Analysis points to electric-motor drivers for Angola LNG

As part of work to develop a set of functional specifications for the Angola LNG project, Angola's state oil company Sociedade Nacional de Combustiveis de Angola (Sonangol) and ChevronTexaco Corp. engaged Foster Wheeler Energy Ltd., Reading, UK, as part of a consortium to investigate the use of large electrical motors to drive the refrigeration (liquefaction) compressors for the onshore LNG plant.

Foster Wheeler was to investigate the use of large electrical motors to replace the gas turbines and to use a central power station to supply the power to the complete facility. The consortium consists of Chiyoda Corp., Foster Wheeler, ABB Lummus Global Inc., and Stolt Offshore Inc.

The study had two main objectives:

- To assess the technical risks associated with the use of large electrical motors in a baseload LNG facility.

- To quantify the benefits, on a life-cycle basis, of such an application.

The study concluded the technical risks associated with the use of large electrical motors are well known and would be manageable as part of the detailed design of the project and that the potentially significant life-cycle benefits support this as an option to be considered during frontend engineering design (FEED) for the Angola LNG project.

The project collects both associated and nonassociated gas from a number of blocks off Angola. The gas flows to a central processing platform in Block 2 for basic processing and condensate stabilization. The gas stream is then routed to shore in Luanda via a 250-km pipeline.

The onshore LNG plant will have a single train of about 4 million tonnes/year (tpy) with potential for future expansion to as many as four trains. The LNG plant will be about 15 km north of Luanda and adjacent an existing refinery. Along with LNG it will produce condensate and LPG. Both LNG and LPG will be stored on and exported from a near-shore, gravity-based structure.

To assess the life-cycle cost benefits, Foster Wheeler created a base-case solution for the plant, estimated its cost, and then estimated the difference in cost of a motor-driven alternative.

The attributes of the base case were:

- A single 4 million tpy LNG train.

- Driven by three GE Frame 7 gas turbines.

- Power supplied by four GE Frame 5 gas turbine generators.

- Production of LPG and condensate products.

The motor-driven cases assumed:

- Split compressor casings to reduce motor size.

- Six electrical motors, each about 35 Mw.

The solution selected for the electrical-driven case was a low-risk approach, using equipment with proven commercial application.

Commercial impact

The first question that the study addressed was to identify the commercial impact of using large electrical motors.

The expectation was that the capital cost would be higher as a result of the need to provide both gas-turbine generators and electric motors. There were thought to be several other attributes that would mitigate the impact of increased capital cost.

To ensure a defensible commercial evaluation, Foster Wheeler assessed the benefits on a life-cycle basis.

Any commercial benefits to the use of electrical motors must be evaluated for their impact on project net present value (NPV) or life-cycle benefit. Not surprisingly, when electrical motors are used, the capital cost is likely to escalate because of the need for a larger power plant. The commercial benefits therefore rely upon increased revenue streams to balance the higher capital expenditures.

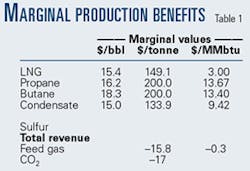

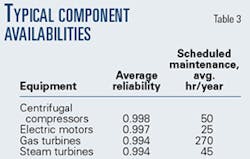

The life-cycle benefits are dominated by four factors: capital cost, plant availability, project schedule, and plant production. Foster Wheeler based its analysis on the marginal values of production as summarized in Table 1.

The marginal value is the value achieved after all costs (other than the variable production costs listed) generated by marginal production. Thus, it has been assumed that any additional LNG produced can be delivered to market and sold to generate a marginal profit of $149 /tonne (equivalent to $3/MMbtu). This assumption is reasonable, as other than the variable production costs listed, most other marginal production costs are zero.

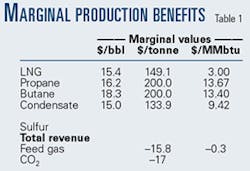

On the same basis propane and butane are assumed to have a marginal value of $200/tonne. Discounting them over a 20-year project life yields the "Capital equivalents" (Table 2).

The capital equivalent is the amount by which the capital cost could be increased in order to have no impact on the overall project's NPV. For example, the production of an additional 1 million tpy of LNG would justify the expenditure of $1,269 million.

