Economic evaluation shows polymer flooding effectiveness

Economic analysis shows the effectiveness of polymer flooding in Daqing's Lamadian oil field, in northern China.

Daqing Oilfield Co. Ltd., a unit of PetroChina Co. Ltd. operates the field. China established PetroChina on Nov. 5, 1999, as a joint stock company with limited liabilities as part of the restructuring of the China National Petroleum Corp.

The polymer flood is in laminar sandstone reservoirs controlled by structure. The field has a gas cap and began producing high water cuts after producing for more than 29 years.

Experimental polymer flooding began in 1994 on the field's south tract in a thick oil bed, Pu I 1-2. The flooding increased oil production, decreased water production, and increased expected ultimate recovery by about 11%.

Since 1996, polymer injection has started on five tracts: La-south test, northeast, south-center, north-north, and northwest.

By 2001, the tract area included 50.4 sq km (12,500 acres) containing about 106.7 million tonnes (780 million bbl) of oil.

The economic analysis compared three cases for producing the Lamadian oil field. These include polymer flooding, polymer injection with high production rates, and no polymer injection but with a natural waterflooding development.

Reservoir description

The reservoirs in the field are in a structural culmination at the northern part of the Daqing ChangYuan second-order structure and southward of a slow and stable structure saddle point between Sa'ertu structure culminations. The structure is a dissymmetry short-axes anticline incised by two groups of major faults extending north-eastward into three large blocks.

This entire oil field area is 100 sq km and crude oil in place was 814.7 million tonnes. The gas-cap area is 32.3 sq km and contained 9.96 billion cu m (352 bcf) of gas.

From top down, the oil reservoirs include the Gaotaizi, Putaohua, and Sa'ertu formations. These reservoirs are of a lacustrine facies formed by sandstone and silt-fluvial-delta sedimentation.

This oil field is characterized by the large number of oil-bearing formations. An average well drills through 70 layers. Sandstone thickness is 112.1 m with an effective 72-m thickness. The sands have an average 600 md gas permeability and a 240 md effective permeability.

The reservoir has a uniform hydrodynamic system in which structure controls the distribution of oil, gas, and water. The oil-gas interface is at –1,050 m, although a viscous crude is present below –950 m. The structural oil column is 280-m high, and structural gas column is about 90-m high.

Crude oil properties are poor. Subsurface crude viscosity is 10.3 cp. The crude solidifies at 26° C. and has a 23% wax content. The original GOR was 48 cu m/tonnes (230 scf/bbl).

Development of the field started in 1973, and production methods varied over the years. Development efficiency improved over time and for the last 14 years production has remained at about 10 million tonnes/year (200,000 bo/d). The operations have kept the oil-water interface comparatively stable during this time.

Since 1994, experimental polymer flooding has taken place at La-south test site in the Pu I 1-2. The test showed good oil displacement, water reduction, and increased ultimate recovery of about 11%.

Based on this test, four other tracts have been put on polymer injection since 1996.

Polymer flooding now accounts for more than one third of total production from the field and has become an integral part of the development. The process now covers 50.36 sq km or 86.7% of the total field area that contains about 106.7 million tonnes of oil or about 84.2% of total reserves.

The south-center tract is the only remaining area that has not been polymer flooded. The 9 sq km area has about 20 million tonnes of remaining oil reserves.

By September 2001, cumulative oil production from polymer flooding was 137.5 million tonnes or 17.66% of the oil in place.

The calculation of incremental production from polymer flooding was 72 million tonnes, or 9.31% of the oil in place.

Tract economic

Each tract has had polymer injection at different times. This was accounted for in the economic evaluation.

The years covered for tract are as follows:

- La-south tract—1993-2001 polymer injection and 1993-2010 natural production.

- South-center tract—1995-2005 polymer injection and 1995-2015 natural production.

- Northeast tract—1994-2005 polymer injection and 1994-2012 natural production.

- Northwest tract—1998-2008 polymer injection and 1998-2015 natural production.

