Big growth ahead seen for Saudi gas utilization

Abdullah M. Aitani

Center for Refining & Petrochemicals

King Fahd University of Petroleum & Minerals

Dhahran, Saudi Arabia

Saudi Arabia is one of the world's richest countries in hydrocarbon resources. Its overall economic stability and growth are heavily dependent on these resources. An ambitious plan is currenly under way to restructure the economy. The development of natural gas has been finally linked with the kingdom's quest to stay economically comfortable. The following two initiatives have been put forward to develop the natural gas sector:

•Expansion of natural gas supplies for use in the production of petrochemicals throughout the kingdom. It is hoped that this approach will attract private capital for expansion of the petrochemical industry at low feedstock prices.

•The Gas Initiative, where eight international oil companies (IOCs) will invest more than $25 billion over the next 5 years in natural gas exploration and production as well as in power generation, desalination, and chemical facilities.

Local utilization of natural gas has been increasing at a fast rate as utilities shift from burning liquid hydrocarbons to natural gas. Strong demand for natural gas continues for power generation, seawater desalination, production of petrochemicals, and other industrial applications.

The scarcity of natural gas supply in most regions in the kingdom stems from the fact that the most Saudi gas production is associated gas, which depends on crude oil output. The national oil company, Saudi Arabian Oil Co. (Saudi Aramco), is working to increase the capacity of gas production to more than 8.8 bscfd by the end of 2003. This will boost gas supplies for industrial use to the central (Riyadh), eastern, and western regions of the country. Availability of dry gas will release a large quantity of NGLs, which can be utilized as a feedstock for petrochemical plants and can meet the fuel needs of new industrial projects.

Subsequent to the long-term natural gas strategy developed by the Saudi Ministry of Petroleum and Mineral Resources and Saudi Aramco in 1998, the government invited interested IOCs to participate in the Gas Initiative for the development of new gas fields, gas production, and downstream utilization projects. In June 2001, the kingdom signed memoranda of understanding with eight IOCs, defining the amounts to be invested and the preliminary project time frame. The scale of the projects required and the size of the investments are vast, providing the industry with challenges and opportunities rarely encountered over the last 2 decades.

The development of the gas industry and related gas utilization have created tremendous job opportunities in the kingdom, especially for young Saudis. It is estimated that about 32,000 personnel are now employed directly in natural gas-related industries: 16% in gas operations, 50% in petrochemical industries, 21% in electricity, 7% in seawater desalination, and 6% in the cement industry. As a result, the natural gas industry and related industries generate about $900 million/year in income and benefits. Furthermore, this gas-based industry has created over 200,000 additional jobs, providing various daily-life services for these employees and their families, such as schooling, health care, communications, transportation, and commercial services. A good example is the city of Jubail, which had been a small and remote fishing village until the late 1970s; it has now grown to become a hub of petrochemical complexes with a population of about 100,000.

Gas resources

Reserves, production

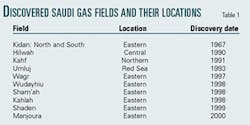

Saudi Arabia has huge gas potential; 12 dry gas fields and 83 oil fields containing associated gas have been discovered since exploration started in 1933. Ten of the gas fields were discovered during 1980-2000. Table 1 presents a list of gas fields in the kingdom and their location.

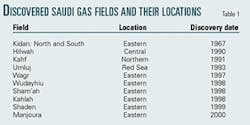

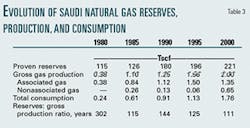

Proven gas reserves have been estimated at 224 tcf, with about 135 tcf associated gas and 86 tcf nonassociated gas. This accounts for 4.1% of global gas reserves, making the kingdom the fourth largest in the world in terms of gas reserves (Table 2).

Most of the associated gas reserves are in onshore Ghawar oil field and the offshore Safaniya and Zuluf oil fields. While eight oil fields account for more than 90% of total oil production, Ghawar accounts for about 30% each of total proven oil and gas reserves.

