said the company.

Projected in-service date of the entire expansion is mid-2003, subject to regulatory approval.

Also with the California market in mind, Enron Corp. subsidiary Trans western Pipeline late last year said it had received requests for more than 1.3 bcfd of capacity on its proposed Sun Devil Pipeline expansion project. As 2002 began, Transwestern told OGJ, it was "working with shippers to finalize transportation agreements" and that specific pipeline diameters and route had not been determined.

The 400-mile line would bring gas from New Mexico's San Juan basin to market in Phoenix and on to California by January 2004, said the company. It will serve the gas-fired electric generation markets in both areas. The company plans to apply with FERC later this year.

At the same time, Transwestern has begun construction on its Red Rock pipeline project to make 150 MMcfd of capacity available for delivery into California by June.

And Questar Pipeline is moving ahead with its conversion from crude oil service of the 705-mile Southern Trails Pipeline. The east portion of the line, from Blanco, NM, to the California border, will be able to move 78.5 MMcfd into the state. The western portion, entirely in California, runs to Long Beach.

As 2002 began, work was under way in California and Arizona on repairs and replacements, and by mid-first quarter, the company told OGJ, construction was to start on four compressors and Blanco interconnect.

The eastern section from Four Corners to an interconnect in California was to be in service during third quarter 2002, and the company said it is "still weighing options" for the western section from Essex interconnect to Long Beach.

Canadian connections

Good news at yearend 2001 greeted the much-troubled Millennium Pipeline Project: FERC granted interim approval for the US portion of the $1.35 billion (Can.) project. Millennium would transport Canadian and US natural gas to markets in the US Northeast, primarily the New York City area. The proposed 551-mile line will run from Dawn, Ont., to Westchester County, NY.

FERC granted a certificate of public convenience and necessity to Millennium Pipeline Co. LP and Columbia Gas Transmission Corp. for 424 miles of interstate pipeline, compressor stations, and related facilities between the Canadian border near Lake Erie and Mount Vernon, NY.

The commission added a number of conditions to the certificate to mitigate any adverse environmental impact and ordered that Millennium begin service within 2 years.

In August, TransCanada PipeLines Ltd., Calgary, and St. Clair Pipelines (1996) Ltd. had withdrawn their applications with Canada's National Energy Board to construct and operate the Canadian portion of the Millennium pipeline, citing US regulatory delays.

But FERC's recent action has prompted the companies to reapply in 2002.

In December 1998, St. Clair applied to construct and operate the Millennium West pipeline, a 46 mile, 36-in. line from Sarnia, Ont., to Patrick Point.

That same month, TransCanada applied to construct and operate the Lake Erie Crossing pipeline, which will interconnect with the Millennium West Pipeline at Patrick Point and extend 60 miles across Lake Erie to connect with the US segment at the bottom of Lake Erie.

In other pipeline action that would move more Canadian gas into the US, El Paso in December began engineering studies for its proposed $1.6 billion Blue Atlantic pipeline that would carry gas from fields off Nova Scotia to markets in eastern Canada and the northeastern US. The company selected several companies to work on the 750 mile, 36 in., 1-bcfd line.

Blue Atlantic would extend from fields near Sable Island to the southern coast of Nova Scotia, then continue subsea to landing points in New York and New Jersey. The companies expect gas demand in the northeastern US to increase to 2 bcfd by 2005, up from about 1.3 bcfd in 2001.

The group will complete preliminary engineering studies by yearend and place the project in service by fourth quarter 2005 (OGJ Online, Dec. 11, 2001).

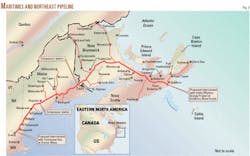

Also in action to bring Canadian offshore gas into the US, FERC approved last month Maritimes & Northeast Pipeline's Phase III and Algonquin Gas Transmission Co.'s HubLine natural gas pipeline (OGJ Online, Jan. 3, 2002). These are complementary projects to bring Sable Island gas to the US Northeast.

