OGJ Newsletter

Market Movement

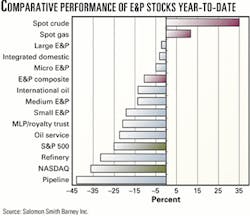

E&P stocks outperform other market indicators

Stock values of publicly traded exploration and production companies on average kept pace with the securities market overall as perceptions of an "inevitable" US attack on Iraq pushed up oil prices through the week ended Aug. 2, said Robert Morris at Salomon Smith Barney Inc. in New York.

In fact, Morris reported that a composite of E&P companies of various sizes has outperformed the broader markets so far this year, due largely to the rise in oil and gas prices (see chart).

In that study, Salomon Smith Barney officials classify large E&P companies as those with market capitalization in excess of $3 billion. Medium E&P firms are those with market capitalization of $>1-<3 billion, while small E&Ps are those capitalized at $>200 million-<1 billion, and micro E&Ps have market caps of $200 million or less.While the near-term prospects for lower commodity prices "remain a concern," Morris reported last week, "the longer-term risk-reward profile for E&P shares is quite attractive at this juncture."

He said, "The upside to our 12-18-month price targets for our coverage group, on average, is now over 35%, while the downside, excluding a post-Sept. 11 scenario or an unexpected collapse in oil prices, is not much more than 15%." That's based on assumed spot prices of $20/bbl for West Texas Intermediate crude and $3.50/Mcf for natural gas.

"The greater concern near term along the commodity price front is with natural gas prices, given that storage levels appear on course to exceed last year's mark at the start of November," Morris said. "However, we do not believe that the near-term downside for composite spot natural gas prices is the $1.73/MMbtu reached last year during September. Instead, we think the downside risk near term is just under $2.50/MMbtu, apart from a sharp drop in oil prices."

Rather than allowing gas prices to fall to the lower levels of last year, he said, E&P companies would begin curtailing North American gas production at a price of $2.50/MMbtu this year. Moreover, Morris said, "Several interesting operating trends emerged from the second quarter results for independents. While overall results were generally better than expected, a much more active second half (of this) year is expected, particularly along the exploration front."

He said, "One third of the companies in our coverage group that have so far reported have announced an increase in full-year spending plans and, despite the recent pull-back in stock prices, share repurchases do not seem to be on the agenda."

Morris noted, "After being nearly flat sequentially in the second quarter, domestic natural gas production appears to have turned the corner for most of our coverage group, although the integrateds continue to come up short of offsetting natural gas declines in North America."

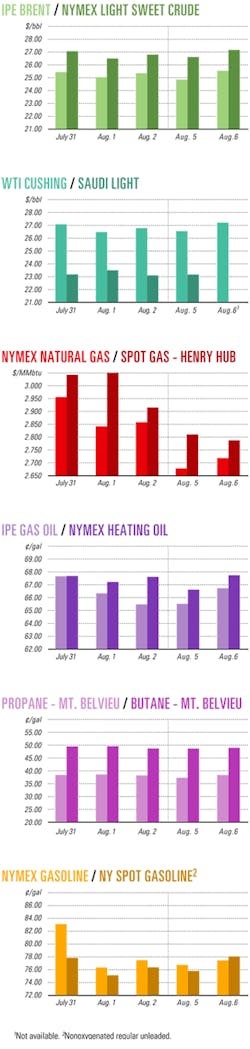

Energy prices waffle

Energy futures prices waffled, up 1 day and down the next, through most of last week as traders responded-or overreacted, some analysts said-to a series of conflicting stimuli in alternate trading sessions.

An American Petroleum Institute report that US oil inventories fell by almost 3.9 million bbl during the previous week prompted Matthew Warburton, with UBS Warburg LLC in New York, to predict on Aug. 7 that such "evidence of tightening crude oil inventories" would likely "keep crude prices well supported" (OGJ Online, Aug. 7, 2002). However, futures prices for oil and petroleum products fell the following day as traders determined that substantial decline was concentrated on the US West Coast, rather than the key consuming East Coast area.

