Far East deepwater exploration to see strong growth, bias to gas

In the next 20 years or more, oil and gas exploration in deepwater basins of the Far East will be of worldwide significance in terms of production growth. Thus far, exploration results in the region have been mixed, with a strong bias toward gas discoveries.

This discussion will review the Far East region in a global context and examine regional trends based on IHS Energy Group's Global E&P database. For purposes of this article, "deepwater" refers to 200 m or more while "ultradeepwater" refers to 500 m or more.

Global overview

The first well drilled in more than 200 m of water, excluding Deep Sea Drilling Project wells, was Deminex-Agip's KK-6-1 in Trinidad in 1971. It also was the first reported hydrocarbon discovery in deep water. However, some publications indicate that deepwater drilling occurred off Newfoundland in the 1960s.

In ultradeep water, the first well was Shell's Astarte Marine-1 drilled off Gabon in 1974. In 1976, the Esso W9-B-1 wildcat in Thailand was the first reported discovery in more than 500 m of water.

In mid-2002, the world water depth record (outside the Gulf of Mexico) stood at 2,879 m when Petrobras spudded the 1-RJS-573 exploration well off Brazil in January 2002. The current world record, however, belongs to the Gulf of Mexico, set in May 2001 by Unocal in 2,970 m of water near the US-Mexico maritime boundary.

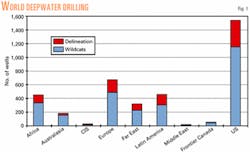

As of mid-2002, 3,708 deepwater exploration and delineation wells were drilled worldwide. The breakdown is 2,730 wildcats and 978 delineation wells. Due to the method the US Minerals Management Service (MMS) uses to report drilling, IHS Energy Group has estimated the figures taken for the wildcat-delineation split.

The US dominates deepwater drilling activity with 40% of the total wells drilled (all in the Gulf of Mexico from the records available), followed by Europe 18%, Africa 12%, Latin America 10%, Far East 9%, Australasia 5%, and Frontier Canada 2% (Fig. 1). The Middle East and CIS each has less than 1% of the total.

The average success rate for the deepwater wildcats drilled is 28%, with Africa recording the highest success at 39%. This is due to the remarkable success of the deepwater African plays, especially the Nile Delta offshore where the success rate has been 70% overall and an extraordinary 80% since 1999.

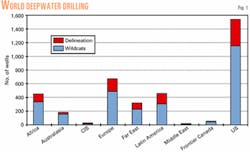

Some 118 billion bbl of oil equivalent (boe) have been discovered worldwide, including 47 billion bbl of oil and more than 400 tcf of gas. Europe holds the largest amount of these reserves with 24%, followed by Africa 21%, CIS 18% despite low drilling levels, Latin America and Australasia 12% each, the US 9%, and Far East 4%. The Middle East and Frontier Canada regions contribute less than 1% of reserves (Fig. 2). Due to the method of reporting by the MMS in the US, it was not possible to break the numbers down.

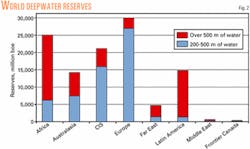

Fig. 3 shows the reserves mix with gas the dominant hydrocarbon in all regions except Africa and Latin America. The overall deepwater reserves split is 62% gas and 38% oil. When considering ultradeep water only, the ratio is slightly more favorable to oil.

When discussing deepwater reserves, there are likely to be a number of cases where operators or national oil companies disclose oil reserves following a nongas discovery. The total of 400 tcf is IHS Energy's estimate of deepwater reserves, considered quite conservative.

Far East status

The first deepwater license granted in the Far East was just northwest of Cebu Island in the Visayan Sea in the Philippines.

It was awarded in May 1960 to American Asiatic Oil Co. Mobil and Esso were understood to be part of this consortium. Oil found in shallow onshore wells at Maya at the northern end of Cebu triggered the decision to become involved offshore.

Since then, more than 460 contracts or concessions have been awarded in the Far East where a reasonable portion of the tract has been in more than 200 m of water. Mid-2002, IHS Energy's database indicates 120 active blocks in more than 200 m of water.

