OGJ Newsletter

Market Movement

Oil price rise may aid US gas market

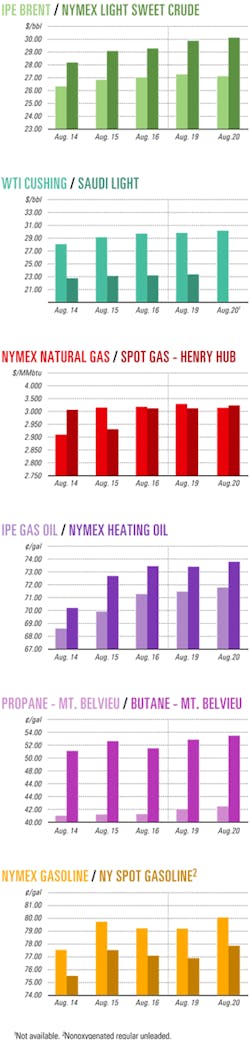

The possibility of military conflict between the US and Iraq has boosted oil prices nearly 10% in recent weeks and could trigger increased US demand for natural gas, said Christopher Theal, an analyst at CIBC World Markets, the investment and merchant banking arm of the Canadian Imperial Bank of Commerce.

"Crude oil prices are now rising faster than natural gas prices, which we believe should result in rising gas demand as end-users switch from fuel oil to gas," he said. That switch should be evident this fall in lower weekly injections of gas into US underground storage, said Theal.

The US Energy Information Administration last week reported gas injections into US underground storage totaled 37 bcf during the week ended Aug. 16, down from 54 bcf the previous week and 85 bcf during the same period in 2001. The latest injection figure was below Wall Street's expectations.

US gas storage now totals nearly 2.7 tcf, representing surpluses of 231 bcf compared with year-ago levels and 307 bcf over the 5-year average.

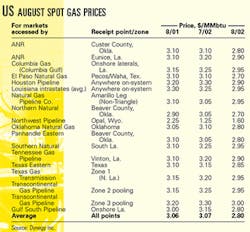

Dynegy Inc., Houston, earlier reported US spot market natural gas prices for August deliveries decreased by 27¢ to $2.80/MMbtu on average due to increased levels of gas in storage this year (see table).

US oil stocks up

Meanwhile, the American Petroleum Institute reported US oil inventories shot up by 6.6 million bbl to a total of 302.3 million bbl during the week ended Aug. 16. That increase reversed more than two thirds of the 9.5 million bbl draw that API had reported the previous week. US gasoline stocks also jumped by 935,000 bbl to 209.9 million bbl during the week ended Aug. 16, while distillates registered a relatively small decline of 282,000 bbl, with 132.7 million bbl still in inventory.

"After the (previous) sharp and inconsistent decline in crude inventoriesellipseand despite API denials over a pipeline transfer error, this latest API (report) further highlighted the extent of timing impacts on inventory reporting and data volatility," said Matthew Warburton, an analyst at UBS Warburg LLC in New York. "Nonetheless, with global crude inventories on a gradual tightening trend and uncertainty surrounding potential US military action in Iraq, we expect any bearish reaction to the crude build to be muted."

US crude and petroleum product inventories "remain comfortably in the middle of the 5-year (average) range," said Warburton.

However, he said, "With total crude inventoriesellipsestill close to their 12-month lows and the ongoing tightness in (Petroleum Administration for Defense District 2, encompassing the upper Midwest US), we expect West Texas Intermediate prices to remain firmly backwardated with incremental crude imports drawn into the US."

Warburton also noted, "Counter to market expectations, gasoline inventories increased slightly as domestic production climbed to near-record levels of 8.8 million b/d and imports rebounded. Barring unforeseen outages, in the coming weeks we do not expect a repeat of the sharp draw in gasoline stocks witnessed this time last year.

"Nonetheless, with economic runs cuts, planned maintenance, and the forthcoming switch to winter grade gasoline, we anticipate a modest drawdown in coming weeks."

