OGJ Newsletter

Market Movement

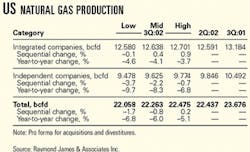

US gas production declines again

A survey of 30 of the largest US gas producers indicates that US gas production declined by 1% sequentially in the third quarter and likely will be down 6% for the year as a whole, analysts at Raymond James & Associates Inc., St. Petersburg, Fla., reported last week.

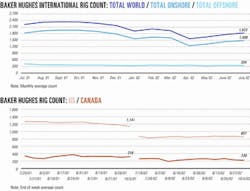

It marked the fifth consecutive quarter that US gas production has declined, they said. "Furthermore, although the rig count bottomed in March, drilling ac -tivity has not increased significantly and is far short of the levels needed to overcome natural de-clines. Conse-quently, we are likely to continue seeing sequential declines in production for the foreseeable future," said the analysts. They cite a "high probability that actual reported results will fall somewhere between our low and mid cases" (see table).

For one thing, data furnished by the surveyed companies did not account for the impact of Tropical Storm Isidore on production in the Gulf of Mexico during the last week of September. The US Minerals Management Service estimated that as much as 30 bcf of gas was shut in because of that storm.

That, said Raymond James analysts, "would have the impact of reducing total US gas supply during the quarter by 0.5%. Regardless, we expect the actual reported results to show at least a 1% sequential decline, excluding the impact of the storm, which would provide yet another data point supporting our thesis that US natural gas production is deteriorating rapidly." F

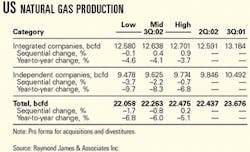

War premium price for oil fades

Even as US crude oil inventories fell to a 20-year low, New York and London markets last week trimmed the war premium that has recently boosted oil futures prices.

Sparked by uncertainties over possible military action by the United Nations—or at least the US—against Iraq that might disrupt oil supplies, that premium has added $2-4/bbl to near-month oil futures contract prices.

By Oct. 9, the November contract for benchmark US light, sweet crude was at $29.35/bbl on the New York Mercantile Exchange, down from its Sept. 27 closing of $30.54/bbl.

Initial price drops came in the aftermath of Hurricane Lili that moved through the central Gulf of Mexico off Louisiana Oct. 2-3. But analysts attributed subsequent daily erosion of NYMEX oil prices to growing doubts over immediate US military action against Iraq.

Ironically, record-low US crude oil in- ventories—normally a bullish market signal—are one reason traders are now bearish, assuming that the risk of disrupting energy supplies further cannon be greater.

Meanwhile, the American Petroleum Institute said US crude oil stocks fell by 2.6 million bbl to 273.3 million bbl during the week ended Sept. 27. MMS reported that gulf production totaling 206,406 b/d of oil and 1.4 bcfd of natural gas was still shut in Oct. 9 as a result of Lili. With the Louisiana Offshore Oil Port also shut down several days by storm conditions, US oil imports dropped more than 1 million b/d to 7.7million b/d. US refineries were operating at 84.7% utilization during that period, down from 91.5% utilization the previous week and 92.8% during the same period last year.

As a result, US gasoline production dropped by 399,000 b/d to 8.3 million b/d, while total distillate production fell 293,000 b/d to 3.3 million b/d. US gasoline inventories fell by 3.6 million bbl to 206 million bbl, and total distillate stocks dropped 2.4 million bbl to 127.6 million bbl. That put total US crude and petroleum product inventories at an 18-month low, "in part reflecting the tightening of stocks globally," said Matthew Warburton at UBS Warburg LLC, New York.

Industry Scoreboard

null

null

null

Industry Trends

INDUSTRY will spend $100 billion on deepwater exploration and production worldwide in the next 5 years, predicts Business Communications Co. Inc. (BCC), Norwalk, Conn.

In a report entitled "World Markets for Deepwater Hydrocarbon Exploitation: Highlighting Production, Projects, and Construction," BCC said that world offshore E&P spending totaled $31.9 billion during 1990-99.

