OGJ Newsletter

Market Movement

Will oil prices jump or slump in 2002?

The state of the oil market largely hinges upon the global economy. If, as many economists believe, the global economy will bounce back in second half 2002, then the production cuts by OPEC and non-OPEC countries will have served to tighten markets and nudge prices up, even if no other factors are considered.

If, as some analysts believe, the economy may be headed for a second recession after an initial recovery, then the outlook for oil demand for the full year is not any better than last year's stagnation.

Oil markets are watching OPEC to see how closely its members comply with pledged output cuts. At the same time, market players are monitoring non-OPEC oil exporters-particularly Russia-to see if those cuts come through as promised.

Russia is a concern after last year's threat of a market share war arose mainly over Saudi ire at Russia's growing market share. Also, Russia's pledge of cuts may prove to be a bit disingenuous, as Russian exports always decline at this time of the year because of weather-related logistical constraints.

Russian President Vladimir Putin seems to be playing a cagey end game with the US and Saudi Arabia-ostensibly deferring to the Saudis with what amounts to moot cuts while courting the US over the situation with Iraq and positioning his country as a reliable oil supply alternative to the Middle East. With US-Saudi tensions already simmering, Riyadh's patience may be thinning.

CGES sees a price floor

OPEC members are unlikely to fully comply with the pledged cuts, especially if Brent stays near $18/bbl, says Centre for Global Energy Studies. But that may be just as well, the London think tank says, because the global economy needs a period of lower prices to stimulate growth.

OPEC's action put the brakes on a looming oil price collapse. OPEC ministers have claimed that the cuts were needed not so much to spike prices up to their targeted price band level but to keep oil stocks from increasing too fast in the first quarter. CGES says OPEC needed to cut output if it was to realize its policy of maintaining prices up towards the $20/bbl level as needed by its largest members.

"Whether or not such a policy is in the best longer-term interests of OPEC, short-term revenue needs are the only thing driving the organization's action at present," CGES said.

Full compliance unlikely

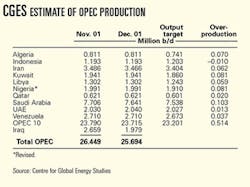

CGES reckons OPEC's actual cuts are likely to be about 1 million b/d from fourth quarter 2001 levels, bringing the group's total output this quarter (including Iraq) to a little more than 25 million b/d (see table).

That's well below the pledged 1.5 million b/d, but CGES believes it will be enough to cause a drawdown of stocks of more than 1 million b/d in the first half. Also helping OPEC's cause is the US decision to replenish the Strategic Petroleum Reserve with royalty in-kind oil totaling 100 million bbl beginning in April.

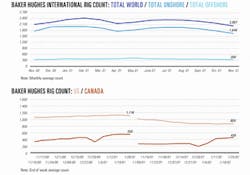

This scenario has Brent stabilizing at $18/bbl in the first quarter and the stock draws catching up with the market in second quarter, when Brent could average $21/bbl.

"Having taken so much oil out of the market, OPEC would then need to increase its output in 3Q02 and again in 4Q02 to prevent stocks from falling to dangerously low levels that would overheat the market," CGES said.

Even after restoring as much as 2.5 million b/d of oil supply in the second half, revived demand could tighten the market enough for oil prices to test the upper end of its price band.

Full compliance with pledged cuts would make it almost impossible to prevent a price explosion the second half, CGES warns.

Industry Scoreboard

null

null

null

Industry Trends

THE US WIND INDUSTRY has ended its most productive year, more than doubling previous records for new installations by adding 1,694 Mw of copacity, or $1.7 billion worth of new generating equipment in 16 states. In 1999, 732 Mw was installed.

Randall Swisher, executive director of Washington, DC-based American Wind Energy Association, said wind farms installed in 2001 will produce as much electricity annually as 475,000 average American households use, and will eliminate 3 million tonnes of carbon dioxide emissions and 27,000 tonnes/year of noxious air pollutants.