US distillate inventories "remain well above normal seasonal levels," said Warburton. "With implied distillate demand remaining below year-ago levels and the threats of reduced jet fuel demand and low natural gas prices, overall refining margins are likely to remain below midcycle for the foreseeable future."

Industry Scoreboard

null

null

null

Industry Trends

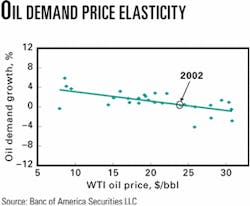

THE CURRENT HIGH PRICE OF OIL is likely to erode oil demand growth in the near to medium term, according to Tyler Dann, analyst for New York-based Banc of America Securities LLC.

"A strict extrapolation of oil demand elasticity to price would imply that annualized demand growth should be flat-to-negative when the West Texas Intermediate oil price is above $26.30/bbl," Dann said.

Based on this analysis in isolation-and with WTI prices hovering presently right around $30/bbl-there would actually be an implied demand shrinkage of 0.6%, Dann said. "We do not place 100% re- liance on this analysis, given the relatively weak relationship and the fact that it can be easily influenced by exogenous factors (such as global GDP trends)," he said.

The analysis, however, "does provide an incremental negative sign for the supply-demand picture," he stated, adding, "The other negative signs include indications of a delayed economic recovery, potential for higher production from (Organization of Petroleum Exporting Countries') 'leakage' or official production quota increases, and increases in non-OPEC production."

BRANDED GASOLINE STATIONS in many US markets are losing market share to high-volume retailers (HVRs) such as mass merchandisers, supermarkets, and warehouse clubs, said NPD Automotive Products Group, a Port Washington, NY-based market information firm. The overall market share of HVR gasoline has increased from less than 1% in 1998 to 5.5% the first half of this year, NPD said.

This shift in consumer behavior corresponds with the volatile retail gasoline pricing that began in February 1999 when the average price was about $1/gal and peaked in May 2001 when gasoline averaged $1.80/gal.

The Motor Fuels Index, which surveys over 200,000 gasoline purchasers annually, indicated that, for the first half of this year, 63% of all consumers and 95% of HVR gasoline customers cite "price" as the main reason for choosing brands of gasoline. HVRs often offer gasoline price reductions of 10¢/gal or more, compared with traditional brands. Such consumers also say they find car performance satisfactory using the HVR brands.

"Traditional gasoline facilities must learn to either institute very lean operations, such as unattended pumps, or evolve to provide other means of generating profits, such as large convenience stores," said David Portalatin, spokesperson for NPD. "Major oil companies should prepare their facilities to operate on thin gasoline margins, be price competitive, and leverage the increased traffic that is generated as a result," he added.

Government Developments

A renewable fuel mandate may prove to be the most difficult aspect of negotiating a final US energy bill, according to Prudential Securities analyst James Lucier. The energy bill, however, will probably be passed during the September-October time period, Lucier noted.

Congressional leaders in late June officially began talks designed to reconcile disparities between the House and Senate energy bills (OGJ Online, July 1, 2002).

Lucier explained that the Senate-passed legislation-in anticipation that methyl tertiary butyl ether would be replaced by ethanol as a motor fuel oxygenate additive-contains a wide-ranging mandate to increase ethanol production to 5 billion gal/year by 2012, nearly triple its present level.

The Senate bill also includes "strong legislation in favor of renewable fuels," Lucier noted, adding, "The House bill is silent on the issue of ethanol, but House members are willing to make a deal."

The issue, said Lucier, is not a partisan one: "Rather, Republicans and Democrats alike from the states of California and New York oppose an ethanol mandate and would probably opt to waive all oxygenate use if permitted."

Lucier continued, "Midwestern farm states, by contrast, are unabashed supporters of the ethanol mandate, as it is clearly in their economic interest.

"Meanwhile, legislators from Texas and Louisiana whose constituents include MTBE producers will most likely oppose any attempt to end the mandate on oxygenates," he said.

Lucier concluded, "During this tight election year, in which control of both the House and Senate is in play, ethanol could well be the deciding factor."

