OGJ Newsletter

Market Movement

IEA trims demand growth projections

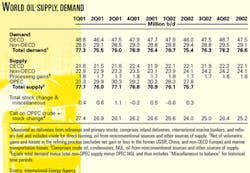

Weaker than expected first half oil demand in Organization for Economic Cooperation and Development (OECD) countries has prompted the International Energy Agency to trim its estimate of 2002 global demand growth by 50,000 b/d to 200,000 b/d. The latest figures released by the Paris-based agency also show changes in baseline demand, primarily caused by underreporting in the Middle East.

Demand, revisions

Preliminary estimates indicate that demand in seven of the largest oil consuming countries contracted by 660,000 b/d in June year-on-year. For all OECD countries, demand declined 640,000 b/d in June following a 760,000 b/d contraction in May. US demand expanded in May and June following 5 months of decline, but early indications are that contraction resumed in July, lowering OECD demand by more than 500,000 b/d from a year earlier. The most recent IEA estimates reduce average 2002 OECD demand 60,000 b/d to 47.5 million b/d.

European industrial activity appears to be coming out of its slump. This could translate into a mild rebound in fourth quarter oil demand, IEA says, and demand estimates might soon be revised upward pending a review of data from Poland.

Updates to IEA's figures reflect major upward revisions to baseline demand. The biggest revision is for the UAE, where demand has been adjusted upward by 175,000-200,000 b/d for 1991-2000. The gain reflects previously unreported bunker demand at the local bunkering hub of Fujairah. In addition, Iranian baseline demand was raised 80,000 b/d in line with the country's rapidly growing population, its preference for private cars over public transportation, and its massively subsidized fuel costs. The effect of these and other revisions is a 550,000 b/d increase in 2002 baseline demand. These adjustments to baseline demand involve increasing the observed demand figures and decreasing the agency's "miscellaneous to balance" numbers (not shown in the accompanying table)-and thereby the "total stock change and miscellaneous" category-by an offsetting amount. The rate of demand growth is thus unaffected, as observed demand is adjusted consistently throughout the historical data, IEA noted. The "call on OPEC plus stock changes" figure is then increased by the amount of the adjustment to baseline demand, although there is no real increase in the call.

Stocks, supply

OECD oil inventories at the end of June were up 15 million bbl to 2.6 billion bbl, offering 56 days of forward demand cover; this is up 1 day from a year earlier, ending 4 consecutive months of contraction. IEA reported a second quarter stockbuild of 500,000 b/d. This seasonal rise in storage is well below the average 800,000 b/d stockbuild that materialized during the second quarter of the 5 previous years.

Early IEA estimates put OPEC 10 (excluding Iraq) production for July at 23.2 million b/d, or 1.5 million b/d over output targets. Worldwide oil production for the month is pegged at 76.5 million b/d. Iraqi output increased to 1.8 million b/d, up from 1.6 million b/d in June, and non-OPEC production was up 220,000 b/d to 48 million b/d.

Gains in production in OECD countries partly offset losses in non-OECD regions. Output fell in North America, though, partly due to maintenance in Alaska, while UK and Norwegian production rose following maintenance in June. Production was down in Angola and Colombia.

Industry Scoreboard

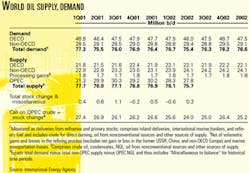

null

null

null

Industry Trends

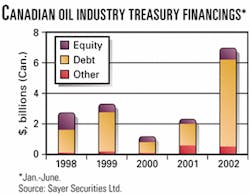

Treasury financings for the Canadian oil and gas industry during the first half of this year soared to $7 billion (Can.)-the highest level in a decade-according to Sayer Securities Ltd., an investment firm specializing in oil industry merger and acquisition activity. Frank J.D. Sayer, founder and president of the Calgary-based company, said, "In the recent past, only 1996 comes close, with a total of $4.2 billion."