In 2000, total world E&P spending was nearly $77 billion. Through 2006, BCC said $100 billion will be spent in deepwater alone with the most activity expected in Brazil, West Africa, and the US Gulf of Mexico.

Distinct from those three oil-dominated areas, BCC analysts forecast an increase in activity dominated by natural gas spending. in Northwest Europe, the Mediterranean, the former Soviet Union, the Middle East, and Asia.

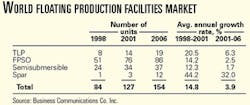

Following a 14.8% average annual growth rate (AAGR) during 1998-2001, the market for floating production facilities will moderate to 2006 (see table). "This growth comes as the large number of projects has moved from the planning to final design and bidding stage since the second half of 2000," BCC said.

The basic floating structures include tension leg platforms, converted or newbuild tankers used as floating production vessels or barges, semisubmersible production units, and spar towers.

Most TLP designs currently offered tend to reach their economic limits in water depths less than 5,000 ft, although some studies with composite materials indicate that it might be possible to install TLPs in water deeper than 10,000 ft.

"TLPs have been growing in popularity, especially the mini-TLPs," the report said.

CANADIAN OIL AND GAS merger and acquisition prices are not moving in step with current spot prices, reports a recent study by Sayer Securities Ltd.

The Calgary-headquartered firm analyzed 532 transactions valued at greater than $5 million (Can.) that transpired during Jan. 1, 1995, through June 30, 2002.

The data, Sayer noted, "proved up some 'truisms' in the business," adding, "One of the obvious truisms supported by the data was that as monthly oil and gas commodity prices went up or down, so did M&A prices," Sayer said.

Sayer looked mainly at M&A prices paid both for reserves in the ground and for daily production, and it based its analysis on spot contract prices for oil and gas on the New York Mercantile Exchange and on AECO-C Hub and Edmonton prices, for Canadian gas and oil, respectively.

Sayer found that, "M&A values measured on the purchase price of reserves, for acquisitions in which gas made up over 50% of the asset, correlated 62% to movements in AECO-C spot gas prices and oil-weighted acquisitions correlated 59% to Edmonton reference prices."

Government Developments

FRANCE has indicated that it is moving toward a full opening of its electricity and gas markets, including retail markets. But Industry Minister Nicole Fontaine said she was not yet prepared to set a specific date.

Following a meeting of the European Union energy ministers on Oct. 3 in Luxemburg, Fontaine still refused the 2005 deadline—which previously was rejected by both French President Jacques Chirac and the then-Prime Minister Lionel Jospin.

Fontaine's present position marks a more flexible stance by the new French government of Jean-Pierre Raffarin. However, Fontaine indicated that "whatever the date" for full opening of the market, it could be fixed only after an "exhaustive examination" of the previous gas and electricity liberalization stages. In Barcelona last spring, EU member countries had agreed to open up the market to all consumers, except households, by 2004.

France was satisfied at the meeting in Luxemburg that the final communiqué insisted on guaranteeing "a high level" of public service for all European consumers, a point to which the French government is particularly attached—especially after the massive demonstration of electricity and gas workers in Paris Oct. 3.

The EU energy ministers are to meet again Nov. 25, and EU Energy Commissioner Loyola de Palaccio is anxious that a global agreement be reached then on all points of dispute. These include—besides fixing the date for opening up the market to households—the "legal unbundling" of production, transportation, and distribution, which both France and Germany oppose. Germany also is opposed to an independent regulatory authority.

IN PERU, Proinvestment, the government commission promoting privatization and concessions, is offering a take-or-pay contract for natural gas from the Camisea natural gas project, 500 km east of Lima.

Operators of the $1.3 billion Camisea project expect to begin producing and transporting natural gas and liquids to Lima by early August 2004. The state's Electroperu signed the take-or-pay contract in January 2000 when private companies were unwilling to take the risk. Within a few weeks, Electroperu is expected to define the contract's quantity and duration.