- North-north tract—1995-2005 polymer injection and 1994-2013 natural production.

For assessing polymer injection economics efficiency, the study reduced the subsequent waterflood production period by normalizing the effects of polymer flooding.

Table 1 shows the economic comparison of the three cases: polymer flooding, polymer injection for high production rates, and no polymer injection but natural development.

For the northeast tract polymer flooding results in an after-tax internal rate of return (IRR) of 42%, which is more than the corresponding base 12% return rate. After-tax financial net present value is ¥493.9 million ($60 million).

These values show the profitability of polymer injection. Static payback time of northeast tract polymer flooding incremental production is 4.28 years with a profitability index of 1.23 years. The 4.28 years is lower that the industry standard of 6 years.

Because the evaluation uses different periods for each case, the analysis includes an annual value to compare the results of different cases. For instance in the northeast track polymer flooding has an annual value of ¥138.4 million compared to ¥121.4 million for no polymer injection. Obviously the polymer flooding is better.

Polymer flooding with high production in the La-south test tract has a negative net present and therefore is not practicable. Also the total annual value of polymer injection is lower than that of no polymer injection. This case, therefore, is worse than for no polymer injection but with natural development.

Field economics

La-south test tract was the first tract to inject polymer and the northwest tract was the last. Polymer flooding evaluation for the field, therefore, is from 1993 to 2008 and natural production time is from 1993 to 2015.

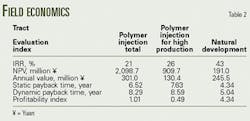

Table 2 shows the economics for all tracts combined.

For field polymer flooding project, after-tax IRR for incremental production is 26%, more than the corresponding 12% base return rate. After-tax financial net present value is ¥910 million.

Static payback time of field polymer flooding incremental production is 7.63 years, more than the 6-year standard. The profitability index is 0.49.

With an annualized net value, polymer flooding has a annual value of ¥300.9 million compared to ¥245.5 million for no polymer injection but natural development.

Analysis

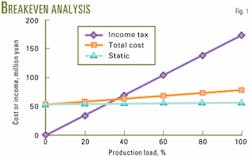

Fig. 1 shows the breakeven analysis for polymer injection in 2004. The breakeven point of this project is 37.24% and the field's oil production resulting from polymer injection is 1.48 million tonnes.

This calculation for 2004 shows that as long as design capacity reaches 37.24%, that is to say, annual production reaches 0.55 million tonnes, the field's polymer injection total could lessen costs, indicating that there is little risk in this project.

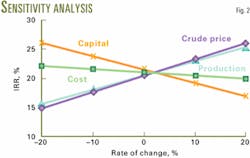

Fig. 2 analyzes the sensitivity of the economics to changes in crude price, investment, and production rate. The figure indicates that crude price and production are the most sensitive factors.

In Fig. 2, if we assign an IRR of 12% then the production maximal rate of change is 30%, and cumulate oil production from the field's polymer injection is 22.6 million tonnes.

Cumulative production from polymer injection was 14.65 million tonnes by the end of 2001. But by the end of 2002, cumulate production from polymer injection would be 17.35 million tonnes, more than the breakeven point The economics, therefore, shows that polymer injection is effective.

Acknowledgments

The authors thank Caoyan and Zouyuhui for their aid in preparing the figures.

Bibliography

Chinese Oil And Natural Gas Parent Company Plan Bureau, Petroleum Industry Construction Project Economics Evaluation Way And parameter, Second Edition, Petroleum Industry Press, 1994.

Caipengzhan, Oilfield Development Economics Evaluation, Petroleum Industry Press, 1997.

The authors

Zhou Zhijun is a lecturer at the Daqing Petroleum Institute. His research interests are reservoir simulation and oil and gas development engineering. Zhou Zhijun holds a BS in petroleum engineering, an MS and PhD in oil and gas development engineering, all from Daqing Petroleum Institute.

Huang Yongmei is an engineer at Daqing Petroleum Insitute. Her research interests are computer applications.