The upward creep of prime interest rates in Canada, to 4.25% by June from a 10-year low of 3.75% in January, was the trigger prompting many major Canadian oil and gas companies to fix debt costs before rates climbed higher, Sayer said.

About $5.7 billion of the new financings is for debt, Sayer said (see chart). Majors secured 98% of the debt total.

Equity financings increased by 156% over the first half of 2001, up $770 million from $300 million during the same period in 2001. Start-up companies accessing the market in the first 6 months were instrumental in pushing this number upward, Sayer said.

Nevertheless, new start-ups have not created as great a volume of financings as the large companies that did business in the past, many of which have now been acquired by others.

Other issues-primarily royalty income trusts (RITs)-decreased slightly to $520 million in the first half from $630 million last year in the same period, Sayer said, yet were the second highest in this category within the past 5 years.

"RITS' strength in the financing markets accelerated some fundamental restructuring on the part of Canadian exploration and production companies," Sayer said. In the past year, a number of oil and gas companies have converted themselves into RITS to take advantage of this strength, he said.

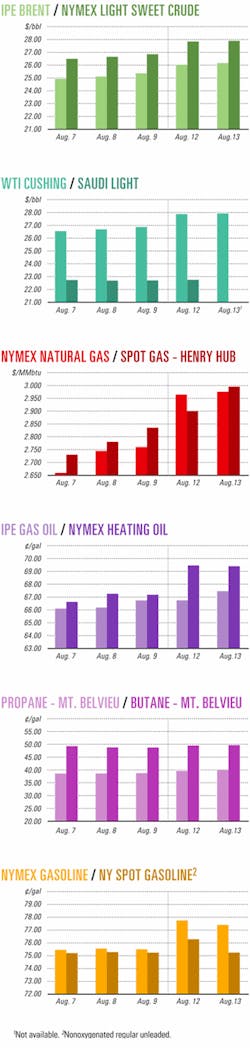

The oil services and equipment sector is in the "early stages of what should be a powerful up cycle," according to Lehman Bros. Inc. analyst James Crandell. The conjecture, Crandell noted, is based on the current and expected strength of oil and gas prices as well as oil and gas companies' expanded exploration and production spending plans.

"US natural gas drilling is just beginning to turn higher, following a short, sharp downturn, reflecting a recovery in prices and the expectation that supply, demand, and inventories will return to balance," Crandell said in a research note. Crandell added that he expects to see this recovery in gas drilling to run through 2004.

Outside North America, meanwhile, the analyst sees "moderate" spending growth over the next 2 years. "The combination of growing domestic and international drilling activity should lead to better capacity utilization and pricing improvement and cause a strong expansion of earnings through at least 2004," Crandell stated.

Government Developments

The US Minerals Management Service said it expects federal royalty oil to play a larger role in the Bush administration's effort to fill the Strategic Petroleum Reserve by 2005. Officials predicted that royalty-in-kind oil volumes dedicated to the SPR will increase to 130,000 b/d in 2003, up from the expected 100,000 b/d levels first announced by the Department of Energy earlier this month (OGJ, Aug. 5, 2002, p. 27).

Under the program, MMS takes oil royalties in kind, rather than in cash, from offshore federal lease operators and delivers that crude to onshore market centers; DOE then takes custody of the oil and exchanges the crude for oil better suited for the SPR stockpiles.

Since May, about 60,000 b/d from the offshore tracts has been exchanged. In a request for bids issued June 26 DOE said it plans to increase the RIK exchange program by an additional 40,000 b/d.

Last February ChevronTexaco Corp., Equiva Trading Co., ExxonMobil Corp., and Williams Cos. Inc. each received 1-year contracts to exchange seven packages of offshore royalty oil in return for delivery at Gulf Coast market centers of similar quantities of crude oil to DOE (OGJ Online, Feb. 8, 2002)

In a coordinated, two-phase contracting effort, DOE also announced its award of a single contract to exchange crude delivered by MMS under those four contracts for similar quantities of oil to be used to fill the SPR sites.

