OGJ Newsletter

Market Movement

Iraqi war market risks

Risks to world oil markets from another war involving Iraq aren't likely to emerge until next year, but the extent of risk hinges largely on whether Saudi Arabia is willing and able to make up any shortfalls in oil supplies, industry analysts said in two recent reports.

"The short answer is that a war with Iraq won't begin until late next summer or in the early fall (weather creates a window of opportunity during September-October through March-April). Hence, most of the cost of the war won't begin to affect the (US) economy until late in the year," said Dan Lippe at Petral Consulting Co., Hous- ton.

"The road to war in the Middle East has been mapped out and driven down far enough to suggest that a consideration of the oil price risks is no longer premature," said Paul Horsnell at J.P. Morgan Securities Inc. in London. In a separate report, he outlined the two most likely scenarios involving:

Controllable upside risks, with "some violent, short-term spikes" to $40/bbl before oil prices can be brought back below $30/bbl "within a matter of days or weeks."

Uncontrollable upside risks, spiking $50/bbl or higher, with "nothing much to bring prices back under control within a reasonable time frame."

Saudi Arabia the key

"The difference between controllable and uncontrollable price shocks is, quite simply, Saudi Arabia," Horsnell said. "Saudi Arabia's power over determining oil prices after any attack on Iraq will be almost total. If they were to choose to sit on their hands or, worse still, faced internal pressure to go further (in restricting oil supplies), then US military action against Iraq would have some very serious consequences for prices."

With total world oil supply currently at 76 million b/d, there is only 6 million b/d of spare production capacity outside Iraq, and that is "almost entirely" within a few Middle Eastern countries, said Horsnell. "Saudi Arabia has the most spare capacity with about 4 million b/d. The rest...is heavily concentrated in Iran and Gulf Cooperation Council members, in particular Kuwait and the UAE."

World oil markets must depend not only on Saudi Arabia's willingness to increase production but also its ability to protect those supplies against outside disruptions.

Vulnerability

"Sabotage or other damage to individual wells or pipelines would shake the market by the fear caused by such events being shown to be even possible," said Horsnell. Damaged pipelines could be repaired quickly with little effect on exports, but a successful attack on the heavily guarded processing or pumping stations could disrupt supplies for months, he said. Even worse would be an attack on one or more key oil ports with radioactive or biochemical weapons that renders the facilities unusable.

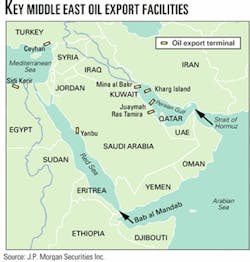

Saudi Arabia exports oil through terminals at Ras Tanura and Juaymah, with a combined loading capacity in excess of 8 million b/d, said Horsnell (see map). In addition, Saudi oil from Abqaiq and Ghawar fields moves through the 1,200 km Petroline pipeline to Yanbu on the Red Sea, a terminal with a loading capacity in excess of 3 million b/d. Some of that oil also goes north through the Sumed pipeline for loading at the Egyptian port of Sidi Kerir.

"The three Saudi ports, with the addition of the Iranian port at Kharg Island, represent the major port vulnerabilities within the region," Horsnell explained. Loss of the larger Ras Tanura terminal would effectively eliminate use of Saudi Arabia's spare production capacity, "although Yanbu and Juaymah would just have enough capacity to maintain current export levels." Loss of any one Saudi port "would be bad enough," he said, "but two would certainly take us into the realm of an uncontrollable price risk."

Even worse would be a prolonged disruption of oil tanker traffic from the Persian Gulf through the Strait of Hormuz. That, Horsnell said, "would shut in Kuwaiti, UAE, Qatari, and Iranian production, plus all Saudi exports not going through Yanbu. Export flows of about 11 million b/d of crude oil and oil products would be at risk, making Hormuz problems the worst of all possible events."

