Special Report: Global LNG industry expanding to meet heightened gas-demand projections

The world's LNG industry is poised for unprecedented growth. Pushed by natural gas demand projected to grow 2.5-3%/year over the next decade, LNG could grow at twice that rate.

LNG's share of the global gas trade could grow to around 30% by 2010 and even higher by 2020 from 21% currently. In the US, LNG could make an important contribution to gas supplies, provided that price and regulatory issues can be settled.

Reviewed here are major trends in supplies, markets, and projects based on the most recent information available.

Recent trends

LNG has been one of the world's most rapidly growing fuels.

Exports have grown 6.4%/year since the mid-1980s (Fig. 1), although this growth slowed somewhat in 2001 when volumes rose 4.2% to 143 billion cu m (bcm) of natural gas (around 104 million tonnes of LNG).1

Still, this rate compares with a 1.6% increase in marketed world gas production to 2,525 bcm and a 3.3% rise to 537 bcm in pipeline deliveries. LNG accounted for 21% of all international gas flows in 2001.

One of the most striking changes in the LNG industry over the past few years has been the emergence and rapid growth of short-term and spot trades, which last year soared 42% to a record 7.8% of LNG sales. LNG may well be on its way to becoming a commodity, like oil-a position unthinkable only a few years ago.

Expansions have been announced for most of the major production facilities, and more than 20 new greenfield projects have been proposed. The Atlantic Basin appears to be the major area of market growth, "Atlantic Basin" referring here to markets on both sides of the Atlantic, including the US, Caribbean, and Western Europe.

LNG could play an important role in the US over the next 2 decades, especially if domestic natural gas production declines faster than expected. Demand in traditional Asian markets Japan, Korea, and Taiwan will grow more slowly than in the past. Expectations for the potential of LNG markets in India and China have been tempered by reality.

Table 1 shows imports and exports by country in 2001. Although Asia remains the dominant player in the world's LNG industry, both as an importer and an exporter, the share of exports from the Middle East, Africa, and Trinidad and Tobago steadily rises.

With 10 countries directly importing LNG, Japan remains the world's largest importer with 52% of the total, followed by Korea with 15%, and France and Spain, each around 7%. As of June 2002, 40 receiving terminals were operating in 11 countries: 24 in Japan, 3 in Spain, 3 in the mainland US plus 1 in Puerto Rico, 2 in Korea, 2 in France, and 1 each in Belgium, Greece, Italy, Taiwan, and Turkey.

They have a total sendout capacity of nearly 1 bcm/day (about 12.8 tcf/year) and total storage capacity of 17.5 bcm of LNG. Around half of these terminals plan to add storage or vaporization capacity in the next few years, including all the US and Spanish terminals.

At least eight new terminals are under construction in Korea, India, Spain, Portugal, the Dominican Republic, and Turkey. In the US, the terminal at Cove Point, Md., inactive since 1980, is set to reopen early next year. Many more terminals have been proposed or considered in Canada, the US, Mexico, the Bahamas, Honduras, Brazil, Jamaica, Spain, Portugal, Italy, Turkey, Poland, Taiwan, China, Japan, India, and the Philippines.

In 2001, 12 countries exported LNG. Indonesia remained the largest exporting nation, but its production fell 12% in 2001 because of the shutdown at one of its plants.

Algeria was second with 16.5%, followed by Malaysia 14.6%, and Qatar 11.5%. Production in Oman nearly tripled in 2002 as its new plant ramped up production, while Nigerian and Qatari output also increased substantially.

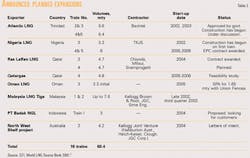

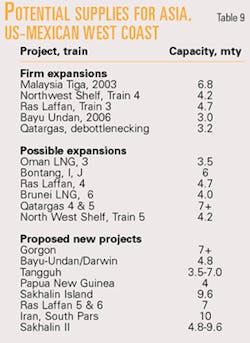

The 12 liquefaction complexes have 64 trains with a production capacity of about 126 million tonnes/year (1 mty ≈ 1,350 cu m of gas). Plans or announcements have been made for the addition of 16 trains with more than 60 mty of capacity at existing projects (Table 2), including 24 mty in the Atlantic Basin: 13 mty in Trinidad and 11 mty in Nigeria.

Middle East projects have announced expansions of nearly 20 mty. Qatar has revised its LNG production target for 2010 to 40 mty from 30 mty and will continue to expand its facilities.