Alternatively stated: If the production of LNG can be increased by 1 million tpy without affecting project capital cost, then the project NPV would increase by $1,269 million.

The table demonstrates the high value of both plant availability and project schedule: plant availability as it increases annual revenue for the entire project life; schedule due the time value of money as it brings forward a revenue stream by the project life.

The production impact of moving to electrical motors is achieved through higher thermal efficiency of the plant. Centralized power generation involves larger and more-efficient gas turbines, which make heat recovery and combined-cycle power generation economic.

Balanced against this increased efficiency are the electrical transmission and drive losses. The first of these increases thermal efficiency by about 12%; the second then loses about 4% of the benefits gained. The result is an overall increase in efficiency of 8% that translates to an additional 0.5% increase in LNG production.

This evaluation will obviously vary with the particular configuration of prime movers selected.

Increased production availability results from two sources:

- Sparing is more cheaply purchased on a centralized than on a localized basis. Therefore, a highly reliable power-supply service can be provided economically.

- The scheduled maintenance needs for electrical motors are much lower than for gas turbines. The increased sparing allows the scheduled maintenance to be carried out without production impact.

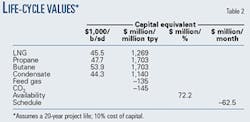

Table 3 summarizes some of the availability statistics for key components of the refrigeration circuit.

As can be seen, the reliability and hence the risk of an unscheduled shutdown are much the same for all components. The scheduled maintenance downtime for gas turbines is five times greater than the next most demanding component.

When all of these factors are considered, production availability increases by 2.9%, which equates to a life-cycle benefit of nearly $210 million.

So far as the impact on project schedule is concerned, Table 4 shows scheduled delivery times in months for some key components.

Following are the key factors from this table:

- The FOB delivery of large electrical motors is considerably shorter, by about 24 months, than that for the GE Frame 7 GTs. Obviously these values are to some extent market dependent, although it has been the norm on LNG projects to place the order for the gas turbines before the final investment decision on the project is taken. Thus, the use of motors would make this practice unnecessary.

- Delivery of either gas turbines or motors is assumed to be to the compressor vendor's works for assembly and testing of the drivers and compressors. It is also expected that up to 2 months would be saved in the assembly of motors and compressors vs. turbines and compressors.

- Sadly, switching to motors does not reduce the overall project schedule by 26 months. But it does take the gas turbines off the project's critical path and transfers the critical path elsewhere, probably onto the LNG storage tanks or the construction of the (now larger) power plant. As important, it helps to reduce schedule risk by elimination of a schedule-driving event.

On the base project used for this article, Foster Wheeler was able to reduce the engineering, procurement, and construction (EPC) phase of the project by 2 months, resulting in a life-cycle cost benefit of approximately $125 million.

Table 5 shows the impact on the capital cost of the change. As expected, the capital cost for the electric-motor option increases, in this case by about 5%. The major "adder" is the cost of the power station, whose capacity has risen to 380 Mw from 55 Mw.

Fig. 2 summarizes the life cycle benefits of approximately $300 million. It is readily apparent that the benefits are dominated by the higher availability and by the shorter EPC schedule. If either of these can be achieved, then the benefits are still positive, as either outweighs the higher capital cost.

Although this analysis presents a strong argument for pursuing the proposal, there are several soft reasons for thinking that the economic benefits could be improved further:

•The range of gas turbines available for power generation is large. Table 6 shows a representative selection. (Note: This table contains lots of numbers that are based on several personal sources; some may be slightly wrong. The table is intended, however, to demonstrate the wide variation in ratings, efficiencies, and costs.)

The market place is very competitive. The capital-cost estimate could be improved through optimization and competitive bidding.

•The technical solution selected was of a low technical risk. Increments for the electrical motors and associated infrastructure could be reduced if fewer and larger motors were used.

Technical risks

However large the commercial benefits, if the technical risks are too high, then the electric-motor option would not be selected. These technical risks of using large electrical motors have been structured as follows:

- The case of precedence: To what extent is this new?

- The risks and solutions involved in large motor supply.

- The options for risk reduction in compressor configuration.

- The risk and solution of large motor starting.

- The options for power generation to provide a design sufficiently robust to survive transient conditions.

