Forecast and Review: US drilling to drop from 15-year high; smaller decline expected in Canada

Drilling in the US and Canada should slow in 2002 after a strong showing in 2001.

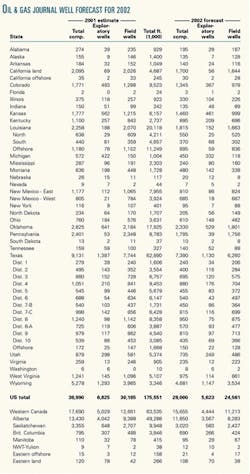

Oil & Gas Journal estimates that total completions will decline 24% in the US and 11.5% in Canada year to year.

The decreases are forecast because of expected year-to-year declines in the prices of crude oil and natural gas at the wellhead.

By OGJ estimates, operators in the US can be expected to obtain wellhead revenues of $91.6 billion this year, substantially down from more than $132 billion in 2001. This should translate into overall drilling and completion spending of $26.6 billion in 2002 compared with $35.1 billion in 2001, OGJ reckons.

The last time US operators exceeded 2001's completion tally was in 1986, when they drilled more than 39,000 wells.

Here are highlights of OGJ's early-year drilling forecast for 2002:

- Operators will drill 28,000 wells in the US, down from an estimated 36,990 wells drilled in 2001, a recent high.

- All operators will drill 4,444 exploratory wells of all types, down from an estimated 6,825 last year.

- The Baker Hughes count of active rotary rigs will average 925/week this year, down from 1,155/week in 2001.

- Operators will drill 15,655 wells in western Canada, down from an estimated 17,690 in 2001.

US estimates

The Baker Hughes rig count topped 1,000/week in 2001 for the first time since 1,010/week in 1990.

Patterns of drilling expected in 2002 will be similar to those of 2001, including less exploratory drilling.

Seven states accounted for almost 70% of US drilling last year. Of 2001's 36,990 total estimated completions, 25% were in Texas, 14% were in Wyoming, and 5-7% each were in California, Louisiana, New Mexico, Oklahoma, and Pennsylvania. The Louisiana figure includes drilling in state and federal waters.

As usual, operators filed large numbers of intents to drill with state and federal agencies but by yearend had drilled wells only on an estimated 65-90% of the permits issued. This generally results from many operators releasing capital and exploration budgets early in the year that later prove to have been optimistic. Especially if oil and gas prices are on the decline during the year, those operators may choose to underspend their initial budgets, sometimes severely.

With what they are drilling, operators are maintaining oil and gas production. OGJ forecasts that US crude oil and condensate production will barely fall from the estimated 2001 average of 5.835 million b/d, and gas production should be maintained at the 2001 figures of 20.25 tcf/year, or 55.5 bcfd.

US drilling plays

Nothing in North America compares with the Gulf of Mexico deepwater play with its ability to add reserves with relatively few wells and apply new technology (OGJ, Nov. 5, 2001, p. 80).

In terms of numbers of wells, high levels of coalbed methane drilling continue in the Powder River basin in eastern Wyoming, San Juan basin of New Mexico and Colorado, Ferron trend in eastern Utah, and the southwestern counties of Virginia. Drilling for gas in extremely tight Cretaceous formations also accounts for a large number of wells in Wyoming.

Drilling for gas and condensate in Jurassic Bossier sands is still in full swing in East Texas. Anadarko Petroleum Corp. reported spudding its 400th well there in August, had 17 rigs running, and counted 404 producing wells in the play.

Anadarko has developed another Bossier play at Vernon field, Jackson Parish, north central Louisiana, where it said development well economics now exceed returns in East Texas. Only a few wells have been drilled, but early evaluations suggest the greater Vernon area has potential similar to the East Texas Bossier, which has more than 1 tcf of proved reserves, the company said.

Drilling in Canada

OGJ estimates that operators will drill 15,655 wells in Canada this year compared with 17,690 in 2001.

These figures are close to a Canadian Association of Petroleum Producers estimate released in October 2001 of 17,500 wells in 2001 and 15,500 wells in 2002. The 2002 estimate, if realized, would still be the fourth highest year for drilling in Canada since 1990.

Drilling in Canada required spending of $23 billion (Canadian) on 17,500 wells in 2000, the same number as estimated for 2001, and resulted in $15 billion in payments to governments, CAPP said.

The degree of expected decline in drilling in Canada in 2002 is not as great as that anticipated in the US. Furthermore, Northern Canada and Canada's Atlantic offshore basins could see more drilling this year than in 2001.

CAPP reported the estimate, attributed to Nickle's Daily Oil Bulletin, that two thirds of the exploratory wells drilled in Canada in 2001 were seeking natural gas. This is a 30 year record.

More than 100 of the onshore wells listed for eastern Canada in 2001 were drilled in Ontario. The others were in New Brunswick, Nova Scotia, and on Prince Edward Island.