US refiners need more hydrogen to satisfy future gasoline and diesel specifications

US Tier II fuel regulations (OGJ, Oct. 14, 2002, p. 20) represent a financial and logistical challenge to refiners and distributors because they place unprecedented sulfur limits on gasoline and diesel. The ultralow sulfur diesel (ULSD) mandate comes less than 1 year after new nationwide sulfur standards for gasoline were finalized.

Refiners will face financial and physical challenges to meet both gasoline and diesel standards. ULSD will be expensive.

Refinery hydrogen will play an important role for refiners attempting to meet the more-stringent specifications. This article shows the results of a study conducted to determine the most economic means of meeting the new sulfur requirements.

The study showed that refiners could buy sweet crude to mitigate the need for additional hydrogen but at a large economic cost. Providing a hydrogen source for desulfurization and other process requirements is clearly more economical.

Refining industry drivers

Market and environmental forces to improve product quality drive refiner spending. Clean fuels regulations will require an estimated $7 billion in US refinery capital spending.

Market drivers

Refiners aim to maximize shareholder return, which requires efficient operations, careful crude selection, modern processing methods, meticulous blending, and new delivery strategies. These tasks are increasingly difficult in an industry that is historically less profitable than other businesses.

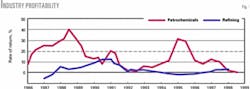

Fig. 1 compares the average rate of return for nonrefining and refining investments.1 Complying with low-sulfur guidelines will be difficult for an industry that has not achieved acceptable returns on its base capital investments.

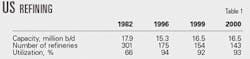

Low profit margins for the higher-quality products are forcing refiners either to invest in or leave the industry. In the past several years, many less-competitive refineries have shut down. Table 1 clearly shows this trend.2

The increase in utilization to 93% in the last few years from 66% in the early 1980s indicates refiners' efforts to increase profitability while trying to meet ever-increasing environmental restrictions.

Environmental drivers

The second phase of the 1990 Clean Air Act Amendments took effect on Jan. 1, 2000. These new rules require that all automobile emissions from gasoline sold in areas in noncompliance with federal air standards must meet emission reductions specified by the Phase 2 reformulated gasoline (RFG) complex model.

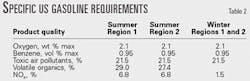

This model is a correlation developed by the US Environmental Protection Agency (EPA) to forecast the amount of toxics, volatile organic chemicals, and NOx as a function of gasoline qualities. Table 2 lists the specific requirements.3

Performance standards are expressed as a percent reduction and are based on a 1990 baseline.

In the US, gasoline-sulfur level averages approximately 350 ppm while the proposed federal gasoline sulfur limit is 30 ppm, which will commence in 2004. California has already imposed this sulfur level for gasoline sold there.

The current concentration of sulfur in on-road diesel fuel is limited to 500 ppm; off-road diesel and heating oil is 2,000-5,000 ppm, depending on the state. EPA's preliminary rule promulgation proposed a limit of 15-ppm sulfur to begin June 1, 2006.5 These new rules require a target sulfur level of 5-7 ppm (wt) to allow for a margin of error during transport and storage.

The Texas Commission on Environmental Quality (previously known as the Texas Natural Resource Conservation Commission) adopted low-emission diesel standards that require diesel fuel sold in Texas to meet a 10 vol % maximum aromatics and 48 minimum cetane number specification by May 1, 2002.

This new standard also specifies a 15-ppm sulfur limit imposed by June 2006, which corresponds to the proposed EPA schedule. The aromatics specification is restrictive and will require severe hydroprocessing to desulfurize and to saturate most of the aromatics in virgin and conversion distillate streams.

The requirement for environmentally friendly fuels has caused a logistics nightmare for refiners and associated marketing companies. Instead of three grades of gasoline (regular, midgrade, and premium), refiners may have to produce four times this amount (conventional, reformulated, oxygenated, and fuels).

Producing gasoline is not the problem, having it in the right place is. Low-sulfur gasoline faces a high risk of contamination, as does distillate. Distillate-product sulfur levels can have these specifications:

- Jet fuel, 3,000-ppm sulfur maximum.

- Diesel, 15-ppm sulfur maximum.

- Off-road diesel, 2,000 to 3,000-ppm sulfur maximum.

- No. 2 fuel oil, 2,000-ppm sulfur maximum.

The same pipeline systems transport these various distillate fuels. The different sulfur specifications cause a volume loss of low-sulfur diesel because the interface must be larger to ensure minimal or no contamination. The interface is usually downgraded to the next higher sulfur level.

A 15-ppm sulfur specification also forces a traditional blending stock (light cycle oil [LCO] from the FCC) out of the blend, which further reduces the amount of diesel available. Refiners can downgrade the displaced LCO to a lower-value product or process it in a hydrocracker. Both options result in lost revenue.

