OGJ Newsletter

Market Movement

OPEC's market share shrinks

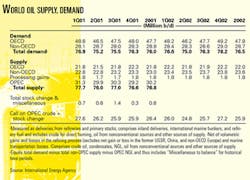

Not since the mid-1980s has OPEC's crude oil market share been below 32%. But full compliance with the organization's Jan. 1 output targets plus Iraqi production of 2 million b/d, says IEA, will again put OPEC's share of the crude oil market below that level (see related story, p. 84).

Growth in non-OPEC production will further erode that share. IEA predicts that production from countries outside OPEC will increase 810,000 b/d this year, while demand is projected to increase only 600,000 b/d.

Compliance would also mean that the US is poised to again become the world's largest producer of crude oil and other liquids, closely followed by Saudi Arabia-which would remain the world's largest producer of crude oil.

IEA's latest projections show that the largest component of non-OPEC supply growth this year will be Russia. As the third leading supplier of crude oil, Russia's total output is forecast to increase 440,000 b/d. Canada, the eighth largest supplier of crude oil and liquids, is expected to increase its total output 240,000 b/d, and the fifteenth largest producer, Brazil, is forecast to boost output 120,000 b/d.

December compliance?

Preliminary IEA estimates indicate that worldwide oil production last month averaged 76.54 million b/d, a decrease of 120,000 b/d from November.

OPEC 10 production, which excludes Iraq, rose 380,000 b/d to exceed the 23.2 million b/d quota target by 450,000 b/d. While output from most of these countries was unchanged, supply from Saudi Arabia is estimated to have increased 270,000 b/d.

Iraqi production fell 770,000 b/d to 2 million b/d in December as the newest phase of the UN oil-for-aid program began on the first of the month. Due to administrative delays in chartering tankers, exports averaged just 1.35 million b/d. In addition, Iraq blamed retroactive pricing for hampering exports, according to IEA. The agency said that because the pricing scheme was imposed to eradicate alleged surcharges, this issue most likely will continue to be a hindrance for a while. This phase of the oil-for-aid program is set to run through May 29. A resolution, unanimously adopted by the UN Security Council on Nov. 29, has pledged to revise sanctions against Iraq within 6 months.

Meanwhile, early estimates show that Decem- ber's non-OPEC supply increased 260,000 b/d from the previous month. US crude production moved up 20,000 b/d from November as Alaskan production increased 30,000 b/d. Output in the Gulf of Mexico and California held steady, but supply from other states declined slightly.

IEA estimates that December production in Norway increased to 3.56 million b/d from 3.44 million b/d a month earlier. Offshore crude production in the UK is estimated to have declined to 2.62 million b/d from 2.64 million b/d.

Kazakhstan is reported to have posted a new production record for the second month in a row last month. Production of crude and natural gas liquids climbed 20,000 b/d to average 870,000 b/d for December. A fall-off in production at Tengiz field was not enough to offset increases in production from other fields, including a boost in condensate output from Karachaganak.

Russian crude output is estimated to have been unchanged from November at just over 7 million b/d.

Natural gas heading for rough year?

Recent weather patterns are not helping to lift natural gas prices despite recent reports of steady withdrawals from underground storage.

In a Jan. 17 research note, UBS Warburg analyst Ronald Barone observed, "The brief cold spell came to a halt last week as the nation experienced its ninth week of warmer than normal conditions this heating season.

"For the week ending Jan. 12, national heating degree-day temperatures were 23% warmer than normal and 17% warmer than the comparable week last year. Season-to-date, temperatures are averaging 17% warmer than normal and 28% warmer than last year."

In addition, a forecast released earlier this month by the National Oceanic and Atmospheric Administration suggested the possibility of an El Niño pattern by early spring. "If this is the case," Barone added, "the cool summer-mild winter temperatures typically associated with El Niño could extend the current period of spot price weakness beyond even our conservative [first half 2002] assumptions."

In spite of this return to overall mild temperatures, the analyst said, the latest AGA storage report shows withdrawals of "solid" amounts of gas, with 137 bcf of gas being withdrawn during the week ending Jan. 11.