MYANMAR's CABINET has endorsed amendments easing stipulations in the long-term contract for natural gas sales to Thailand from Yetagun field in Myanmar's Gulf of Martaban.

The contract amendments approval followed protracted negotiations between a Yetagun field development group led by the UK's Premier Oil PLC and outgoing Thai Industry Minister Suriya Jungrungreangkit, who acted on behalf of the Thailand state-owned PTT PLC, the gas buyer (OGJ Online, Dec. 11, 2000).

The amendments involve certain adjustments in the gas pricing structure and deferment of the schedule to raise the daily contract quantity. The pact also would include a reduction in the minimum amount of gas that PTT must buy from Yetagun.

The 2.92 tcf Yetagun gas-condensate field is 400 km south of Yangon (OGJ Online, Aug, 21, 2001).

Quick Takes

SHELL EXPLORATION & PRODUCTION CO. (Sepco) has confirmed the presence of hydrocarbons in its Deimos prospect on Mississippi Canyon Block 806, off Louisiana-Mississippi.

Deimos, in 3,000 ft of water, is adjacent to the huge Mars discovery, which has been producing from Shell's Mars tension leg platform since 1996. Shell said additional drilling would be required to delineate the actual field potential.

"Oil was present in excess of 535 vertical net ft of sands, which included both exploratory sections and known producing field pays," said David Loughman, Sepco's vice-president, exploration and development. "We are currently evaluating appraisal drilling options." Sepco, as operator, has a 72% interest in the prospect, and BP PLC has 28%.

Transocean's Deepwater Nautilus spudded the Deimos well in June, reaching total depth in September.

"(The Deimos) discovery reinforces the validity of our current exploration strategy, which includes both a vigorous greenfield component as well as a nearfield program," said Sepco CEO and Pres. Raoul Restucci. "We have confirmed about 2 billion bbl so far in the (Mars) basin, with developments and discoveries such as Mars, Ursa, Crosby, Europa, King, Princess, and Deimos. This gives us strong encouragement regarding other similar prospects in our inventory," he said.

Shell and partners BP and ChevronTexaco Corp. announced in mid-September the deepwater discovery of Great White, a greenfield prospect on Alaminos Canyon Block 857 in the newly prospective Perdido foldbelt about 250 miles south of Houston.

Also operated by Sepco, that well, drilled to 19,907 ft. TD, is in about 8,000 ft of water.

Meanwhile, action is heating up in Yemen. A group led by DNO ASA, Oslo, found new pay in Tasour field on Block 32 in the Masila basin in a well that extended the main field pay south into an area previously assumed to be below the oil-water contact. The structurally high Tasour 7 cut full oil columns in Cretaceous Qishn S1A sandstone and the unspecified new pay just below Qishn, said partner TransGlobe Energy Corp., Calgary. Tasour field went on production Nov. 3, 2000, and peaked at 12,500 b/d in February 2001. It averaged 8,187 b/d in 2001, and TransGlobe expects 7,200 b/d this year, consistent with predicted natural declines. Due to Tasour's strong water drive and production history, the Qishn recovery factor used in 2001 was 45% compared with 20% assumed in 2000. Tasour 7 is expected to increase the field's reserves. The group could drill 2-3 more appraisal wells at Tasour, and 2 of 11 seismically defined exploration prospects are ready for drilling on the 220-sq-mile block, where Trans-Globe has 13.8% interest, while DNO and Ansan Wikfs (Hadramaut) Inc., San'a, Yemen, hold the rest. F On another project, the Yemeni affiliate of Vintage Petroleum Inc., Tulsa, has spudded the Osaylan 1 exploration well on the Alif/Lam prospect on Block S-1. Vintage operates the block with 75% interest, and TransGlobe has 25% (OGJ, Mar. 13, 2000, p. 67).

