BURGOS TARGETS—2: Frio-Vicksburg exploration focus areas identified in Mexico's Burgos basin

In an effort to identify future exploration focus areas, Pemex conducted a detailed analysis of the Burgos basin's dominant Frio-Vicksburg play.

The first part of this article (OGJ, Sept. 23, 2002, p. 34) described the structural setting and stratigraphic framework of this area of northeastern Mexico.

Play analysis

Fifty-two subplays were identified in the 13 Frio-Vicksburg stratigraphic units of the Burgos basin. Of these, 26 have proven hydrocarbon production, 19 have hydrocarbons in well tests and mud log shows, and 7 currently have no indications of hydrocarbons.

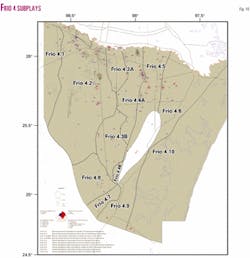

Criteria used to define the plays and subplays included the depositional system and related facies architecture, reservoir quality, and structural trapping characteristics. The 52 subplays were condensed into nine subplay types (Table 1). For example, see a depiction of the subplays for Frio 4 (Fig. 10). Here, 10 subplays have been identified (Table 2).

Play depths range from 100 m to greater than 5,200 m and average 2,000 m. Gross sandstone thickness ranges between zero and 1,000 m, while phi-h, a measure of reservoir quality sand, ranges from zero to more than 50 phi-m.

The most dominant subplays include those in the barrier-lagoon and wave-reworked delta systems, which together make up 24 of the 52 subplays. These cover 34% of the total area yet contribute 74% of the Frio-Vicksburg production.

The next largest contributors are bedload-fluvial and fluvial-dominated deltas, which cover 19% of the total play area, and have contributed 18% of the Frio-Vicksburg production. Both shelf and slope have been historically poor producers, while interdeltaic embayment subplays have no production to date.

Texas comparisons

South Texas is geologically and geographically contiguous with the Burgos basin and, because of its maturity of hydrocarbon exploration and development, offers a unique opportunity for providing insight into the future potential of the Burgos basin.

In the simplest comparison, significantly more wells have been drilled in Texas than in the Burgos basin. RRD4 contains 28 times the 2,900 wells drilled in the Burgos basin. Similarly, RRD4 has 9,299 producing wells, compared with 800 in the Burgos basin.

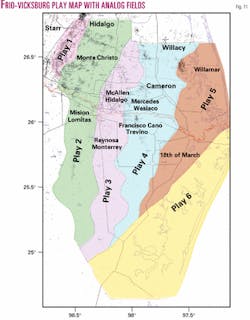

To facilitate comparison between Texas and the Burgos basin, the Frio-Vicksburg was divided into 6 play regions (Fig. 11) based on tectonic and depositional systems and hydrocarbon trapping styles. Four of the Texas plays can be correlated with major producing regions in the Burgos basin.

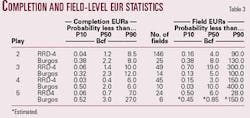

Maximum flooding surfaces from the Burgos basin are readily correlated north into Texas and show that the stratigraphic framework of the two regions is very similar. This is apparent from a comparison of estimated ultimate recoveries by well completion and at the field-scale for the correlative play regions in Texas and Mexico (Table 3).

Five times more fields have been discovered in the Texas plays to date than in their Burgos basin equivalents. In plays 2 and 4 median field sizes appear significantly larger in the Burgos basin. Much of the field-size contrast may be attributed to different criteria used for defining field boundaries in Texas and Mexico.

What this comparison masks but is known from experience is the contrast in well spacing and its impact on recovery of gas in most Texas and Burgos fields. Many Burgos fields have recovered only a small percentage of gas in place because the original well spacing exceeds the drainage capability of the wells.

The data also reveal that while the number of Burgos basin completions is far fewer than in Texas, median completion EURs in the Burgos basin are higher in each of the four play regions. This may be attributed to a higher incidence of reservoir commingling by Pemex and a focus on completing higher quality sands, and also because more favorable drilling and completion costs have enabled Texas operators to target smaller accumulations and poorer quality reservoirs.

Production vintaging plots for the four play regions common to Texas and the Burgos basin (Fig. 12) display production from completions that have been separated out into 5-year time classes. These graphs compare the impact of post-1985 drilling and completions activity on reserve growth in Texas against the mostly unrealized reserves growth potential of the Burgos basin.

In Burgos play region 2 development activity in the Cuitlahuac field in 1995 resulted in significant reserves growth, similar to that displayed in Texas. Absence of reserves growth "spikes" in the other Burgos play regions strongly suggests, at least from a statistical perspective, that substantial volumes of gas remain to be found.

Play summaries

A summary of the play regions, their main characteristics, and a comparison with South Texas follows.

•Play 1

This play lies between the Vicksburg flexure and the counter-regional fault system of Whitbread and others.3

Vicksburg production from the play is prolific; however, it is interpreted to have no correlative in the Burgos basin as the faults shift eastward northwest of Sam Fordyce field.

