Western gulf sale generates less money for more tracts

Interests were almost evenly divided between shallow and deep waters at the federal oil and natural gas Lease Sale 184 held last week in New Orleans, which drew apparent high bids of $151.3 million out of a total $181.6 million bid by 44 participating companies on 323 of the 4,102 tracts offered in the western Gulf of Mexico.

That's down from the previous sale in that same area a year ago, which drew $165.6 million in high bids for 320 tracts (OGJ Online, Aug. 22, 2001). Nearly $190 million total was bid by 50 participating companies in that earlier sale, which at the time was the fourth largest federal lease sale in a decade in terms of the number of leases that drew bids.

Still, as one observer pointed out before the bids were opened, "There's a lot of industry interest in this sale because of several new trends proven by recent discoveries." It also was the first lease sale under the US Minerals Management Service's new 2002-07 oil and gas leasing program for the Outer Continental Shelf.

Sale details

Amerada Hess Corp. was the biggest spender at the sale, with 45 apparent high bids totaling $14.6 million (Table 1). Kerr-McGee Oil & Gas Corp. was second, also with 45 apparent high bids, totaling $13.1 million.

But when it came to the 10 highest single bids on individual tracts, it was largely a story of Shell Offshore Inc. and the independent exploration and production companies, with Shell submitting six of those top bids. Shell also submitted apparent top bids for all three of the most contested tracts at the sale, which each drew four bids.

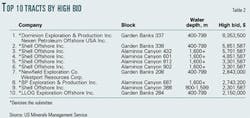

Dominion Exploration & Production Inc., a subsidiary of Dominion Resources Inc., Richmond, Va., combined with Nexen Petroleum Offshore USA Inc., a subsidiary of Calgary-based Nexen Inc., to make the highest apparent bid of the day-$8.4 million-for Garden Banks Block 337, in 400-799 m of water (Table 2). Other bidders for that block were Unocal Corp., $2.l million; and Amerada Hess at just under $730,000.

Shell made the second highest single bid of the day, $5.85 million, for Garden Banks Block 338, also in 400-799 m of water. That also was one of the three blocks drawing the most bids, but Shell left a great deal of money on the table against competitors including Dominion at $555,000; Amerada Hess, $539,000; and Unocal, $255,000.

In the other top contests, Shell bid $3.3 million-the sixth highest single offering of the day-for Alaminos Canyon Block 812 in more than 1,600 m of water. Competing for that block were BP Exploration & Production Inc., $2.2 million; Chevron USA Inc., $1 million; and ExxonMobil Corp., $225,000. In the third major contest, Shell bid $1.9 million for Garden Banks 302, against $1.8 million by Walter Oil & Gas Corp.; $679,000, Amerada Hess; and $219,000, Kerr-McGee.

Shell also was the only bidder for the deepest block, offering $3.3 million-the fifth largest single bid of the day-for Alaminos Canyon 902 in 2,996 m of water.

Shallow water focus

While deepwater tracts drew much of the attention and generated most of the drama at the sale, some participants focused on shallow-water leases.

Of the 11 bids submitted by Houston-based Spinnaker Exploration Co., 8 were for tracts on the continental shelf in less than 200 m of water. Spinnaker was high apparent bidder for 8 tracts, including 6 on the shelf that focused primarily on deep natural gas prospects in the Galveston Island area.

The sale drew bids totaling $9.9 million, including $8.1 million in apparent high bids, for 31 blocks in the 3-mile wide 8(g) area where the federal and state governments share royalties.

Many of the leases offered qualify for a number of incentives targeting deep-pay and deepwater oil and gas production, MMS said (OGJ Online, Nov. 21, 2001). One suspends royalties for the first 20 bcf of gas production from a well drilled 15,000 ft or deeper below sea level. Another provides royalty relief for deepwater tracts in greater than 400 m of water.

The shallow-water, deep gas initiative is designed to provide incentive for bolstering US natural gas production during 2003-07, the MMS said (OGJ Online, Feb. 19, 2002). The deep gas initiative applies to new leases in less than 199 m of water and does not apply to oil production. The incentive ends for a year if natural gas prices trigger a $3.50/MMbtu price limit, MMS said. MMS officials will evaluate high bids on each block to ensure the public receives fair market value before a lease is awarded.