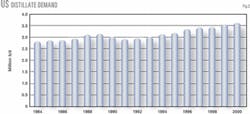

A further tightening of ULSD cetane and aromatics specifications will reduce diesel supplies. This loss of diesel material is significant because demand is expected to increase 6.5 %/year from 2000 to 2006.5

EPA expects the production of low-sulfur diesel to cost between 4.0 and 5.4¢/gal more than regular diesel.6 This range does not include additional costs required to produce low-aromatics diesel or for transportation. Other estimates predict additional costs of 8-15¢/gal.7

Fig. 2 shows the growing demand for distillate fuels.8

The fraction of on-road diesel, which has the lowest proposed sulfur specification, out of the entire distillate fuel pool is also growing: 59% in 1999 from 52% in 1995.9

Typical refinery

Meeting required clean fuels regulations will force refiners to explore several options including: feedstock changes, product upgrading or downgrading, and expansion or debottlenecking of existing hydroprocessing units.

If a refiner decides to stay in the fuels business, a provision for a reliable source of hydrogen plays an important role in the decision-making process.

This article explores the effect of environmental restrictions on hydrogen demand by analyzing the economics for a typical US Golf Coast refinery using a linear program model.

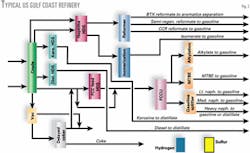

Fig. 3 shows a typical FCC-centered US Gulf Coast fuels refinery. We added delayed cokers to this configuration to enable the refinery to process heavier (lower priced) crudes and to maximize FCC feed.

Before implementation of the latest environmental policies, most refiners had a surplus of hydrogen, which allowed them to react to such market opportunities as lower-cost crudes or production of higher-value fuels to increase profit margins.

The ULSD regulation has taken away this luxury.

Refiners must now consider a range of solutions such as purification, generation, supply outsourcing, and build-to-own options for meeting hydrogen needs.

The primary source of hydrogen is the catalytic reformer and purified off-gases and purge gases.

Operating severity, usually indicated by C5+ reformate octane, dictates the amount of hydrogen produced in a reformer.

As reformer severity increases to produce more hydrogen, however, the volume of reformate decreases. The amount of hydrogen required to desulfurize refinery intermediate products directly relates to the amount of sulfur and cracked stocks in the hydrotreater feed.

Primary hydrogen consumers in this model are the distillate and FCC feed hydrotreaters.

Economic drivers

Table 3 shows market-related restraints and the free-on-board (FOB) product prices.10

We imposed market limits to ensure a product slate that is reasonable for the US Gulf Coast market. We considered two crudes: Arabian Light at $21.99/bbl and Brent at $25.26/bbl.

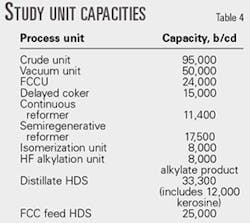

Table 4 lists the process unit capacities.

Cases considered

This analysis generated three cases:

- Base case with present product sulfur specifications ("Today").

- Tier II sulfur specifications for diesel and gasoline without outside hydrogen ("No H2").

- Tier II sulfur specifications for diesel and gasoline with outside hydrogen ("H2").

We expanded the refinery model to include Axen's Prime G+ process, which desulfurizes FCC gasoline produced in the cases that imposed Tier II sulfur restrictions.

Hydrogen could be purchased at $2.50/MMscf.

The Today case sets base profitability. The H2 case demonstrates the value of having access to additional hydrogen at the refinery. The No H2 case is a distinct possibility because refiners can always purchase more sweet crude to offset the need for more hydrotreating and hydrogen.

Study findings

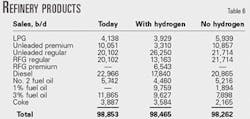

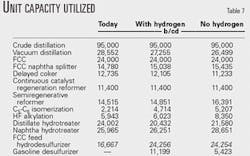

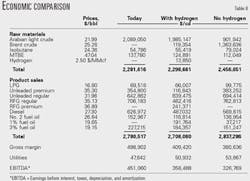

Tables 5-8 show the study results. Table 5 shows that more sweet crude is required to make salable products if additional hydrogen is not available. Table 6 shows the products for each case and Table 7 shows the process unit capacity utilization.

We found some interesting points from the study results:

FCC gasoline desulfurization is required even with sweet crudes.

A higher reformer capacity and severity is needed to meet the hydrogen demand when an outside hydrogen source is unavailable.

The FCC is at full capacity in all cases, but the incentive to expand unit capacity decreases as the more restrictive sulfur specifications are imposed.