In other exploration activities, SOCO International PLC made an oil and gas discovery with the first exploration well drilled on Block 9-2 in the Cuu Long basin off Vung Tau City, Viet Nam. The 09-2-CNV-1X well, drilled to 4,567 m TD, flowed 2,500 b/d of crude oil and 6.6 MMcfd of natural gas through a 1/2-in. choke during preliminary tests. The well was tested in a basement granite at 3,696-4,567 m. The natural flow test was conducted over a 36-hr period without any stimulation. In addition, oil shows were found above the basement granite in upper sandstone, at which the final test is being conducted. SOCO International and its two joint venture partners, state oil companyPetrovietnam and PTT Exploration & Production PCL (PTTEP), intend to drill a second well on Block 9-2 towards yearend. Block 9-2 covers an area of 1,370 sq km. The partners plan a total of 4 wells on Blocks 9-2 and 16-1. SOCO International owns 80% of SOCO Vietnam Ltd., which farmed out a portion of the two blocks to PTTEP earlier this year (OGJ Online, Feb. 14, 2002). PTTEP, an affiliate of partially privatized Thai company PTT PLC (formerly Petroleum Authority of Thailand), is funding its own and SOCO International's share of the drilling—up to $50 million.

State oil agency Perupetro SA has selected UK firm Robertson Research International Ltd. to design and implement a strategy to promote crude oil exploration and exploitation in Peru to boost Peru's hydrocarbon exploration, which has fallen steadily to 97,124 b/d from 183,000 b/d during the past 20 years. The contract, valued at $493,963, has a 71/2-month term.

IRVING OIL LTD., St. John, NB, currently has maintenance turnaround activities under way at its refinery at St. John. The refinery's fluid catalytic cracking unit was taken offline Sept. 27 for adjustments to the unit and installation of new equipment.

The work, which will take a minimum of 25 days to complete, represents the first full turnaround on the FCCU since March 1997, said a company representative. It was commissioned in 1960 with a capacity of 8,300 b/d, but upgrades to the unit have since increased its capacity to 25,000 b/d.

The FCCU is being cleaned, inspected, and new feed nozzles installed, along with other technological upgrades.

Meanwhile, Irving is using the refinery's residual FCCU process for its operations.

ESSO NORGE AS has awarded a contract valued at 75 million euros to Technip-Coflexip's Norwegian unit Coflexip Stena Offshore Norge AS for engineering, procurement, construction, and installation of 81 km of rigid natural gas flow lines, flexible risers, and flexible jumpers from Ringhorne field to Jotun and Balder fields in the Norwegian sector of the North Sea.

Ringhorne field is on Blocks 25/8, 25/10, and 25/11 about 160 miles west of Haugesund in 124-129 m of water. Installation will be performed in cooperation with global subsea contractor Subsea 7 in a 50:50 work split.

The work includes procurement, fabrication, and installation of 33 km of 6-in.and 24 km of 8-in. and 12-in. rigid flowlines; 10-in., 8-in., and 6-in. flexible risers; and a 6-in. flexible jumper, which will be manufactured at Technip-Coflexip's plant in Le Trait, France.

The work also includes hookup of spools using divers, diverless tie-ins, presurvey, crossing preparation, trenching, rock dumping, and commissioning of the installed system. The facilities will be installed in summer 2003. The project will be managed from Technip-Coflexip's Oslo offices with support from Subsea 7's Stavanger and Grimstad operations.

DAMAGE TO SEVERAL RIGS in the Gulf of Mexico following Hurricane Lili has been reported.

Houston-based Rowan International Inc. lost its Rowan-Houston drilling rig, which was severed from its legs and sank about 1,750 ft northwest of its prestorm location on Ship Shoal Block 207. The hull was found resting on the bottom of the gulf in 105 ft of water, with the bow elevated at about 30°. Prior to the storm, the rig had been secured and the crew evacuated. The hull had been 63 ft above the water.

A company spokesman said the port side of the hull near the bow was severely damaged, "indicating a collision had occurred." Rowen is investigating that probability and developing a plan for wreckage removal.