There is great interest within the LNG community in this topic. Most of the major operators, suppliers, and contractors have investigated or are investigating the use of electrical motors to drive baseload and smaller LNG facilities.

Developments in floating LNG (FLNG) facilities reported in the literature are well publicized. Electrical motors are planned for any FLNG projects for the compactness they allow in design and the reduction in hazard.

The farthest advanced reference in LNG is Statoil ASA's Snøhvit project at Hammerfest, Norway, now entering detailed engineering. It will use motors of around 65 Mw driven by a number of LM 6000 gas turbo-generators.4 This facility, however, is connected to the grid, which is unlikely to be an option for more remote gas reserves.

There are a number of useful reference points in industries unrelated to LNG. The largest two-pole motors (3,000–3,600 rpm) in the world are slightly larger than 50 Mw. Larger but slower speed motors have been fabricated at more than 100 Mw.

That the air-separation industry provides a number of useful reference points is not surprising because it uses similar technology to similar ends. One such unit is a power-generation plant in Delaware City, which uses large quantities of oxygen to feed a ChevronTexaco gasifier. The vital statistics of this installation appear in Table 7.

A Petróleos de Mexico SA (Pemex) installation in Mexico is even more relevant. It employs four air-separation plants to produce nitrogen for gas injection to the Cantarell offshore oil field. The facility uses an "island" configuration (i.e., not connected to a power grid) power plant to supply power to four 52-Mw air compressors. Its vital statistics appear in Table 8.

The availability of a large motor supply would seem to be the least of the technical risks, i.e., the ability of the market to supply a reliable large electrical motor.

The three suppliers with the best reference points for large motors are Siemens AG, ABB AG, and Alstom SA. The largest motors supplied by these are, respectively, 38 Mw, 52 Mw, and 44 Mw. These are within a range that would be suitable to drive an LNG plant, although there are advantages to going higher still.

All three of these suppliers have been involved in studies of using large motors for LNG projects and all are confident of their abilities to design and fabricate motors at higher ratings.

In the area of compressor configuration, there are really two issues to be addressed: the speed at which the compressor is driven and how it is started. Fig. 2 shows some of the configuration options.

The large gas turbine market has grown around the need to drive large power-generation plants, generally targeting the US market. Thus, the running speed of gas turbine and compressor is 3,600 rpm, equivalent to a two-pole electrical motor with 60 hz supply.

Electrical motors installed in a 50-hz supply scheme where two pole motors will run at 3,000 rpm may be disadvantaged. This can mean either that the compressor needs to be redesigned for the lower speed or that a gearbox is needed.

A third option is to use a variable speed drive (VSD) capable of driving the motor and compressor at 3,600 rpm without a gearbox.

The strengths and weaknesses of these options are represented in Table 9.

LNG plants have traditionally used the largest technically proven gas turbines as drivers and built their compression strategies around them. This has meant that, often, two compressors in separate casings are driven on a single shaft by a single gas turbine.

For the motor option, the refrigerant compressors can be split and driven by individual motors. This would reduce the motor size to one with an operating reference. The capital cost will increase but may be compensated by each compressor being driven at a speed optimized to improve life-cycle benefits.

Clearly, the voltage drop caused by starting a large motor has to be addressed. Direct on-line starting of such a motor from an "island" power station is not an option.

There are, however, several options that allow starting with minimal voltage drop:

•Variable-speed drives (VSDs) have the advantage of being able to drive the motor at 3,600 rpm and so allow operation on a 50-hz power system without a gearbox. They also allow the compressor to be started without depressurizing and thus should allow a faster restart of the liquefaction system after a trip.

VSDs have the ability to ride out voltage drops that result from upstream electrical faults. This can be a major advantage on a grid-connected facility but less important on an island power plant.

There are disadvantages, however: The VSD is in circuit all the time, overall efficiency is lower, and—unless significant redundancy can be included—availability may be affected.

•Reduced-voltage start is probably the most proven, reliable, and lowest cost option, although unsuitable for motor sizes much greater than 40 Mw.

•From Foster Wheeler's investigations, soft start emerged as the favored approach, offering reasonable balance of cost and risk. A configuration that provides two 100% dual-redundant soft starters would be provided to start all motors. The equipment is shared between motors because it is unlikely that two large motors will be started simultaneously.