This month, MMS announced the award of two additional contracts to ChevronTexaco and Equiva for a 6-month term to exchange 38 packages, including about 44,000 b/d of offshore royalty oil. Koch Supply & Trading Co. will perform the exchange for DOE.

DOE said that actual volumes arriving at SPR are adjusted to account for transportation and quality differentials. Deliveries will begin in October and run through next April.

DOE said about 108 million bbl is needed to fill the SPR to its current 700 million bbl capacity.

Alaska's Coastal Policy Council (CPC) voted July 24 to approve new regulations streamlining the permitting process for projects affecting the state's coastal uses or resources.

The regulations-developed over a 3-year period with the input of state resource agencies, coastal communities, regulated industries, and the environmental community-clarify the roles and authorities of review participants and establish a more timely, predictable permit process for project proponents.

A statement released by the governor's office said the new review process should ensure that Alaska's coast is "managed as a whole" (to sustain coastal communities and ecosystems), rather than "fragmented into multiple jurisdictions and management philosophies."

"This regulations package…provides a model for regulatory reform in Alaska," said Robert Fagerstrom, public cochair of Alaska's CPC. "The involvement and input of each of the stakeholder groups…allowed the CPC to approve a well-rounded package."

Quick Takes

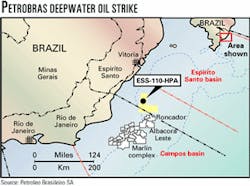

PETROLEO BRASILEIRO SA (Petrobras) has confirmed a major deepwater oil discovery at the edge of the Campos basin off Brazil's Espirito Santo state. It is the first major hydrocarbon discovery off the state; all major finds in the Campos basin to date have occurred off Rio de Janeiro state, immediately to the south (see map).

Appraisal drilling and production testing of a January 2001 discovery yielded an estimate of reserves totaling 600 million boe. The crude is 17° gravity with no sulfur.

Plans call for two more appraisal wells to further delineate the find plus a long-term production test of an extended-reach appraisal well drilled last month.

Petrobras said the find was the company's biggest since 1996, when it discovered Roncador giant oil field in the deepwater Campos basin. The Brazilian state firm drilled the 1-ESS-100 discovery well to 3,154 m TD on Block BC-60 in 1,246 m of water 80 km off Espirito Santo state. Petrobras holds 100% interest in the block.

The discovery well cut a 46 m thick pay zone with reservoir characteristics similar to those seen elsewhere in the prolific Campos basin, which accounts for 80% of Brazil's oil production.

In May Petrobras spudded a confirmation well, 6-ESS-109D, 3 km away from the discovery well. This well cut a 120 m pay zone in the same formation as the discovery well but also encountered a 25 m oil-bearing reservoir-in an older formation-not found in the discovery well.

Last month, Petrobras drilled an extended-reach appraisal well, 3-ESS-100HPA, with a horizontal displacement of 1,000 m. During initial tests, the well flowed 3,000 b/d of oil.

Petrobras has scheduled, starting this month, a 6-month test of the extended-reach well, using the Seillean floating production, storage, and offloading vessel, to appraise the reservoir's producibility.

In addition, the Brazilian oil giant has scheduled two delineation wells to gauge the extent of the new field during the coming 6 months. These two wells are expected to cost $10-12 million each.

Following the testing and appraisal drilling, Petrobras plans to submit a report on the field's commercial viability and a development plan to the National Petroleum Agency. Should development prove viable, Petrobras E&P Director Jose Coutinho Barbosa estimated that the field could produce as much as 120,000 b/d of oil within 3 years. He said the long-term test could yield flow rates as high as 20,000 b/d, comparable to other Campos basin fields.

The discovery is near the confluence of the Campos and Espirito Santo basins. The latter has yet to see a major oil discovery, although a handful of minor fields produce oil onshore and from nearshore, shallow waters.