The amount of associated gas produced varies from one oil field to another. For example, in Ghawar oil field, 530 scf of gas are extracted with every barrel of oil, while in Saffaniyah oil field, about 920 scf of gas are produced with every barrel of oil. Associated gas reserves have been discovered in the late 1990s in fields that contain light sweet crude oil, especially south of Riyadh. In addition, a number of fields containing nonassociated gas were discovered in that time.

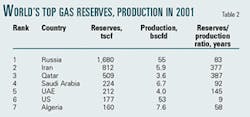

In the late 1970s, total Saudi gas reserves were estimated at 85 tscf, or about 3% of known world gas deposits. In 1980, the kingdom's total gas reserves amounted to 113 tscf, and by 1991 gas reserves in Saudi Aramco fields were estimated at about 179 tscf, while gas reserves in the Neutral Zone shared with Kuwait were estimated at 6 tscf. Table 3 presents historical data on the development of natural gas reserves and gas production in the kingdom. During the last 2 decades, Saudi Arabia's proven reserves of natural gas increased by more than 94%, or an average growth rate of 5 tscf/year.

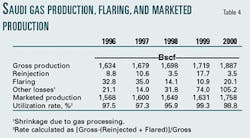

Gas production increased steadily during the last decade to about 2 tscf in 2000, making the kingdom the 10th largest producer worldwide. The ratio of reserves to current production has remained relatively steady at 125-150 years since the mid-1990s.

It is worth mentioning here that all gas produced in the kingdom is consumed domestically, which adds importance to the kingdom as a major world gas consumer as well as producer, in addition to being an exporter of gas liquids. Saudi Arabia's gas utilization rate is currently more than 99%, with flaring confined to limited oil fields where associated gas is not connected to the network, mainly in the Neutral Zone. By comparison, the gas utilization rate was 15% in 1973, 25% in 1978, and 85% in 1985, when the Master Gas System (MGS) was started up.

Many experts believe that the full potential of the kingdom's gas resources remains underexplored. Continuous and active exploration and delineation of gas resources are being maintained to identify the volume and quality of the gas for long-term energy planning. Initial assessments indicate that vast reserves of gas remain to be discovered in many parts of the kingdom. These findings are supported by public-domain information from respected international organizations. The assessments suggest that Saudi Arabia holds one of the largest and most accessible gas reserves in the world. The massive quantities of yet-to-be-discovered gas offer investors the promise of major investment opportunities.

Exploration for dry gas

In general, Saudi exploration for hydrocarbons has been very successful; all gas targets have been met and oil production replaced every year.

The prime objective of current gas exploration is to increase the kingdom's nonassociated gas reserves whose exploitation is not dependent on crude oil production. Large-scale development of nonassociated gas reserves in the kingdom did not start until the early 1980s and continued through 1992. During this time, 30 gas-producing wells were drilled in the Shedgum, Ain Dar, and Uthmaniyah areas of Ghawar field in the Khuff reservoir (a late Permian dolomite-limestone formation about 250 million years old lying 3,700 m below the surface).

Khuff gas became the swing supply of feed gas to the MGS. In other words, as the production of associated gas decreased, Saudi Aramco increased the production of nonassociated gas within capacity limits to maintain the supply of gas to satisfy the local demand.

Activity picked up again in 1995, when an aggressive nonassociated gas reserves development program was embarked upon to further aid economic diversification. The goal set for the program was the complete development of known gas reserves in Ghawar field and the location and development of as many as new fields as could be discovered in the greater Ghawar area.

Discoveries of nonassociated gas in the kingdom continued into the 1990s at a rate of 4 tscf/year. The success ratio in drilling for new oil and gas reserves over the past 5 years was more than 60%, which is much higher than typical worldwide values. During this period, Saudi Aramco has concentrated its efforts on drilling in the deep Khuff zones, in particular on the periphery of Ghawar.