Phase III and HubLine, which must still obtain other federal and state permit, would connect the 650-mile Maritimes pipeline with the 1,000-mile Algonquin system to move gas from off eastern Canada to the northeastern US (OGJ Online, Oct. 13, 2000).

Joint venture Maritimes & Northeast Pipeline LLC would extend the existing M&NE system with 25 miles of 30-in. line from Methuen, Mass., to Beverly, Mass., where it would connect with Algonquin's HubLine project.

Algonquin, Boston-based subsidiary of Duke Energy Gas Transmission, would build the HubLine project, a 30 mile, 24-in. offshore gas line extending from Beverly to Weymouth, Mass. The project also includes 5 miles of 16-in. offshore lateral.

Maritimes is owned by affiliates of Duke Energy Corp. 37.5%; Westcoast Energy Inc. 37.5%; ExxonMobil Corp. 12.5%; and Emera Inc. 12.5%.

And, an open season in late 2001 for capacity on Phase IV expansion of the Maritimes & Northeast Pipeline drew nominations of more than 1.7 bcfd on the Canadian portion and nearly 1.3 bcfd of transportation into the US (OGJ, Oct. 15, 2001, p. 9).

In June 2001, M&NE had executed definitive agreements with PanCanadian Petroleum Ltd. in Canada and PanCanadian Energy Services in the US for transportation services of up to 400 MMcfd beginning as early as July 1, 2004.

The Phase IV expansion is designed to meet new market demand through phased-in facilities before the in-service date of the PanCanadian volumes or for building facilities in addition to those required for the PanCanadian volumes to meet in-service dates during 2004-05 and beyond.

M&NE operates a 653-mile gas pipeline through the Maritimes and Northeast US (Fig. 3). The main pipe line and the lateral pipelines are designed to transport Sable Island-area offshore natural gas to markets in Nova Scotia, New Brunswick, and New England. M&NE interconnects with the existing North American pipeline grid at Dracut, Mass.

Total estimated cost of the entire pipeline project in Canada and the US was about $1.8 billion (Can.) with the Canadian portion, including the mainline and the laterals, estimated at about $830 million. Construction of the main pipeline began in May 1999 and was completed in October 1999. The main pipeline received first gas from Sable Offshore Energy Inc. on Dec. 31, 1999.

The Canadian portion of the main pipeline consists of 353 miles of 30-in. OD pipe; the US portion 97 miles of 30-in. OD pipe and 203 miles of 24-in. OD pipe. The size was increased in Canada to recognize the potential Canadian market demand and realize construction efficiencies, says Maritimes.

The Point Tupper lateral is about 37 miles long and includes associated metering, control, and pressure-regulation facilities. The first 34 miles of the pipeline, from the main pipeline, is 8 in. OD and was installed at the same time as the Sable Offshore Energy Inc. natural gas liquids pipeline; the remaining 3 miles is 6 in. OD. This lateral entered service on June 30, 2001.

The 7 mile, 12-in. OD Halifax lateral moves natural gas from the main transmission pipeline near Stellarton to the Halifax Regional Municipality. The 68 mile 4 and 16-in. OD Saint John lateral transports natural gas from the main transmission pipeline near Big Kedron Lake to the City of Saint John.

Finally, TransCanada PipeLines and National Fuel Gas Co. continue to weigh options in development of the Northwinds project. National Fuel told OGJ last month, "we are pursuing the commercial market for the project following successful initial geotechnical work on the proposed pipeline."

The company said it had not reached a decision on "when and if" it would present project filings to Canada's National Energy Board and the FERC.

Announced in late 2001, the Northwinds 215 mile, 30-in. natural gas pipeline would run from Kirkwall, Ont., to Buffalo, NY, then south to the Ellisburg-Leidy, Pa., area. The companies estimated the costs for the 500-MMcfd line at about $400 million.