Finally, one of the key issues to be addressed in the design and installation of a large island-configuration power plant is the stability of the system and its ability to survive trip and upset conditions.

Following are the three options that have been considered:

- Option 1– The combined cycle–the most efficient and most integrated of the powergeneration solutions.

- Option 2–The hybrid solution that uses waste-heat recovery to generate steam which is then used for process heating, driving steam turbine compressors or both.

- Option 3–The open cycle–the least efficient and least integrated.

Stability studies have indicated that the design of certain combined-cycle configurations is problematic. The larger the gas turbines and the lower the sparing selected, the less able is the system to survive the trip of one of the gas turbines without a drop in frequency which takes out the steam turbines.

Selecting the wrong combination of gas turbine and cycle configuration could lead to a system with low operational stability. Such a system would respond poorly to electrical upsets and could seriously jeopardize plant availability.

This problem can be overcome in a number of ways:

- The use of more, smaller gas turbines makes the impact of a trip of any one turbine proportionately less important. At the extreme, this may favor use of aero-derivative gas turbine generators, which typically run at higher efficiencies. This option is attractive for lower capacity plants and in cooler climates.

- The use of auxiliary firing on the waste-heat recovery units helps to reduce the impact of a trip of the gas turbine on the steam turbine.

- Using a hybrid configuration (Option 2) more completely decouples the gas turbines from the steam system.

- Fast-acting inlet guide vanes on the gas turbine can considerably improve its ability to ramp up in the event of a trip.

Foster Wheeler believes this issue to be the most important impediment to the use of electrical motors. From the work done so far, it is clear that there are configurations that will not be stable in operation. The company has also shown, however, through stability study that there are a number of stable solutions available and that the tools exist to manage the technical risks.

Possibility; advisability

There is enough relevant experience within other industries so that the application of electrical motors on baseload LNG technology would be but a small extension of existing experience.

The use of electrical motors is not without risk, however, which of course is the case with anything being done for the first time. But Foster Wheeler believes that the risks are well understood and can be managed as part of a project's development and execution.

Specifically, there are strong reasons to consider use of electrical motors on the Angola LNG project and probably other baseload facilities, as well. There are potentially large commercial benefits to be reaped in terms of plant availability and project schedule. Whether these can be realized on a given project depends upon four key questions:

References

- Bloch, Heinz P., and Geitner, Fred K., "Use Equipment Failure Statistics Properly," Hydrocarbon Processing, January 1999.

- Heiersted, R.S., Jensen, R.E., Pettersen, R.H., and Lillesund, S. "Capacity and Technology for the Snohvit LNG plant," LNG 13, Seoul, May 14-17, 2001.

- Costello, M.J., Lawrie, R.J., DeBlock, M.J., and Jackson, W.J., "Large Synchronous Motors for Delaware City Repowering Project," IEEE Paper No. PCIC-2000-9.

- "Ecology and Economy Decide for 50,000 hp Electric Turbocompressor Drivers," IEEE/PCIC 46th Annual Conference, Sept. 13-15, 1999, San Diego.

Based on a presentation to "Advances In Liquified Natural Gas: Outlook, New Sources, New Technologies and Facility Planning," New Orleans, Apr. 15-16, 2002.

The authors

Steve Shu is the principal project engineer with ChevronTexaco Corp. on the Angola LNG project. He has nearly 25 years' experience in international upstream oil and gas projects with Texaco. Shu holds a BS (1972) in mathematics from the University of North Carolina and a master of engineering science (1977) from North Carolina State University.

Frank Christiano is a project manager with ChevronTexaco in the South Africa Projects Group. He previously worked as a project engineer on the Angola LNG project, the Gorgon LNG, and Pembroke refinery projects for Texaco. He has a BSc (1991) in chemical engineering from Worcester Polytechnic Institute and is a member of AIChE.

Malcolm Harrison is manager of the process department for Foster Wheeler Energy Ltd. Previously, he was chief engineer for gas-to-markets, working in gas monetization. He has previously worked for BP PLC and BOC PLC where he was product development manager. Harrision graduated in chemical engineering (1987) from Bradford University and with an MBA (1994) from Kingston Business School. He is a fellow of the Institute of Chemical Engineers.