Suezmax caught in economic squeeze

Utilization is up for Suezmax tankers, one of the more usefully sized vessel groups (120,000-200,000 dwt) in the oil and gas tanker industry. But the world's economic malaise is nevertheless holding down Suezmax shipping rates.

Current crude oil shipping patterns and the vessel's size have made it ideal for some major routes, but consumption in those markets remains in the doldrums with higher rates nowhere in sight.

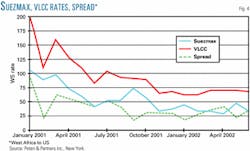

That's the recent opinion of shipping consultant Poten & Partners Inc., New York, which says recent history of Suezmax Worldscale (WS) rates seems to "fly in the face of reason." Since early 2002, fixture activity has improved, while rates have collapsed (Fig. 1), says the company, which is an oil tanker and liquefied gas carrier broker and consultant.

Suezmax activity

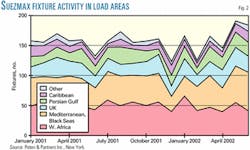

West Africa is not a growing source of employment for Suezmax tankers because of continuing competition from very large crude carriers (VLCCs). But the number of Mediterranean area "fixtures" (vessels) is growing, reflecting the increase in Black Sea exports, says the company (Fig. 2).

The Atlantic Basin is the source of 88% of the spot-market employment for Suezmax tankers. The remaining 12% is exports from the Persian Gulf region, of which 90% are to Asian destinations and 10% primarily to the Mediterranean:

- Fifty percent of West Africa spot-market cargoes are to the US, 19% to the Mediterranean, 12% to Northern Europe, 8% to the east coast of South America, and the remaining 11% to other destinations.

- Fifty-six percent of Mediterranean spot-market cargoes are intraregional with 36% to Northern Europe, and 8% to the US, Asia, and the east coast of South America.

- Forty percent of UK "liftings" (vessel loadings) are intraregional, 47% to the US and east coast of Canada, 6% to Asia, and 7% to Mediterranean markets.

Clearly, says Poten & Partners, many Mediterranean and UK fixtures are to satisfy short-haul intraregional cargo movements.

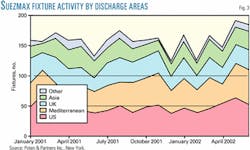

Fig. 3 shows that Europe is the most important destination for Suezmax tankers, followed by the US. Both destinations are in an upward trend in the number of fixtures since the start of the year.

No rate improvement

The trend for Suezmax tankers, says the consulting company, is a growing volume of fixtures. In fact, the level of fixtures at midsummer was higher than at the start of 2000 when rates were much higher.

The apparently simple economic positive relationship between the volume of fixtures (demand) and the Suezmax tanker fleet (supply) is complicated, however, when the Suezmax tanker fleet is viewed in relation to other fleets, especially VLCCs.

If Suezmax tanker rates become too high with respect to VLCC rates, says Poten & Partners, there is an incentive for VLCCs to carry a greater share of West African cargoes, which takes away from demand for Suezmax tankers and causes Suezmax rates to weaken.

Fig. 4 shows the close relationship between the Suezmax and VLCC markets. The rate spread since October 2001 has varied between 20 and 40 WS points, according to data compiled by Poten & Partners, with an average of 30 WS points.

As prospects for Suezmax tankers brighten with the likelihood of increased exports from the Black Sea, those prospects are at the same time dimmed because increased Black Sea exports cut into VLCC cargoes from Persian Gulf load areas to the Atlantic Basin, thus putting pressure on VLCCs to seek cargoes elsewhere.