More than 20 new greenfield projects have been announced, proposed, or discussed in Angola, Australia, Bolivia, Egypt, Indonesia, Iran, Nigeria, Norway, Papua New Guinea, Russia, Venezuela, and Yemen. Together these projects have potential capacity of 130-160 mty. This reflects continued growth in the world's gas resource base and a desire to monetize reserves.

Politics can promote or discourage project development-the reason Iran has never fulfilled its LNG exporting potential. Although Trinidad and Tobago's resources are relatively small, its proximity to markets in the US and Spain has made it an important exporter.

Gas quality can be critical: Economically valuable quantities of condensate and LPG can add 10-15% to project revenue and create a revenue stream before LNG production begins, while such impurities as CO2 or nitrogen, can damage economics.

The past decade has seen a steady drop in the cost of producing, transporting, and regasifying LNG from an estimated $3.50-4.10/MMbtu in the early 1990s to $2.80-3.40 today. Liquefaction costs alone have fallen from $350/tonne of annual capacity in the 1980s to $200/tonne.

The combined capacity of all the proposed projects is not as important as the general tendency: There is no shortage of potential projects chasing demand. One result has been delays in signing agreements as LNG buyers exert pressure for lower prices and more flexible terms.

Outlook for LNG markets

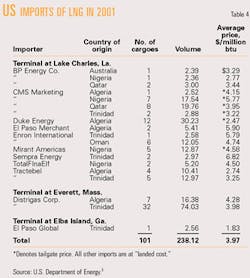

The US is the only market where imported LNG competes directly with other gas supplies and is priced on a netback basis. Three terminals are operating on the US mainland: CMS Energy Trunkline's plant at Lake Charles, La.; a facility owned by Distrigas (now a subsidiary of Tractebel LNG North America) at Everett, Mass.; and Southern LNG Inc.'s Elba Island, Ga., terminal (Table 3). All are planning expansions.

According to the US Department of Energy, after increasing around 90% and 70% in 1999 and 2000, respectively, US LNG imports rose just 5.4% to 238.1 bcf in 2001, as shown in Table 4. Another 25.6 bcf were shipped to Puerto Rico. The slower growth is largely due to a sharp drop in fourth quarter 2001 to 32.8 bcf, down 49% from imports in fourth quarter 2000.

The winter of 2000-01 saw US gas prices soar to record levels (approaching $10/MMbtu), which stimulated imports. A slowdown in the economy and warmer-than-normal weather drove prices back to more reasonable levels in late 2001 and 2002.

As a result, in first quarter 2002, LNG imports fell 58% from the same period in 2001 to 25.8 bcf. Long-term imports, all from Trinidad into the Everett terminal, fell to 14.6 bcf from 22.7 bcf; short-term imports plummeted to 11.2 bcf from 60.6 bcf. Whereas in first quarter 2001 six companies bought spot cargoes, this year only Distrigas has done. This illustrates the volatility and price sensitivity of the US LNG market.

In second quarter 2002, LNG imports into all three operating terminals picked up in response to higher US prices, surplus production capacity, weak demand in Asia, surplus capacity, and the availability of ships.

Subsidiaries of the Williams Cos. Inc.'s terminal at Cove Point, which has been closed down as an import terminal since 1980, is set to start receiving cargoes in 2003. Its capacity has been acquired by Shell NA LNG Inc., El Paso Merchant Energy LP, and BP Energy Co. El Paso, which controls the capacity at the Elba Island terminal, has an agreement to buy 2.4 bcm/year of Norwegian LNG and a memorandum of understanding for possible development of a liquefaction plant in Egypt. Following an open season, Shell was awarded the additional 3.3-bcf capacity that is being added to this facility.

The US Department of Energy has projected that US gas consumption will increase 59% to 35 tcf in 2020.4 Domestic production is forecast to rise 2%/year to 28 tcf by 2020.

But production now appears to be declining faster than expected; so that gas from unconventional and frontier resources as well as imported LNG may be needed to meet demand.

According to DOE, LNG imports could play an important role in the US natural gas market, provided there is sufficient terminal capacity. In a reference scenario, LNG imports grow from 160 bcf/year in 2000 to 830 bcf/year (around 27.4 mty) by 2020, based on increased use of existing terminals and some expansion at existing sites.