•Play 2

Vicksburg production downdip of the counter-regional fault system in Texas is interpreted to correlate with Vicksburg production downdip of the Vicksburg flexure in the Burgos basin.

On both sides of the river, varying delta morphologies in the Vicksburg sediments have resulted from the interplay of progradation, subsidence, and marine reworking. The depositional architecture of delta-flank shoreface and beach ridge facies as well as delta mouth bar and distributary channel facies in the Texas Vicksburg reservoirs is comparable to those of the Burgos basin.

Several gas-productive subplays are recognized on the Mexican side, including wave-modified deltaic and shoreline-strandplain sandstones. Potentially productive proximal deltaic facies may extend east of known production.

The Vicksburg section thickens greatly into the Vicksburg flexure and structural complexity increases with depth. Trapping opportunities are anticipated in rollover anticlinal structures and in association with smaller synthetic and antithetic faults.

Texas completion depths range widely from 600 to 4,900 m, compared to a narrower depth range of 1,200 to 3,670 m in the Burgos basin. Average completion EURs in Texas increase significantly in size below 2,500 m from 1 to 5 bcf, which can be related in part to overpressuring, beginning typically at 2,400 to 3,000 m.

The low average EUR is also skewed by a very large number of small recompletions above 3,000 m. Insufficient penetrations exist in Burgos Play 2 to identify a similar EUR increase with depth, and average Burgos EURs remain fairly consistent at 3 bcf. However, pore pressure versus depth plots indicate the average top of overpressure to approximate 2,400 m for the Burgos basin, though overpressuring has been observed as shallow as 1,800 m.

Analog fields in Play 2 include Texas' Monte Christo and Burgos' Mision-Lomitas, which are situated along the same fault system.

•Play 3

Frio and Vicksburg production downdip of the McAllen fault system in South Texas in Play 3 is equivalent to production downdip of the Burgos basin Reynosa fault system.

The Frio is the primary producer in this region, but Vicksburg reservoirs have also contributed substantial amounts of gas. Frio and Vicksburg strata thicken and dip toward this syndepositional fault system forming well-developed rollover anticlines that define the most prolific traps.

The structural setting and trapping mechanisms of Burgos basin Reynosa and Monterrey fields are similar to McAllen and Hidalgo fields in South Texas. Deltaic, coastal barrier, lagoon and coastal plain facies in the Frio and Vicksburg reservoirs at Monterrey and Reynosa fields are similar to Frio and Vicksburg reservoirs of South Texas.

Burgos Play 3 contains seven high-ranked subplays and includes six of the nine identified depositional systems. Future potential includes infill and step-out drilling to untested rollover anticlines and fault traps with anticipated high porosity reservoirs. Texas Play 3 completions are similar in depth to those in Burgos Play 3 (1,500-4,000 m).

Both regions show a steady increase in average EUR with increasing depth.

•Play 4

Frio production in the Burgos basin on the downdip side of the Francisco-Cano fault is equivalent to production on the downdip side of the May fault in Hidalgo and Cameron counties. Fields on either side of the Rio Grande exist in comparable structural settings and display similar trapping mechanisms.

The lower part of the Frio section thickens and dips toward the syndepositional May fault system to form rollover anticlinal traps, but the shallower Frio section maintains approximately equal thickness across the fault, follows regional dip, and owes its trapping mechanism to fault displacement.

Deltaic, coastal barrier, lagoon, and coastal plain environments in the Frio reservoirs in South Texas fields are comparable to the Frio depositional systems represented at Francisco-Cano, Trevino, and Brasil fields. Moreover, the producing intervals in these Burgos fields can be correlated with the producing intervals in Weslaco North and South, Cano-Mexico, Mercedes, and Lacy fields in South Texas.

Six subplay types from barrier-lagoon, strandplain, and deltaic depositional systems exist in the Frio and Vicksburg of Play 4. Considerable unexplored acreage exists in the deep Frio, where thick deltaic sands are predicted. Fault traps and deep anticlinal structures are expected along the Francisco-Cano, Trevino-Brazil, and subsidiary faults.

While Texas Play 4 completion depths range from 600 to 4,300 m, the majority in the Burgos basin are situated above 3,000 m. Play depths exceed 5,000 m in this region, providing the opportunity for gas accumulation in the overpressured section.

•Play 5

Production from Frio reservoirs on the downdip side of the 18th of March fault is equivalent to production on the downdip side of the Willamar fault in Willacy and Kenedy counties.

The shallow structural setting is relatively uncomplicated, and hydrocarbon traps occur in rollover anticlines and on the upthrown sides of major growth and antithetic faults. Hydrocarbons are produced from the middle and upper parts of the Frio formation where numerous upward-coarsening sandstone-rich sequences alternate with thick marine shales.

The bulk of gas production from Burgos' Play 5 comes from the 18th of March field. Beyond this field the play is relatively unexplored. Other successful gas tests and shows exist in widely-spaced exploratory wells.