"With this latest withdrawal, the year-over-year storage surplus fell to 1.07 tcf from 1.104 tcfellipse," Barone said, adding that he would expect surplus to fall below the 1 tcf mark heading into February.

Regarding gas prices, Barone said, "Influenced by the recent uptick in withdrawal pace and considerable short-covering, NYMEX futures have firmed in recent trading sessions after drifting lower in prior weeks.

Some factors could accelerate a downward trend in gas prices, however. According to Energy Security Analysis Inc. Senior Analyst Mary Menino, noting ESAI's prediction of a generally downward trend in gas prices over the next 6 months, "If a move to dump storage begins earlier than February, the downturn could occur more rapidly than we have predicted."

ESAI contends that while late February is the traditional time for cleaning out inventories, with this year's buildup, the Boston-area consulting group projects heavy withdrawals during the first 2 weeks of February: "Once the heavy draws begin, there tends to be a rush for the door," Menino said. "No one wants to be caught with low-valued stocks at the end of the season." F

Industry Scoreboard

null

null

Industry Trends

Global butadiene demand will increase an average of 3.9%/year in 2001-06, predicted Chemical Market Associates Inc., Houston.

In its 2002 World Butadiene Analysis, CMAI noted this is higher than the 1996-2001 rate of 2.7%/year. The growth rate slowed then following a global economic slowdown.

The report said demand during 2001-06 would outpace the rate of capacity additions.

Butadiene is concentrated in manufacture of synthetic rubbers, including chloroprene rubber, nitrile rubber, polybutadiene rubber, and styrene-butadiene rubber. Those derivatives made up 61% of the demand for butadiene in 2001. Over the 2001-06 period, CMAI expects demand for butadiene in the production of acrylonitrile butadiene styrene resins will see the greatest average annual rate of growth of all derivatives (see table).

Polybutadiene will lead all derivatives in the increase of total tonnes of butadiene consumed, increasing by more than 500,000 tonnes by 2006.

The regions expected to have the fastest butadiene demand growth over the period are the former Soviet Union, Southeast Asia, and the Middle East. Demand in North America, meanwhile, declined by more than 300,000 tonnes in 2001 from 2000.

US gasoline prices remained basically unchanged at $1.11/gal for the week ended Jan. 11 after rising for 3 weeks in a row, according to API.

Fluctuations in oil prices are the most important cause of gasoline price swings over the long term, API said, noting that last year the US imported almost 60% of its petroleum needs.

"Gasoline demand remains healthy-up 1.3% in the fourth quarter of 2001 on a year-over-year basis-and refiners continue to supply significant amounts to US consumers," the association said.

Gasoline production for the week ended Jan. 11 averaged more than 8.1 million b/d. Nationwide inventories, including both conventional and reformulated gasoline, remained above average for this time of year and are higher than in the same week a year ago.

Total inputs into the nation's 152 refineries were 2% less than in the same period last year. Refineries nationwide ran at 89.4% of capacity, down 1.5 percentage points from the previous week. Production of distillate fuel-used as diesel fuel and heating oil-was at a time-of-year record at more than 3.6 million b/d.

Government Developments

State regulators should develop security standards defining the minimum requirements for the oil and gas industry in protecting facilities vulnerable to terrorist attack, said Michael Williams, chairman of the Texas Railroad Commission, earlier this month in Houston.

As a member also of the state task force for the national Homeland Security program, Williams said he planned to recommend such a program soon.

Detailed information of the resulting security programs should be maintained by the individual companies implementing those programs but subject to inspection by regulators, Williams said at a Jan. 11 luncheon of the Association of Texas Intrastate Natural Gas Pipelines in Houston.

He opposes a potential exemption to Texas's open records law, proposed by some state officials to prevent leaks of security information to would-be terrorists. Instead, Williams said industry should channel such information directly to Homeland Security officials at the federal level, where it would be protected by existing national security exemptions.

Saudi officials, in a meeting with top ExxonMobil officials last week, gave no indication whether they will postpone foreign investment in Saudi Arabia's gas sector.

