OGJ Newsletter

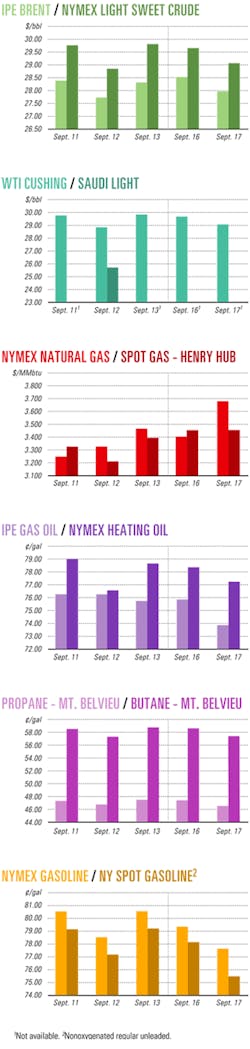

Market Movement

IEA sees oil stocks trending lower

Amid sluggish product demand growth, poor refining margins, decreased compliance with output quotas by members of the Organization of Petroleum Exporting Countries, and the risk of a double-dip recession, the price of oil recently has hovered around $30/bbl. While it's widely thought that market psychology surrounding a war premium for a possible Western-led conflict in Iraq has driven this price hike, the International Energy Agency asserted that those who argue that market fundamentals are weak underestimate the disconnect between crude and product stocks.

In its latest report, Paris-based IEA said that, although product inventories are comfortably in the middle of their 5-year range in terms of days of forward cover, crude stocks are low and are trending lower.

The agency's preliminary estimates indicate that Iraqi oil-for-aid exports fell 270,000 b/d in August, while OPEC-10 (minus Iraq) production increased a mere 24,000 b/d. In addition, North Sea and former Soviet Union output declines coincided with a seasonal increase in transportation demand, increased military purchases, and injections into strategic stocks.

Crude stocks look uncomfortably low going into the heating season, said IEA. "The market bears may be correct about soft fundamentals and a weak global economy over some longer time frame, but their conclusions do not apply in the short term as the Northern Hemisphere heads into winter," officials reported.

Stocks

During July, Organization for Economic Cooperation and Development (OECD) industry oil stocks slipped to 55 days of forward demand cover, even with that of a year earlier, as crude stocks de- clined 790,000 b/d and product stocks grew 80,000 b/d. Total crude stocks closed the month at 895 million bbl.

With westbound oil from the Middle East in decline since the beginning of the year, overall arrivals of crude into western ports were more than 1 million b/d below end-July 2001 volumes, said IEA.

North American crude stocks finished July 14.5 million bbl lower. Crude runs in the US were unchanged from a year earlier, but import volumes were off, forcing a draw on refiners' inventories. At 2 million bbl, additions to the US Strategic Petroleum Reserve were down more than 50% from the previous month.

In Europe, crude inventories held steady. Pacific crude inventories declined 320,000 b/d; this was led by Japan, where refiners increased runs following regular maintenance in May and June.

Peak demand during the US summer driving season eroded gasoline stocks in the Atlantic Basin during July. US finished gasoline stocks fell 4 million bbl for the month.

Oil demand

Due partly to strong US gasoline use, IEA raised its third quarter assessment of global oil demand by 220,000 b/d, the same pace at which the agency pegged overall 2002 demand growth.

IEA expects that August demand will show the strongest growth in a year. OECD demand is forecast to continue to expand from then on, in line with the unhurried progress of the global economic recovery.

First half 2002 non-OECD oil demand contracted a bit more than previously reported due to the impact of the Argentine financial crisis and its effects on Latin American demand and other economies in the region. Argentine oil demand has been sinking at or near double-digit rates for more than a year, down 11.7% for second quarter 2002.

Industry Scoreboard

null

null

null

Industry Trends

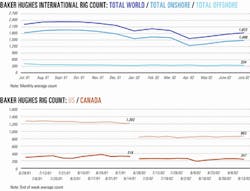

MORE ANALYSTS are projecting a slower drilling recovery than they earlier anticipated.