The current exploration work has focused on the development of Khuff reserves in the Haradh and Hawiyah areas. In addition to Khuff gas, reserves from two additional formations below the Khuff are also being developed. These pre-Khuff formations are the Jauf and Unayzah sandstones.

Most of the nonassociated gas reserves (Mazalij, Manjoura, Shaden, Niban, Tinat, Waar, Ghazal, etc.) are located in the deep Khuff reservoir that underlies Ghawar. Discoveries have also been made in new gas fields, namely Wudayhiu, Sham'ah, and Kahlah, in the Eastern Province.

Gas also has been found in the country's extreme northwestern reaches, at Midyan. By the end of 2001, Saudi Aramco had 48 gas drilling rigs in operation; it plans to drill 58 gas wells this year, including 6 delineation wells that will produce gas for supply to the Haradh processing plant.

In March, the company discovered sweet gas from three wells around Ghawar, namely Jufayn-1, Warid-1, and Tukhman-2, with a total combined test production of 33.2 MMscfd.

Gas utilization

MGS

Saudi Aramco's involvement in gas initiatives began in 1975, when it was asked by the Saudi government to design, construct, and operate a system to collect, process, and utilize gas produced in association with crude oil.

The MGS was designed to aid the country's industrial development by providing fuel and feedstock for new petrochemical industries that were a key part of the country's economic diversification. The design capacity of the MGS was consistent with the crude production rates existing or forecasted at that time, namely about 8.5 million b/d. Saudi Aramco installed facilities capable of producing almost 500 MMscfd from the Abqaiq field gas cap to meet peak demand and 60 MMscfd from the Qatif storage reservoir for emergency use withdrawal.

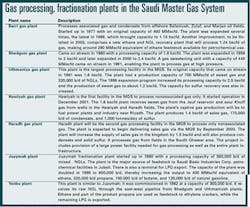

In 1996, Saudi Aramco started a 5-year expansion program of the MGS that currently comprises more than 60 gas-oil separator plants, four processing plants, two NGL fractionation facilities, and the 1,170 km east-west NGL pipeline. A fifth gas plant is being built south of Ghawar at Haradh.

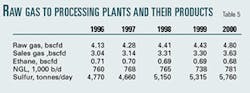

MGS is a state-of-the-art, integrated gas collection, recovery, and processing system that handles in excess of 6 bscfd. Table 5 presents the amount of raw gas processed in the gas plants and the production of sales gas (methane) and NGLs. The large processing facilities at Berri, Shedgum, Uthmaniyah, and Hawiyah treat the gas and recover NGLs. These facilities supply gas to the sales gas distribution grid and NGLs to the downstream fractionation plants at Juaymah and Yanbu.

The box on p. 22 presents brief information on the gas plants and NGL fractionation plants within MGS. More than 85% of the gas comes from Ghawar, but Saudi Aramco also installed a gas compression plant at Safaniyah to collect the output of the offshore Safaniyah and Zulf fields as well.

Sales gas

Currently, the MGS includes associated gas gathering from various oil fields and gas processing plants. After sweetening and recovering sulfur, ethane, and heavier NGLs, sales gas is distributed throughout the Eastern Province via a pipeline network.

Recently, Saudi Aramco completed a new sales gas pipeline network extending the MGS to Riyadh. This will serve three electric power generating stations for Saudi Electricity Co. in the central region of the country. The 800-km pipeline was designed to cater, to a considerable extent, to the demand for natural gas in this region, which is estimated at 740 MMscfd. A second pipeline has been recently built to supply gas to the industrial zone in Riyadh. Work also is under way to deliver about 300 MMscfd of sales gas from Shedgum to Yanbu via a 1,200 km pipeline to be completed by the end of 2003.

Fig. 1 presents the current MGS network of sales gas distribution in the kingdom.

NGLs

NGLs are transported via pipeline to Juaymah and Yanbu for fractionation.

Ethane is consumed in Jubail and Yanbu as petrochemical feedstock, while propane, butane, and natural gasoline are primarily exported. Liquid sulfur is trucked to Berri and exported as prilled sulfur from Jubail.

