This article, last year, celebrated the drilling industry's achievements in finding crews and mobilizing an aging rig fleet to exceed not only the 1997 drilling activity peak but also what many pundits said was the industry's drilling capacity at the time.

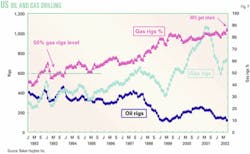

The cycle was short, leaving North American drilling contractors to manage the ensuing sharp downturn (Fig. 1). The drilling industry's mood, however, appears to remain cautiously optimistic.

Where wages, day rates, and rig counts remain soft, contractors appear to be maintaining rigs and crews and even growing their fleet by continuing new-build programs and rig-acquisition plans.

Working to keep experienced personnel, at least two drillers reported that they have no plans to cut crew wages.

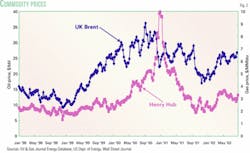

Commodity prices have recovered from their lows during the exceedingly warm 2001-02 winter when gas prices had dropped below $2/MMbtu and crude oil sold for less than $17/bbl (Fig. 2). North American drilling activity, however, has been slow to respond.

Worldwide activity

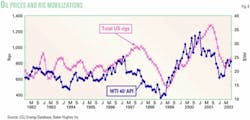

According to Baker Hughes Inc., Houston, worldwide rig activity dropped 22% from last year to 1,822 active rigs in July 2002 (Fig. 1). Most dramatic is the 34% slide from the February 2001 peak of 2,430 rigs operating to the most recent low in April 2002 of 1,597 active rigs.

The world rig activity, heavily influenced by North American rig counts, exhibits similar features as the predominantly gas-price driven North American rig count curve in Fig. 3 and also includes the influence of Canada's annual winter freeze-over rig mobilization.

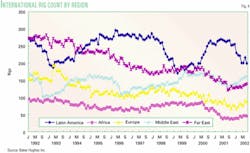

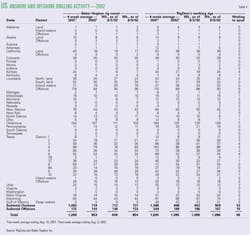

The international rig count that excludes Russia, onshore China, and North America, averaged 705 rigs in July 2002, down 43 rigs from last year (Fig. 3).

In the major international regions (Fig. 4), the active rig count in the Middle East and Far East increased by 20 rigs in each region, with 201 and 172 rigs running in July 2002, representing 11% and 13% increases, respectively. Africa remained unchanged with 55 active rigs running in July 2002.

The active rig counts in Latin America declined 24% during the year to 199 active rigs operating in July 2002, down from 262 in 2001. In Europe, the active rig count dropped 20% for the year from 98 to 78 active rigs as of July 2002 (Fig. 4).

Baker Hughes counts only rotary rigs and considers a rig active in North America if it is actually drilling or "turning to the right." The company considers an international rig active only if it has drilled for 15 days during the month counted.

The rig counts do not include rigs that are in transit from one location to another, rigging up, drilling less than 15 days internationally, or being used in nondrilling activities, such as production testing, well completions, or workovers.

From this perspective, the Baker Hughes rig counts would not serve as a rig census or indicator of the rig fleet's drilling capacity but only as an indicator of current rig activity and wells being drilled.

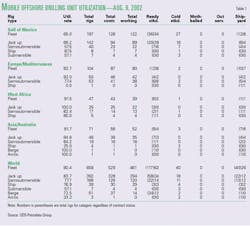

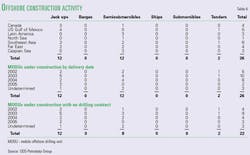

Worldwide offshore activity declined by 14 rigs during the year to 461 working rigs by Aug. 9, 2002, a decline from 475 working rigs last year and a drop in working utilization from 88% to 80%, according to ODS-Petrodata Group, Houston (Table 1).