Due to its sulfur-concentrating effect in liquid product streams, the delayed coker is not used as much.

The model produced no propylene product because it is more valuable as alkylate feedstock.

Refiners can process more sweet crude to mitigate the need for additional hydrogen or hydrodesulfurization capacity.

Sweet crude generates more high-quality, high-value products but the increased raw materials cost has a dramatic impact on refinery profitability.

Economic observations

Table 8 shows economic results for the three cases. Important points regarding the economics of the three cases include:

Raw materials costs for the No H2 case are significantly higher.

Higher utilities costs for the H2 and No H2 cases are primarily due to increased reformer severity.

Even though the No H2 case makes more higher-value products, they are not enough to offset higher raw materials costs.

The value of hydrogen calculated by comparing the difference in earnings before interest, taxes, depreciation, and amortization (EBITDA) between the H2 and No H2 cases is $8.23/MMscf.

Buy or build?

This analysis shows that Tier II sulfur specifications will cost the industry a great deal in terms of profitability.

The study also demonstrates that a refiner can buy sweet crude to mitigate the need for additional hydrogen source, but at a large economic cost.

Providing a hydrogen source for desulfurization and other process requirements is clearly the correct economic choice.

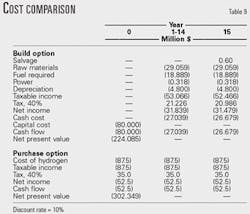

Our analysis to determine if it is better to buy hydrogen across the fence or build a hydrogen plant in the refinery is basically a lease-purchase calculation.

We then compared net present values of the two cases to see which is greater at a specified discount rate. Our methodology was to determine the after-tax cost of each option for a specific period of time.

Table 9 shows that the economic incentive is to build a hydrogen plant. The after-tax cost of building the hydrogen plant is $285.6 million vs. $410.7 million for the outside purchase of hydrogen.

Other benefits of building

Building a hydrogen plant requires an initial investment that can strain a refiner's budget, especially because it is a low or no margin investment. Building and owning a hydrogen plant, however, lets the refiner adjust the design to take advantage of feed economic and environmental drivers.

Refiners can customize hydrogen plant designs to operate with variety of feedstocks and fuels to take advantage of price differences.

Hydrogen-plant design can also provide the operational flexibility to generate steam, which allows refiners to reduce capacity or eliminate boilers and take advantage of the environmental credits.

Owning a hydrogen plant has operational and reliability benefits. Operating and labor synergies can also result by integrating the hydrotreating, hydrogen, and hydroprocessing control schemes.

References

- www.eia.doe.gov/emeu/perfpro/ref.pi/fig1.gif, US Energy Information Administration, Washington.

- OGJ, Dec. 20, 1999, p. 45.

- Lidderdale, T., and Bohn, A., "Demand and Price Outlook for Phase 2 Reformulated Gasoline, 2000," Energy Information Administration, Washington, August 1999.

- Peckham, J., "EPA Propses 15 ppm Diesel Sulfur Rule," World Refining, June 2000, p. 5-3.

- Letter to Margo T. Oge, Director, Office of Transportation and Air Quality, EPA, Aug. 14, 2000, from the National Petrochemical & Refiners Association.

- "Draft Regulatory Impact Analysis for the Proposed Heavy-Duty Engine and Vehicle Standards and Highway Diesel Fuel Sulfur Control Requirements Rule, Chapter IX: Diesel Fuel Program Alternatives," EPA, Washington, May 2000.

- "Report criticizes API diesel sulfur outlook," Platt's Oilgram News, Vol. 78, No. 240.

- "Distillate Fuel Oil Supply and Distribution, 1984 to Present, Table S5," EIA Petroleum Supply Monthly, November 2000.

- "Adjusted Sales of Distillate Fuel Oil by End Use in the United States," EIA, Washington.

- Platt's Oilgram News, Vol. 80, No. 54.

The authors

Minoo F. Khorram is a technology specialist with Stone & Webster, Inc., Houston. She has 10 years' experience in refining and petrochemicals. Khorram has previously worked for two other engineering companies, concentrating on process design for gas plants and hydrotreaters. She holds a BS (1983) and an MS (1993) in chemical engineering from Texas A&M University, College Station, Tex.

Timothy E. Swaty is a senior technology specialist with Stone & Webster, Inc., Houston. He has 28 years' experience in most aspects of the petroleum refining industry. Swaty has worked for four different refining companies, two consulting firms, one engineering firm, where his duties included refinery-petrochemical planning, investment analysis, blending, refinery audits, performance control, competitor analysis, strategic planning, conceptual engineering, asset valuation, and market issues. He holds a BS (1974) in chemical engineering and an MBA (1979) and is a registered professional engineer in Texas, Kansas, and California.