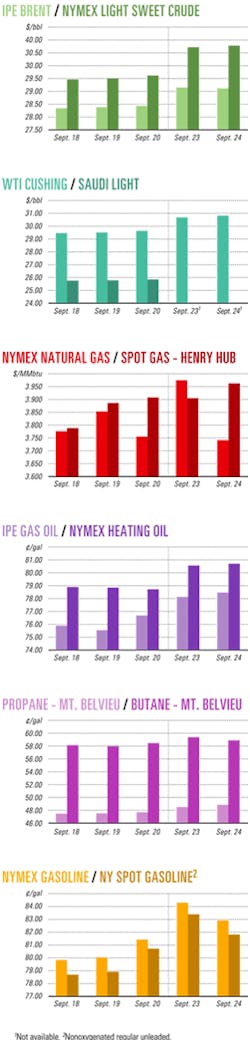

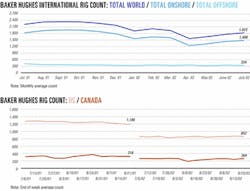

Industry Scoreboard

null

null

null

Industry Trends

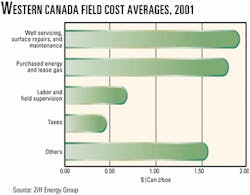

WESTERN CANADA'S operating costs at oil and natural gas fields continue to rise, but producers can cut costs and maximize cash flow through better energy management programs, said Ziff Energy Group, Calgary.

In its 2002 study of 195 oil and gas fields in western Canada, Ziff reported that average oil operating costs increased 9% to $6.50 (Can.)/boe in 2001 from $6.10 (Can.)/boe in 2000. For gas, the average cost increased 18% to 69¢/Mcfe in 2001 from 58¢/Mcfe in 2000.

Energy costs for electricity and natural gas increased by 38% for gas and 32% for oil. The cost of many services also increased, raising the total cost of repairs and maintenance 33% for gas and 11% for oil (see chart).

All other operating costs—including field overhead, contract services, trucking, and third party processing—rose 3% for gas but fell 4% for oil.

For 2 years, Ziff CEO Paul Ziff said he has urged US and Canadian clients to manage their energy use more efficiently. "Those who did were prepared, while many others continue to be stressed by the full impact of high costs," he said.

He expects that volatility in energy costs will continue for several years. "Alert, knowledgeable managers will be able to outperform industry averages," Ziff said.

ASIA-PACIFIC'S PETROCHEMICAL sector is set to expand, with a number of world-scale ethylene crackers coming on stream and more being planned.

Business Communications Co. Inc., Norwalk, Conn., reports in a study that work has resumed on major petrochemical industry projects that were suspended during the Asian financial crisis.

Total annual petrochemical demand in the Asia-Pacific region is estimated at 67.5 million tonnes. Rising at an average annual growth rate (AAGR) of 6.1%, demand will reach 85.4 million tonnes by 2006, reported the study entitled Petrochemical Business in the Asia-Pacific Region.

Ethylene demand is highest at 33.1 million tonnes and is rising most rapidly at an AAGR of 7.1%. Demand in 2006 will reach 43.5 million tonnes. Propylene demand will rise at an AAGR of 5.8% to 28.9 million tonnes in 2006, while benzene demand will grow at an AAGR of only 3.6% to 13 million tonnes.

The total annual ethylene capacity in the Asia-Pacific region stands at 27.5 million tonnes, but new ethylene facilities being developed will add 9.4 million tonnes of capacity by 2006. China and India remain strong markets for regional petrochemical product exporters, Business Communications' study said.

Government Developments

THE EUROPEAN COMMISSION'S energy security proposals face skepticism from the International Energy Agency, oil companies, and some member governments.

EC Energy Commissioner Loyola de Palacio said she believes that the "framework of the IEA and (European) Community legislation introduced at the beginning of the 1970s is no longer relevant for the oil market." Meanwhile, the natural gas market has no framework, she added.

The commission pointed to the EU's vulnerability in "geopolitical, economic, and social terms" in fossil fuel supplies—which account for four-fifths of energy consumption and of which two-thirds are imported. The proposed measures deal with both physical risks and price risks.

Oil and gas supply safety measures "can be conceived only in coordination with producer countries," the EU said.