Project design, said the companies, will likely include construction of a tunnel to cross the Canada-US border.

Northwinds would allow US markets to draw from growing gas supplies at the market hub in Dawn, Ont. More than 3.5 bcfd of pipeline capacity and 870 bcf of storage capacity are linked to that hub, said the companies.

Through interconnections along the route and in the Ellisburg-Leidy area, Northwinds will have access to more than 5 bcfd of transportation capacity on interstate lines that supply major East Coast markets.

Construction will take up to 20 months; completion is targeted for late 2004.

And 2002 may well bring a final decision on whether there is ever to be a natural gas pipeline from Alaska's North Slope and over what route.

Last month, Sen. Frank Murkowski (R-Alas.) was to have held a meeting in Washington among stakeholders, including White House representatives and Alaska Gov. Tony Knowles (D), to assess current plans (OGJ Online, Dec. 13, 2001). Murkowski is the ranking member of the Committee on Energy and Natural Resources.

For many months, debate has centered less on whether such a line should be built and more on which of two proposed routes it should take. Indeed, some have suggested that Alaska North Slope gas reserves can support two lines.

The southern route would follow already-permitted right-of-way along the Alaska National Highway; a northerly, "over the top" route would involve some offshore pipelay in Prudhoe Bay and the Beaufort Sea and a shore route through Canada's Mackenzie Delta in the Northwest Territories. There, its volumes could, when needed, be augmented by large-but at present stranded-Canadian gas reserves.

Both lines would eventually connect in northwestern Alberta Province with existing (but expandable) pipelines; natural gas from the North Slope would then either flow on into the US or displace an equal amount of gas out of systems flowing from southern Alberta into the US.

A recent study by two University of Houston researchers, however, emphatically argued for this latter route, chiding Alaskans not to make a short-term decision on the pipeline route based solely on the employment boost possible for Alaskans (OGJ Online, Dec. 19, 2001).

A better approach, they said, was a staged pipeline beginning with a modest connection into Alberta from Mackenzie Delta area producers.

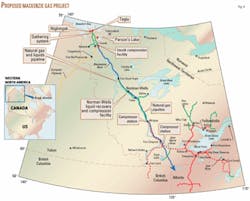

Coincidentally, the Mackenzie Delta producers group and the Mackenzie Valley Aboriginal Pipeline Corp. last month announced their intention to move from a feasibility-stage for the area and takeaway pipelines to the "project definition" phase.

"This phase includes technical, environmental, consultation, and commercial work required to prepare, file, and support regulatory application for field, gas gathering, and pipeline facilities," said the group in a prepared statement.

The group stated development in the region is "anchored by 6 tcf of sweet gas from Taglu, Parsons Lake, and Niglintgak" fields, whose reserves comprise "the three largest onshore discoveries of natural gas in the Mackenzie Delta."

The project includes a pipeline to move dehydrated gas and NGL from compression near Inuvik, NWT, to Norman Wells, where a separation and processing plant would remove the NGL and compress the gas for a planned pipeline on to the south to link up with existing lines in northwestern Alberta (Fig. 4). The liquids would then be injected into the existing, southbound Enbridge Ltd. Norman Wells crude oil pipeline.

The importance of this step lies in its potential to provide a ready-made southerly route for North Slope gas, which would only have to travel a short distance in a subsea line to reach the Mackenzie Delta area and link up with the proposed gathering system around Inuvik.

US product action

Also in late 2001, Colonial Pipeline Co., Atlanta, Ga., unveiled plans to expand petroleum products service in Georgia. Shortly before the announcement, Colonial had revealed plans to expand service to Chattanooga and Knoxville, Tenn.

Expansion of Colonial's pipeline from Atlanta to Bainbridge, Ga., will add up to 15,000 b/d for markets in central and southern Georgia and northern Florida. The line currently serves terminals and shippers in Griffin, Macon, Americus, Albany, and Bainbridge.