The wind power industry has been the fastest-growing energy industry in the world over the past decade. Prospects for a 2002 repeat have been clouded, however, by the expiration Dec.31 of a key incentive, the federal wind production tax credit (PTC). AWEA is urging swift approval of the PTC extension early this year.

Shell Renewables' US wind energy operation, Shell WindEnergy, which entered the US market in November 2001 with the launch of a 50-Mw wind power facility, Rock River I, near Foote Creek Rim, Wyo. (OGJ, Dec. 3, 2001, Newsletter, p. 9), has purchased and begun commercial operation of Llano Estacado Wind Ranch at White Deer, an 80 Mw wind power facility near Amarillo, Tex.

Cielo Wind Power of Austin, Tex., developed the project, which will operate under a 15-year power purchase agreement with Southwestern Public Service Co.

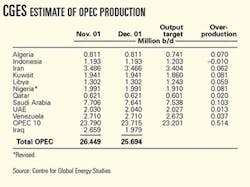

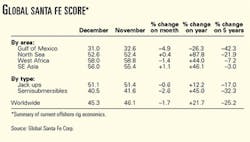

WORLDWIDE DRILLING MARKETS are firming up, compared with last year, while Gulf of Mexico markets moderate; however, only the North Sea and Southeast Asia showed month-on-month gains in December compared with November.

Offshore drilling contractor GlobalSantaFe's worldwide SCORE for December 2001 fell 1.7% from the month before. However, the worldwide SCORE for December was 45.3, up 21.7% from a year ago but down 25.2% from 5 years ago (see table).

GlobalSantaFe Pres. and CEO Sted Garber said, "SCORE clearly reflects some of the key trends in the major offshore drilling markets over the year. While international drilling markets have benefited from increased activity by the majors, Gulf of Mexico drilling markets softened as highly cash flow-sensitive independents responded to sharply declining natural gas prices."

SCORE compares the profitability of current mobile offshore drilling rig rates with the profitability of rates at the 1980-81 offshore drilling cycle peak, when speculative rig construction was common.

Government Developments

RUSSIA has moved closer to securing a deepwater oil export terminal on the Mediterranean Sea.

Ukraine's acceptance in December of a lower transit tariff for Russian oil crossing its territory advances plans to send Russian oil through the Druzhba and Adria pipelines to Croatia's port of Omisalj, where it could be shipped out. The terminal would allow Russia to transport Urals Blend to the US and Asia.

Ukraine agreed to the reduced tariff of 64¢/tonne/100 km for pumping oil destined for Omisalj across its territory. Russian oil companies see this as the last major obstacle in the way of the project.

Pakistan President Pervez Musharraf has approved the privatization of the country's largest oil distribution company, Pakistan State Oil, said the Pakistan privatization commission.

The company has a domestic market share of more than 70% and assets worth 30 billion rupees ($500 million). For the year to June 2001, it booked a profit of 2.2 billion rupees. The government said stakes would be offered to prospective investors after February in a manner ensuring that national interests are protected.

Petroleum Minister Usman Aminuddin first will issue a policy statement for the country's downstream oil industry.

US EPA and Department of Justice announced settlements with Conoco and Holly Corp. over alleged federal clean air violations. Under the action, the refiners also reached agreements with the states of Louisiana, Oklahoma, Colorado, and New Mexico.

Under terms of consent decrees, which remain subject to 30-day public comment, Conoco will spend $95-110 million to install the "best available" technology to control emissions from stacks, wastewater vents, valves, and flares at Lake Charles, La., Ponca City, Okla., Commerce City, Colo., and Billings, Mont., refineries.

Holly subsidiaries Navajo and Montana Refining will spend $16-21 million to undertake similar work at refineries at Artesia, NM, and Great Falls, Mont.

The affected refineries comprise about 3.5% of the US total refining capacity, DOJ said.

A PERUVIAN LAW forgiving the 18% sales tax on goods and services for unsuccessful oil exploration campaigns is on hold until Feb. 8 pending governmental text clarification.

The regulation, signed into law Jan. 7, is intended to promote increased hydrocarbon exploration. It applies to companies signing exploration contracts or technical evaluation agreements after the law was approved.