The US Department of the Interior's Minerals Management Service has revealed the "proposals, alternatives, and mitigating measures" that will be studied in the environmental assessment (EA) analyses of the two upcoming eastern Gulf of Mexico Lease Sales 189 and 197, which are tentatively slated to occur December 2003 and March 2005, respectively.

In February, the MMS published in the Federal Register a Call for Information and Nominations and a Notice of Intent to Prepare an Environmental Impact Statement (EIS).

"This MMS area identification decision will be incorporated in the two-sale EIS as well as in a planned subsequent (EA) for Eastern GOM Sale 197, the second sale," MMS said, adding, "The EA will focus primarily on new issues, to determine whether MMS should prepare either a 'Finding of No New Significant Impact' or a supplemental EIS."

Being studied will be unleased blocks within the Eastern Gulf of Mexico Planning Area (OGJ Online, Dec. 6, 2001).

Included where applicable in the planned EAs, MMS noted, "will be three stipulations designed to reduce potential conflicts between oil and natural gas operations and military activities, and one stipulation designed to mitigate potential adverse effects on protected marine species."

Quick Takes

Royal Dutch/Shell Group unit Shell Brasil SA has placed an order for a drilling and production rig to begin producing oil from its find on Block BC-10 in Bijupira-Salema field in the prolific Campos basin, off Brazil.

The well lies in 1,924 m of water 110 km off Rio de Janeiro state. The pioneer well, 1-SHEL-2-ESS, was spudded Dec. 11, 2000, by the Stena Tay semisubmersible drilling rig. Shell said it expects to be producing about 70,000 b/d of oil from the discovery by mid-2003.

The production unit will be a floating production, storage, and offloading vessel-to be renamed "FPSO-Fluminense"-which is being converted from an oil tanker in a Singapore shipyard at a cost of $250 million. It is expected to arrive at Bijupira-Selema field in April or May 2003.

Bijupira-Salema production will make Shell the first foreign oil company to produce oil in Brazil.

Shell said it plans to invest $1 billion in oil and gas exploration and production in Brazil during the next 4 years, primarily in developing Block BC-10 in which it owns an 80% interest from its purchase earlier this year of Enterprise Oil PLC (OGJ Online, Apr. 2, 2002). Brazilian state oil and gas firm Petroleo Brasileiro SA (Petrobras) and Mobil Exploração Desenvolvimento Ltda. hold the remaining interest in the block.

Shell's exploration activities in 15 blocks throughout Brazil, either alone or in association with other companies, have already required investments of about $300 million. Out of 10 wells drilled in the Campos and Santos basins, there were 7 discoveries currently being evaluated. x

In other development news, Spain's Repsol-YPF SA has received approval from Libya's National Oil Co. (NOC) to develop 'A' field on Block NC-186 in Murzuq basin 720 km from the Mediterranean coast in the southwestern Sahara Desert. The field, estimated to hold 140 million bbl of oil reserves, is a middle Ordovician structure trap sealed by the Tanezzuft Silurian shale, said block operator Repsol-YPF.

The $155 million development scheme will involve transporting production through a 31 km pipeline to facilities of the Repsol-YPF-operated, giant El-Sharara field, then carried via pipeline to the Mediterranean port city of Zavia. Peak field production is expected to reach 40,000 b/d, with production expected to start by first quarter 2004. Repsol-YPF and its block partners have drilled 8 exploration wells in the area since May 1998. Five tested at rates of 1,600-2,300 b/d, "demonstrating a reserves potential in excess of 300 million bbl," the company said. Repsol-YPF's block partners are NOC, Austria's OMV AG, France's TotalFinaElf SA, and Norway's Saga Petroleum Mabruk.

INDONESIAN state oil and gas enterprise Pertamina has begun deliveries of natural gas to Malaysia from the South Natuna Block B producing area off Indonesia.