If limits are imposed on carbon-dioxide emissions, LNG imports could increase to 1.26 tcf/year (26.5 mty) by 2015 and to 1.35 tcf (28.4 mty) by 2020.

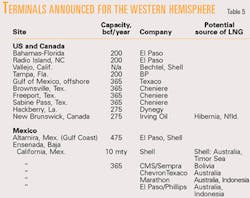

Table 5 shows planned and announced terminals in the US, Mexico, and Caribbean. Which ones will ultimately be built depends mainly on economic and regulatory issues. Cost reductions across the entire LNG chain have reportedly resulted in a total cost of less than $2/Mcf for Atlantic Basin LNG, which would mean acceptable margins to upstream suppliers and downstream marketers if the Henry Hub price is in the $3-3.50/Mcf range.

A potential obstacle is public opposition to new LNG plants. Local opposition blocked construction of a receiving terminal in California in the 1970s. And concerns over LNG plant safety have intensified following events of Sept. 11, 2001.

Thus, companies are looking to build offshore receiving terminals and terminals in Mexico, linked by pipelines to the US. El Paso plans to build floating regasification facilities on tankers that can be moored offshore and deliver LNG into pipelines at 400 MMcfd.

In Mexico, gas demand is rapidly expanding at a time when domestic production is stagnant. The Mexican government estimates that by 2010 imports will be needed to meet 20% of domestic gas requirements. Several LNG plants are in the planning stages for the Mexican Gulf of Mexico and Pacific Coast, where almost no gas production or infrastructure exists.

A number of fuel-oil-fired power plants could also be converted to combined-cycle gas units that could be anchors for LNG import terminals. The sponsors of these terminals are developing their own supply sources, although no contracts have been signed. And regulations are not in place to govern the siting and operation of the proposed facilities.

Elsewhere in Latin America, in the Dominican Republic, AES Corp. is building a terminal and a 300-Mw power plant that will start up this year. The terminal has a sendout capacity of 250 MMcfd and a 160,000-cu m storage tank.

Plans a few years ago called for the building of an LNG receiving terminal in northeast Brazil, but the availability of hydropower and reduced demand for power have made the need for LNG problematic.

The Caribbean is an excellent market for LNG, especially if an economic method can be found to transport relatively small volumes to small markets. Jamaica, Honduras, and the Bahamas are possible locations.

Availability of supplies

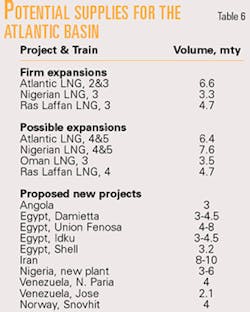

Table 6 lists projects that could serve the Western Hemisphere and Europe. Clearly there is no shortage of potential supplies.

In Europe, LNG accounts for around 8% of gas supplies. Liberalization of European energy markets and opening of gas markets to competition could create new opportunities for LNG. Pipeline supplies from Russia and Central Asia, Norway, and North Africa offer competition, however.

Spain is poised to become Europe's largest LNG importer as its economy grows and energy consumption soars. Natural gas consumption grew 8% last year to 17.3 bcm, triple the 1990 level. Natural gas comes via pipeline from Algeria and as LNG into three receiving terminals owned by Gas Natural SDG SA: at Barcelona (8.5 bcm/year of import capacity), Huelva (3.5 bcm/year), and Cartagena (2.3 bcm/year). All are being expanded.

Liberalization is proceeding rapidly. The government's monopoly is being divested and pipelines and terminals are being opened to other companies. By 2004, no company can hold more than 70% share of the total Spanish gas market, and a certain percentage of capacity is reserved for short-term volumes.

Spanish electric utilities Iberdrola SA, Union Fenosa SA, Endesa, and Hidrocantabrico Group as well as independent power producers (IPPs) and oil companies, such as BP, Shell, and CEPSA (formerly Compañía Española de Petróleos SA, a privately held Spanish oil company), have been aggressively developing markets and lining up gas supplies, sometimes by developing their own LNG projects.

Union Fenosa, for example, is a partner in a liquefaction plant in Egypt. LNG imports are expected to reach 26 bcm in 2005 and 31 bcm by 2010, making Spain Europe's leading LNG importer.

Supplies will come from the new trains in Trinidad and Nigeria, new projects in Norway and Egypt, and possibly the Middle East. Plans call for the construction of four new terminals. Table 7 shows expected future capacity.