Nevertheless, Warburton observed, "US crude stocks are gradually trending downward. They currently stand 6.5% below their recent peak levels in April and at their lowest level since October 2001."

Industry Scoreboard

null

null

null

Industry Trends

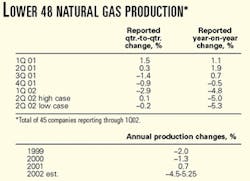

SECOND QUARTER natural gas production estimates for the US range from a 0.1% increase to a 0.2% sequential decrease, compared with a 2.9% sequential decline in the first quarter from fourth quarter 2001, according to results from a Lehman Bros. survey reported July 31 (see table). The result compares with the firm's July 26 forecast for a 0.2-0.8% increase over the first quarter.

Lehman Bros. analyst Thomas Driscoll said 28 companies, representing about 45% of US gas production, responded to the second quarter survey, reporting the 0.2% sequential decrease vs. first quarter production and a 6.4% decline vs. year-ago levels.

"We are maintaining our forecast for a 4.5-5.25% decline in US production in 2002," Thomas Driscoll reported. That forecast would be based on results reported from the analysts' previous, 45-company survey, which would account for roughly 70% of US gas production.

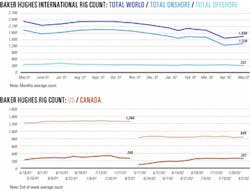

US drilling activity rebounded from a 10-week low the week ended Aug. 2, with 848 rotary rigs working, 15 more than the previous week but well below the 1,200 units that were active during the same period last year, officials at Houston-based Baker Hughes Inc. reported.

This latest gain made up most of the 26 rig loss reported the week ended July 26. But land operations increased by only 10 units to 712 active rigs after dropping 23 the previous week. The number of rigs drilling offshore increased by 4 to 111 in the Gulf of Mexico and by 5 to 116 in US waters overall. The number of units working inland waters was unchanged at 20.

Among US rigs, the number drilling for natural gas increased by 16 to 729, while those drilling for oil were down 2 to 117.

Louisiana led the rebound, up 7 rigs to 165 working. Oklahoma was up 6 to 111. There were 325 rotary rigs drilling in Texas, an increase of 3 following a loss of 13 the week before when floodwaters closed some roadways in central and southern portions of the state. Alaska's rig count increased by 2 to 10.

New Mexico registered the only decline among major producing states, down 2 rigs with 43 working. Wyoming and California were unchanged at 43 and 22, respectively.

Both the number of mobile offshore rigs available for work and the number under contract in the Gulf of Mexico were down by 1 to 195 and 132, respectively, causing a slight dip in the utilization rate to 67.7%, said officials at ODS-Petrodata Group in Houston.

Government Developments

INDONESIAN PRESIDENT Megawati Soekarnoputri has signed a regulation establishing a new, independent Indonesian national oil and gas authority. The agency, to be known by the Indonesian language acronym BALAK, will assume all regulatory functions formerly performed by state-owned Pertamina, which will be privatized as a commercial oil and gas company.

Lawmakers have sought since 1999 to end Pertamina's monopoly, tie local fuel prices to international benchmarks, and remove costly government oil and gas subsidies. One official said the move could save the government as much as $4.8 billion/fiscal year (OGJ Online, Nov. 10, 2000).

BALAK will regulate the oil and gas industry, award oil and gas concessions, sign contracts, and provide oversight to companies operating in Indonesia. Indonesia's president, in consultations with the House of Representatives, will appoint the top officials.

Pertamina, officially relieved of oil and gas governing responsibilities, is now free to concentrate on upstream exploration and development and downstream activities ahead of its privatization beginning in 2004.

US interior sec. Gale Norton has approved the US Minerals Management Service's 5-year program for oil and natural gas lease sales on the Outer Continental Shelf for 2002-07. The program schedules 20 lease sales in eight OCS planning areas in the Gulf of Mexico and off Alaska. It does not involve sales in any area under congressional spending moratoriums or presidential withdrawals (OGJ Online, Mar. 19, 2002).

