SPECIAL REPORT: Surveys track US, Canada well service rigs

Organizations having surveys that track US and Canada well service rigs activity include Weatherford Artificial Lift Systems Inc., Houston, in conjunction with the Association of Energy Service Companies (AESC), Houston, Baker Hughes Inc., Houston, and the Canadian Association of Drilling Contractors (CAODC), Calgary.

The latest data from each survey are as follows:

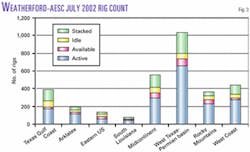

Weatherford-AESC for July 2002 shows total available rigs of 3,170 in the US and 994 in Canada. Of these, active are 1,832 rigs in the US and 604 rigs in Canada. Peak number of active rigs in the US was 5,367 in January 1982. But the peaks in Canadian rigs were only reached earlier this year. The survey shows a count of 739 active rigs in January and March 2002 out of the 994 available rigs.

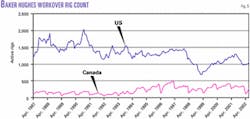

The Baker Hughes rig count for July 2002 shows active rigs of 1,036 in the US and 246 in Canada. The survey, which started in April 1987, has a US peak in November 1990 of 2,041 rigs and a Canadian peak of 496 rigs in March 1997.

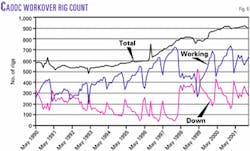

The CAODC survey, which goes back to May 1990, for February 2002 shows 905 total rigs in Canada with 638 working. A peak of 738 working rigs was reached in February 2001 and the survey counted the most total rigs of 921 in November 2001.

The surveys are available on www.weatherford.com, www.bakerhughes.com, and www.caodc.ca.

Well service rigs

The surveys cover well service rigs that work on land. The main features that distinguish these units from drilling rigs are their mobility and their guy-wired masts.

Workover rigs, pulling units, and completions rigs are other names for well service rigs. Their primary activity is well maintenance, such as replacing downhole pumps, sucker rods, and tubing. In the US, there are more than 400,000 sucker-rod pumped wells, according to Dave R. Wallis, director of e-commerce for Weatherford Artificial Lift Systems Inc., Houston.

The category of well service rigs does not include coiled-tubing units, both slickline and electric line wireline units, and snubbing units.

Jim Yancy, AESC executive director, says that about 85% of the US well service rig fleet consists of units rated for a 300,000-lb load (Fig. 1). He indicates that most work daylight hours, although some are equipped for 24-hr. work.

Some rigs can also drill, usually for deepening or cleaning the wellbore. Yancy says the drilling typically entails the use of a power swivel, although some well service rigs also may have a rotary table.

Most workover rigs operate with a four-man crew: two floor hands, one derrick man, and one operator. The rig also has a supervisor who often oversees a number of rigs.

Some contractors provide pumping equipment with these units.

Workover service rig counts outside of US and Canada are unavailable. As Wallis explained, Weatherford has looked at taking an international count but found that drilling rigs often serve as pulling units outside of the US and Canada because in remote locations drilling rigs have more flexibility than workover rigs.

He says two countries with a significant number of workover rigs are Russia and China, but these rigs usually do not move from field to field. In general internationally, the well service industry is not a separate business. Often a national company owns the workover rigs, which is unlike the US where operating companies do not own the rigs.

In the US, service rigs tend to move from state to state but rarely across the US-Canadian border.

Weatherford-AESC

Weatherford and AESC jointly track US well service rig counts and Weatherford by itself counts Canadian well service rigs.

Their survey's origin goes back to Guiberson Corp.'s well service rig count that started in the 1970s. According to AESC, the survey became inconsistent after Halliburton Co. acquired Guiberson in the late 1990s as part of its purchase of Dresser Industries Inc. To improve the numbers, AESC worked with Spears & Associates, Tulsa, on the survey during 1999-2001.