Elsewhere in Europe, Portugal, to diversify supply, is building its first LNG terminal in Sines, 90 km south of Lisbon, which will go online in 2003 as a gas-processing facility. In the meantime, Portugal's natural gas distributor Transgas is taking delivery of 0.35 bcm from Nigerian LNG through Spain's Huelva terminal.

France imports 30% of its gas supplies as LNG at Gaz de France's two receiving terminals at Fos-sur-Mer and Montoir. The LNG comes mainly from Algeria and Nigeria. Gaz de France also imports spot cargoes from the Middle East. Gaz de France is planning to build a terminal at Fos-sur-Mer on the Mediterranean, set to open in 2006.

TotalFinaElf has announced a new terminal at Verdon on the Atlantic Coast north of Bordeaux.

The terminal at Zeebrugge, Belgium, is owned 41.6% by Tractebel, itself majority-owned by Suez Lyonnaise des Eaux of France. In 2000, Tractebel Inc., US subsidiary of the Tractebel Group, purchased Cabot LNG LLC, owner of the terminal at Everett, Mass.

Zeebrugge, which is also terminus of the Interconnector pipeline from the UK, could emerge as a gas-trading hub to exploit arbitrage and trading opportunities with European, UK, and North American markets.

Italy imports Algerian LNG into its sole terminal at Panigaglia, owned by SNAM Rete Gas SPA, which operates Italy's pipeline network. Italy's electric company ENEL SPA imports 3.5 bcm from Nigeria via a swap agreement with Gaz de France.

The Italian energy company Edison has received approval to build a 4-bcm/year terminal near Rovigo on the northern Adriatic coast (with ExxonMobil Corp.) and has signed contracts for the purchase of Qatari LNG. A preliminary agreement has been signed for the purchase of additional volumes of Nigerian LNG. Edison and BG Group are seeking approval to build another terminal at Brindisi in southeast Italy.

Under new regulations, up to 20% of new terminal capacity must be available to third parties. This will remain in effect until Italy's total regasification capacity reaches 25 bcm/year.

The UK imported LNG from Algeria from 1964 to 1994 when it dismantled the terminal at Canvey Island. As North Sea production declines, the UK is again looking at LNG.

Lattice Group PLC (owner of Transco, the UK gas network) is considering a 2.55-bcm/year facility on the Isle of Grain in the Thames River that might be supplied by ExxonMobil from Qatar. Another site under consideration is Mildford Haven in Wales.

Asian supplies

The three Asian LNG importing countries of Japan, Korea, and Taiwan account for more than 70% of all imports, although their share is declining as their markets mature. New markets are emerging in India and China, although more slowly than many expected.

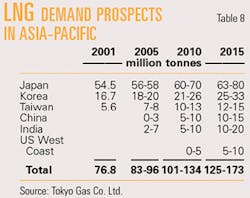

Table 8 shows an estimate of future Asian demand. Existing contracts and their extensions could supply 87 million tonnes by 2010, leaving a shortfall of 31-47 million tonnes in 2010 and 38-86 mty by 2015. The potential of proposed projects is far greater, however, as Table 9 indicates.

Deregulation and liberalization of Japan's gas and power markets, including third-party access to pipelines and LNG terminals, has intensified gas-on-gas and interfuel competition and created uncertainty about market trends.

Japanese LNG demand is forecast to grow to between 63 mty and 80 mty by 2015 from 54.5 mty in 2001. Other factors that affect demand are the pace of the development of nuclear power and the rigor of environmental regulations.

For many years, Japanese companies were willing to pay premium prices for LNG in return for security of supply based on long-term ironclad contracts with stringent offtake obligations. Shipping was left to the seller or the trading companies.

But deregulation is changing the LNG business in Japan, as elsewhere. Utilities now argue that they can no longer accept traditional 20-year contracts, which they wish to replace by a basket of short, medium, and long-term arrangements with more favorable prices as existing contracts expire.

Tokyo Gas Co. Ltd., Osaka Gas Co. Ltd., and Tokyo Electric Power Co. have acquired their own ships.

When Tokyo Gas and Tokyo Electric renewed 20-year contracts with Malaysian LNG for 7.4 mty, they were able to obtain new terms that reduced their prices by around 5%. The agreement also provides that 20% of the contract have terms set for only 1 year. The availability of LNG supplies enhances Japanese buyers' bargaining positions with one official predicting prices could fall 10% by 2010.