Simmons & Co. International, Houston, reduced its second half 2002 and full year 2003 rig count forecast for the US and Canada along with its oil service companies' earnings projections. On a brighter note, Simmons & Co. expects large and midsized capitalization oil service companies that it follows to report year-on-year earnings per share growth of 33% next year.

In a research note, analysts Scott Gill and Bill Herbert said the decreased expectations stem from "heightened concerns" among exploration and production companies that "full storage" will depress natural gas prices throughout this year. Oil and gas companies also are uncertain about the economy.

US companies have slowed the pace of capital expenditures, which also stalls oil service activity and pricing momentum. Meanwhile, a UK North Sea drilling slowdown is proving to be more severe than previously expected.

"Our outlook assumes that the recovery in (US and Canada) drilling activity is pushed out 6 months and resumes a gradual recovery in early 2003," Gill said.

For the US and Canada, Simmons & Co. adjusted its average second half 2002 rig count assumptions downward by 6% and lowered its average 2003 rig count assumptions by 9% (see table).

US drilling activity increased for the week of Sept. 13 with 863 rotary rigs working, up 12 from the previous week for the largest Bakere Hughes rig count since Jan. 18 and the third largest weekly tally this year (OGJ Online, Sept. 13, 2002).

Gill expects rig numbers to bounce between 840 and 860 for the next few weeks. He still expects a third quarter average of 850 rigs in the US, which would mark a YOY decline of 32%.

BP PLC is seeking to secure natural gas supplies across the North Sea's UK-Norway border.

Within 3 months, BP hopes to develop plans with input from the UK and Norwegian governments, gas suppliers, and pipeline owners.

In August, BP solicited other North Sea operators regarding their interest in new links with the North Sea's pipeline infrastructure. BP said it wants to secure a "competitive future" for UK gas supplies from Norway.

Cooperation between the UK and Norway is at "unprecedented levels," said Scott Urban, BP group vice-president, North Sea.

By 2005, BP said existing UK infrastructure would have "significant excess capacity" to meet the needs of Norwegian gas suppliers.

Government Developments

France's Parliament plans a broad debate during October to try to transpose into law the European Union's directive that would open up the French natural gas market.

The 2-year-old liberalization process, originally scheduled for August 2000, hit a stalemate when the previous government linked the official opening of France's gas market with the public offering of the capital of Gaz de France SA. This triggered opposition from the trade unions (OGJ, July 29, 2002, p. 7).

The parliamentary debate will replace a fast-track process that Industry Minister Nicole Fontaine had suggested.

It's uncertain whether France's Parliament will be able to pass the law by Dec. 31 in order for the country to avoid condemnation from the European Court of Justice for not adopting the EU directive sooner.

THE US Environmental Protection Agency may allow two independent refiners more time to meet the agency's low-sulfur diesel rule.

EPA said it would allow public comment on the refiners' request through Oct. 15, although under the fuel rule it may give a small refiner an extension without a formal rulemaking.

The agency said that Scottsdale, Ariz.-based Giant Industries Inc. filed a "hardship application" for its 59,000 b/d Yorktown, Va., refinery; another independent, Farmland Industries Inc., Kansas City, Mo., also sought relief for its 112,000 b/d facility in Coffeyville, Kan.

The rule calls for highway diesel fuel sulfur levels to drop to an average of 15 ppm from 500 ppm beginning in June 2006 with a final phase-out by 2010. Small refiners had the chance to have more time meeting the rule if they petitioned EPA by this summer.

THE US Federal Energy Regulatory Commission has reasserted its jurisdiction over a gas-gathering system off South Texas.

Williams Cos. Inc.'s subsidiaries Transcontinental Gas Pipe Line Corp. and Williams Field Services, a midstream unit of the Tulsa-based parent, "acted in concert" to charge excessive rates for gas-gathering services on Transco's pipeline system in the Gulf of Mexico off Padre Island, said FERC officials. Acting on the earlier recommendations of an administrative law judge, FERC set a "reasonable" rate of 1.69¢/Mcf for the unbundled gathering service. Officials stressed that FERC policies for gas-gathering systems are not to be "used to circumvent or undermine regulation of interstate transportation of gas" under the Natural Gas Act (NGA) or the open-access provision of the Outer Continental Shelf Lands Act.

