Styrene industry to recover after dismal 2001

In 2001, instead of its expected up-cycle, the styrene industry experienced its first decline in demand for almost 20 years, according to a recent study from Chem ical Marketing Associates, Inc. (CMAI). For 2002, CMAI is forecasting annual growth of 4.2% over 2001 demand.

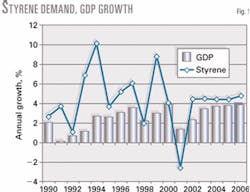

Worldwide styrene demand declined sharply in 2001 even though GDP growth was positive (Fig 1).

On the supply side, it is not often that the styrene industry has a year without a new unit starting up. It was surprising to see the Huntsman Corp. styrene plant in the US shut down in the second quarter of 2001. Sterling Chemicals filed for bankruptcy protection shortly after.

New records have been set for demand decline, capacity utilization rates, and margins.

US production

The US market was the center of the global styrene implosion, according to CMAI. The US industry's problems on the demand side have been aggravated by high production costs.

This normally robust global "leader" has been hurt by high costs and lack of demand in overseas markets. It is surprising and unprecedented, said CMAI, that the US industry suffered for an entire year from styrene spot prices that only covered variable cost. The temporary removal of ChevronPhillips Chemical Co.'s, Donaldson, La., 520,000 tonne/yr styrene unit for most of 2001 did not improve the situation.

In the past 15 years, spot prices have touched the variable cost level for a couple of months at the most, according to CMAI. Total US demand for styrene has declined to such an extent that average industry operating rates have been in the 70 % range.

Worldwide demand

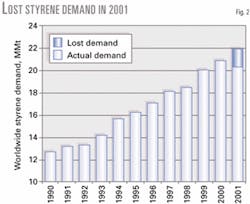

The key issue for the styrene market is that the starting point on Jan. 1, 2002 is considerably lower than if it had had typical growth in 2001 (Fig 2).

According to the study, the average annual worldwide growth rate in the 1990s was 4.9 %. Global styrene demand in 2000 was 20.985 million tonnes (MMt). If the market had sustained an average growth rate through 2001, demand would have grown to 21.9 MMt. Instead, the result for 2001 is around 20.35 MMt.

The demand decline in 2001 was more than 500,000 tonnes, or 2.6 %. The decline could have been worse if not offset by a 22 % demand increase in China. Demand in the rest of the world shrank by 5 %. Meanwhile, China's 1.9-MMt market in 2000 grew by more than 400,000 tonnes in 2001.

Styrene operating rates

Worldwide demand declines, combined with further inventory reduction, had a devastating effect on operating rates, said CMAI. The North America region was the world's weakest major performer, with an average operating rate of only 76.5 %.

Despite a 1.6 % pro rata capacity increase in 2001, the world's average operating rate plunged to 86 % in 2001 from 92 % in 2000. This is the lowest such rate since the early 1980s.

A typical growth year would have resulted in an average operating rate of 93 %. For a commodity such as styrene, a 7 % swing in operating rate is enormous. This setback is not something from which a market can quickly recover.

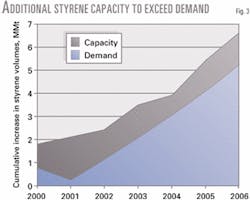

In 2002, there will be 23.8 MMt of capacity available to satisfy a demand of 21.0 MMt, if it grows by 4.0 % or more.

In the past, the operating rate was higher entering a period of re-stocking. In other words, there should be more than enough available supply via higher operating rates as long as there are sufficient raw materials available.

CMAI's predicted 2002 growth rate of 4.2% will lift the world average operating rate to only 89 %, little better than the rate in 1998. It is not likely that operating rates or absolute consumption volumes can recover by 2006 after the setback in 2001.

Demand growth

CMAI predicts some refilling of the "pipeline" when the manufacturing recession ends and economic confidence is restored. But with operating rates for styrene (and polystyrene capacity) at low starting levels, the market's supply side will not be seriously challenged by demand growth.

Two main regions, North America and Western Europe, have increased polystyrene capacity, suggesting the derivatives will be unable to absorb any significant increase in styrene prices. CMAI feels growth in 2002 demand will be "real," as opposed to GDP-related, with some potential restocking down the chain. The downstream markets and finished products markets are as close to "empty" as is logistically possible.

Previous recovery years rebounded off higher starting operating rates for styrene monomer and were reinforced by simultaneous upswings in the olefin markets.

There is too much slack in the styrene and styrenics markets and too many extraneous negatives to predict a more bullish recovery in 2002. The predicted recovery, therefore, will be more visible as product volume than industry profitability.

Long-term forecast

CMAI's demand forecast shows reasonably consistent growth to 2006. Demand forecasts were generated on a country-by-country basis. The result for world demand growth is an average annual growth rate of 4.4% from 2001 to 2006.

From 1996 to 2000, average world growth was 5.2 %, which included the depressed year of 1998.

When 2001 is included, the average annual growth rate falls to 3.6 % for 1996 to 2001.

CMAI's growth forecast is built on GDP growth forecasts and does not factor in psychology and major inventory shifts.

These are too arbitrary and are smoothed out over the long run.

History suggests that future growth will fluctuate more than these figures suggest but, over a 5-year time span, could reach a similar final level.

Styrene demand growth, however, can be more orderly because it has fewer reasons to grow in a disorderly fashion.

The GDP part of demand growth has too much inertia to cause a monomer demand "explosion," and there are no technological or derivative development changes on the horizon that might result in a step change in styrene consumption, CMAI predicted.

The inventory rebuild after the depletion of 2001 can easily be achieved without straining the supply side because there is so much supply slack.

The styrene market over the next 5 years has little chance of experiencing a shortage, i.e, greater than 95 % worldwide operating rate.

Fig. 3 shows that forecast styrene demand can be met with ease. With planned capacity additions and at the forecast rate of demand growth, the peak global operating rate projected for the period to 2006 is only 92 %.

CMAI's pricing and margin forecasts do assume some more "typical" behavior for the market towards 2004 with margin levels boosted by a more broad-based recovery for olefins and major thermoplastics amplifying the individual dynamics of the styrene chain.