For nearly a decade, Korea was the world's fastest growing LNG market. The Asian crisis of 1997-98 led to a slowdown, but demand has again accelerated and could grow to as high as 26 mty by 2010 and 33 mty by 2015 from the current level of 17 mty. Korea Gas Corp. continues to expand its two terminals at Pyeong-Taek and Inchon and is completing construction of a third terminal at Tong Yung.

Korean demand, evenly divided between power and residential-commercial heating, is highly seasonal: Winter demand is nearly double that in the summer, a disparity that at times has made Korea an eager buyer of spot cargoes.

The government has long had plans to privatize Korea Gas Corp. (Kogas). and Korea Electric Power Corp., but the privatization program has moved slowly, in part because of concerns over how much foreign ownership should be allowed and opposition from labor unions.

Plans have been announced to split the import and wholesale division of Kogas into three parts, two of which would be privatized by yearend, subject to parliamentary approval.

ExxonMobil and Petronas have submitted bids to buy a 15% share in Kogas. Market liberalization will also intensify interfuel competition and gas-to-gas competition.

These changes make future LNG demand in Korea highly uncertain. As one Kogas official recently stated, "The current LNG sales and purchase agreement does not look compatible with the changing market environment."6 Consequently, as in Japan, Koreans are seeking such concessions as:

- More flexibility in offtake obligation, including greater downward quantity tolerance, extended makeup periods, and relaxed take-or-pay clauses.

- Varied contract durations, allowing a strategic mix of shorter term and baseload long-term contracts.

- Market-driven competitive pricing mechanisms, such as linkage to oil products, coal, or electricity prices.

Chinese Petroleum Corp. has a monopoly on Taiwan's LNG imports from Indonesia and Malaysia and owns its only terminal in Kaohsiung. Since it opened in 1990 with a capacity of 1.5 mty, it has been expanded to 4.5 mty in 1996 on its way to an eventual 7.75 mty. A consortium of local and Japanese companies, Tung Ting Gas Corp., plans a second terminal that is reportedly due on stream by 2004.

China's natural gas demand is projected almost to triple from 25 bcm/year in 2001 to 80 bcm/year by 2007, as urban distribution systems are expanded and transmission lines built, including the 4,200-km East-West pipeline from Xinjiang in the northwest to Shanghai.

China has a large appetite for LNG, especially in the industrialized coastal regions that are remote from domestic energy sources. A group headed by BP is building China's first LNG terminal at Shenzhen in Guangdong that will have an initial capacity of 3 mty. A second terminal has been proposed for Fujian.

Three projects are competing to supply the Guangdong terminal: Tangguh in Indonesia, led by BP; Ras Laffan Liquefied Natural Gas Co. Ltd. (RasGas) in Qatar, headed by ExxonMobil; and the North West Shelf Venture in which Shell Development (Australia) Proprietary Ltd. is a partner. Negotiations have been prolonged, as the Chinese are reportedly driving a hard bargain. If the seller ultimately agrees to a large discount, this would lead to demand for similar reductions by other buyers.

In India, Petronet, a consortium of four state-owned companies, is building a terminal at Dahej in Western India, which will be completed by 2003 to receive LNG from Qatar. According to reports, Petronet and Ras Laffan LNG have amended the original terms in the contract to set a price ceiling of $3.60-$3.80/million btu. Petronet has an option to buy another 2.5 mty for a second planned terminal at Kochi that is still seeking customers.

Enron's nearly completed Dabhol project is now on the market, with Gas Authority of India Ltd. (GAIL), British Gas, and Shell reportedly to be interesting in buying it. The project has 20-year purchase agreements with Abu Dhabi Gas Liquefaction Co (ADGAS) for 0.5 mty and Oman LNG for 1.6 mty.

Spot, short-term market

In the LNG industry, the term "spot market" is something of a misnomer. Whereas in the oil industry a spot sale generally denotes a single cargo, in LNG, where 20-year agreements have been the norm, deals covering multiple cargos delivered over a 6-month period or longer may be referred to as "spot." "Short-term" may be a more accurate term for this type of transaction.

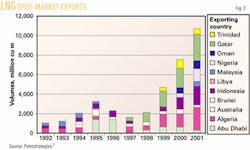

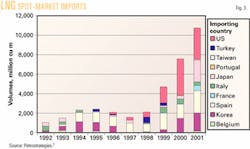

In 2001, the LNG spot trade soared 42% to a record 10.8 bcm and accounted for more than 80% of the increase in the world LNG trade; i.e., 3.2 bcm out of a total increase of 3.8 bcm. Spot shipments now make up 7.8% of the world LNG trade.