MMS estimates the new 5-year program will make available a postulated resource of 10-21 billion bbl of oil and 40-60 tcf of gas. The first lease sale scheduled under the new program is western Gulf of Mexico Sale 184, slated for Aug. 21 in New Orleans.

Oil and gas produced from the OCS currently provides about 25% of total US production, MMS noted, adding that new technology has opened up more areas for offshore drilling in the past decade, with 35 rigs currently exploring in water depths of more than 1,000 ft.

US SENATORS FROM NEW YORK Charles E. Schumer and Hillary Rodham Clinton said Aug. 1 they are hopeful the full Senate will soon permanently ban oil and gas exploration and drilling in the 16,000-acre New York Finger Lakes National Forest.

The forest, slightly bigger than Manhattan, is located in the central part of the state. The Senate Committee on Energy and Natural Resources approved S. 1846, a bill that imposes a permanent ban. Congress last year implemented a 1-year ban that expires Sept. 30. The House is expected to follow the Senate's lead this year and block access for good.

Oil companies did not actively oppose the ban, given the limited amount of anticipated reserves. However, lobbyists said the measure is yet another "troubling" example of congressional efforts to limit access to public lands. Similar proposals have been called for in the Great Lakes region, the eastern Gulf of Mexico, and along the east and west coasts.

Quick Takes

Exxon Neftegas Ltd., a unit of ExxonMobil Corp. and operator for the Sakhalin 1 consortium, let a $987 million contract to ABB Lummus Global for the engineering, procurement, and construction of the Chayvo and Odoptu onshore processing and well site support facilities for the Sakhalin 1 project off the eastern coast of mainland Russia.

Under the contract, ABB will provide detailed engineering and design, procure equipment and materials, and subcontract construction of two onshore production units and support facilities for three land-based well sites. A majority of the work, ABB said, will be subcontracted to Russian companies.

ABB said it would address several technical issues with this project, including the harsh arctic environment, international supply, and transportation logistics with a "narrow weather window" for construction (OGJ, June 17, 2002, p. 41).

The Sakhalin 1 project, which is being developed in four phases, is expected to reach first oil production from Chayvo field by yearend 2005.

In other development news, Woodside Energy Ltd., operator of Thylacine and Geographe gas discoveries in the Otway area off southwestern Victoria, said environmental assessments of field development proposals are under way for the project. Woodside's Otway Development Manager Bruce Steenson said that more than $15 million (Aus.) would be committed to development studies this year. Steenson said the Australian Commonwealth and Victorian governments would be jointly responsible for issuing environmental approvals for the gas fields' development. The fields, which are 55-70 km south of Port Campbell, are expected to contain gas sufficient to provide more than 10% of current annual demand in southeastern Australia for at least 10 years. Reserves for the combined Geographe and Thylacine fields are estimated at 0.8 tcf of gas and 9 million bbl of condensate. Initial screening studies gave the partners reason to believe the fields could be developed in time to provide gas to customers in Victoria and South Australia in 2006. Woodside operates the Otway gas discoveries on behalf of two joint ventures: Participants in VIC/P43 (Geographe) are Woodside Energy Ltd. 55%, Origin Energy Resources Ltd. 30%, and CalEnergy Gas (Australia) Ltd. 15%. Participants in T/30P (Thylacine) are Woodside Energy Ltd 50%, Origin Energy Resources Ltd. 30%, and Benaris International NV 20%.

The Thai-European consortium led by PTT Exploration & Production PCL (PTTEP) has awarded a $33 million contract to Nippon Steel Corp. of Japan to build and install the 13th wellhead platform at Bongkot gas field in the Gulf of Thailand. Installation of the structure, to be built at Nippon Steel's fabrication yard in Samut Prakan near Bangkok, is scheduled to take place at the field, 600 km south of Bangkok, in mid-2003. The platform is part of the Phase 3C Bongkot development aimed at sustaining Bongkot's gas production at the current level of 550-630 MMcfd plus about 13,000 b/d of condensate and crude oil. Twelve wellhead platforms, a production platform, and a platform for living quarters are in place at Bongkot, one of Thailand's largest gas fields. Bongkot's development was moved further ahead by the group, which includes TotalFinaElf SA and BG Group PLC. The field is most likely to be able to sustain gas production at the current rate over the next decade, PTTEP Pres. Chitrapongse Kwangsuksith said. About 2 tcf of proven gas reserves remain in the structure, where 1.2 tcf has already been recovered since production began in 1993.