Fig. 5 graphs only competitive rigs, excluding rigs owned by national oil companies or with geographical exclusions, which accounts for the 417 working rigs in August 2002 compared to the 461 working rigs in Table 1.

The US picture

OGJ estimates that operators will drill 26,350 wells by yearend 2002, almost 29% fewer than the 36,990 wells that the industry drilled in 2001 (OGJ, July 1, 2002, p. 80).

Considering West Texas Intermediate (WTI) 40°API oil prices sank to a low beginning-of-the-month posted price of $17.50/ bbl in December 2001, prices have rebounded, stabilizing in a range near $23.50/bbl by July 2002 (Fig. 6).

Natural gas prices have had a greater impact on US rig count than oil price. Henry Hub gas prices spiked to $10/ MMbtu during the winter of 2000, driving US rig mobilizations to peak at 1,698 rigs in North America in February 2001 (Fig. 2).

The subsequent gas price collapse to less than $2/ MMbtu going into summer 2001 caused an equally dramatic decline in drilling activity with active rigs plummeting from the February 2001 peak of 1,698 rigs to an April 2002 low of 872 active rigs in North America.

While drilling contractors mobilized an average of 28 rigs/month or almost 1 rig/day leading up to the February 2001 peak, the fall to the April 2002 low was equally dramatic (Fig. 6).

Based on information provided by RigData for wells deeper than 2,500 ft, by August 2002, the top 50 operators in the US had drilled 4,971 wells (average well depth of 8,246 ft) for a cumulative 41.0 million ft drilled (Table 2).

The five most active operators in terms of wells drilled included Dominion Exploration & Production (439), BP PLC (340), EOG.Resources Inc. (236), Occidental Petroleum Corp. (229), El Paso Corp. (223).

BP PLC was the most active operator in terms of total footage drilled, with 3.26 million ft, averaging 9,579 ft/well (Table 2).

US land rigs

Drilling utilization for the top 25 US drilling contractors has fluctuated in the 50-60% range since the beginning of the year based on rigs that the drilling contractors were marketing (Table 3).

The data in this table include both onshore and offshore rigs and is not completely accurate as an indicator strictly of land rig utilization. US land rigs make up most of the statistics in Table 3, however, making it a good off-the-cuff reference.

On the basis of marketed rigs, the 2002 land-rig utilization for the top 25 US drilling contractors has declined almost 30% over last year.

Table 4 is a survey of onshore and offshore drilling activity for a 4-week period ending in mid-August.

Based on a 4-week mid-August 2002 average for US onshore activity, RigData says 896 land rigs were drilling, a decrease of 490 units operating or almost 36% from the same 4-week period last year (Table 4).

Calculating land-rig utilization from the data requires a rig census. Schlumberger Oilfield Services has made the decision, however, to discontinue the formerly known Reed-Hycalog Rig Census, with the 49th census taken in 2001 being the last.

Company sources said the census was discontinued as a cost-cutting measure and as a result of industry feedback that the information was not widely used by drilling contractors and operators.

The Land Rig Newsletter (LRNL) reported that it, along with RigData, took a rig census of 264 US land rig contractors and identified 2,010 drilling rigs capable of drilling for oil and gas, with potentially 50 to 100 additional rigs that could increase the count.

LRNL's objective for the survey was to get an estimate of the size and capacity of the US drilling rig fleet. "The current tally is believed to be the most comprehensive survey of the land drilling fleet in more than a decade," said LRNL's Richard Mason (LRNL, June 28, 2002, p. 1).

Based on this census, the land rig utilization of the 896 rigs operating from Table 4 would be less than 45% utilization.

Wages, dayrates

Mason explained that daily operating margins for at least two drilling contractors had fallen below the $2,000 level in the second quarter. Others have seen margins in the $2,500-$2,800 range (LRNL, July 2002).

Grey Wolf and Helmerich & Payne are two examples of drilling contractors that say they have avoided reducing worker wages during this downturn.