Saudi Foreign Minister Saud al-Faisal called the talks "fruitful" in an official statement from the Saudi Press Agency. The minister was present at the talks along with ExxonMobil Pres. Lee Raymond and other top ExxonMobil officials; Saudi Oil Minister Ali al-Naimi also was part of the Saudi negotiating team.

The discussions come about a week after US companies indicated up to $30 billion in gas deals scheduled to be finalized this March with Saudi Arabia may be delayed because of diplomatic tensions between the White House and the kingdom (OGJ, Jan. 21, 2001, p. 24).

ExxonMobil has not released any official statement on whether it expects the timetable for the gas deals to slide past this spring. The company is leading two of three "core ventures" made available to foreign energy companies.

The first project, which the Saudis call the most attractive investment opportunity, will be led by ExxonMobil and includes drilling in eastern Saudi Arabia at South Ghawar. Gas from that field will be used to fuel two planned petrochemical plants, two power stations, and four desalination plants. Initial investment is estimated at $12-16 billion.

ExxonMobil was also tapped to lead a Red Sea project estimated to require at least a $5 billion investment. The third project at Shaybah field in the Empty Quarter near the UAE border will be led by Royal Dutch/Shell and will require an investment of $5-10 billion, the Saudis say.

A sticking point between the Saudis and foreign investors is how much gas the Saudis, through their state-controlled oil and gas company, Saudi Aramco, want to earmark for the various infrastructure projects on the table.

Quick Takes

Statoil sold its first 1 million bbl crude shipment from the $3.5 billion Girassol field off Angola, with the shipment to be lifted in mid-February. Statoil said Girassol oil is low-sulfur, similar to North Sea crude.

Statoil also will market Norsk Hydro's 10% share of Girassol crude. The two companies will receive a 1 million bbl shipment into Europe every 40 days. Statoil has a 13.33% stake in the field, which came on stream Dec. 4 (OGJ Online, Dec. 4, 2001).

The first cargo of Girassol crude went to the other partners at yearend 2001. Operator TotalFinaElf has 40% of the field, ExxonMobil's Esso Angola subsidiary has 20%, and BP PLC 16.67%.

Production at the field started with six wells, and two more will come on flow the first week in February. Output from the field is 140,000 b/d. Although peak production is capable of reaching 230,000 b/d, Statoil will maintain output at 200,000 b/d for the next 4 years.

Bouygues Offshore and Stolt Offshore are 50:50 partners in the 2 million bbl Mar Profondo Girassol FPSO, the world's largest.

None of the produced gas on the field will be flared. Angolan state oil firm Sonangol owns the gas and eventually may use it in an LNG export project. Four of the six flowlines from the wells have been installed, and work is nearing completion on the other two.

In other production news, Unocal Indonesia has installed a second production platform at its Yakin field off East Kalimantan. Indonesian constructor H&H Utama installed the CPP2 platform in the oil and gas field 8 km off Balikpapan. H&H used a float-over and ballast-down technique to install the platform, which is connected by a 20 m bridge to the existing CPP1 platform. CPP2 will separate 10,000 b/d of wellstream oil and water and 10 MMscfd of associated natural gas. Consulting firm Sinclair Knight Merz carried out the process, mechanical, electrical, instrumentation, and structural design of the platform's double deck topsides. It also engineered the loadout, seafastening, and installation of the topsides during transportation to the site.

Veba Oil & Gas Netherlands is producing 31,500 b/d from its recently developed Hanze field, representing almost two thirds of Dutch oil production. The field, in the North Sea 200 km north of Den Helder, came on stream in August 2001 and is the first offshore chalk reservoir to be developed in the Netherlands. The field produces from two wells and includes two water injection wells. Produced oil from Hanze is being taken by tanker and the gas exported via a pipeline into the existing system to Den Helder. VOGNL as operator holds 45% of the field; other field partners are Oranje-Nassau Energie 20%, Dyas Nederland 20%, and EDC (Europe) 15%.