SG Resources Louisiana LLC (SGR), a unit of Houston-based SGR Holdings LLC, said it is moving forward with the development of a new salt cavern natural gas storage facility in Evangeline Parish, La. The storage facility, to be called the Louisiana Energy Center, will have the capacity to hold a total of 16 bcf of gas in two caverns. The 60 acre site and acquired mineral rights would allow for two additional caverns to be built to support future growth in demand, SGR said.

SGR plans to hold an open season for storage capacity starting in the third quarter of this year. The project is slated to begin operation in fourth quarter 2004.

The new storage site will function as a transportation and storage hub for nine major natural gas pipelines.

PETROLEO BRASILEIRO SA reported its first oil find as an operator in Argentina.

Petrobras Argentina SA, the company's subsidiary in Argentina, found condensate and natural gas in the Neuquen basin.

The discovery well, PZX-1001, was drilled on the Puesto Zuniga prospect on Block CNQ-32 in the Neuquen basin near Cinco Saltos in Rio Negro Province. The well flowed on initial tests at a rate of 516 b/d of condensate and 8.5 MMcfd of gas from Jurassic Lajas at 3,650 m.

The company is assessing commerciality of the find and plans to drill confirmation wells, although details were not disclosed.

Elsewhere in South America, Empresa Colombiana de Petroleos SA (Ecopetrol), the Colombian state oil company, signed three new association contracts earlier this week, bringing to seven the number of association contracts signed this year. The total area covered by the three new contracts is 50,000 hectares in the southern region of the country. With the Guayuyaco contract, Argosy Energy International intends to explore a 20,000 hectare area in the Putumayo basin. It is the first contract signed under Ecopetrol's "adjacent prospecting" scheme, which seeks to increase investment and exploration in nontraditional areas of the country. Argosy, which is 30% owned by Dallas-based Aviva Petroleum Inc., has been involved in oil exploration in Colombia since 1972. Argosy's Santana contract, which covers Toroyaco, Mary, Linda, and Miraflor fields in the Putumayo region, currently produces an average of 3,200 b/d of crude oil. Last year, Argosy signed the Magdelena contract to explore a 50,000 hectare area in the Middle Magdalena Valley. Canada's Petrobank Energy & Resources Ltd. signed the Moquetá A and B association contracts to explore an area of 30,000 hectares, also in the Putumayo basin. The contract was signed through the company's Colombian affiliate, Petrominerales SA. F ENI SPA has completed drilling an exploration well, Gabela-1 on Block 14, about 400 km northwest of Luanda off Angola. The well, drilled in more than 320 m of water, penetrated a 25-m net interval of oil-bearing rock and flowed more than 1,000 b/d during tests. Geologic and engineering studies will follow to define the field's reserves and a development scenario. ENI said its equity production in Angola currently amounts to 70,000 b/d of oil.

NATIONAL PETROCHEMICAL PLC (NPC) of Thailand awarded a $67.9 million contract to the South Korean conglomerate Samsung Engineering Co. to build a new polyethylene plant. The contract forms a key part of the $130 million investment NPC is putting into building the 250,000 tonne/year facility in Rayong, some 220 km southeast of Bangkok.

It represents NPC's diversification into the downstream phase from its core upstream operation, which currently produces 437,000 tonnes/year of ethylene and 170,000 tonnes/year of propylene based on ethane and propane extracted from natural gas piped from the Gulf of Thailand.

NPC, owned 38% by PTT PLC, Thailand's partially privatized energy concern, said the plant is expected to begin operation in 2004, coinciding with a projected upturn in the petrochemical industry during 2004-05 and an expected rise in petrochemical product prices.