Apache Corp., Houston—one of the affected producers—claimed Williams took advantage of captive producers by "spinning down" to an unregulated affiliate the only gas pipeline system from North Padre Island to the mainland (OGJ Online, Aug. 16, 2002).

Another affected producer, Shell Offshore Inc., Houston, filed a complaint with FERC on Nov. 30, 2001. On June 4, an administrative law judge recommended that FERC reassert NGA jurisdiction over the transferred facilities.

Quick Takes

THE CONSTRUCTION STAGE of Phase 2 of the Azeri-Chirag-Gunashli (ACG) full field development project in the Azerbaijan sector of the Caspian Sea was sanctioned Sept.18 by the development project's steering committee comprised of representatives from the State Oil Co. of Azerbaijan (SOCAR) and from each of the nine foreign companies participating in the project.

Phase 2 involves a $5.2 billion development of Azeri field's eastern and western sectors, which project operator BP PLC said contain an estimated 1.6 billion bbl of oil. Production is planned for 2006.

Phase 2 marks the second major step for the project partners' development scheme, which began after the Early Oil Project started producing an average of 130,000 b/d of oil from Chirag platform in 1997.

Phase 1, which received approval in August 2001, covered the central portion of Azeri field. Once completed, production from this development phase will reach about 1 million b/d of oil in late 2004 or early 2005.

Production from ACG will be transported, starting in first quarter 2005, through the Baku-Tbilisi-Ceyhan (BTC) pipeline to Turkey's Mediterranean Sea coast. Partners of the proposed $2.8 billion BTC pipeline earlier this year formed the BTC Pipeline Co. to construct, own, and operate the system (OGJ Online, Aug. 14, 2002).

Phase 3 of ACG will develop deepwater Gunashli field, which is expected to start production in 2008.

The ACG partners on Phase 2 are BP 34.1%, Unocal Corp. 10.3%, OAO Lukoil 10%, SOCAR 10%, Statoil ASA 8.6%, ExxonMobil Corp. 8%, TPAO (Turkey's state oil company) 6.8%, Devon Ltd. 5.6%, Itochu Corp. 3.9%, and Delta Hess Inc. 2.7%.

In other development news, Husky Oil Operations Ltd., a unit of Husky Energy Inc., Calgary, awarded a 165 million euro contract to a unit of Technip-Coflexip for design and construction of Husky's subsea production system for its White Rose development project off Newfoundland. White Rose field, which consists of both oil and gas pools, lies in Jeanne d'Arc basin 350 km east of St. John's and contains an estimated 200-250 million bbl of recoverable oil, Husky said. Husky and Petro-Canada, its joint venture partner, received provincial and federal government regulatory approval for the project in December 2001 (OGJ Online, Jan. 21, 2002). The White Rose development plan centers around the installation of a floating production, storage, and offloading vessel with the capacity to handle production of 100,000 b/d of oil (OGJ Online, Apr. 8, 2002). St. John-based Technip CSO Canada Ltd. will head up engineering, procurement, installation, and construction of the White Rose system, which will incorporate a flexible riser system, in-field flexible flowlines, dynamic and static umbilicals, subsea manifolds, trees, and a subsea control system.

The project will involve a total of 42 km of flexible risers, flowlines, and umbilicals; five subsea manifolds; and 15-21 wellheads and wellhead assemblies distributed across three "glory holes," depressions that protect wellhead facilities from iceberg scour. Technip CSO also has the option to install the mooring system for the White Rose FPSO. Houston-based Cooper Cameron Corp. will supply trees, wellheads, and the control system. Installation of the subsea production system will be carried out using Technip-Coflexip's CSO Constructor and CSO Marianos vessels in the summer of 2004.