Meanwhile in India, BG India Pte. Ltd., a unit of BG Group PLC, said it has initiated talks with prominent Indian companies with which it would like to form joint ventures in competing for deepwater blocks during the forthcoming third round of New Exploration and Licensing Policy (NELP-III) bidding. Prospective partners include state-owned Oil & Natural Gas Corp., Gas Authority of India Ltd., Oil India Ltd., and the privately owned Hindustan Oil Exploration Co. There will be 27 fields offered under NELP-III. "We are looking at various factors such as cost of drilling and developing the fields," said Nigel Shaw, BG India's chief operating officer. "We are currently concentrating on the CB-OS-1 Block, off the Cambay basin, and the Panna, Mukta, and Tapti fields that we acquired earlier this year from Enron India."

Rowan Cos. Inc. said it will expand its Tarzan-class rig construction program with the addition of three jack ups, bringing the total fleet to four.

The Houston-based drilling company said the Tarzan rigs will target deeper drilling on the Gulf of Mexico's Outer Continental Shelf "beyond 15,000 ft (deep), operating in up to 250 ft of water," Rowan said (OGJ, Oct. 8, 2001, p. 42).

The first of the rigs, the Scooter Yeargain, is under construction and is expected to be ready for service by midyear 2004.

The other rigs are expected to be delivered by yearend 2006, Rowan said. In all, the rigs will cost $300 million to build.

In other drilling action, Statoil ASA let a 260 million kroner contract to Dallas-based Halliburton Co. to provide drilling, well fluids, and cementing services for Kristin field in the Norwegian Sea. The contract, which extends through fall 2004 and can be extended to 2006, also covers pumping and personnel services. "Kristin is a reservoir under high temperature and high pressure, and presents technological challenges," said Bengt Rasmussen, the field's drilling manager. Drilling is due to proceed from summer 2003 to mid-2006. Plans call for Kristin to be produced via 12 subsea wells tied back to a floating platform, which will come on stream in fall 2005, Statoil said. The field is expected to produce 35 billion cu m of gas to 2016, as well as 220 million bbl of condensate, and 8.5 million tonnes of natural gas liquids.

CONOCO (UK) LTD., a unit of Conoco Inc., and its partners completed a successful test of the first development well, 44/17a-6Y, in the Caister Murdoch System III (CMS III) natural gas development in the southern sector of the UK North Sea.

The well, which flowed 148 MMscfd at maximum rate, is the first of a six-well development scheme for the five natural gas fields comprising the CMS III development program.

The £207 million development program involves tying in the cluster of discoveries-Hawksley, McAdam, Murdoch K, Boulton H, and Watt-through subsea wellheads to the existing Murdoch platform (OGJ Online, June 25, 2001).

CMS III partners are operator Conoco 59.5%, GDF Britain Ltd. 26.4%, and Tullow Exploration Ltd. 14.1%. The CMS infrastructure is 75 miles northeast of Theddlethorpe St. Helen, Lincolnshire.

The well was drilled horizontally in 60 ft of water in Hawksley field using the Ensco 72 jack up, Tullow said. Drilled through the reservoir, it found more than 1,000 ft of net pay in the Carboniferous Westphalian formation, Tullow said, adding, "An additional reservoir zone was encountered, and the impact of this on the field reserves is being evaluated."

Conoco said the CMS III project is still on track to begin flowing natural gas later this year.

In other development news, the UK secretary of state for trade and industry has approved development of Helvellyn field on Block 47/10 in the southern gas basin of the UK North Sea. ATP Oil & Gas (UK) Ltd., Guildford, UK, has been confirmed as production operator of the field, and production is expected to commence in 2003. ATP said the field would be developed with a well tied back to the BP PLC-operated Amethyst field via 10 miles of subsea pipeline.

DME DEVELOPMENT CO. LTD., a consortium formed last year by TotalFinaElf SA and eight Japanese firms, said it will begin a government-subsidized project to develop direct synthesis technology for dimethyl ether (DME). The company, which operates as a sister company to Tokyo-based DME International Corp., will study DME production using partner company NKK Corp.'s proprietary direct synthesis techniques (OGJ Online, Oct. 10, 2001).