The longest standing deepwater acreage held by an international oil company is the Unocal-operated East Kalimantan Production Sharing Contract (PSC) Extension in the Kutei basin in western Indonesia. This was awarded in July 1968 to the predecessor of Unocal, Union Oil, as the East Kalimantan PSC.

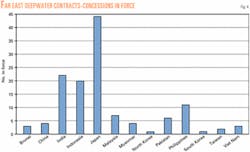

The distribution of active contracts or concessions among Far East countries is distorted due to the large number of licenses awarded to Japan in the 1960s (Fig. 4). The most recent award in Japan was made in 1985, with local companies holding all the acreage.

The next biggest player is India, where 22 blocks are active primarily in the Konkan-Kerala-Lakshadweep basin off the southwest coast and Krishna-Godavari basin off the east coast. Indonesia follows with 20 blocks, more than half between Kalimantan and Sulawesi.

Some 875,000 sq km of acreage in more than 200 m of water is held in the Far East. Japan accounts for 54%, India 21%, and Indonesia and Malaysia 5% each. Total deepwater contracts or concessions held in the region comprise almost 30% of the licensed acreage.

Outside of Japan, the biggest operators are TotalFinaElf (which has a strong position in Pakistan), closely followed by Murphy (all Malaysian-Sabah acreage), Shell, Conoco, and Petronas. More than 20 companies operate deepwater acreage in the Far East.

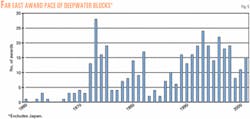

Japan is excluded from Fig. 5 to reveal a clearer picture of activity. The intense period of deepwater awards in the Far East can be seen between 1989 and 1998. An economic crisis in the region in 1998, coupled with a falling world oil price, corresponded with a regional decline in exploration activities, both in conventional water depths and onshore.

The series of peaks in the 1972 to 1975 period is primarily due to some 55 licenses awarded in the Philippines during the country's "mini-boom." The peak followed President Marcos' modification of the country's fiscal terms.

However, a number of these blocks were relatively small, and it is likely that due to the nature of fiscal terms in the Philippines some were held for short periods before being awarded under a new license often of similar configuration. After a lull, a new batch of awards in the Philippines again generated renewed deepwater activity in the late 1970s, with a peak in this cycle in 1982 when India awarded 10 blocks.

Mid-1980s figures again reflect a relatively quiet exploration period throughout the region. Moving into the late 1980s and early 1990s, industry interest through the Far East was high: China, Burma (Myanmar), Malaysia, the Philippines, and Viet Nam all awarded numerous frontier blocks to international oil companies. The Philippines was again a significant deepwater player, but due to short contract periods the blocks there were rapidly recycled.

Hot spots during that period included the deepwater basins of eastern Indonesia and the East Java Sea, the Philippines, and Viet Nam, as well as Malaysian portion of the South China Sea.

No doubt the Chinese made the most controversial award during this cycle in June 1992. The granting of the large WAB-21 contract area to Crestone Energy of Denver caused international concern since it overlaid parts of the Spratly Islands, which included acreage on the eastern edge of the Nam Con Son basin claimed by Viet Nam.

This block is still under contract and operated by Harvest Natural Resources Inc., formerly Benton Oil & Gas. Viet Nam has since awarded blocks to Conoco (Blocks 133 and 134) that partly overlap WAB-21.

Following the sharp drop in awards in the Far East during 1999, the next 2 years showed an apparent increase in industry interest (Fig. 5). However, a closer look reveals some 60% of the awards were made in India to local companies following the New Exploration Licensing Policy (NELP) I and II rounds, giving a false impression of the region's activity level.

The overall lack of awards throughout the Far East since 1998 is a big cause for concern. The low level of bids received for deepwater Brunei and Indonesian acreage recently highlighted the region's problems of attracting investment.

Far East seismic work

Due to the methods used by companies reporting seismic surveys, it is difficult to obtain reliable statistics for the deepwater.