The existing Abqaiq NGL recovery plant and the Ras Tanura fractionation plant were integrated into the MGS system.

Domestic demand for LPG by petrochemical industries is increasing due to a favorable pricing structure. The volume of NGL production is over 700,000 b/d, of which more than 145,000 b/d is consumed domestically.

Fig. 2 presents the current MGS network for NGL fractionation and its distribution, which extends across the country, from Jubail to Yanbu. The kingdom is the world's largest LPG exporter, with a 30% market share of world seaborne trade in LPG.

Natural gas demand

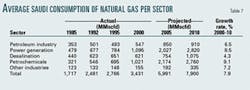

The natural gas share of Saudi Arabia's total hydrocarbon consumption currently accounts for 35%, compared with 29% in 1985.

As shown in Table 6, the natural gas share is expected to reach 51% in 2010, indicating the rapid expansion of gas utilization in various industrial and utilities sectors. Over the last 20 years, local demand for natural gas has grown at an average rate of 5.1%/year to reach 3.43 bscfd in 2000.

This has been encouraged by plentiful gas supply and low prices. (The domestic price of natural gas currently stands at $0.75/MMbtu, up from $0.50/MMbtu prior to 1995.)

Local demand for gas is expected to grow at a rate of 7.5%/year during 2000-10 to reach about 7.9 bscfd. Gas is especially needed in the eastern, central, and western regions of the country, where the population and industry are concentrated.

The current structure of gas consumption shows that about 32% of total gas is consumed in power generation, 30% in petrochemicals manufacture, 18% in seawater desalination, 16% in the petroleum industry (oil and gas operations), and about 5% in other industries (Table 7).

By 2010, petrochemicals manufacture is expected to account for 34% of total gas consumption, equivalent to 2.8 bscfd, at an average growth rate of 9.1%/year. Additional gas production is being encouraged for other industrial establishments and as a replacement for direct oil burning.

However, substantial increases in gas consumption are more likely to be achieved if gas is utilized in large-scale industrial or power generation applications. Until now, however, natural gas has not significantly penetrated the commercial and residential sectors because of the lack of gas transportation and distribution infrastructure.

Power generation

Saudi Electricity Co. (SEC) is Saudi Arabia's electric utility, with majority shares held by the government. The utility is the largest in the Middle East, providing power to more than 3.5 million customers representing more than 80% of the population.

The utility has 21,000 Mw of generating capacity (not including power generated by desalination plants), more than 17,000 km of transmission lines and 200,000 km of distribution lines.

SEC was created in 1999 by merging 10 regional power companies into a single company. A plan to unbundle the SEC into three separate companies specializing in transmission, generation, and distribution is currently being reviewed.

The restructuring of the electricity sector is expected to give private investors increased confidence in the power sector. There are two ways for involving private sector investors in the electricity sector-either by direct sale of the government's shares in different power companies or by the establishment of independent power producers on the basis of build, operate, and own or build, operate, and transfer.

The kingdom's 25-year electrification plan calls for $90 billion in capital investment to boost total generation capacity to 70,000 Mw by 2023. About 52% of this investment will be for generation, 27% for tranmission, and 21% for distribution. Electricity demand growth during the 25-year period will average 4.5%/year.

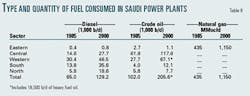

About 66% of the electricity generated in 2000 was fueled by hydrocarbon liquids, either crude oil or diesel. Table 8 presents the type and quantity of fuel used in Saudi power generation in 1985 and 2000. The kingdom consumed more than 200,000 b/d of crude oil to generate electric power. This will gradually be reduced by delivering gas to the central and western regions.

At present, there are 12 gas turbine generating stations throughout the Eastern Province and two major steam turbine generating stations located in Gazlan and Qurayah, with total electrical power generating capacity of about 7,200 Mw. After the completion of the Gazlan-II project in 2003, the total generating capacity for SEC in the Eastern Province will be about 9,600 Mw.