The project calls for the start-up of a pilot plant, to be built in Kushiro, Hokkaido, that will have the capacity to produce 100 tonnes/day of DME from a feed of synthesis gas (comprising carbon monoxide and hydrogen) made from natural gas. NKK has already constructed a benchscale plant capable of producing 5 tonnes/day of direct-synthesis DME.

Based on the test results, the consortium said it would conduct a feasibility study for a commercial DME plant with a capacity of 2,500 tonnes/day.

DME Development will design, fabricate, construct, and perform commission tests on the pilot plant this year and in 2003 and will run the plant on an experimental basis in 2004-06, it said.

ENVIRONMENTAL OPPOSITION to the Camisea natural gas transmission pipeline has forced joint public hearings during Aug. 6-27 on all three aspects of Peru's Camisea natural gas megaproject.

Operators representing consortiums of the upstream, transmission, and distribution portions of the project are holding the hearings on the environmental impact assessments (EIAs) conducted separately for each aspect of the megaproject.

The operators and their respective consortium's concessions are Argentina's Pluspetrol Peru Corp., upstream; Argentina's Tecgas SA for Transportadora de Gas del Peru (TGP), transmission pipeline; and Belgium's Tractebel SA, the distribution and marketing of gas in Lima and Callao.

Although the three EIAs had previously been approved, and clearing for rights-of-way for the pipeline has already begun, the Inter-American Development Bank, developing the main financing for the project, requested the joint hearings.

China National Offshore Oil Corp. (CNOOC) and Guangdong LNG partners have selected Australia's North West Shelf (NWS) venture to supply China's first LNG import terminal planned at Guangdong in southern China. The bid was placed through Australia LNG Pty. Ltd. (ALNG), Beijing, NWS's marketing arm in China.

The contract calls for initial deliveries of 3 million tonnes/year of LNG for 25 years, with deliveries planned to begin from Western Australia in 2005-06.

Fulfillment of the contract will require construction of a fifth LNG (liquefaction) train at Karratha, on Western Australia's Burrup Peninsula, and a second natural gas trunkline from the fields. Addition of the fifth train will require expenditures of more than $1 billion (Aus.) over 3 years. Construction of the trunkline and the fourth train, which will have a capacity of 4.2 million tonnes/year of LNG, will cost $2.4 billion (Aus.). Work on them is already under way.

Completion of the fourth and fifth trains will more than double Karratha's current LNG processing capacity of 7.5 million tonnes/year.

In China, under Phase I of the Guangdong construction project, the grassroots LNG receiving terminal and regasification plant will be built along with 300 km of pipeline on the eastern side of the Pearl River delta in Guangdong Province. A lateral also will be built to deliver natural gas to Hong Kong.

Phase II of the China construction, planned to start in 2008, is an extension of the pipeline around the western side of the Pearl River delta. Total cost for both phases is $850 million.

In addition, two to three new LNG transport vessels will be required to serve the China trade route. A fleet of eight LNG ships currently serves the NWS project, with a ninth vessel under construction by Daewoo Corp. in South Korea.

"It is proposed that (NWS) and the Chinese shipping companies, Cosco and China Merchants, will establish a joint venture company to support LNG transport to Guangdong," said NWS operator Woodside Petroleum Ltd.

A CNOOC affiliate also will become a partner in NWS. "As a result of China's decision, and after the execution of the LNG sale and purchase agreements, CNOOC Ltd. will have the opportunity to acquire a participating interest in NWS reserves and production that will supply gas to Guangdong," said Woodside. A proposal has been made that will allow CNOOC Ltd. to become a full member of the joint venture that will be created to facilitate the LNG supply to China. CNOOC Ltd. Chairman and CEO Wei Liucheng said that terms of such reserves acquisition agreements are expected to be announced at a later date (OGJ Online, Aug. 14, 2000).

Meanwhile, CNOOC is planning a second new LNG terminal at Fujian, China, and is talking to BP regarding possible supply of LNG from BP's Tangguh gas field off Indonesia.

CNOOC, which has a 60% equity interest in the proposed terminal, plans to begin regasification operations in 2006-07 with an initial capacity of 2.5 million tonnes/year of LNG.