California entity expects green initiatives to drastically reduce gas use

The state-funded California Power Authority said that by 2006, energy efficiency programs and renewable energy projects could reduce the state's electric utility natural gas consumption costs by $10-15 billion.

The state entity said buying gas drains money from the California economy instead of stimulating growth inside the state. With renewable energy and efficiency strategies, CPA predicts it can meet California's need for 8,000 Mw of new electric power capacity by 2006 while reducing gas consumption by electric utilities.

The CPA staff report detailing the proposal did not provide an estimate of the potential avoided gas volumes, but it did say that the upper end of the avoided cost savings range, $15 billion, assumed a gas price of $2.20/MMbtu for 20 years. It specified that, under a "business as usual" case, at least 10-14 natural gas-fired power plants would be needed to meet the state's power needs in the coming 5 years.

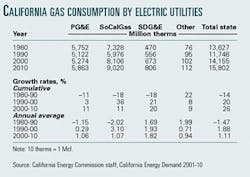

By comparison, the California Energy Commission recently projected an increase of 26% in gas consumption by the state's electric utilities during 2000-10 (see table). Including facilities currently under construction, gas accounted for 38% of California electric utilities' total fuel supply in 2001. About 96% of the proposed power projects in the state are gas-fired.

More power capacity is required in California to guard against a repeat of the energy disaster the state suffered in 2000-01, CPA said. The state entity's plan for new power capacity calls for $3.3 billion in total capital investments for 2002-03 from public and private sources and another $17.3 billion by 2006.

The agency contends that it could meet much of the projected new capacity needs by replacing the state's aging gas-fired power plants with units powered by renewable energy sources.

"It is important to remember that many of California's fossil power plants are over 30 years old and are very inefficient and therefore highly polluting even with controls," CPA staff said in a working draft. "They will need to be replaced over the next decade. The issue is whether they will be replaced by renewables and demand-side projects or still more gas-fired plants.

"Based on public preferences, we believe the answer is to replace these old natural gas-fired plants with geothermal, wind, solar, and biomass. If only 10% of these natural gas-fired plants are closed down, it will create a 3,000 Mw [market] for renewable[s], which is within our goal for the next 4 years. We urge public policy to make that happen."

However, there remains skepticism over whether the CPA could meet its target of meeting the state's future incremental power needs with a "lean and green" approach.

Conservation, renewables

CPA predicted that electricity reserves will fall to 5-13% within the next 4 years, far below the target of 22%. It recommended diversifying the fuel mix to become less dependent on natural gas and emphasizing conservation and renewable energy. After successfully cutting energy use last year, CPA said Californians need to be refocused on conservation because their efforts have tapered off.

"We have found that there is sufficient opportunity in energy efficiency, load management, renewables, and decentralized generating resources to meet all of the projected load growth," said the report.

Finally, it found that specific transmission constraints-particularly in the San Francisco and San Jose corridor-need to be rectified.

The state will arrange financing for permanent efficiency changes and for new renewable energy projects. CPA said it will leverage its $5 billion of bond authority with at least $2-5 billion or as much as $8-12 billion from the private sector and other public organizations to finance the plan.

The money will be targeted for renewable energy to ensure that 50% of the energy needs of state and local public buildings is met with renewable sources by 2006. Other investments will be made in strategic power reserves to help meet peak demand in certain areas and in energy efficiency and load management projects.

CPA predicted the strategy will lower overall electricity costs by $20-40 billion primarily by dampening volatile spot market prices. Nitrogen oxide emissions will be reduced by 100,000 tons, it said. The plan will also create 5,000-10,000 more jobs than a conventional strategy, according to CPA.

The state entity also asked for authority to finance new transmission lines and for increased and more "viable" power of eminent domain to take over privately operated power projects and undeveloped sites.

Skepticism

Kristin Dall, senior analyst with Boston-based consulting group Energy Security Analysis Inc. voiced skepticism about the CPA plan in general and current projections of the state's future capacity growth in particular.

"…First of all, the Enron [Corp.] fallout is likely to affect project financing and future capacity development nationwide-including California. We are already seeing evidence of this, and ESAI believes that projects that have not already been financed will have a difficult time moving forward; thus forward capacity projections may have to be revised everywhere."

However, should the economy pick up again as expected, demand from smelters in the US Northwest increase, another drought ensue, or a gas supply crunch come about, prices could spike again, Dall said. Much also depends on the new design for the state's power market and what FERC does with the power price cap.

"So, do I feel that renewables will help California electricity supply? Yes, I do. Do I see them as displacing or replacing gas-fired capacity? I do not," Dall said. "That's not to say companies aren't interested and pursuing a renewable strategy-diversifying portfolio-they are.

"I think gas project delays or cancellations will have everything to do with financing, energy company balance sheets, and the economics of operating in the [California Independent System Operator] pool-not with fear or new interest in renewables."