The southern Georgia expansion is comparable, said the company in its announcement, to the 15,000 b/d expansion under way in the Chattanooga-Knoxville market. Those additional deliveries are the first phase of a three-phase expansion of service to East Tennessee.

As with Phase One of the Chattanooga-Knoxville expansion project, the South Georgia capacity expansion will be accomplished by upgrading and optimizing the performance of pumps.

These Georgia and East Tennessee expansion projects are in addition, the company also said, to efforts under way to increase service to northern Alabama and Middle Tennessee. That Talladega-Nashville line would provide 200,000 b/d in capacity to those markets. In 2000, Colonial increased the capacity of its main distillate line by 140,000 b/d.

Elsewhere in product action, construction is complete and product began flowing last month for the 720-mile Centennial pipeline between the Gulf Coast and Midwest US refiners.

Trunkline Gas Co., an affiliate of CMS Energy Corp., last year obtained FERC permission to abandon a gas pipeline for conversion to the petroleum products line. Trunkline, Marathon Ashland Petroleum LLC, and TEPPCO Partners LP converted the 26-in. line, one of Trunkline's three parallel gas lines, to carry gasoline, diesel fuel, and jet fuel from Gulf Coast refineries to Midwest markets.

Centennial extends from Longville, La., to Bourbon, Ill. As part of the project, the partners completed in November 2001 a new 74 mile, 24-in. pipeline connecting TEPPCO's facility near Beaumont, Tex., with the existing line.

Centennial will intersect TEPPCO's existing mainline in southern Illinois where a new 2-million bbl petroleum products storage terminal is under construction in Creal Springs. Centennial initially has capacity to transport more than 200,000 b/d of refined petroleum products to the Midwest.

In California, Kinder Morgan Energy Partners LP is at work on a $9 million expansion of its 550-mile Calnev products pipeline from California to Nevada. The expansion will increase jet fuel supply to the McCarran International Airport in Las Vegas.

Calnev transports gasoline, jet fuel, and diesel fuel to Las Vegas from Colton, Calif. It consists of an 8-in. jet fuel line that runs directly to McCarran and a 14-in. line that before the project started had excess capacity to carry products to the Las Vegas market.

The project is expanding the 14-in. line to 128,000 b/d from 108,000 b/d and installing more handling and storage facilities at Kinder Morgan's Las Vegas terminal.

Targeted completion is second quarter 2002. Kinder Morgan and LASFUEL, the McCarran International Airport fuel consortium, are sharing the project's costs.

New oil line

Despite intense environmental opposition, construction on Latin America's highest profile pipeline project-Ecua dor's Oleoducto Crudos Pesados (OCP)-was in full swing as 2002 began.

Techint International Construction Corp., Buenos Aires, an affiliate of another OCP partner, Techint SA, has a fixed-price engineering, procurement, and construction contract to build the line.

The 312-mile line is being built from producing areas near Lago Agrio to the marine terminal at Esmeraldas on the Pacific coast. Approved in July 2001, the $1.2 billion line must be flowing in 2003 under conditions imposed by its permitting process. Capacity will be 450,000 b/d.

The line will move crude oil of less than 24° gravity heated to 75°C. at four pump stations on the uphill side of the line.

That portion will climb to more than 12,500 ft above sea level. The existing Transecuadoran Pipeline System (known by its Spanish acronym SOTE), parallel to most of which OCP is being built, will carry lighter crude oils. It was built in the 1970s and reached capacity in 1990.

The new line will transport oil for Repsol-YPF SA, Occidental Petroleum Corp., Kerr-McGee Corp., Agip SPA, Alberta Energy Co., and Perez Companc SA. OCP Ecuador is made up of five oil companies that produce oil in the Oriente basin, and Techint of Argentina, which owns 4.1% interest in the line. The producers are Occidental Ecuador Inc. with a 12.3% share, Alberta Energy 31.4%, Kerr-McGee 4%, Perez Companc 15%, Repsol-YPF 25.7%, and Agip 7.5%.