Tom Richards, Grey Wolf's chairman, president, and CEO, said in a company statement, "Highly skilled crews enhance the safety, efficiency, and value of our operations which allowed us to enter into long-term contracts in the last cycle. By retaining our experienced personnel during the downturn, Grey Wolf is positioned very well for the next expansion of the business cycle."

New builds, consolidation

Drillers apparently share the view that gas production rates are rapidly declining and that the industry is not currently replacing produced reserves.

Drilling contractors are adding rigs to their fleets through acquisitions or new builds, even though current drilling activity levels, dayrates, and revenues are down.

Rowan Cos. is actively under way with construction of its first Tarzan class jack up rig, the Scooter Yeargain, for deep drilling projects on the Gulf of Mexico's outer continental shelf, and has committed $300 million to build three more of the rigs for delivery by 2006.

Exxon Neftegas Ltd., a subsidiary of ExxonMobil Corp., expects to spud its first well on Sakhalin Island during the fourth quarter with its Parker Drilling Co.-built arctic rig (OGJ, June 17, 2002, p. 41).

Helmerich & Payne Inc., Tulsa, is under way with construction of the third series of its FlexRig design.

John Lindsey, vice-president US land operations for Helmerich & Payne said the company's Houston facility has built six FlexRig III rigs. Five of the rigs are currently working, and the sixth one is in the process of mobilizing to a location.

Two additional rigs are under construction with expected delivery and commissioning by the end of September. Including the two currently under construction, Helmerich & Payne expects to build 17 of the rigs by June or July 2003.

Lindsey explained that if everything goes according to plan, two of the rigs would come out of the construction yard every month.

"Construction costs for the new rigs are favorable, with a FlexRig III costing about $10.5 million, which includes the top drive, blow-out preventer handling equipment, and AC-drive motor technology," said Lindsey.

He added that earlier estimates for new rig construction priced a new 2,000 hp, 20,000-ft SCR rig at $12.5 million but without any of the new technologies that come with the FlexRig III's (OGJ, Sept. 22, 1997, p. 62).

He highlighted that the new rigs had maintained 100% utilization, which he attributes to the new technologies and safety in operations. He suggests that the new-build rigs must be displacing older rigs in this depressed drilling environment. "All of the new rigs have gone to work incident free," said Lindsey.

Other examples of new build programs that are under way include the Dallas-based Heartland Rig International Inc. rig the company is building for Alaska and the series of high-end rigs for the Middle East that are being built by Cooper Manufacturing Corp.

Gas, directional wells

The percentage of wells the industry is drilling in the US to meet domestic natural gas demand continues to increase. According to Baker Hughes, 86% of the total US drilling rig fleet was drilling for gas in July, up from 83% a year ago (Fig. 7).

As of Aug. 9, 2002, US operators had a cumulative permitted depth of about 8.8 million ft seeking natural gas, compared with only about 2.1 million ft for oil wells (Table 5).

The relative percentage of vertical, horizontal, and directional wells remains with typical historic levels, despite continued improvements in directional drilling technologies and the maturity of US oil and gas fields that can require advanced techniques.

Canada

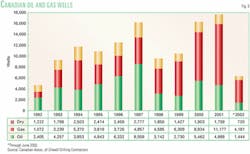

Canadian drilling activity slumped in 2002, along with the rest of the industry, as was apparent from Canada's customary winter drilling-season peak (Fig. 8). Canadian drilling rigs mobilize more easily following winter freeze-over and drilling activity normally peaks in February.

February 2002 saw 493 active rigs or 75% utilization compared with 97% utilization and 608 active rigs during the February 2001 peak. Drilling activity was lower in summer as well with 234 rigs active in June 2002 compared with 340 active rigs in June 2001.

The Canadian Association of Oilwell Drillers (CAODC) forecasts that the Western Canadian rig fleet will drill 14,323 wells by yearend 2002, which is a 20% decline compared to the 17,933 wells that it drilled in 2001.

Even though this estimate is based on a second-quarter forecast, Don Herring, president of CAODC, expects the actual number of wells drilled in 2002 to come close to the projection.

