Special Report: Norway outlines strategy to attract oil, gas investment

The Norwegian government has launched an initiative to garner increased foreign investment in its oil and gas sector.

The government in June published a "white paper" that outlines a strategy for securing such investment. It also calls for a greater emphasis on technology to develop and sustain production for its maturing fields, especially along Norway's continental shelf (NCS).

"Norway has a potential for maintaining its oil production for another 50 years and its gas production for another 100 years. Such a long-term development course will provide large income for the Norwegian society but is dependent on our ability to meet the challenges (that) the petroleum activities are facing," said Einar Steensnæs, Norway's minister of petroleum and energy. "One of the main tasks is to efficiently discover new petroleum resources. This is a challenge for both the authorities and the oil companies.

"To facilitate long-term development and further develop the oil and gas industry, it is vital to develop new technology and competence. To meet these challenges it is important that the industry is attractive and attracts highly qualified labor, especially younger people," said Steensnæs.

Norway is the world's third largest exporter of crude oil and ranks sixth among oil producers (including natural gas liquids).

Thinking globally

Norwegian oil companies, although still largely owned by the government, should also be more flexible, according to the white paper. They should be more receptive to outside investors while also considering investment outside of the country, officials said.

That's advice that company executives seem to be following to some degree. Principal state oil company Statoil ASA has been named as a possible participant in a Saudi Arabian gas project initiative if talks with several US multinationals fail later this year, for example. And on a recent visit to London, Statoil officials said they plan to be more aggressive about investing in other companies, either through partnerships or acquisitions.

The Norwegian parliament has already given its approval for the sale of up to one third of the company, but only 18% of Statoil was floated in a partial listing last year. The government has also said it would consider reducing its stake in Norsk Hydro AS to 34% from 43.82%

Norwegian companies should look to diversify their operations on an international scale to be competitive, officials said.

The future of the Norwegian oil and gas industry depends on its ability to compete on a global scale, the white paper said. And forcing the country's largely state-owned oil and gas industry to invest outside the country will help diversify the nation's holdings outside the mature NCS.

The energy paper said there are reasons to be optimistic the country is moving in the right direction.

"Today, a lot of companies in the Norwegian oil and gas industry have international activities. Examples of areas where Norwegian companies have done well are subsea technology and reservoir seismic surveys. In 2001, Norwegian supply companies had an international turnover of 35 billion NOK (Norwegian kroner). The ambition of the industry is to increase this turnover to 50 billion NOK by 2005. Apart from direct impacts on the Norwegian economy, such as export earnings and employment, internationalization is important for the long-term competitiveness and growth of the companies," the paper said.

"International competition is important for learning, innovation, and development, and it is a prerequisite for continued growth in the Norwegian oil and gas industry."

To that end, multinational oil companies made peace with Norwegian North Sea producers in a recent settlement over gas production. The Competition Directorate General of the European Commission last month reached an amicable agreement with Statoil and Norsk Hydro, settling the long-standing GFU (Gas Negotiation Committee) case. (OGJ Online, July 26, 2002).

The case stemmed from charges that Norwegian offshore natural gas producers were fixing prices and competing unfairly with European Union nations through Norway's now-defunct GFU, which negotiated gas sales contracts on behalf of the country's offshore producers. Norway is not yet a full member of the EU.

The Norwegian Ministry of Petroleum and Energy discontinued the marketing of Norwegian North Sea gas through GFU in June 2001, when that entity was abolished, and the producers were instructed to market their gas individually.

Warning signs

More work still must be done to keep Norwegian oil revenues at a steady pace, however.

A recent analysis of deepwater oil and gas exploration by Deutsche Bank AG cautions that lower tax rates might be needed to attract outside investment in maturing Norwegian fields. Norway's deepwater theater faces dwindling exploration success and an overinvestment risk, Deutsche Bank analysts said Aug. 2. The news isn't all bad, though: There are still solid opportunities among deepwater extensions of proven plays that carry lower risks, analysts said.

On balance, however, analysts warn that oil and gas producers have been generally disappointed with their results in the ultradeep water of the NCS, largely due to the high entry costs.

Deutsche Bank oil analysts predicted that a future trend for the country might be an easing of fiscal terms to renew interest in maturing and undeveloped offshore tracts. Also in the cards may be a lower tax burden for companies that invest in the country, although government officials have not signaled under what kind of terms they would find that acceptable.

"[There is] potential for Norway if terms ease," Deutsche said. Other deepwater plays, such as in Nigeria, the Gulf of Mexico, Equatorial Guinea, and Angola all are tough competitors, given their reserves and production growth potential, analysts said.

The government's energy blueprint acknowledged that there are challenges to realizing the country's resource potential. The government must give industry access to new, prospective acreage through revised licensing rounds, the policy paper said. The deepwater areas in the western parts of the Norwegian Sea are of special interest, with potential for new, large discoveries, energy officials noted. Of particular note to producers are the northern areas outside Lofoten and in the Barents Sea.

Concerns over ramifications

But despite that interest from outside investors, the government still does not appear ready to wrestle with the possible political and economic ramifications of opening choice acreage to foreigners. Instead of eyeing possible leases in the region, the ministry appears content for now with just mulling the idea of expanded exploration. Environmental concerns also will be considered before the government makes any decision on expanding new acreage, officials said.