Around 30 companies are active in the spot market: 10 as exporters and 20 as importers. Last year, the largest exporting countries were Qatar with 2.8 bcm, Algeria 2.4 bcm, and Indonesia 1.9 bcm. The US was the largest single spot-market importer with 3.2 bcm, followed closely by Spain, Japan, and South Korea, with 1.9-2.3 bcm each. Figs. 2 and 3 show spot exports and imports by country.

The French publication Petrostrategies, 7 which tracks spot sales, notes that whereas in the past the spot market was driven by sellers' excess production capacities and buyers' shortfalls, it has become a trade of opportunity benefiting from price differentials in markets.

For exporters, spot sales add value to their sales, complement their long-term contractual commitments, and have become a permanent part of their sales portfolio. There has also been an increased reliance on "committed spot cargoes" whereby buyers agree to take a certain number of cargoes over a year or longer.

For example, Oman LNG recently agreed to sell nine cargoes to Gaz de France in 2002. Shell has 5-year contracts for around 700,000 tonnes/year with both Oman LNG and Australia's North West Shelf planned fourth train.

Swaps are becoming more common as companies hold positions in different markets. Tractebel, for example, sold 17 cargoes of Algerian LNG to Spain's Gas Natural in return for which Trinidad delivered 1 bcm of LNG to Tractbel's terminal in Everett, Mass.

Producers in Brunei, Indonesia, and Malaysia have agreed to synchronize operations of their plants to ensure continuous supplies to their customers and to pool their shipping capacities in order to leverage their excess capacities. They are also looking at opportunities to create additional value by "pooling" cargoes and shipping capacity to respond to market needs and take advantage of arbitrage situations.

A important factor in promoting the spot market is the availability of shipping. At the end of 2001, 128 ships were operating, and 48 were on order, the highest figure ever recorded. Capacity is expected to grow 11% in 2002 and 12% in 2003.

Traditionally LNG ships were built for a specific trade and used on a dedicated route. But in the past year, several companies have ordered ships that are not assigned to a project, including Japanese utilities. Progress is being made by dropping the "destination clauses" in contracts that currently preclude the resale of gas in third-party markets.

References

1. Cedigaz, Natural Gas Statistics for 2001, initial estimates, Mar. 28, 2002.

2. Sen, Colleen Taylor, ed., Gas Technology Institute, World LNG Source Book 2001, Des Plaines, Ill.: GTI, June 2001.

3. US Department of Energy, Office of Natural Gas and Petroleum Import and Export Activities, 2001 Year in Review, at http://www.fe.doe.gov/oil_gas/ im_ex/analyses/focus/4th01foc.pdf.

4. US Energy Information Administration, U S Department of Energy, "US Natural Gas Markets: Mid-Term Prospects for Natural Gas Supply, December 2001." www.eia.doe.gov/oiaf/ servicerpt/natgas/pdf/sroiaf(2001)06.pdf.

5. "The Spanish Gas Miracle," Bulletin of Cedigaz Members, No. 1, January 2002.

6. Jeon, Hong-Shik, Korea Gas Corp., presentation to Gasex 2002, May 28, 2002.

7. "World LNG Spot Trade Hit Record Level of 10.8 bcm in 2001 (up 42%)," Petrostrategies, Vol. 17, No. 779, June 10, 2002, pp. 1-3, p. 7.

About this series

This article is part of Oil & Gas Journal's 2002 special report "LNG's Progress," which kicks off on p. 18. Detailed here are the expected rise in LNG demand over the next several years and a rundown of the liquefaction and regasification projects that will support it and of the markets that will drive it. Another part of the report, in next week's issue, looks at trends in LNG liquefaction technologies. The final two articles, in the Aug. 26 issue, present one of the more recent technologies for siting LNG liquefaction terminals offshore along with a review of codes governing LNG vessel design.

The author

Colleen Taylor Sen is associate director, LNG research, for the Gas Technology Institute, Des Plaines, Ill. She is the editor of the World LNG Source Book and organizes courses and seminars on all aspects of the LNG industry. Previously she served as director of external relations at the Institute of Gas Technology. Sen holds a BA and MA from the University of Toronto and a PhD from Columbia University.