Peru's oil production fell to an average 97,097 b/d last year compared to an average 180,000 b/d in the early 1980s.

Companies already exploring must wait until they begin a new stage in their contracts to benefit from the law.

Quick Takes

Alaska remains a hotbed for natural gas discoveries.

Marathon Oil said it discovered a gas field in its Ninilchik prospect on Alaska's Kenai Peninsula. Grassim Oskolkoff 1 is the first exploration well drilled in the Ninilchik exploration unit, under a joint exploration agreement between Marathon and Unocal unit Unocal Alaska. Operator Marathon holds 60% of the prospect.

The well is 35 miles south of Kenai, Alas. It was drilled to 11,600 ft and found several gas-bearing sands, Marathon said. One 39 ft interval at 9,822 ft flowed 11.2 MMcfd of gas with 1,565 psi flowing tubing pressure.

Three more completed wells are yet to be tested, and the companies plan to drill several more delineation wells.

Marathon estimates the structure contains 90 bcf of gross proven gas reserves. It predicts first gas sales in late 2003 via a gas transmission line, Kenai Kachemak Pipeline. Marathon and Unocal are in the design and permitting stage for the joint venture line.

Elsewhere on the exploration front, Amerada Hess found oil at its Ebano prospect in the Rio Muni basin off Equatorial Guinea. Ebano is on Blocks F and G in 2,052 ft of water. Amerada Hess said the 11,011 ft F-2 discovery well and a 9,446 ft sidetrack on adjacent Block G confirmed a 300 ft gross pay interval with 181 ft of net oil-bearing pay at 7,469-7,756 ft. The oil is 36.5° gravity. The discovery well is 10 miles northeast of Amerada Hess's Ceiba field and tested reservoirs similar to those encountered in the Ceiba, Okume, and Oveng discoveries. Once operations at the sidetrack well are completed, Amerada Hess plans to spud a well on Block G about 3 miles southeast of Ebano. Amerada Hess operates both blocks with 85% working interest. South African company Energy Africa Ltd. holds the rest. Equatorial Guinea will carry 5% participating interest in any Ebano-area commercial production.

Shell Nigeria Exploration & Production and its partners made what they are calling a "significant" deepwater oil discovery on OPL 219 off Nigeria. The Bolia-1X discovery well was drilled to 13,050 ft TD in 3,600 ft of water and flowed 6,000 b/d of oil on test. Operator Shell holds 55% interest in OPL 219; other participants are Esso Exploration & Production Nigeria (Deepwater) 20%, Elf Petroleum Nigeria 12.5%, and Nigeria Agip Exploration 12.5%. Nigerian state oil firm Nigerian National Petroleum Corp. serves as the block's concessionaire.

Yukos and TotalFinaElf unit TotalFinaElf Tchernomorie formed a 50-50 JV-subject to Russian approval-to explore and develop the Shatsky Ridge area in the Russian portion of the Black Sea. The first phase of work involves interpretation of seismic data already acquired by Yukos and the launch of another 2D seismic survey over the area in 1,500-2,500 m of water. "Entry into the Shatsky zone is in line with TotalFinaElf's strategy of expanding its deep offshore operations, bringing the group's expertise to a region where no exploration drilling has ever been conducted," the company said. TotalFinaElf operates production of 12,000 b/d of oil under a production-sharing agreement for the Khariaga field in Russia's Timan Pechora region. It expects to increase production to 30,000 b/d before yearend.

Statoil and ExxonMobil have exchanged interests in licenses on the Norwegian continental shelf. On Jan. 1 Statoil took over operatorship and a 20% stake in the F prospect in the Barents Sea from ExxonMobil. The area, 150 km east of the Statoil-operated Sn hvit field, consists of three exploration licenses. Statoil also received 11.1% of an exploration license on Block 33/1 (Production License 152) on Tampen in the North Sea. Tampen is one of the state firm's core areas on the Norwegian continental shelf and the home of Statfjord and Gullfaks fields. Statoil will have 70% of production license PL 152 when the exchange is completed, and Petoro will have 30%. In return, ExxonMobil has received 3% in an exploration area near the Norsk Hydro operated Grane field in the southern Norwegian North Sea. Statoil sold its ownership of Grane field last year but kept 15% of the exploration part of Production License 169. Following the exchange Statoil's share will be 12%. ExxonMobil is heavily involved in Grane, Jotun, Balder, and Ringhorn fields in the area.