Under a sales agreement signed in 2001 between Pertamina and Malaysia's state-owned oil and gas company Petronas Carigali Overseas Sdn. Bhd., Pertamina will deliver 1.5 tcf of natural gas to Malaysia from Block B over a 20-year period. The gas was valued at $4 billion when the agreement was made (OGJ Online, Mar. 29, 2001).

Conoco Inc., operator of Block B, began the initial deliveries this month of 100 MMcfd, which are expected to increase to 250 MMcfd by 2007. The natural gas is being produced from Conoco's Hang Tuah movable offshore production unit and is flowing to the Petronas-operated Duyong field complex off peninsular Malaysia via a 96 km pipeline that Conoco operates under a separate agreement.

As part of the Block B production-sharing contract with Pertamina, Conoco holds a 40% interest in the field; Tokyo-based Inpex Masela Ltd. holds 35%, and Texaco Inc.-now ChevronTexaco Corp.-has 25%. F

In other production news, BG Tunisia, a unit of BG Group PLC, has awarded a $70 million contract to Bechtel Group Inc. for the installation of a compression package on its Miskar natural gas field in the Mediterranean Gulf of Gabes, 125 km off Tunisia. Bechtel will modify the Miskar platform and install a single, 20-Mw, gas turbine-driven compressor, which is to be operational in 2004. The upgrade, BG said, will allow the field to maintain peak production for an additional 5 years. The revamp also will increase the total recovery of field gas. BG, under a long-term contract with Tunisia's state gas and electricity company Societe Tunisienne de l'Electricite et du Gaz, supplies more than 205 MMscfd of gas. Siemens Demag Delaval Turbomachinery Ltd. has been contracted to build the compressor package, which will be housed in a 1,600 tonne module. The package will be installed in a single lift onto the top deck of the platform. Construction is planned to start in March 2003. Rolls Royce Energy Systems, a unit of Rolls Royce PLC, will provide the gas turbine.

Pogo Producing Co., Houston, reported late last month the drilling of the first three wells in a planned six-well exploration program on Block B8/32 in the Gulf of Thailand. Pogo, through its Thai subsidiary Thaipo Ltd., holds 46.34% interest in the B8/32 concession. Other concession partners are operator Chevron Offshore (Thailand) Ltd., a unit of ChevronTexaco Corp., 51.99%, and Palang Sophon Ltd. 1.67%.

In mid-2001, ChevronTexaco predecessor Chevron Corp. revealed plans to embark on a $180 million scheme to build and install six minimum facilities platforms on the Thai block (OGJ Online, May 30, 2001).

The next 3 wells, Pogo said, will be an additional test well in north Jarmjuree field and two exploratory wells to test the northern and western limits of Tantawan field.

The first well, Benchamas North No. 4, was drilled on exploration acreage beyond the present northern periphery of the 102,000 acre Benchamas field production license area, Pogo said.

The well found 163 ft of total pay, which included 126 ft of oil-bearing section and 37 ft of natural gas sands. Based on this discovery, Pogo and its partners intend to file for an extension of the present northern boundary of the license area.

The second well was drilled west of any previously drilled wells. Benchamas No. 26 found 137 ft of total pay, including 62 ft of natural gas and 75 ft of oil from a previously untested fault block, Pogo said.

Jarmjuree No. 9, the third well, found 120 ft of total pay, which included 38 ft of oil and 82 ft of natural gas. x

Elsewhere on the exploration front, Nexen Inc. said it has farmed into Block BC-20, an exploration license 100 km off Brazil in the Campos basin. The Calgary-based firm acquired a 20% interest in the 2,060 sq km block; other block partners are operator Petrobras 50% and ChevronTexaco 30%. Terms of the farmin are subject to approval by Brazil's National Petroleum Agency. "Block BC-20 offers several 3D seismically defined exploration prospects on trend with recent discoveries on adjacent blocks," Nexen noted. The first well, to be spudded in the third quarter, is part of a 2-well drilling program to test a structure in about 1,700 m of water.