Shell Exploration & Production's $298 million subsea Crosby development in the US Gulf of Mexico is on stream, producing 20,000 b/d of oil. The three-well development is in 4,400 ft of water on Mississippi Canyon Blocks 398 and 399. It is tied back 10 miles to the Ursa tension leg platform on Mississippi Canyon Block 809. At peak, expected by the end of the first quarter, Crosby will produce 60,000 b/d of oil and 90 MMcfd of gas, boosting Ursa's total production to 170,000 b/d of oil. Shell operates Crosby with 50% interest; BP holds the remaining 50%. Target reserves are at 17,000-18,000 ft below sea level in three separate reservoirs.The oil is primarily 24-30° gravity with 2% sulfur. Shell expects Crosby's total gross ultimate recovery at more than 70 million boe. The company also said Einset field on Viosca Knoll Blocks 872 and 873, 170 miles southeast of New Orleans, is producing 30 MMcfd of gas. Einset is expected to yield more than 30 bcf of gas during its life. Peak production is expected to reach 60 MMcfd. The field is in 3,500 ft of water and is tied back to Shell's Southeast Tahoe manifold on Viosca Knoll Block 784, which carries production 12 miles to Shell's Bud Lite platform on Main Pass 252. Shell said it used existing infrastructure to accelerate production of the single-well development. Shell operates Einset, with 50% interest, and Dominion Exploration & Production holds the remaining interest.

INDONESIA'S national gas company, PT Perusahaan Gas Negara (PGN), is seeking equity partners and $2.95 billion in financing for four pipeline projects to be completed by 2007. One pipeline, scheduled for construction start in the first quarter, would ship gas to Singapore, while the other three projects would make up an Indonesian distribution network.

The Singapore line, which already has commitments for $450 million in loans, would take gas from fields in southern Sumatra from mid-2003. The partners are expected to provide another $276 million. PGN will also seek loans and partners for the 1,100 km East Kalimantan-East Java pipeline, which would be ready by 2005-07, and the onshore, 680-km pan-Java pipeline.

PGN would have to raise up to $1.4 billion for the two projects. PGN plans to increase its gas distribution volume to 1 bcfd by 2004 from the current 350 MMscfd. It hopes to raise distribution to 2 bcfd by 2005-07, when the four pipelines are completed.

That volume could more than double by 2010 as the government removes fuel subsidies and encourages natural gas use. Industry sources say Indonesia's gas demand is expected to rise 5-8%/year when the present fuel subsidy is phased out in 2004.

Elsewhere on the pipeline front, Westcoast Energy applied to the Canadian National Energy Board for a $338.4 million (Can.) expansion of its Southern Mainline gas pipeline system in British Columbia. Southern Mainline extends from a point 40 km south of Chetwynd, BC, south to Huntingdon, BC. Westcoast plans to build 55.5 miles of 42-in. line in eight loop segments along the route of the existing line. The loops, from 2.1 to 19.4 miles long, would be installed between McLeod Lake and Rosedale. Westcoast also would upgrade and construct additional facilities at several compressor and meter stations. Westcoast Energy said the facilities would increase the trunk line capacity 200 MMcfd when completed by Nov. 1, 2003.

Bison Pipeline plans to apply to the Alberta Energy Utilities Board in July for authorization to build an $800 million (Can.), 516 km pipeline to transport bitumen from the Athabasca oil sands to the Edmonton, Alta., area. Bison Pipeline, a wholly owned subsidiary of BC Gas, said it expects final regulatory approval in first quarter 2003. The insulated system would retain the temperature of bitumen with minimal use of diluent. Initial capacity would be 100,000 b/d, expandable to 450,000 b/d. When fully developed the pipeline would cost $1 billion. Bison Pipeline is involved in joint engineering and technical studies with potential shippers, including TrueNorth Energy and Petro-Canada. Bison Pipeline expects to begin building the system in time to meet the earliest shippers' planned production schedule of mid-2005.

PLAINS ALL AMERICAN PIPELINE will expand its Cushing, Okla., terminal again-to 5.3 million bbl of oil capacity.

The third expansion will add 1.1 million bbl of storage and will cost $11 million. The last expansion, also 1.1 million bbl, was announced in June (OGJ Online, June 25, 2001). Work on that project will be completed at midyear.

Phase III work will begin immediately and end in December. Matrix Service of Tulsa is the contractor for both the second and third expansions.