In another Thailand petrochemical development, Rayong Olefins Co. (ROC), Thailand's largest olefins producer, has clinched a long-term accord to source LPG and NGL from PTT PCL, formerly Petroleum Authority of Thailand, for its olefins complex on Thailand's eastern coast.

The agreement involves the supply of 50,000-100,000 tonnes/year of LPG and 35,000-70,000 tonnes/year of NGL from PTT's natural gas processing facilities for 15 years starting in December. The deal marks ROC's switching of feedstocks from naphtha to LPG and NGL processed from indigenous Thai natural gas. ROC's Mab Ta Phud plant in Rayong Province has the capacity to produce 800,000 tonnes/year of ethylene and 400,000 tonnes/year of propylene. ROC is a subsidiary of Thailand's major industrial conglomerate Siam Cement.

Instrumental to ensuring future LPG and NGL supplies to ROC is PTT's fifth gas processing plant, now under construction at Mab Ta Phud (OGJ Online, Mar. 6, 2002). The new plant will have capacity to process 530 MMcfd of natural gas into 500,000 tonnes/year of ethane, 170,000 tonnes/year of propane, and 480,000 tonnes/year of LPG.

In other petrochemical news, Huntsman Corp., Salt Lake City, has permanently idled 15% of its total ethylene oxide (EO) and ethylene glycol (EG) production. A spokesman for the company said that 175 million lb of EO production and 240 million lb of EG production at Huntsman's Port Neches, Tex., manufacturing site have been shut down. In explaining the shutdown, David S. Parkin, vice-president, intermediates, said, "Ethylene glycol markets have been experiencing weak demand and inadequate margins for far too longellipseIf we don't see improvement in the ethylene glycol market, we will seriously consider further reductions in EG production, and diverting our ethylene oxide to other derivatives." Parkin emphasized, however, that Huntsman remains committed to its EO and EG markets and will continue to meet all contract and merchant demands for the products.

A tripartite international consortium is undertaking a $450 million joint venture to build an oil pipeline across southern Thailand to expedite shipments of Middle East crude oil to North Asia.

When completed in 2005, the pipeline will provide a short cut for crude oil shipments from the Middle East to North Asian countries, diverting oil traffic that normally goes through the congested Malacca Straits and at a lower transportation cost.

Talal al-Zawawi Enterprise LLC, a privately owned Omani investment concern and independent Thai oil firm Sukhothai Petroleum Co. each holds a 45% stake in the scheme, while the Canadian industrial group SCN Lavalin Group Inc. has a 10% share. SNC Lavalin would undertake engineering and construction of the pipeline and related facilities.

The companies have formed a joint venture firm known as Taksina Pipeline Co. to undertake the project, the first of its kind in Thailand, according to company executives.

The scheme calls for laying a 46-in. pipeline 160 km from Satun on the Andaman Sea coast to Songkhla on the Gulf of Thailand coast.

It will include two storage terminals, each with crude storage capacity of 10 million bbl, on both ends of the pipeline that will be laid underground paralleling Thai highways.

Also, there will be two single-buoy moorings installed about 15-20 km off the coasts, to facilitate loading and offloading of crude oil from 200,000-300,000 dwt very large crude carriers.

At the moment, only tankers with maximum capacity of 150,000 dwt are allowed to transit the Malacca Straits.

The pipeline would have crude oil throughput capacity of about 1 million b/d, compared with 12 million b/d of crude oil shipped through the Malacca Straits every day. By using the pipeline, the shipment of crude oil from Middle East to countries such as Japan, South Korea, China, and Taiwan can be cut by a few days.

Companies involved in oil shipments from the Middle East to North Asia are targeted as users of the pipeline and related facilities.

WesternGeco begins 3D survey of North Sea Buzzard field

WesternGeco's Geco Topaz seismic vessel, equipped with the company's Q-Marine single-sensor technology, performs a 3D survey over Buzzard field in the UK North Sea in July, deploying six streamers with a 50 m streamer separation. The 305 sq km proprietary survey, performed for EnCana UK Ltd. and partners Intrepid Energy North Sea Ltd., BG Group, and Edinburgh Oil & Gas PLC, is expected to become a baseline for future seismic data acquisition over the field.