Amerada Hess Corp. said it plans to drill four exploration wells in Equatorial Guinea this year, following the plugging and abandonment of its F-4 dry hole, which lies 13 miles northeast of the company's Ebano field discovery well in the Rio Muni basin. Amerada Hess said reservoir sands were present in F-4, but it proved to be water-bearing. Amerada Hess said that the first of the planned exploration wells would be spudded in the southern portion of Block G before the end of the month. The company also said that drilling would shortly begin on an appraisal well to Elon field. Most recently Amerada Hess made a new oil discovery, called Abang, which was drilled on Block G and found 170 ft of net pay-157 ft of oil and 13 ft of gas (OGJ Online, June 19, 2002). Amerada Hess, with an 85% working interest in Block G, is operator. South Africa's Energy Africa Ltd. holds the remaining interest. The company plans a phased development plan for its fields in the northern part of Block G-Okume, Oveng, Ebano, Akom, Elon, and Abang.

A $3.2 BILLION NATURAL GAS PIPELINE from Iran to India via Pakistan is showing more promise with the expectation that Pakistan and Russia will sign a memorandum of understanding (MOU) in Moscow the second week of September allowing studies for the pipeline to proceed.

The MOU would allow Russian energy firm OAO Gazprom to launch a prefeasibility study on the construction of the pipeline into or across Pakistan and to negotiate with international financial institutions for monetary support for the project.

Under a confidentiality agreement, Pakistan would facilitate Gazprom's efforts and provide available information regarding the oil and gas sector.

Pakistan would benefit from the receipt of a portion of the line's natural gas to fuel its program of converting diesel vehicles to compressed natural gas-a program in which Gazprom would assist. The MOU would be valid for 1 year or until the conclusion of an alternative relevant agreement. F

In other pipeline action, Kinder Morgan Interstate Gas Transmission LLC (KMIGT), a subsidiary of Kinder Morgan Energy Partners LP, Houston, launched an open season Aug. 7 to gauge shipper interest in its planned Advantage natural gas expansion project. The open season will end Sept. 6. The proposed project will offer 324 MMcfd of firm gas transportation to various market areas between Cheyenne Hub, in Weld County, Colo., and Kansas City, in Jackson County, Mo. KMIGT would build and operate 411 miles of 24-in. pipeline with about 27,000 hp of new compression. The line would have interconnections with Natural Gas Pipeline Co. of America in Lincoln County, Kan., and Northern Natural Gas Co. and KMIGT's existing Pony Express Pipeline, both in Ottawa County, Kan.

The Trinidad & Tobago government has granted conditional approval for the construction and operation of a 224,000 b/d full-conversion export refinery and ancillary infrastructure. It is expected to cost $2 billion, with the targeted completion date of yearend 2005.

If constructed, the refinery would be one of the largest in the world, with a 17.4 million bbl terminal and port facilities.

Already state-owned National Gas Co. of Trinidad & Tobago Ltd. has agreed to provide the refinery with 50 MMscfd of natural gas, while a site close to the Atlantic LNG export plant has been identified for the refinery.

Trinidad & Tobago Director of Energy Planning Vernon De Silva said it would be a challenge to bring the refinery to the dual island nation. "If the project does not succeed, it would not be for a lack of government support, since the government is aware that it would create jobs and wealth in the country, but it really is up to the promoters of the project," he said.

De Silva added: "A refinery is a risky business. I do not know of any refinery that has been built in this part of the world for a long time now. Added to that, a refinery operates with small margins, so there is a question of profitability."

Refinery promoters have said that the new refinery would not be competing with Trinidad's remaining state-owned refinery, the 160,000 b/d refinery at Point-a-Pierre, operated by state petroleum company Petroleum Co. of Trinidad & Tobago Ltd. (Petrotrin).

The existing Petrotrin refinery exports 85% of its products, mainly into the Caribbean region, and once had been operated by Texaco as a major export refinery with throughput capacity of 355,000 b/d (OGJ, Mar. 25, 2002, p. 24). A second refinery, a 70,000 b/d hydroskimming refinery at Point Fortin, was shut down in 1995, with much of its operations consolidated at Point-a-Pierre.