Prompted by prospects of greater export capacity along the new line, Ecua doran state oil company Petroecuador announced last year it planned a major exploration effort by 2003 in preparation for completion of the pipeline (OGJ, Apr. 12, 2001). Many exploration and development plans have been held up because of lack of capacity on the existing 380,000-b/d SOTE line.

Private companies producing oil in the Oriente basin are also boosting exploration activities, with one estimating that $2.5 billion will be spent over the next 2 years on seismic and drilling activity.

Environmentalists, however, have fought the project vigorously since its inception. As late as December 2001, a consortium of groups signed a letter to World Bank President James Wolfensohn protesting the construction.

Admitting the World Bank had no direct involvement in the project's financing, the group nonetheless asked the bank to "take immediate steps to address the destructive impacts that this pipeline will unleashellipse."

Among other concerns of the group was the increased exploration and development that producers have already announced and are well into implementing: "The pipeline is fueling a second oil boom in Ecuador," said the letter, with exploration plans encompassing "intact Amazon rainforest [and] ancestral territories of ellipse indigenous communities."

The group also dislikes the route through seven "protected areas and ellipse very sensitive montane [sic] forests and remnant of the Andean Choco and Pacific lowland forest,"

OCP in fact undertook a significant 60-mile route deviation near Quito from original plans solely to placate environmentalist opposition.

Caspian activity

Plans to move hydrocarbons out of the rich but heretofore constrained Caspian Sea region received a major boost last year as the first oil-export line started up. And plans for a second had moved measurably ahead as 2002 began.

In November 2001, Caspian oil began flowing through the 900-mile pipeline from Kazakhstan to a new terminal near the Russian port of Novor ossiysk on the Black Sea. With a price tag of $2.65 billion, the line has taken nearly 10 years to complete.

Before mid-2002, that terminal will be operating at its capacity of 600,000 b/d, receiving oil from the large Tengiz and other oil fields in western Kazakh stan. The Tengizchevroil (TCO) Joint Venture operates Tengiz field, which has potential reserves of 6-9 billion bbl. ChevronTexaco Corp. has 50% of Tengizchevroil, ExxonMobil Corp. 25%, Kazakhoil LC 20%, and LukArco BV 5%.

Proponents have said the Caspian Pipeline Co. (CPC) project will stimulate new oil extraction projects and benefit the region's economies along the pipeline route. Over the 40-year lifespan of the project, the Russian and regional governments expect to receive $23.3 billion in taxes and revenues; Kazakhstan, $8.2 billion.

Under contractual arrangements, regions along the OCP route will receive 66% of the taxes and 50% of the revenues from the pipeline.

Russia, Kazakh stan, and the Sultanate of Oman established CPC in 1992. After it was restructured in 1996, private investment followed.

CPC is owned by, among others, the Russian Federation 24%, Kazakhstan 19%, Oman 7%, ChevronTexaco Caspian Pipeline Consortium Co. 15%, LukArco 12.5%, Rosneft-Shell Caspian Ventures Ltd. 7.5%, ExxonMobil Caspian Pipeline Co. 7.5%,

Start up of this major pipeline will likely push another, well-publicized but long-delayed crude oil pipeline project. The Baku-Tbilisi-Ceyhan (BTC) crude oil pipeline will transport Azeri crudes to world markets via Turkey (OGJ, Jan. 14, 2002, p. 60).

Detailed engineering for the Turkish section of BTC began in June 2001 and is expected to take 12 months, working under the assumption that first oil would flow by first quarter 2005. Upon completion, the pipeline will be operated for at least 40 years by Tur key's Botaintergral Petroleum Pipeline Corp.

Sponsors of the project include nearly all the Azerbaijan International Operating Co. (AIOC) members, the oil producers in Azerbaijan.