Houston-based Atlantia Offshore Ltd., which has a turnkey contract from TotalFinaElf SA unit TotalFinaElf E&P USA Inc. to install a monocolumn tension-leg platform in Matterhorn oil field in the Gulf of Mexico, awarded a subcontract to Paragon Engineering Services Inc., Houston, to provide facilities design and engineering. Matterhorn field is in 850 m of water on Mississippi Canyon Block 243, about 170 km southeast of New Orleans. TotalFinaElf owns 100% of the field. Paragon said it expects to complete the core work for detailed engineering this month, and will, for the balance of the project, support Atlantia with fabrication oversight and precommissioning assistance.

RENTECH INC., Denver, and Global Process Systems Inc., Dubai, have signed a memorandum of understanding to provide technology license and engineering services worldwide for gas-to-liquids process technology on floating production systems.

The alliance will target various prospective stranded natural gas projects in which Rentech's GTL process could be used. GTL plant sizes will be 2,500-10,000 b/d, Rentech said.

Rentech's GTL technology includes design, procurement, construction, project technical development, and estimating services for specific projects.

GPS specializes in providing turnkey packages for process equipment and plants. This includes engineering and fabrication of natural gas processing and treatment systems, design and supply of crude oil separation systems, and FPSO-based topside process equipment.

Through an alliance with specialist fabricator Lamprell Energy Ltd. of the UAE, GPS has access to topside fabrication services at Lamprell's Jebel Ali yard in Dubai, which builds modular FPSO process units and GTL topsides.

PERU'S CAMISEA natural gas project will have a guaranteed income for the transportation and distribution of gas via pipeline through a contract covering the difference in the cost of transportation until production reaches 380-450 MMcfd.

The guarantee had been in place since the contract was signed in December 2000 with Etecen, Peru's main power grid operator. The government, however, transferred the guarantee to state oil firm Perupetro on Sept. 3 after Colombia's Interconexion Electrica SA won a 30-year concession to operate Etecen and affiliate Etesur.

Perupetro is to set up a contingency fund of $12 million in 2004 for immediate availability of funds to Camisea should there be delays in payment to the transportation and distribution concessionaires.

Transportadora de Gas del Peru will pipe the gas from Camisea to the city gate south of Lima. It is scheduled to arrive in early August 2004. Belgium's Tractebel SA will distribute the gas throughout Lima and Callao.

Work on the Camisea project continues on schedule, according to the consortium in which Argentina's Pluspetrol SA and Tecgas, a Techint SA unit, are the operators.

The consortiums hope funds will be available by March.

In other pipeline news, ANR Pipeline Co., a unit of Houston-based El Paso Corp., is holding a nonbinding open season through Oct. 11 to gauge shipper interest in additional natural gas capacity on ANR's existing system along the Lebanon lateral in Southwest Ohio. Additional capacity will be developed by increasing compression at an existing facility near Glen Karn, Ohio, ANR said. The project would provide the added capacity by November 2004, ANR said. Gas supply could be sourced from the Gulf Coast, the Midcontinent, Joliet Hub, or ANR's gas storage fields.

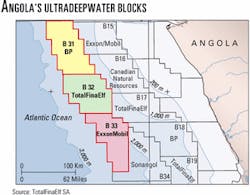

BP Exploration (Angola) Ltd. has made an oil discovery on ultradeepwater Block 31 off Angola, 248 miles northwest of Luanda. This is the second exploration well BP has drilled on Block 31, which lies in 4,922-8,203 ft of water and covers an area of 5,349 sq km.

The Leiv Eiriksson semisubmersible drilled Plutão-1 in 6,628 ft of water and reached 14,607 ft TD below sea level. The well was tested through a 48/64-in. choke at a maximum rate of 5,357 b/d of oil.

BP has 26.67% equity in Block 31. Its partners are ExxonMobil Corp. unit Esso Exploration & Production Angola 25%, state-owned Sonangol EP 20%, Statoil Angola AS 13.33%, Marathon Angola Petroleum Ltd. 10%, and TotalFinaElf SA unit EPA Ltd. 5%.

Plutão marks the first ultradeepwater discovery following numerous deepwater finds off Angola. On an adjacent ultradeepwater block, the initial well on TotalFinaElf-operated Block 32—the Gindungo prospect—will be drilled in the fourth quarter, according to partner Marathon.