Conoco and TotalFinaElf have brought the $400 million Desgas associated gas project in eastern Syria's Deir Ez Zor region to full capacity of 13 million cu m/day (MMcmd), said TotalFinaElf.

Conoco operates the project, which includes collection, treatment, and export of associated gas from Deir-Ez-Zor region to the Syrian gas transmission network and production of condensate from Tabiyeh field (operated by TotalFinaElf) through gas reinjection.

The project ends associated gas flaring.

The contract involved construction of a two-train, 450 MMcfd gas processing complex, six compressor stations, a 100 mile gathering system, and a 150 mile trunk pipeline (OGJ, June 26, 2000, p. 64).

The gathering system transports up to 5 MMcmd of gas to the 13 MMcmd processing plant; the facility also processes 8 MMcmd from Tabiyeh field before reinjection into the reservoir.

The processed gas not reinjected at Tabiyeh is shipped via a 250 km line to the Syrian grid to fuel power plants and industrial facilities in the west of the country.

NGLs associated with production is exported via rail while condensate is transported through the Syrian Co. for Oil Transport line to the Banias terminal.

In other production news, Petro-Canada-operator of the $2.8 billion (Can.) Terra Nova field off Newfoundland-said production from the newly opened field continues to increase. The flow rate was 75,000 b/d from two wells, up from initial production of 35,000 b/d from one well. However, Petro-Canada expects production may be intermittent in the coming weeks as systems are fully tested and more wells are brought on stream to reach a planned production rate of 125,000 b/d of oil. The wells are producing to the Terra Nova floating production, storage, and offloading vessel. The FPSO can handle up to 150,000 b/d of oil production and store 960,000 bbl (OGJ, Jan. 21, 2002, p. 58). The field is expected to have a production life of 15-18 years.

Russia's Tyumen Oil (TNK) and Slovenian company Petrol agreed to cooperate in oil processing and marketing in Croatia, Bosnia and Herzegovina, the Federal Republic of Yugoslavia, and Macedonia.

TNK will provide crude for processing and will manage processing of oil products. Petrol will provide marketing and sales services as well as manage logistics, marketing, and sales of oil products.

"Cooperation with the leading marketer in Slovenia will provide a good growth opportunity for our company in the area of refining and marketing in the region of Former Yugoslavia," said TNK Pres. Simon Kukes.

The cooperation will provide new opportunities for growth in the region, said Janez Lotric, president of Petrol.

The Borouge joint venture of Abu Dhabi National Oil Co. and Borealis started first shipments from the $1.2 billion petrochemical complex at Ruwais this month, reported OPEC News Agency.

The complex achieved full ethylene capacity of 600,000 tonnes/year and 70% of polyethylene capacity of 450,000 tonnes/year; full polyethylene capacity is expected by the end of February.

One third of the total production will be exported to the Middle East, and the rest will be shipped to Asia and Europe, said Joost Schrevens, Borouge CEO.

Borouge signed a contract last month with Abu Dhabi National Tanker Co. to undertake ethylene shipments from Ruwais to hub port Mina Zayed and to Dubai's Jebel Ali. Borouge also signed an accord with Mina Zayed, Mussafah port, and Jebel Ali for the export of polyethylene.

In other petrochemical news, Shell Nederland Chemie brought a 100,000 tonne/year propylene oxide glycol ether plant on stream at Pernis, the Netherlands. The plant makes propylene glycol monomethyl ether, dipropylene glycol monomethyl ether, and propylene glycol monoethyl ether, some of which will be esterified to form acetates. It began operations at the end of November and has been tested at design capacity. It adjoins a multipurpose plant in Pernis, which is producing 65,000 tonnes/year of ethylene oxide glycol ethers and brake fluids. The unit is connected by pipeline to cost-competitive propylene oxide supplies from Shell's existing styrene monomer and propylene oxide operations in Moerdijk. Demand for propylene oxide glycol ethers as high-performance solvents is increasing worldwide in order to meet environmental quality legislation, Shell said.