"In the government's opinion, there is a need for more information prior to expansion of the petroleum activities in these areas. The government has therefore initiated an impact assessment study of all-year petroleum activities outside Lofoten and in the Barents Sea," the paper said.

"Consideration for the environment and fisheries is important, as the petroleum activities are moving north," Steensnæs said. "I believe that the petroleum industry is able to develop necessary technology and make necessary adjustments that will allow coexistence with the interests of the environment and the fisheries, within a framework of sustainable development."

Exploration in mature NCS areas

Potential investors still have new opportunities within maturing NCS fields that they can leverage, officials insist. But there is a risk those new pockets of production may be overlooked as companies move on to fields that are younger and appear to offer more overall promise.

"In mature areas, it is still possible to discover new, small resources that can be developed profitably if they are tied into already existing installations. It is important that these smaller fields are found and developed before the existing installations are shut down. This constitutes a challenge to the licensing system in mature areas," the white paper said.

The government is therefore introducing a new policy for predefined exploration areas in mature parts of the NCS, said Steensnæs.

Through the exploration and licensing policy, the government's aim will be to facilitate and encourage exploration and development of smaller fields in mature areas within the life span of existing infrastructure. To achieve this, the licensing system in these areas has to be predictable and efficient, officials said.

"In order to meet this challenge, the government has decided to establish a predefined exploration area, where annual awards will take place. Previously, the industry has had to wait for the announcement of acreage for each licensing round before knowing what areas will be available in the upcoming licensing round. With the new system, industry will know in advance the available acreage in mature areas in the coming years," the report said.

Producers will also have the opportunity to submit applications for production licenses throughout the year, officials said. Then every autumn the government will process all the pending applications at once. That way industry will be able to better predict a licensing cycle and do more long-term planning, officials said. Environmental impacts will still be a consideration even as permits are streamlined, officials stressed.

"The establishment of this predefined exploration area will be done according to the routines used for including acreage in ordinary licensing rounds, where due care is given to the environment and the fisheries. As new areas are maturing, it is natural to include these in the predefined area," officials said.

The ministry said its primary aim is to create a revamped system that will lead to a licensing policy that better distinguishes between mature and immature areas. And by streamlining the process, energy officials hope to boost interest in developing smaller fields on the NCS.

The new system is an acknowledgement that remaining NCS resources are gradually becoming more difficult to produce, both technologically and commercially, officials said.

Moving forward

Government energy officials cautioned that they need to be more ambitious developing the country's natural resources or face declining production, with less government revenue that can be used for important social programs. Keeping the status quo would be akin to a "decline scenario" while making onshore production more attractive to outside investment is considered a "long-term scenario," petroleum ministry officials said.

"In the decline scenario, the development of the NCS and the Norwegian oil and gas industry would stagnate within 10-20 years," officials warned. "A more sensible alternative is a long-term scenario in which there is oil and gas production on the NCS in a 100-year perspective."

An important precondition for the long-term scenario is that oil and gas prices are on a reasonably high level, officials said, although they did not specify what "reasonably high" means.

Along with reasonably high prices, the ministry said that it is also important that the oil and gas industry and regulators be committed to cost-efficient development of petroleum resources.

"The long-term scenario is demanding. If the industry and the authorities are not committed to develop the petroleum sector, this would mean reduced value creation and revenues for the Norwegian society and the Norwegian state. The best way to safeguard the welfare state is to secure the largest value creation possible from the petroleum sector. Development along the long-term scenario is the foundation of a Norwegian oil and gas industry in all of this century. Today, there are few other Norwegian industries with a corresponding long-term perspective," the white paper said.

Social issues

Oil and gas drilling play a central role in preserving the nation's economic health, but long-term planning is critical for ensuring that relationship is stable, government officials said.

According to the white paper, in 2001 the country's petroleum sector accounted for 23% of the Norwegian gross domestic product (GDP), demonstrating the important role oil has to state revenues. In 2001, 32% of the state's revenues came from the petroleum sector.

In 2001, 74,000 people were directly employed in the sector, about 3% of the country's total work force. But government officials estimate that indirectly the petroleum sector contributes about 220,000 jobs.

Remaining oil and gas resources can, if efficiently managed, be the basis for substantial value creation and activity over the long haul, officials said.

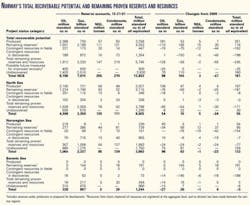

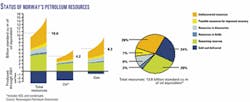

The white paper, for example, noted that the current value of the Norwegian Petroleum Fund is more than 625 billion NOK. And even after 30 years of petroleum production on the NCS, less than a quarter of the proven petroleum resources has been produced.

"This illustrates that the largest values in the petroleum activity are still ahead and that there is a long-term perspective for this industry in Norway," the paper said.

"Today, challenges related to increasing the value creation from the Norwegian petroleum sector are almost absent in the Norwegian public debate," Steensnæs said. "The focus is on how to manage the income from the oil and gas activities. There is a great potential for further development of the NCS as well as the competence of the Norwegian petroleum sector. This means that the oil and gas policy needs to be based on a different mindset: It has to be ambitious. We have to ask ourselves: What is the best possible way to develop the remaining resources and secure welfare and industrial development in the years to come?"