A number of vessels acquired deepwater data in the late 1960s and early 1970s, but the first 2D "deepwater-specific" seismic is thought to have been collected in 1974 by Union Oil or Esso. The data covered Andaman Sea blocks off Thailand.

Meanwhile, the first 3D deepwater seismic acquired in the Far East is attributed to Cities Service in the vicinity of its North West Palawan SC-14. According to retired Cities Service veteran Allen Hatley, the data were first obtained in late-1977 across the shallower Nido area as part of the development feasibility study. Then, the study extended to other areas including Matinloc and the deepwater Galoc structure in March 1978, using GSI's Tasman Sea seismic vessel.

Records indicate Cities Service was far ahead of the game. The next 3D deepwater work in the region was most likely performed by Brunei Shell Petroleum (BSP) and Shell on northern Borneo (Brunei, Sarawak, and Sabah) some 16 years later in 1994-95. Shortly thereafter, Shell obtained 3D data across Malampaya-Camago in the Philippines.

Far East drilling

The first deepwater well, drilled in late-1972 in western Indonesia, was Shell's Alveolina-1 in 352 m of water in the South Central Java Sea.

Shell was apparently encouraged to explore the offshore by gas-prone source rocks and shows identified onshore, but Alveolina-1 was dry. The wildcat was drilled using the Sedco 445 drill ship and is, according to IHS Energy Group records, the world's first deepwater well drilled with a dynamic positioning (DP) system on such a large vessel.

Alveolina-1 was the Shell's first well in a 2-year deepwater program, followed by the dry Borealis-1 in the same contract area. The rig then moved to deepwater locations in Australia, Brunei, Gabon, and Mauritania for Shell.

In ultradeepwater, the first well drilled was Esso's W9-A-1 in 583 m of water in 1976. It was located on the W9 concession area in the Andaman Sea off Thailand in 1976. The Esso well was drilled using the Discoverer 511 drill ship.

Drilling of the W9-A-1 well was problematic, with only 1,800 m of section drilled in 10 weeks. Apparently, when the crew ran the riser, a ball-joint fractured and the BOP stack fell to the ocean floor without any attachment. The lack of an appropriate substitute required a lengthy recovery operation and was in fact the first time a BOP stack had been recovered by "trawling" in such deep water.

Esso then completed a 5-well deepwater program following modifications to the rig. Esso reportedly spent $40 million on this pioneering drilling program that, at the time, represented a challenging technical achievement.

The first reported deepwater discovery in the Far East, and the first ultradeepwater well in the world, was Esso's W9-B-1 gas well in the Andaman Sea, drilled in 1976 in 802 m of water. The well encountered a 71 m gross gas column based on logs and some oil staining that was observed in cores. Plans to conduct DSTs on the well failed due to mechanical problems.

The current drilling record for deep water in the Far East goes to Unocal's East Kalimantan wildcat Geng-1 in 2,049 m of water drilled between May and June 2000.

Thirty operators have drilled deepwater wells in 10 Far East countries. Outside of Japan, the most active operator has been Unocal, with more than 30% of the total. With the exception of 7 wells off Thailand, all drilling by Unocal has been in Indonesia. Mobil, Shell, Oil & Natural Gas Corp., and Amoco followed Unocal.

Reserves picture

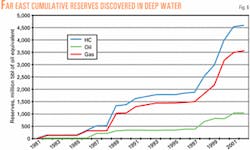

Information in the IHS Energy Group database in mid-2002 indicated that deepwater reserves in the Far East totaled 4,598 million boe.

This includes 1,040 million bbl of oil and 20 tcf of gas, or 77% to 23% in favor of gas in terms of barrels of oil equivalent. Interestingly, 70% of the total reserves are in ultradeepwater fields.

The largest amount of Far East reserves is held in Indonesia with 47%, followed by the Philippines 21%, where virtually all the hydrocarbons are contained in Malampaya-Camago field off Northwest Palawan.

Malaysia with 9% of reserves has generally been disappointing, though full details of some of Shell's recent drilling are still not available, while India with 8% has registered success in the first half of 2002 which is not yet included in these figures. Following India are Viet Nam 7% and China 5%.

