Plentiful inventories of natural gas diminished drilling activity and thus production during the third quarter, lowering revenues for most US oil and gas companies. Continued economic weakness and import strength constrained the earnings of refiners and gas producers, yet strong oil and gas prices buoyed upstream earnings overall.

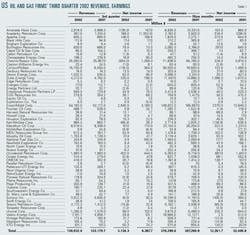

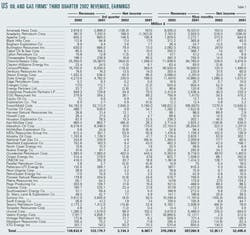

Most US-based exploration and production independents in Oil & Gas Journal's sample reported lower earnings from a year earlier, as did all of the integrated companies (Table 1). Among all 58 oil and gas producing firms in the sample, 17 reported improved profits from the same quarter a year ago.

The Canadian firms that OGJ sampled posted mostly stronger third quarter results as compared with the same quarter of last year (see related story, p. 20).

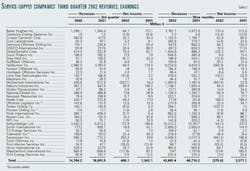

The financial results of US-based service and supply companies were dampened by weak demand for rigs and other equipment as well as diminished demand for oil field services in North America (Table 2).

Integrated companies

ChevronTexaco Corp. reported a $904 million net loss for the quarter. The loss is the result of a number of one-time charges against earnings, most notably a $1.55 billion write-down in the company's investment in Dynegy Inc. This write-down reduces the book value of ChevronTexaco's Dynegy investment to $400 million.

ChevronTexaco's results were lower than some analysts' expectations, including those of Steven A. Pfeifer of Merrill Lynch. Pfeifer calculates that a combination of various one-time charges slashed the company's quarterly earnings by $185 million. These items include a $90 million loss due to crude oil production in excess of sales and a $50 million loss for crude oil pricing and inventory effects in the refining and marketing segment.

Besides the Dynegy write-down, other special items during the quarter include $485 million in asset impairments, which were unanticipated and disappointing, Pfeifer said. Reserve write-downs occurred on assets in the US, Canada, and Africa.

ChevronTexaco E&P operating earnings were nearly unchanged from a year ago, although oil and gas output was down year-on-year because of adherence to production quota cuts by some members of the Organization of Petroleum Exporting Countries and because of production interruptions in the North Sea, Angola, Nigeria, and the Gulf of Mexico. Downstream earnings were off sharply from a year earlier due to weak refining margins.

ExxonMobil Corp. reported third quarter net income of $2.64 billion, down from $3.18 billion a year earlier. However, capital and exploration expenditures were up 15% from the same period a year ago to $3.56 billion, which compares with $3.1 billion in the second quarter of this year. Upstream earnings improved by $264 million from the second quarter, primarily reflecting the continued upward trend in crude oil prices. ExxonMobil refining-marketing earnings declined due to weak US refining margins and unfavorable foreign exchange effects and to marketing margins that were lower and remained weak overall. Chemicals earnings of $353 million were more than double year-earlier results primarily due to record third quarter sales volumes and a net improvement in margins.

Independents

Although most US oil and gas producers reported a large decline in profits, a few independents posted an improvement in net income compared with third quarter 2001. Among those with greater net income were Burlington Resources Inc., Harvest Natural Resources Inc., Pogo Producing Co., and Vintage Petroleum Inc.

Houston-based Harvest Natural Resources, formerly Benton Oil & Gas Co., announced third quarter earnings of $12.1 million, up from $1.7 million a year ago. The company attributes some of the increase to a $3.3 million partial recovery of a bad debt and a $1 million adjustment to the gain on the sale of Russian subsidiary OAO Arctic Gas Co.

In addition, production was up from a year earlier at the firm's operations in Venezuela and Russia.