At mid-2001, Azerbaijan state oil company SOCAR said construction of the $2.8 billion BTC trunkline could begin in second quarter 2002 (OGJ Online, June 7, 2001). The 1,082 mile, 42 in., 1-million-b/d oil pipeline would include seven pumping stations and three metering systems and pass over mountains in Turkey up to 8,000 ft.

BP Azerbaijan Associate Pres. David Woodward said last year that "summer of 2002 is actually like a 'D-day' for this project. ellipse [We] could decide that we need more time to get others to come on board [and at that time] many of the bids for the project have expiration dates on them."

Woodward also debunked the idea that US pressure, driven by its political animosities for the Iran government, is the driving force for the Ceyhan route. "This is not the case" he said.

"We are moving ahead with this project because we think it is good business. We think it will provide us with the most commercially competitive means of exporting oil from the Southern Caspian to international markets, while avoiding the Turkish straits and the environmental issues which that poses. And that is clearly what the host government here desires as well."

He added that "even if Iran were open for business today," the current plans would go forward.

A Socar official has said the consortium already had conditional volume commitments from all project stakeholders and was in the midst of "intensive discussions" with other companies expected to join the consortium.

First-phase production from AIOC's Azeri-Chirag-Guneshli field would most likely fill the line beginning at yearend 2004. Azerbaijan expects to export 50 million tonnes/year of oil by 2015.

Middle East gas

In the Middle East, Iran has begun a major push to get its large gas reserves out to markets.

Shortly before yearend 2001, Iran began gas deliveries into Turkey via a new 1,588-mile line as a result of a 1997 accord between the two countries calling for Iran to export 10 billion cu m/year of gas to Turkey for 25 years. Over the contract, Turkey would import 225 billion cu m of gas.

The line initially supplies 3 billion cu m/year and will increase deliveries gradually to 10 billion cu m/year in 2007.

Further into the general area of the Caspian and Black seas, more Iranian gas was made likely by the announcement in late 2001 that Iran and Armenia plan to build a 87-mile gas link between the two countries and had invited Russian and French companies to participate in the project.

The cost of the project was estimated at $120 million, with 62 miles of the pipeline to be built in Iran. The line will be able to move up to 1.5 million cu m/day in Armenia, which currently gets its natural gas from Russia.

The project has been planned for nearly 10 years but, before the latest announcement, had been held up because of financing problems.

Announcement of these plans followed hard upon other news that Iran had chosen Australian consultant BHP Kinhill and Snamprogetti SPA of Italy to conduct a feasibility study for a proposed $6 billion gas pipeline from Iran to India.

The nearly 1,660 mile, 58-in. line would begin at a National Iranian Oil Co. gas field in southern Iran and pass through Pakistan. It would carry about 180 million cu m/day.

It is planned for 70% of the line's capacity be contracted to India, the rest to Pakistan. To reduce security threats, a consortium of multinationals may develop the project and then work to resolve disputes among the three countries. It was unclear at yearend 2001 what effect the heightened military status at that time was having on plans for this pipeline.

Also in the Middle East, Enron Corp.'s collapse in late 2001 led to a dilemma for several major companies over wheth er to bid on Enron's 24.5% stake in the intergulf Dolphin gas project to be operated by Dolphin Energy Ltd. (DEL). Bids were expected to reach or exceed $1 billion from each company.

Enron was to have operated the subsea pipelines in the project but withdrew in May 2001, selling its holding to the state-owned United Arab Emirates Offsets Group (UOG), which now holds 75.5% of DEL.

The other project partner is TotalFinaElf SA, with 24.5%, which will operate the upstream section of the project.

The Dolphin project is to provide export outlets for gas in the region. In December 2001, Qatar and Abu Dhabi completed a $3.5 billion contract to send gas from Qatar to the UAE. Complications over contractual matters involving the DEL operation had delayed plans to sign a development and production sharing agreement in October.

The agreement allows the companies to produce up to 2 bcfd from a North field block off Qatar and move it through a subsea pipeline to Taweelah in Abu Dhabi. In the second phase, the volume of gas would be increased by 50%.