Gas dominates the region, with the exception of China, which has mainly oil reserves in the deep water (Fig. 3). Meanwhile, the rest of the Far East has more than 60% gas, with the Southeast Asia countries themselves being very gas prone.

Creaming curves created from the database (Fig. 6) show two kicks. One in the late 1980s can be largely attributed to the Malampaya-Camago discovery off Northwest Palawan. Another occurred in the late 1990s, when Unocal started to register success in the deepwater Makassar Strait off Indonesia. Interestingly, its early successes contained more oil, but the company encountered more gas as it stepped out into deeper water.

Fields on production

Four deepwater fields are on production in the Far East, two off the Philippines and two off China.

In the Philippines, Alcorn cyclically produces from West Linapacan A oil field in the Northwest Palawan basin. The field was discovered in 348 m of water in 1990, and development was fast-tracked, with official production starting in May 1992.

The field proved challenging and although originally thought to contain more than 100 million bbl recoverable, this figure is now estimated to be below 20 million.

The decision to develop the field resulted from a fortunate set of factors that included attractive fiscal terms of the Philippines and the availability of equipment from nearby, shut-in Nido field.

The second producing field in the Philippines, also in the Northwest Palawan basin, is ultradeepwater Malampaya-Camago field in 736 m of water. This was discovered originally by Occidental in 1989 (Camago-1) and is now operated by Shell.

Gas production started from the field in September 2001, with plans under way to develop the oil reserves. Estimated reserves in the Miocene reef are 75 million bbl of oil, 120 million bbl of condensate, and 3.5 tcf of gas.

Phillips and Cities Service mapped the giant Malampaya-Camago reef in the late 1970s and, after Shell took a farmout on all Phillips-operated blocks in the Philippines, an agreement to drill was prepared and approved in 1982. Since the reef extended onto Cities Service's adjacent block, approvals were contingent upon Cities' participation. However, Cities apparently had a "no deepwater policy" and the prospect was not drilled.

By 1984, Shell and Phillips left the Philippines, and Cities was acquired by Oxy. It was not long before Cities-Oxy joined the retreat from the Philippines. However, Oxy returned in 1989 when the dual Malampaya-Camago reef was picked up in 1988 under a new contract.

After drilling Camago-1 in 1989, which was mainly gas, Oxy personnel relinquished the contract area due to their inexperience in the Far East gas market. However, at the last minute, they received an unsolicited farmout request from Shell.

Malampaya-1 subsequently tested at the rate of more than 12,600 b/d of oil, 38 MMcfd of gas, and 1,623 b/d of condensate from the Nido limestone. The field was first thought to be a major oil field, but appraisal drilling proved it to be a significant gas field with an oil rim.

Between Feb. 28 and Apr. 14, 1988, US independent Alcorn produced oil for three months from Galoc field in Northwest Palawan. A total of 383,460 bbl was produced. Galoc field, in more than 305 m of water, has never been developed, despite a number of attempts to prove its economic viability.

Alcorn purchased the field from Oxy following its takeover of Cities Service. Potential development will depend on bringing other nearby fields such as Galoc South and Octon into a combined development.

In the Pearl River Mouth basin off China, Amoco (now BP) brought the 170 million bbl Liuhua 11-1 oil field onstream in April 1996. Amoco had discovered the field in 1987 in 317 m of water after wildcat Liuhua 11-1A tested at the rate of 2,240 b/d of 20° gravity crude. Two subsequent appraisal wells proved a large reservoir of more than 1 billion bbl in place, but the recovery factor is low at 13%.

Complications arose in the development due to the relatively shallow depth of its Miocene carbonate reservoir and the stratigraphic pressure. Amoco and the Nanhai East engineering teams tested a number of concepts before finding the best solution to develop the field using a permanent, floating production system (FPS).

In 1997, Statoil started production from the smaller Lufeng 22-1 oil field in 330 m of water in the same basin. Occidental discovered the field in 1989, and Ampolex assumed operations in 1991. Statoil assumed Ampolex's interest in 1995.