The Cushing terminal was completed in 1994 with initial capacity of 2 million bbl.

In other storage news, a subsidiary of SGR Holdings plans to develop a gas storage cavern in Greene County, Miss. SG Resources Mississippi has completed engineering work and has acquired land and pipeline rights-of-way for the Southern Pines Energy Center. The high-deliverability storage facility will have two caverns, each with 8 bcf of capacity. The 80-acre site will accommodate three additional caverns. The project could serve nine major pipelines. SGR will hold an open season for storage capacity and will begin the project permitting process in the first quarter. Completion is expected in late 2003. SGR also is developing two other salt cavern storage facilities in the Gulf Coast region.

TURKMENNEFTEGAS, Turkmen's state-owned oil and gas company, awarded Technip-Coflexip a 130 million euro contract for the design and construction of a diesel hydrotreating plant at its 116,477 b/d refinery at Turkmenbashi.

The contract will become effective as soon as financing is arranged, said Technip-Coflexip. The work should be completed 33 months after that.

The lump sum, turnkey contract calls for a plant that will produce 1.5 million tonnes/year of hydrotreated diesel-less than 10 ppm of sulfur-and 20 tonnes/day of sulfur as by-product.

The plant will include a hydrotreating unit, a sulfur recovery unit based on Technip-Coflexip's proprietary technology, and associated utilities, storage tanks, and control systems.

Technip-Coflexip's engineering center in Dusseldorf, Germany, will conduct the plant engineering, procurement, construction, and start-up.

In other refining news, Flint Hills Resources (formerly Koch Petroleum), will invest $145 million in upgrades to its 300,000 b/d Corpus Christi, Tex., refining complex. Flint Hills will begin engineering and construction of a sulfur-processing unit within the next 6 months. The expected completion date is mid-2003. Jacobs Engineering Group will manage the project. Flint Hills said the upgrades would allow it to produce fuels with 80% lower sulfur levels. The 2005 standard is an average 30 ppm.

Holly Corp. subsidiary Navajo Refining completed the expansion of its petroleum products terminal at Moriarty, NM. The expansion added gasoline and jet fuel to existing diesel fuel delivery capabilities. An expansion of the pipeline from Navajo's 60,000 b/d Artesia, NM, refinery to Moriarty allows it to deliver more than 45,000 b/d of light products. The system's initial capacity at yearend 1999 was 16,000 b/d. The system consists of 330 miles of 8-in. pipe leased from Williams and 60 miles of Navajo-owned 12-in. line. Holly recently announced the receipt of permits for the expansion of Navajo's Artesia refinery and the addition of a new gas oil hydrotreater (OGJ Online, Jan. 8, 2001).

DUAL RAM RIGS the focus of drilling news this week. Smedvig said that during minor repair work on its drillship West Navion, it discovered cracks in the wire sheaves in the ram rig hoisting system of the dual derrick set. West Navion is expected to stop work for 2-3 weeks. Aker Maritime affiliate Maritime Hydraulics, the supplier of the proprietary design dual derrick set, has issued a request to all its users to inspect all drilling units equipped with the dual ram rig. Smedvig will inspect its West Venture drilling rig.

Indonesian authorities have approved an extension of Gat Bangkudulis Petroleum's term to perform the drilling commitment on the Bangkudulis technical assistance contract off East Kalimantan. They have also granted permission for the company to proceed with its planned 2002 drilling and development program on Bangkudulis field.

ON THE DEVELOPMENT FRONT, Algerian oil and gas company Sonatrach and its partners awarded a $257 million contract to a joint venture of Saipem and Bouygues Group for development of oil reserves in the Berkine basin in southeastern Algeria.

The contract involves development of Rhourde Oued Djemaa oil field and five other bordering oil fields in southeastern Algeria that are held jointly by Sonatrach, Italy's Agip, and Australia's BHP Billiton.

The project involves various installations, including a central treatment unit, a gathering network, and oil storage tanks.

The companies will spend another $190 million to drill 20 production wells.

The six fields, with estimated reserves of 300 million bbl, are scheduled to come on stream at 80,000 b/d in 2004.