Third-quarter rig utilization is currently running slightly ahead of the projected 40%, but Herring thinks the fourth-quarter prediction of 395 active rigs or 60% utilization of the fleet may be high based on his perception of restrained drilling budgets and operator spending levels for the remainder of the year.

Although based on limited feedback from the operators, Herring said oil and gas companies have not committed to drilling even in light of higher commodity prices. Revenue streams from higher prices have not spilled over to the drilling industry.

Operators appear to be waiting for direction in the supply and demand balance and commodity price movement.

Herring explained that Canadian operators go through the budgeting process in the fall and there is not a great deal of commitment, particularly for shallow-gas development drilling.

The Canadian shallow-gas reserves decline rapidly and require continual drilling to maintain production rates. Herring noted that in the case of Alberta during the past year, there has been insufficient drilling activity to replace the reserves that were produced.

The percentage of wells targeting gas continues to increase, with gas wells making 74% of the producing wells drilled in Western Canada in 2002, compared to 70% in 2001 (Fig. 9).

After receiving a 10% wage increase in 2001, Canadian rig operator pay scales remain unchanged at a driller's hourly rate of $31.00 (Can.) and a floorman's at $20.25 (Can.).

Herring commented that the industry has not cut pay scales but would not consider an increase either unless work activity increased to the level that made workers difficult to find.

Even in light of the lower drilling activity since last year, the Western Canadian rig fleet has expanded by 24 rigs to 656 rigs in June 2002 from 632 in June 2001 (Fig. 8).

Herring explained that the increase could be rigs coming out of construction that had been planned as well as introduction of rigs with new technology, for example slant rigs or coiled tubing equipped rigs. Older rigs would remain on the available rig list.

Offshore markets

According to ODS-Petrodata Group (ODS), Houston, 529 rigs held contracts on Aug. 9, 2002, 42 fewer than a year ago, for a worldwide utilization rate of 80.4%.

Out of 104 rigs in the fleet, Europe and Mediterranean markets maintained fleet utilization rates of 83.7%, with 87 rigs holding contracts. ODS said rig utilization rates in the Gulf of Mexico, however, have dropped to 65.0% on Aug. 9, 2002.

Simmons & Co. International in a recent oil service industry research report highlighted that the slowdown afflicting the UK sector of the North Sea is looking to be deeper and longer than initial expectations, with the Baker Hughes rig count showing the North Sea down nine rigs from June to July.

GlobalSantaFe President and CEO Sted Garber said in a company statement, "The North Sea market has shown the greatest weakness following the imposition of a 10% incremental tax on operating profit generated from oil and gas production from certain North Sea fields.

"A number of operators there have reduced their drilling activities, causing rig utilization in the area to soften for both semisubmersibles and jack ups," he said.

Offshore construction

This year, 12 jack ups, 12 semisubmersibles, and 2 tenders are being built, or have been proposed, with 5 of these vessels to be finished by the end of 2002 (Table 6).

Out of the 26 offshore rigs under construction, 6 units will go to work in Southeast Asia, 4 will go to the Far East, and 5 to the Gulf of Mexico.

Offshore consolidation

ENSCO International Inc., Dallas, announced in August that it had completed its acquisition of the Houston-based Chiles Offshore Inc. in a stock and cash deal. ENSCO acquires Chiles' five premium jack up rigs in the deal, which are of the Keppel FELS MOD V-B design.

One of the rigs, the Chiles Galileo, and to be renamed the ENSCO 105, is still under construction in Brownsville, Tex.

An ENSCO spokesman said the company was strategically focusing on the premium jack up rig market to participate in the deep gas drilling in the Gulf of Mexico's outer continental shelf and other areas of the world. The company operates in the North Sea, Venezuela, Trinidad, Middle East, and the Pacific Rim.

The combined company will have a fleet of 56 offshore rigs, including 43 premium jack ups, and 28 oil field support vessels.