Reserves in the Miocene carbonate reservoir are a modest 30 million bbl, but with new technology and a flexible contractual arrangement, it was made economically viable despite the low-pour point and waxy nature of the crude.

Meanwhile, development is under way on Unocal's West Seno oil and gas field off East Kalimantan, with first production cited for mid-2003 from the 210 million to 320 million boe field. According to Unocal, its net investment in the West Seno Phases I and II will be $615 million, with Overseas Private Investment Corp. to provide $350 million in financial support. In the same area, Unocal will bring Ranggas and Merah Besar oil and gas fields into production in 2006.

Recent activity

During the past 12 months, perhaps one of the most closely followed deepwater events in the Far East has been the first round of bidding for open exploration acreage (the Petroleum New Areas) in Brunei.

The acreage consisted of two previously unexplored and unlicensed blocks in 1,000 to 2,800 m of water. In February 2002, preliminary awards were announced and awarded to Shell Deepwater Borneo with partners Conoco and Mitsubishi (Block K); and to TotalFinaElf with partners BHP Billiton and Amerada Hess (Block J). No timetable has been announced for the formal awarding of the blocks. Contract negotiations are still in progress.

In Indonesia, there was general disappointment in the country's deepwater Kalimantan-Sulawesi tender round held in 2001 despite the location of the blocks, which are close to Unocal's hydrocarbon discoveries.

Five blocks were offered in the protracted round, and awards were made in December to TFE and its partners, Pertamina and Inpex (Donggala PSC) and to Amerada Hess and its partners Pertamina and Petronas (Tanjung Aru PSC). Little-known Malaysian companies Zodan and Zudavi were awarded the Popodi and Papalang PSCs, respectively.

Amerada Hess has already drilled two wells in its new contract area, Halimun-1 and Papandayan-1, and encountered gas in both.

In February 2002, Migas announced a list of tender blocks with a bid deadline of July 31, 2002. The list included five deepwater blocks between Kalimantan and Sulawesi. The results of the round had not been disclosed at this writing.

In the deepwater Rapak PSC off East Kalimantan, Unocal announced in April 2002 that its Ranggas-5 appraisal well penetrated 62 m of net oil pay and 188 m of net gas pay. This represented more net pay than any well in Unocal's history.

The results of the appraisal program have enabled Unocal to estimate the gross discovery volume of the main Ranggas structure at 200 million to 350 million boe. Unocal also announced at about the same time that reserves in the Gendalo-Gandang complex were 2 tcf to 2.5 tcf of gas following appraisal drilling.

In the eastern Timor Sea in Indonesia waters close to the Indonesia-Australian Zone of Cooperation, Inpex is appraising the late-1999 Abadi-1 gas discovery in the Masela PSC (580 m of water). According to industry sources, the large structure holds 5-10 tcf of gas in Jurassic reservoirs.

It was expected that Sri Lanka would open bidding on the deepwater blocks in the Gulf of Mannar during the first quarter of 2002. The area was the subject of a 2D deepwater seismic survey by TGS-Nopec in 2001, where previously only one wildcat had been drilled. However, this round has been deferred until late 2002 or early 2003. TGS will undertake further seismic to help define the structure and number of blocks to be offered in the bidding round.

On Mar. 27, 2002, India launched the third licensing round under terms and conditions of the New Exploration Licensing Policy (NELP). The round, which closed Aug. 28, 2002, included 9 deepwater blocks. It is hoped that recent deepwater successes by Cairn Energy and Reliance, a local company with its Canadian partner Niko Resources, will help promote the acreage to international oil companies.

In the past two NELP rounds, awards have been presented mainly to Indian companies. In June 2002, it was reported Reliance had made a gas discovery on deepwater block KG-DWN-98/3 off the east coast. It plans two more wells in this program.

During the past year, Shell has drilled several deepwater wells in Malaysia and Brunei off northern Borneo. These include Ramin-1 and Ubah-1 in Sabah waters and Pungguk-1, Bilis-1, and Suit-2 in Brunei. However, largely due to the proximity of the wells to the blocks on offer in the Brunei deepwater round, the operator has released little information.