Basell Polyolefine let a 140 million euro contract to Montedison Group unit Tecnimont for a 320,000 tonne/year high-density polyethylene plant to be built at Wesseling, Germany. Tecnimont will supply engineering, materials, and equipment for the plant, as well as construction and construction management. The plant, scheduled for start-up early in 2004, will be Basell's largest capacity facility based on the Hostalen technology. The company expects the western Europe pipe market to grow 5.5%/year through 2009.

Poland's PKN Orlen let a $165 million contract to ABB Group for the expansion of an ethylene plant in Plock, about 100 km from Warsaw. ABB will revamp the 21-year-old plant, increasing PKN's annual ethylene capacity to 660,000 tonnes from 360,000 tonnes and increasing annual propylene capacity to 315,000 tonnes from 130,000 tonnes. PKN's ethylene cracker is the largest in Poland, said ABB, and was based on older ABB technology. The contractor will apply new proprietary technology. ABB will design the expansion at its offices in Germany. ABB engineers and local contractors will perform the site work. The expansion is expected to be complete at yearend 2004.TOPPING PIPELINE NEWS, Alaska North Slope producers will meet in Washington Feb. 4 with US officials and pipeline companies to review regulatory obstacles that could delay or postpone a proposed arctic gas pipeline, according to industry and government officials.

A BP PLC official said last month that under current economic conditions, the $15-20 billion pipeline will have a difficult time attracting capital. A more detailed picture will develop later this winter, however, when the large North Slope producers-BP, ExxonMobil, and Phillips Petroleum-review a $100 million business plan for the project (OGJ Online, Jan. 15, 2001).

Phillips said all three producers support legislation that would update the 1977 Alaska Natural Gas Transportation System Act that first authorized permits for a gas line. Producers also want accelerated depreciation on federal taxes. But Phillips alone is publicly supporting additional tax incentives.

Elsewhere on the pipeline front, a unit of Williams chose Paragon Engineering Services to coordinate its application with FERC to build the proposed Western Frontier Pipeline. Western Frontier Pipeline is tendering for the engineering contract for the line; Paragon is participating in that tender. The proposed 400 mile, 30-in. Western Frontier line would transport up to 540 MMcfd from the Cheyenne Hub in northeastern Colorado to Williams's Central pipeline system and various other pipeline interconnects in southwestern Kansas and the panhandle of Oklahoma (OGJ Online, Oct. 25, 2001). Williams previously said it hopes to bring the pipeline in service by Nov. 1, 2003. Paragon recently completed a similar filing for Williams's Sundance pipeline, using a proprietary pipeline database mapping system, photographs, surveys, environmental assessments, and wetlands delineations.

US law enforcement officials announced a proposed $5.5 million settlement with Murphy Oil USA for alleged clean air and water violations at the sulfur recovery unit in its 33,250 b/d Superior, Wis., refinery.

The civil penalty was the largest ever leveled in Wisconsin for an environmental enforcement case, US officials said.

Murphy will also spend $7.5 million in pollution control equipment over a 5-year period for the refinery's other processing units.

The proposed agreement is subject to a 30-day public comment period and final court approval.

The settlement comes after a 10-day trial last year. Chief US District Judge Barbara B. Crabb ruled Murphy Oil violated the Clean Air Act when it made major modifications at its refinery without obtaining the required Prevention of Significant Deterioration (PSD) permits, part of the US EPA's New Source Review program.

She ruled that when Murphy Oil obtained a PSD permit exemption from the Wisconsin Department of Natural Resources, it had "withheld information knowingly and intentionally and that if it had submitted the withheld materials, they would have been material to the [WDNR's] decision-making process."

US officials said the consent decree only resolves Clean Air Act New Source Review violations at the sulfur recovery unit. It does not preclude EPA or Wisconsin from investigating and bringing enforcement actions for NSR violations at other units at the refinery.