In association with the completion of the Hawiyah gas processing plant this year, a new gas pipeline was built to transmit sales gas to Riyadh for power generation. This has replaced crude oil as fuel for power generation in the central region, which currently has an installed capacity of some 4,500 Mw and 473 Mw of capacity under construction.

Seawater desalination

Saudi Arabia accounts for 21% of world production of desalinated water, with 30 plants built at a total cost exceeding $20 billion, including $4 billion for operation and maintenance.

More than 70% of local water consumption in cities is now secured from desalination plants built along the eastern and western coasts. Several foreign companies have shown interest in investing in the kingdom's water desalination industry, which experts estimate will need an investment of $40 billion over the next 20 years. The drive is led by companies from the US, Japan, and South Korea but also involves local investors.

The average per capita consumption of drinking water in major cities jumped from 120 l./day in 1980 to 315 l./day in 2000. According to the Saline Water Conversion Corp. utility, total domestic (household) consumption will increase from 1.8 billion cu m (bcm) in 2000 to 2.03 bcm in 2004 and 3.1 bcm by 2020. The increase is attributed mainly to rapid development in the industrial and agricultural sectors and to the high rate of population growth. While the production, pumping, and transport of 1 cu m of desalinated water costs the state $1.10, it is sold to consumers at 3.3¢.

About 42% of the desalination plants are powered by liquid fuels, especially those on the Red Sea. The desalination plants produce over 3 million cu m/day of fresh water. Ten of the plants are dual-system, generating 18% of the kingdom's total capacity. While part of the power generated by the desalination plants is used to operate the facilities themselves, the significant excess production is transmitted into the Saudi power grid. In 2001, the maximum load of excess power transmitted to the grid was 3,400 Mw.

Two of the world's largest seawater desalination plants operating on natural gas have been constructed on the eastern coast. One of these plants is in Jubail and the other is in Khobar, with total desalination capacities of 324 million gpd. The plants were constructed to support industrial water requirements as well as municipal water demands of the eastern and central regions. The two plants also generate electricity for the SEC East network, with a combined power generating capacity of 2,770 Mw.

Petrochemicals

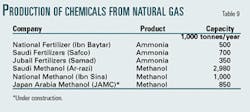

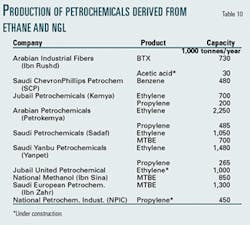

The Saudi petrochemical industry is basically a methane and NGLs-derived industry, and its main products are derivatives of ammonia, methanol, and ethylene.

Tables 9 and 10 present the production of chemicals derived from methane, ethane, and NGLs. The kingdom has a relatively limited production of propylene and aromatics-based petrochemicals, because more than 95% of the basic petrochemicals are derived from methane and NGL feedstocks.

Approximately 10 million tonnes of methane, ethane, butane, and natural gasoline are converted annually into various petrochemicals, fertilizers and plastics. In 2001, about 1 bscfd of methane was consumed in Jubail and about 350 MMscfd equivalent of ethane at Jubail and Yanbu.

The creation of Saudi Basic Chemicals Corp. (Sabic) and its continued growth and development as a world industrial leader is based on these fundamental resources. A total of 25 petrochemical manufacturing plants are operating in the country, and most of the output is directed toward export. The kingdom has experienced the greatest level of petrochemical investment activity in the region, and Sabic is now the largest petrochemicals company in the Middle East. Its recent acquisition of the Dutch chemicals group DSM has moved Sabic from a ranking of the world's 22nd largest petrochemicals firm to the 11th position, and made it the third and fourth-largest producer of polyethylene and polypropylene, respectively (OGJ Online, May 21, 2002).

In the petrochemicals private sector, production of formaldehyde, hexamine, benzene, cyclohexane and other resins became available in the 1990s. The Saudi private sector investments have been concentrated in downstream petrochemical projects that use as feedstocks basic chemicals produced by Sabic.