Anticipated structures include rollover and high-side traps on synthetic and antithetic faults. Reservoirs may be found in barrier-lagoon and shelf sands. Three Frio subplay types were identified in this play. Completion depths are similar on both sides of the Rio Grande.

•Play 6

The traditional Gulf Coast structural style of north-south trending down-to-the-east growth faults is truncated in the southern part of the Burgos basin by a system of northeast-southwest trending normal faults, commencing with the San Fernando fault. This fault system defines Play 6 in the Burgos basin, which has no correlative in South Texas.

Reservoir quality sands have been mapped across Play 6, but additional work is necessary to assess the hydrocarbon sourcing, charge, and trap style. Winnowing from the Anahuac transgression may enhance the quality of shelf sandstones in this play. Frio oil shows have been reported.

Study findings

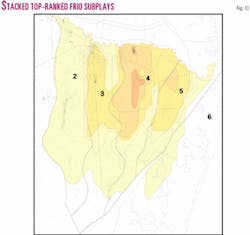

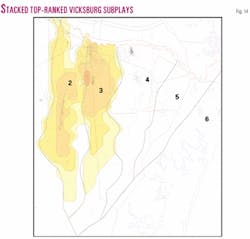

By ranking and stacking the top subplays, exploration focus areas have been defined for the Frio and Vicksburg (Figs. 13 and 14).

The greatest potential in Vicksburg reservoirs is interpreted to exist in the deeper stratigraphic units where extending the structural mapping along trend from current production may define additional anticlinal closures. Shallower Vicksburg and Frio units also have potential in untested fault blocks.

In the deep Frio, predicted rollover anticlinal traps south of the Reynosa-McAllen fault zone and fault traps along other major growth faults are expected. Areas were also identified within the Burgos basin where additional data may reveal favorable structural and stratigraphic conditions for commercial hydrocarbon accumulations. An example of this occurs in Play 6 in the southern part of the basin, where to date discovery of commercial hydrocarbons has been limited. F

References

- Garcia Morales, D.G., and Goodoff, L., "Fault Styles across Santa Rosalia and Santa Anita Fields, Burgos Basin, Mexico" (abs.), SEG annual meeting, San Antonio, 2001.

- Hernandez, J. J., "Interpretation and Distribution of Depositional Systems: Oligocene Frio Deposits in the Subsurface of Burgos Basin, Northeastern Mexico," The University of Texas at Austin master's thesis, 2000, unpub.

- Whitbread, T., Nicholson, T., and Owens, B., "Structural evolution of a detached delta system—the Vicksburg of south Texas," The Leading Edge, October 2001, pp. 1,106-17.

The authors

Mark A. Cocker (mcocker@ scotia-group.com) is senior vice-president of geology for The Scotia Group Inc., Houston. He has over 25 years' domestic and international experience in the industry, conducting geological studies from prospect to basin scale and has been involved in studies in Mexico for the last 4 years. He holds a BSc Hons. in geology from Aston University.

Lynne Goodoff is principal geophysicist with Scotia in Houston and has over 25 years' experience. She was associated with Exxon as exploration and production geophysicist and with Pennzoil as geophysical advisor before joining Scotia. Her responsibilities have included 2D-3D interpretation, prospect mapping, new venture assessment, and field development studies in South Texas and the Burgos basin. She has also worked extensively on the Gulf of Mexico and internationally.

Juan Antonio Cuevas-Leree is exploration manager in the Activo de Exploración Reynosa for Pemex Exploración & Producción (PEP). He has 23 years' experience in PEP and has served as exploration manager in Misantla-Gulf of Mexico, exploration manager for North Region in PEP, and exploration coordinator for the Burgos Project in Reynosa. He holds a BSc in geology from Universidad Nacional Autónoma de México and an MSc in geological sciences from the University of Arizona.

Ricardo Martinez-Sierra is regional coordinator of geological studies in the Activo de Exploracion Reynosa for PEP. He has over 21 years' experience in the industry in subsurface and surface geology in the Sabinas and Mar Mexicano basins. He has been involved in play studies in the Burgos basin for the last 5 years. He holds a geologist engineer title from Tecnológico de Ciudad Madero.

J. Javier Hernández-Mendoza is a geoscientist, specializing in regional geology, for (PEP) in the Burgos basin. He has worked for Pemex since 1986, conducting subsurface and surface geological studies at the prospect and play levels in the Burgos basin. A member of Pemex's Multiple Services Contracts team, he holds a geologist engineer title from Tecnológico de Ciudad Madero and an MSc in geological sciences from University of Texas-Austin.

Douglas Hamilton is a consulting geologist in Austin with 20 years' international experience in the petroleum industry. That includes over 10 years as a reservoir geologist and 10 years at the Bureau of Economic Geology on fluvial, lacustrine, and shallow marine oil and gas reservoirs from the US, Venezuela, Mexico, Argentina, Australia, and Trinidad. He holds bachelor's (Hons.) and PhD degrees in geology from the University of Sydney.