M&A deal values decline in 2001, study says

The value of global energy merger and acquisition transactions was $243.5 billion last year, down 8% from 2000, according to consulting company John S. Herold Inc., Norwalk, Conn.

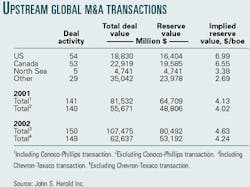

Herold attributed the decline to a 24% drop in upstream global M&A transactions. They were $81.5 billion in 2001.

The consultant said US implied reserve value hit a record of $6.99/boe. Canadian implied reserve value also hit a record of $6.55/boe.

"North American implied reserve values climbed with commodity prices through 2000 and into 2001, but continued to remain elevated despite falling oil and gas prices later in the year," said Christopher Sheehan, Herold senior vice-president. "The widening gap between what sellers were asking and what buyers wanted to pay resulted in North American deal volume declining nearly 15% in 2001," he said.

Instead, buyers turned their attention to higher risk, higher reward frontier areas. Overseas deal volume in 2001 accounted for 43% of transaction value, compared with 17% in 2000.

Herold said global downstream transaction values rose to $35.4 billion in 2001 from $19.9 billion the previous year, in part because of US refining mergers, including Phillips Petroleum Co.'s $9.8 billion acquisition of Tosco Petroleum Corp.

Power industry transaction value dipped slightly to $82.6 billion from $84.8 billion in 1999. Midstream activity declined to $22.3 billion in 2001 from $32.3 billion in 2000. Consolidation in the oil field equipment and services sector drove deal value to $20.1 billion from $16.7 billion in 2000. Coal transactions in 2001 totaled $1.4 billion.