Member states are invited to each set up a public body to own oil stocks representing at least 40 days' consumption. The commission wants the current volume of stocks, now set at 90 days' consumption, to be gradually increased to 120 days. Most stocks are now held by oil companies.

The commission also wants the power to manage these stocks in case of a crisis, with the help of a committee representing the member countries.

In addition, the EC advocates gas supply safety measures, albeit in more vague terms, "based on a clear definition of the roles and responsibilities of the different market players." No minimal gas stocks are suggested.

A senior IEA official, who did not wish to be identified, said "the project of setting up additional stocks to manipulate prices was not new."

The IEA's emergency stocks system is set up to use strategic stocks in times of crises, the official said. He does not see many governments agreeing to manage prices through stocks.

The official added that the IEA already has difficulty getting its members to respect its own 90-day rule for stocks.

The propositions on gas supply safety are viewed warily. France, for one, has sufficient storage capacity to hold out for 1 year in the event of a major supply cut. Gas accounts for only 17% of France's primary energy use, and very little of that generates electricity. In addition, France has long-term gas supply contracts with Algeria, Russia, and Norway, which are the main EU gas suppliers.

As for the oil companies, France's trade group UFIP (Union Française de l'Industrie Pétrolière) notes that increasing stocks by 30 days would only marginally improve oil supply safety, which is now considered adequate.

The oil companies and a few distributors already spend 350 million euros/year to fund maintenance of oil stocks.

Quick Takes

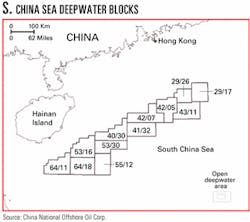

CHINA NATIONAL OFFSHORE OIL CORP. (CNOOC) has requested bids from foreign companies for oil and gas exploration and development of 12 virgin deepwater blocks in the South China Sea. The area, south and east of Hainan Island, covers 76,000 sq km in waters 300-2,000 m deep (see map).

CNOOC, through its Hong Kong-based subsidiary CNOOC Ltd., will own all working interests resulting from the exploration and development activities.

CNOOC Ltd. also reported Sept.12 that its PY34-1-1 exploratory well in the Pearl River Mouth basin in the eastern South China Sea, confirmed an earlier gas discovery in the PY34-1 area. The well flowed on test at a rate of 13 MMcfd. PY34-1-1 is about 30 km southwest of the gas-bearing PY30-1 structure.

The confirmation follows on the heels of a late August confirmation of a gas discovery in the western South China Sea. That appraisal well, YCH13-4-2, on the YCH13-4 discovery, produced about 20 MMcfd through a 16-mm choke during drillstem tests. CNOOC holds 100% interest in both discoveries.

And, more recently, CNOOC Ltd. signed two production-sharing contracts (PSCs) with Husky Oil China Ltd. on Blocks 23/15 and 23/20 in the Beibu Gulf basin of the South China Sea.

Under terms of the PSCs, Husky will drill and complete one wildcat well in each contract area in the first 3 years. Husky will finance 100% of exploration expenditures, and CNOOC Ltd. will take a 51% participating interest in any commercial discoveries.

Blocks 23/15 and 23/20, which cover 1,327 sq km and 1,543 sq km, respectively, are 80 km from Weizhou oil field.

Husky Oil China is a unit of Husky Energy Inc., Calgary. The company recently produced first oil for CNOOC Ltd. from Wenchang field in the Pearl River Mouth basin about 140 km east of Hainan Island and 400 km southwest of Hong Kong. (OGJ Online, July 25, 2002).

Cash flow from Wenchang Blocks 13/1 and 13/2 oil sales will support exploration on the surrounding 57,000 acres on Block 39/05, which Husky also operates under a July 2001 agreement.

Husky plans to initiate a drilling program for Block 39/05 involving two or three wells by yearend or in first quarter 2003. Wenchang facilities could be used to develop fields in the 5,700 sq km lease area.

SHELL EXPLORATION & PRODUCTION CO. (Sepco), Shell International Exploration & Production Inc., and Enventure Global Technology, all of Houston, successfully completed the world's first application of their MonoDiameter expandable tubular technology, with the May 18 spudding of the Starr County, Tex., Thomas-Rife Gas Unit No. 15.