Meanwhile, Murphy began a 4-well deepwater program on Sabah Block K during March 2002. The first well, Bagang-1, encountered noncommercial gas. Murphy moved the rig and spudded Bliais-1, which also failed to encounter significant hydrocarbons.

Murphy's fortunes changed on the third well, Kikeh-1. The wildcat, in 1,333 m of water close to deepwater Brunei J, encountered significant oil pay but was not tested.

Murphy moved 1 mile and spudded the Kikeh-2 appraisal well in August using the Ocean Baroness semisubmersible. That encouraging well found the same five primary oil reservoirs as the discovery well, and Murphy was moving the rig 2 miles to drill Kikeh-3 in mid-October in a further attempt to ascertain the structure's size. Based on information available, the Kikeh structure could extend into Brunei waters

Plans to open two deepwater blocks in China's Baiyon sag in the Pearl River Mouth basin received a boost when China National Offshore Oil Co.'s wildcat Liuhua 19-3-1 encountered gas in 2001. This well, along the boundary between the Panyu Low uplift and Baiyon sag, confirmed the southeastern margin is situated in the migration path of hydrocarbons from the Zhu II depression.

CNOOC is involved in drilling a 3-well program in the area in less than 200 m of water due to unavailability of deepwater rigs in China and is hoping to follow the success of Liuhua 19-3-1 to draw further interest in the area. Sources indicate one of these wells, Panyu 30-1-1, has encountered more than 100 m of gas pay.

Other deepwater wells worth watching in the near future include Murphy's wildcat on Block H in Sabah; Shell's programs on Block G in Sabah and Block E in Sarawak; and Amerada Hess' drilling on Block F in Sarawak, where TFE completed a farm-in during May 2002.

In the Philippines, Unocal launched an initiative to drill 5-6 wells in 2002. However, this may have been delayed for failure to attract partners. The program, expected to focus on deepwater prospects in the Northwest Palawan and Sulu Sea basins, will benefit from Unocal's low-cost saturation exploration drilling technology.

The future

Evidence thus far indicates the deepwater basins of the Far East seem gas prone, unlike counterparts in West Africa and Latin America. Initial studies on some of the lesser-explored basins, such as those in eastern Indonesia, the Bengal Delta, and the South China Sea, suggest these basins also may be gas prone.

Although there is an abundance of undeveloped gas in conventional water depths and nearer potential markets, the dynamics of supply and demand in the Far East are changing. For example, the Chinese see themselves becoming less dependent on Middle East supplies of oil and gas, and there is a general recovery in the demand growth for the region as a whole.

It is very clear that liquefied natural gas will remain a key part of Far East supply. And with new, planned LNG receiving terminals in China and a strong projected LNG demand growth until 2020 in Japan, South Korea, Taiwan, and India, when coupled with evolving technology, there is every likelihood that a number of deepwater gas fields (off East Kalimantan, Sabah, Sarawak, and Brunei, particularly) will be developed.

Key deepwater players in the Far East, such as TFE, Unocal, and Conoco, have considerable expertise from other deepwater regions, and it is believed their knowledge will continue to be applied to Far East "hotspots." Additionally, it is only a matter of time before national oil companies in the region, particularly Petronas (with its strong capabilities in its own deepwater basins in Malaysia), become more dominant in deepwater exploration.

With only modest success in the deepwater areas of the Far East to date, international companies will need further encouragement to embark on exploration activities. For a government to attract the type of investment that recognizes elevated costs and risks associated with deepwater, and with many of the Far East deepwater basins being gas prone, the need for incentives in the region becomes more critical.

Suitable models can be found in the Gulf of Mexico—where relatively small companies have been extremely successful in deepwater areas—in Egypt's Nile Delta, in Australia, and even in the traditionally higher-cost areas off Northwest Europe.

The author

Ian Cross ([email protected]) is vice-president of worldwide information services for IHS Energy Group. Based in Houston, he worked as a geologist for Elf, BP, and Fina, and for IHS Energy Group in Singapore since 1990. He has a BSc from Cardiff University.