Diamond Offshore Drilling Inc., Houston, reported that its Ocean Lexington semisubmersible rig became separated from its moorings and drifted 45 miles, grounding in an estimated 35 ft of water off Louisiana. A company spokesman said damage assessment was under way along with efforts to refloat the rig so that it could be moved to a shipyard for inspection. Prior to Lili's approach, the rig had been detached from its subsea well control equipment, the riser and the blowout preventer, all of which were reported to be undamaged.

Noble Corp., Sugar Land, Tex., said its Noble John Sandifer cantilever jack up on Eugene Island Block 305 sustained leg and hull damage. The company expects to complete preliminary damage assessment this week and have the unit examined more fully in dry dock within the next 3 weeks.

PETROLEO BRASILEIRO SA expects to invest more than $2.5 billion by 2005 in new pipelines, said Petrobras CEO and Pres. Francisco Gros at the International Pipeline Conference & Exposition in Calgary Oct. 1.

Under a program called PEGASO, a Portuguese acronym for "Excellence in Environmental Management & Operational Safety Program," the company has already invested $800 million, of which $400 million was for improvement of company pipeline activities and $300 million for enhanced pipeline integrity. By June 2003, an additional $1.3 billion will be invested.

Under the integrity program, Petrobras has inspected more than 4,700 km of pipelines since Jan. 1, he said, and eliminated 5,200 defects, rehabilitated more than 3,300 km of pipeline, and replaced 245 km.

With the opening of the Brazilian oil and gas markets to competition, Petrobras also created an independent subsidiary, Transpetro, to operate and build pipelines for the entire Brazilian market, Gros said. Petrobras has been investing in automation to be able to operate its pipeline network at Transpetro headquarters control center in Rio de Janeiro, Gros said.

At present, 70% of the oil and gas pipeline network is remotely operated, and Transpetro intends to conclude this program by late 2003. The 20,000 km Brazilian pipeline transportation system should reach 25,000 km of oil, gas, and product lines by 2005 said Gros.

THE FRENCH AND YEMENI GOVERNMENTS are investigating the cause of an explosion and fire that occurred Oct. 6 on the 500,000 dwt, double-hull Limburg very large crude carrier off Yemen. Of the tanker's crew of 25—8 French and 17 Bulgarian nationals—12 were injured, and one Bulgarian was killed.

The fire was extinguished the following day, but an oil slick of 8,000 tonnes began fouling Yemeni waters.

The 2-year-old VLCC, which was flying the French flag, is owned by Cio. Maritime Belge, whose Belgium affiliate Euronav SA chartered the vessel on behalf of Malaysian company Petronas to deliver Persian Gulf area oil to a refinery in Melaka, Malaysia.

The VLCC had loaded 400,000 bbl of crude at Ras Tanura in Saudi Arabia, and was to lift 1.5 million bbl more at the oil terminal of Mina Al-Dabah, near Al-Mukalla.

At the time of the explosion, the tanker was preparing to receive a pilot boat to escort it to the Mina Al-Dabah terminal 3 nautical miles away. Captain Hubert Ardillon, the Limburg skipper, said he saw a small boat approaching his tanker at a high rate of speed just before the explosion.

Although the ship's owners stand by Ardillon's contention that the explosion came from the outside and that the breach was above the waterline, another authorized source indicated that an internal explosion could have caused the hole in the supertanker's side, which the French newspaper Le Monde reported was "10 yards across." A US Department of State official was quoted by Le Monde as saying "the metal sheets exploded outwards."

The French government has sent oil spill experts to Yemen to contain the spill and sent members of its counterespionage body to determine the cause of the explosion. Foreign Minister Dominique de Villepin had said in a radio interview Oct. 7 that "no possibility is excluded."

Stuart oil shale sets record

The Stuart Stage 1 oil shale demonstration plant at Gladstone, Queensland, has achieved its longest production run—121,000 bbl of oil—during a 52-day run completed Aug. 31. The year's total oil production of 276,000 bbl at the end of August has exceeded calendar year 2001 total production of 233,000 bbl. The Alberta-Taciuk processor partners are Southern Pacific Petroleum NL and Central Pacific Minerals NL.