The technology eliminates the telescoping effect in current well design and allows operators to slim down the top of the well while increasing the well diameter at TD. Sepco currently is reviewing three possible locations in the Gulf of Mexico where it plans to drill a MonoDiameter well in 2003.

BASF CORP. at presstime was still investigating the cause of a fire that erupted Sept. 13 at its Freeport, Tex., petrochemical facility. An explosion occurred following reports of a railcar chemical release of xyxlohexanone oxime, which is used to make nylon. BASF said the explosion and subsequent fire damaged several tanks but caused no serious injuries to any of the plant's 1,100 employees.

BASF's Freeport site includes 16 plants and produces a wide range of chemical products.

In other petrochemical news, Shanghai Cabot Chemical Co. Ltd. plans to expand its carbon black production facility in Shanghai, China, to increase production by more than 50,000 tonnes/year. The $25 million plant expansion will use advanced technology developed by Cabot Corp., Boston, and is expected to be fully operational by early 2004. Formed in 1988, Shanghai Cabot Chemical is a joint venture of Cabot 70% and Shanghai Coking Chemical Co. 30%.

SHELL GAS TRANSMISSION LLC and Enterprise Products Partners LP, both of Houston, plan jointly to construct a $40 million pipeline in the western Gulf of Mexico to deliver natural gas from the deepwater Garden Banks area to existing pipeline facilities.

The 16-in. Triton pipeline would extend 41 miles from the Gunnison development in the Garden Banks area to a connection with Stingray Pipeline Co. LLC's natural gas pipeline to shore. The Triton pipeline will have a capacity of 275 MMcfd, sufficient to accommodate Gunnison's 200 MMcfd production (OGJ, Feb. 18, 2002, p. 8) plus additional volumes from future developments in the area, Shell said.

Gunnison, the first discovery in this area, is on Garden Banks Blocks 667, 668, and 669 in 3,150 ft of water. It is being developed with a truss spar platform that can serve as a hub for future development and third-party production.

Kerr-McGee Oil & Gas Corp., a subsidiary of Oklahoma City-based Kerr-McGee Corp., is operator of the Gunnison development and owns a 50% working interest in it.

The Triton pipeline, also operated by Kerr-McGee but owned by Triton Gathering LLC, is expected to be online as early as November 2003. Triton and Stingray are both owned jointly by Shell and Enterprise.

In other pipeline activities, Colonial Pipeline Co., Atlanta, has approved plans to construct a new, larger pipeline to Knoxville that would provide eastern Tennessee with additional gasoline and other liquid fuels.

Colonial plans to lay 16-in. pipe along its current right-of-way, from northeast of Chattanooga to Knoxville. Engineering and other preparatory work for the project has been under way since last year (OGJ Online, Sept. 24, 2001).

The project will be completed in four phases, with construction to begin on the first 43 mile section in mid-2003. The expansion—which includes the addition of larger pumps and motors—ultimately will increase Colonial's Knoxville deliveries to 180,000 b/d of products. Upon completion of the project, the existing 10-in. line will be idled.

SUNOCO INC., Philadelphia, plans to build and operate a sulfur recovery plant at the company's 175,000 b/d refinery at Marcus Hook, Pa. Currently, acid gases are being treated at a neighboring plant operated by General Chemical Corp., and Sunoco must flare gases that the plant cannot handle.

Black & Veatch Corp. has been selected to perform the front-end engineering and design work for the plant, Sunoco stated, adding, "This project is on a fast track." Earlier this year, Sunoco entered into an agreement with the Delaware Department of Natural Resources and Environmental Control to take steps to reduce flaring following "a series of flaring incidents." Sunoco already operates a sulfur plant at its Philadelphia refinery, the company said.