In fourth-quarter 2001, Weatherford acquired Guiberson and decided to participate in counting well service rigs. It initiated its joint count of US rigs with AESC in January 2002.

Weatherford also has restored Guiberson's Canadian workover rig count, but without AESC's involvement.

Weatherford and AESC have recalculated the previous survey numbers with input from Spears & Associates. Over the last 3 decades, it says that the US regions have had occasional adjustments. For instance in the 1980s, the Eastern region included the Arklatex region, and from 1998 through 2001, the Eastern and Mid-continent regions were combined.

Also in the 1970s, the records did not break out the rigs on a regional basis, and only showed active rigs but not the total rigs available. Consequently, this period does not have a utilization percentage.

For the US, the survey currently receives data from about 130 US well service rig contractors, which are about 90% of the workover rig population, according to Yancy. Most of these contractors are members of AESC.

Fig. 2 shows the eight geographic regions that the survey tracks and Weatherford expects to maintain in the future.

In the US, three operators Pool Well Services, Midland (a unit of Nabors Industries Ltd.), Key Energy Services Inc., Midland, Tex., and Basic Energy Services, Midland, operate about 70% of the workover service rigs surveyed, according to Yancy.

For competitive reasons, these three companies and some others first send their data directly to AESC, which consolidates the data before forwarding them to Weatherford for combing with data that Weatherford receives directly from contractors. In the survey, Weatherford includes data estimated by its local offices, if the contactor did not respond to the survey.

Weatherford publishes this rig count on a monthly basis, by the 15th working day of the subsequent month.

Weatherford-AESC's survey breaks the rig count into four categories for each region. These categories include active, available, idle, and stacked.

Fig. 3 shows the breakdown of these categories by region for July 2002.

The survey defines an active rig if, on average, it is crewed and works every day during the month.

An available rig is one that has a crew and is ready to work but is not working.

The definition of an idle rig is one that is capable of being put to work in less than 48 hr and does not require more than $50,000 to activate. Also no crew is currently assigned to it.

The last definition is a stacked rig that has no crew assigned and cannot be put to work without significant investment in repairs and additional equipment of more than $50,000.

Fig. 4 shows the historical trend of the Weatherford-AESC reactivated Guiberson rig count.

Baker Hughes in its survey counts only well service rigs that are engaged in work that requires pulling production tubing from wells drilled deeper than 1,500 ft.

It started its survey in April 1987 and relies on its district offices in the US and Canada to gather the information. Baker Hughes says each district starts contacting all workover contractors in its territory 3 days before the end of a given month.

The regions it surveys include Texas Gulf Coast, Southeastern, Midcontinent, North Eastern, Rocky Mountains, West Texas, Western US, and Canada.

Fig. 5 shows the historic trend for both US and Canadian workover rigs as surveyed by Baker Hughes.

The CAODC maintains its own survey for 30-35 well service rig contractors in Canada. Their survey started in May 1990 and contains only two categories: working and down rigs.

As in the US, three contractors represent a large 60% of the market, according to CAODC.

These contractors all headquartered in Calgary include Precision Well Service (a unit of Precision Drilling Corp.), Rockwell Servicing (a unit of Ensign Resource Service Group Inc.), and Nabors Production Services.

Fig. 6 shows the historic Canadian rig count as surveyed by CAODC.

Factors influencing the surveys

Weatherford says that operator's need to protect and maintain their assets and cashflow is the predominant influence on the number of active well service rigs. Oil and gas prices further affect these numbers.

Other factors influencing the rig count according to Weatherford include:

•Seasonal spending patterns because various producers have predefined spending cycles. Also there is an historical decline in rig activity during the first quarter in the US and the second quarter in Canada. The Canadian decline is due to spring thaw making the ground often too soft for movement of heavy equipment between locations.

•Local tax issues.

•Availability of capital to producers.

•Labor availability. Weatherford noted that early 2001 was the first time the rig count was limited by personnel shortages.

•Variable volatility between oil and gas prices such as seen during the gas peak of late 2000 and early 2001.