Swift Energy Co., Houston, reported that income and cash flows for the quarter were lower primarily as a result of the shift of production from US natural gas to New Zealand natural gas and higher interest expense. Average composite gas prices were down 11% from a year earlier.

Devon Energy Corp., Oklahoma City, posted record high third quarter oil and gas production and revenues, but net earnings declined from a year ago due to a loss from discontinued operations resulting from the sale of the company's operations in Argentina.

Refining, petrochemicals

Weak margins continued to punish refiners during the third quarter. Valero Energy Corp., San Antonio, reported that net income dropped 71% from third quarter 2001, while revenues jumped 86%. Valero's acquisition of Ultramar Diamond Shamrock Corp. closed on Dec. 31, 2001, so only the 2002 results include operations of the combined entities.

Bill Greehey, Valero's chairman and CEO said, "For the fourth quarter, our financial position continues to strengthen, given the recent significant recovery of refined product margins and the improved sour crude oil discounts. With respect to industry fundamentals, we are encouraged by the fact that inventories of both gasoline and distillate have declined to below-average levels for this time of year. This has primarily been due to refinery production cuts, heavy turnarounds, hurricanes along the (US) Gulf Coast, and strong product demand."

Greehey added that the improvement in refining fundamentals seen thus far in the fourth quarter has resulted in refined product margins increasing more than 25% from the third quarter.

"On the feedstock side of our business, sour crude oil discounts have widened considerably from the very low levels we saw earlier this year. For October and November deliveries of our benchmark sour crude oils, the discount to (West Texas Intermediate) is averaging $2.90/bbl, which is an improvement from $2.42/bbl in the third quarter and $2.06/bbl in the second quarter. We believe this trend will continue, given the increased availability of OPEC sour crude oils on the market and the fact that Iraq has increased its exports to roughly 1.7 million b/d, Greehey said."

Sunoco Inc. reported a net loss of $9 million for the third quarter vs. net income of $92 million for the 2001 third quarter. Sunoco's chemicals segment earned $10 million in the third quarter vs. a break-even quarter in the prior-year period. The company attributes the increase primarily to higher polypropylene margins and increased phenol and related products sales volumes. Results from the plasticizers business and Sunoco's joint venture interests were also up vs. the prior-year period. Total chemicals sales volumes increased 6% from a year earlier.

Sunoco's refining and supply segment had a loss of $18 million, however, compared with income of $49 million in third quarter 2001. The decline was largely due to lower margins in each of Sunoco's refining centers, particularly refineries in Toledo, Ohio, and Tulsa, compared with the exceptionally strong margins of the prior year.

Service and supply companies

Weak demand for land rigs, low day rates, and inclement weather in North America are among the factors that depressed the results of many service and supply companies. Of the 37 companies in this sample of firms, only five improved on their third quarter 2001 profits. Some of these are GlobalSantaFe Corp., Grant Prideco Inc., and Hornbeck Offshore Services Inc.

Pioneer Drilling Co., San Antonio, reported a net loss of $1.3 million for the quarter ended Sept. 30. Michael E. Little, chairman and CEO, stated that although rig demand continued to be weak and weather conditions were poor, the company was successful at keeping its rigs utilized and is beginning to see a slight increase in overall demand. Pioneer was affected during the quarter by wet conditions in July that delayed the movement of several rigs for as long as 2 weeks in some cases.

Halliburton Co. reported net income of $94 million for the quarter, down from $179 million a year earlier. Revenues declined 12%. The company said that reduced gas drilling activities in the US and Canada are the reasons for the diminished financial results. Chairman, Pres., and CEO Dave Lesar commented that Halliburton bolstered liquidity through the sale of noncore assets and cash flow from operations. The company's results for the quarter also benefited from a corporate reorganization, which reduced costs and strengthened efficiencies, Lesar said.

Analyst James Stone of UBS Warburg said that Halliburton's results from pressure pumping and drillbits exceeded expectations, but engineering and construction unit KBR had a disappointing quarter and should have a hard time meeting its target of 3% operating margins in 2003 as it continues to see extremely low margins.