Elsewhere on the refining scene, a 7-day workers' strike—which had affected vessel traffic to and from Statoil ASA's Mongstad refinery and reduced that plant's output—was called off Sept. 16 after the Confederation of Vocational Unions and the Norwegian Oil Industry Association reached an agreement. The accord was achieved before turnaround work was due to start Sept.18 at the refinery. x‡ In other refining news, Premcor Inc., one of the largest independent refiners and marketers of unbranded transportation fuels and heating oil in the US, is shutting down its 70,000 b/d Hartford, Ill., refinery in early October. The Old Greenwich, Conn.-based firm notified refinery employees earlier this month that it would close the refinery on the early October date originally announced in February. See Company News, p. 40. At that time it had paid $2 million in fines for alleged New Source Review violations associated with modifications made to a fluid catalytic cracker in 1994 and was facing expected costs of $8-10 million for installation of antipollution equipment (OGJ, Mar. 11, 2002, p. 19). Premcor Refining Group Inc. also closed a 76,000 b/d plant at Blue Island, Ill., last year after paying $6.25 million in environmental violation fines (OGJ Online, Apr. 1, 2002).

A UNIT OF WILLIAMS COS. INC., Tulsa, has begun receiving natural gas through its 500 MMcfd Canyon Station production-handling platform commissioned earlier this summer in the eastern Gulf of Mexico. The fixed-leg platform stands in 300 ft of water on East Main Pass Block 261, about 60 miles south of Mobile Bay, Ala. (OGJ Online, July 23, 2002). Production from 35,000 acres of federal leases is dedicated to the facility.

Current initial gas volumes are being sourced from two deepwater Mississippi Canyon wells in water 5,000-7,200 ft deep—one in Aconcagua field operated by TotalFinaElf E&P USA Inc. and the other in Kings Peak field operated by BP PLC. The platform is expected to begin running at nearly full capacity by the end of October when nine other wells in Kings Peak, Aconcagua, and Marathon Oil Co.-operated Camden Hills fields begin production.

The system marks a world record water depth for natural gas production, which is transported to the Canyon Station platform through the TotalFinaElf-operated Canyon Express natural gas gathering system.

At 57 miles, Canyon Express is one of the longest multiphase gas gathering lines in the world. It also marks the first time production from such deepwater fields is being commingled in a single flowline and the first use of subsea multiphase meters to determine the production from individual wells.

TotalFinaElf jointly owns Canyon Express with BP, Marathon Oil Co., Pioneer Natural Resources USA Inc., and Nippon Oil Exploration USA Ltd. (OGJ Online May 7, 2002), which together share the production delivery infrastructure. The five Canyon Express working interest owners also own reserves in one or more of the three fields tied into the system.

Initial production will be ramped up over the next 2 months as remaining wells from the three fields are connected to the system, reaching an expected production plateau of 500 MMscfd.

PETROCHINA CO. LTD. signed a 30-year PSC with Sunwing Energy Ltd., Calgary, and Pan China Resources Ltd., subsidiaries of Vancouver, BC-based Ivanhoe Energy Inc., for joint venture development of natural gas reserves on the Zitong Block in the western portion of China's Sichuan basin.

The PSC covers 900,000 acres with "gross resource potential" of 5 tcf, Ivanhoe said. The Sichuan basin is China's largest gas-producing region, with production of more than 800 MMcfd and an estimated 260 tcf of potential gas resources, Chinese officials have said.

In addition, pursuant to existing exclusive agreements, Ivanhoe has the right to negotiate for a PSC on the 1 million acre Yudong Block on the eastern edge of the Sichuan basin. Ivanhoe management expects these negotiations to begin before Dec. 31.

The recent PSC was finalized after feasibility studies and independent engineering studies were completed as outlined in a memorandum of understanding between Sunwing Energy and Petrochina (OGJ Online, Feb. 13, 2001.)

Interpretation from existing 2D seismic data has identified 16 structures with hydrocarbon-bearing potential. Four wells are producing, and larger potential exists from other zones in the producing well bores, Ivanhoe said.

In addition to further developing existing producing structures, Ivanhoe will conduct exploration activities, acquire new 2D seismic data, reprocess existing seismic data, and drill at least four exploratory wells over 6 years. Drilling could commence in late 2003.

In return for its investment and development on Zitong Block, Ivanhoe will receive 80% of the revenue before costs are recovered and 45% after costs are fully recovered. PetroChina participates as a partner in any successful developments, with a working interest of up to 51%.