The new contract has DEL investing $2 billion to drill 16 wells and build a production platform and treatment facilities to strip condensate, sulfur, NGL, and LPG from the wet gas and spend another $1.5 billion on the construction of a 217 mile, 48-in. pipeline from the Ras Laffan gas processing facilities in Qatar to Taweelah.

Qatar will own all the condensate, sulfur, NGL, and LPG extracted from the wet gas, and charge $1.30/MMbtu for the dry gas, which DEL will export. The first delivery of gas to Taweelah is expected in late 2004 or early 2005.

African plans

Construction continues on the Girassol project, in Block 17 off Angola. As 2002 began, Saibos Constru

The two 1.5 mile, 16-in. flowlines connect the Girassol FPSO, the world's largest floating production, storage, and offloading unit, to the unloading buoy. They are suspended at water depths of 45-550 m with centrally positioned buoys in a W-shaped configuration, said the contractors.

Sonangol holds the concession for the field, which is operated by TotalFinaElf (40%) for partners are ExxonMobil (20%), BP (16.67%), Statoil (13.33%) and Norsk Hydro (10%).

Also off Nigeria, work will begin later this year on the Shell Petroleum Development Co. Nigeria offshore gas gathering system (OGGS), installing 54.6 miles of 24-in. line from the Forcados-Yokri area to the Bonga OGGS riser platform and 11.2 miles of 16-in. line from South Forcados to the same riser platform.

Also, the contractor consortium, led by Stolt Offshore and DSNL, subsidiary of the Nigerian Adamac Group, will install a 164 mile, 32-in. trunkline (including nearly 5 miles onshore) to connect to the Bonny Island LNG plant.

The amount of the contract was not disclosed, but Stolt said its share was $135 million. Stolt also said this is the largest trunkline off West Africa so far.

The major pipeline news out of Africa last year, however, was the advancement of plans for a trans-Sahara gas line between Nigeria and Algeria. The two countries signed a memorandum of understanding for the $7.5 billion project (OGJ Online, Sept. 7, 2001).

Early this year will begin a 20-month World Bank feasibility study to consider, among other issues, environmental impact. The bank will seek to attract other financing.

The 2,484-mile pipeline to carry Nigerian gas north and eventually to European markets (via Spain) would be part of the country's program to use its huge gas resources. It would move Nigerian gas from Abuja fields to the Algerian port of Beni Saf, in the northwestern part of the country.

As part of a strategy to prepare Nigeria for the project, the state-run Nigerian National Petroleum Corp. was to begin extending the 500 MMscfd line from Ajaokuta in Kogi state to Kaduna state, to facilitate the export of gas to the European market.

Prospects of African gas moving north through Algeria to Europe are behind yet another project to link Algeria and Italy.

Algeria is already linked to Europe by two other gas pipelines-the Maghreb-Europe line moves 8 billion cu m/year to Spain and 2.5 billion cu m/year to Portugal; the Trans-Mediterranean line supplies Italy with about 20 billion cu m/year.

Last month, Algeria,s Sonatrach, Italy,s Enel SPA, and Germany,s Wintershall AG agreed to study the feasibility of a $2 billion second gas pipeline to connect Algeria and Italy (OGJ, Jan. 7, 2002, p. 8).

First phase of the project would carry 10 billion cu m/year of natural gas to Italy. A 932-mile line would be built in four sections:

- The first would cross nearly 400 miles of Algeria from the Hassi R,Mel gas field to the northeastern part of El Kala.

- A 193-mile subsea line would link El Kala to Cagliari, Sardinia.

- The third section would connect Cagliari to Olbia, 125 miles away on the northeastern shore of Sardinia.

- The fourth, 186-mile section with much of it offshore would connect Olbia to Pescaia, southeast of Florence.

The consortium said a later extension could move gas to Germany.

Sonatrach holds 50% of the joint venture, Enel 35%, and Wintershall 15%.