There have been significant discoveries of major oil fields on nearby Blocks 14, 15, and 17. Oil found to date has an API gravity of 32-39.5° and sulfur content of 0.12-0.14%. On TotalFinaElf-operated Block 17, Dalia field alone has an estimated 1 billion bbl in estimated reserves and Girassol, an estimated 725 million bbl of reserves. Girassol came on stream last December, and field development is now under way on Block 15, which is 22 miles east of Plutão (see map).

BP also operates the Greater Plutonio project on Block 18, a 50:50 joint venture with Royal Dutch/Shell Group. Front-end engineering and design is currently under way on that project.

Sonangol recently entered into a production-sharing agreement, effective Sept. 1, with CNR Ranger (Angola) Ltd., the wholly owned subsidiary of Canadian Natural Resources Ltd., Calgary, for an initial 4-year exploration of Block 16, which is in 985-4,920 ft of water.

Canadian Natural will operate the 1,219,831-acre block and retain a 50% working interest while Odebrecht Oil & Gas Angola Ltd. has 30%, and Sonangol, 20%. x‡

Also off West Africa, Amerada Hess Corp. struck pay again with an appraisal well in the eastern portion of Elon field off Equatorial Guinea. The well, drilled in 165 ft of water, encountered 316 ft of net oil pay in a single, continuous column, the company said. The well confirms the Elon G-8 discovery reported earlier this year that found 157 ft of net oil pay. (OGJ Online, June 19, 2002). Elon field is on Block G in the Rio Muni basin, 15 miles northeast of Amerada Hess's Ceiba field and 6 miles southeast of the Akom discovery made in late February. The successful appraisal increases the areal extent and size of Elon field and will be incorporated into the development plan that Amerada Hess will submit to the Equatorial Guinea government for approval. In addition to Elon, that submission includes development plans for Okuume, Oveng, Ebano, Akom, and Abang fields in the northern part of Block G. Amerada Hess has an 85% working interest in Block G and adjacent Block F and is operator of both. Amerada Hess's partner in the blocks, Energy Africa Ltd. of South Africa, holds the remaining 15% working interest. The government of Equatorial Guinea will have a carried 5% participating interest in any commercial production from the field.

Syntroleum Peru Holdings Ltd. and Houston-based BPZ Energy Inc. are seeking one or more partners to join their activities in Block Z-1 off Peru's far northern coast, according to BPZ Pres. Fernando Zuñiga. Syntroleum and BPZ hope to build on previous discoveries on the block and declare a commercial oil and gas find before the fourth year of the contract—signed Nov. 30, 2001—to receive a 30% discount on royalties offered by the government. Syntroleum Peru, a unit of Tulsa-based Syntroleum Corp., is aiming to use its GTL technology to install a GTL plant in Peru, provided it confirms sufficient natural gas reserves (OGJ, Dec. 17, 2001, p. 34). Syntroleum and BPZ currently are completing the environmental impact assessment on the block and have completed diving operations to determine the condition of four existing 30-year-old platforms prior to accepting responsibility for the facilities or installing drilling rigs on them. Perupetro said that small hydrocarbon finds made previously by companies exploring the area led to reserves estimates of 540 bcf of gas.

EXXONMOBIL subsidiary ExxonMobil Exploration & Production Malaysia Inc. has awarded a 2-year contract to Houston-based Atwood Oceanics Inc. for drilling operations to be performed by Atwood's Vicksburg jack up off Malaysia.

The rig currently is undergoing equipment upgrades and other required vessel modifications prior to starting the project. Atwood said it would have modifications completed around Sept. 22 and would mobilize to the site at that time.

ExxonMobil is the largest oil producer in Malaysia, with current production of about 280,000 b/d—nearly 50% of the nation's total. It also produces 1.4 bcfd of natural gas, which supplies 70% of Peninsular Malaysia's requirements.

Correction: The Independence drilling barge (shown in OGJ, Sept. 9, 2002, p. 9) is a 500 ton drilling barge, not a 2,500 ton drilling barge as reported.