However, a more substantial effort is under way, with the involvement of private investment in a number of independent basic and derivative chemical projects, especially those based on LPG feedstocks. Given the proprietary nature of the technologies for these chemicals, the future development of the downstream sector will depend heavily on the prices of raw materials, market development, and access to advanced technologies.

Current investments in the Saudi petrochemical sector are heavily concentrated in upstream segments of the petrochemical industry. A move further downstream in the petrochemical chain dilutes the feedstock cost advantage, as the share of feedstock cost in the total production cost decreases. Production costs include overhead, labor, capital, and additional technical support. Conversely, however, a downstream move along the production chain maximizes the added value.

Other uses

Currently, Saudi sales gas is used as fuel in the Eastern Province by three cement plants that began operations during the 1980s, with total production capacity of 9 million tonnes/year of cement and clinker, consuming 100 MMscfd of sales gas.

Sales gas is also made available through a local grid to Saudi Aramco and a few government organizations.

Locally produced LPG, which is contained and distributed in cylinders, currently meets all domestic and commercial gas demand throughout the kingdom.

There have been some plans to build a national gas distribution grid to serve major cities, with priority given to utilities.

Gas Initiative

The Gas Initiative was conceived by Crown Prince Abdullah, deputy premier and commander of the National Guard in 1998, as a major thrust toward industrialization in the kingdom. He initiated the negotiations with the oil giants as he invited the international firms for talks during a visit to the US.

International oil companies have been competing since then for a stake in the Gas Initiative, estimated to require an initial investment of $25 billion. The initiative gives exploration rights in a total area of 440,000 sq km, making it one of the world's largest areas for hydrocarbon investment. The awards mark the biggest advance in the kingdom's efforts to develop its gas reserves since Saudi Arabia unveiled the opening of the energy sector more than 3 years ago. Details of the three core ventures are presented in Table 11.

Gas exploration under the initiative is one component of the project that would be undertaken by IOCs in collaboration with Saudi Aramco. The exploration area will be outside Aramco's exclusive zone.

The second component of the initiative involves the production of gas and power generation for desalination plants. In this phase, the role of the Saudi private sector is to form joint ventures with the consortiums of international oil companies. It is anticipated that the oil majors would set up joint stock companies for attracting private sector capital. The design and implementation of the projects would take at least 3 years. The IOCs will be expected to offer the kingdom new supplies of economically priced power and water as well as sales gas. The gas will be used as a feedstock for the expansion of the petrochemical industry as well as for electric power generation and water desalination.

The general objective of the initiative is to establish strategic partnerships between foreign and Saudi investors and achieve economic prosperity in the kingdom. Such partnerships are expected to develop comprehensive industries, starting with gas exploration and extraction and ending with vital projects including power generation, water desalination, and petrochemicals.

The Gas Initiative and associated projects could create 32,000 jobs over the next 5-7 years. In addition to the $25 billion investment already expected, this initiative could generate an extra $100 billion in investment for related sectors and services, including energy, creating up to 1.6 million jobs in the next 30 years.

The critical activity period for down stream projects connected to the gas initiatives, and the time when the role of the energy services sector will be crucial, is 2003 and 2006. The initiative is not to explore, produce, and only export product; rather, it is to explore, produce, and utilize gas resources within the kingdom.

References

Energy in the Kingdom of Saudi Arabia, proceedings of the 7th Arab Energy Conference, Organization of Arab Petroleum Exporting Countries, Cairo, May 2002.

Juma'ah, A., "Saudi Gas Industry and its Role in Industry Development," presented at the King Fahd University of Petroleum & Minerals Symposium on Saudi Industrial Development during the Last 20 Years, Dhahran, February 2002.

Chabrelie, M., "Natural Gas in the World-2000 Survey," Cedigaz, Paris.

"Gas Goes Strong in Saudi Arabia", Saudi Aramco Dimensions, Spring-Summer 2000, p. 34.

Facts and Figures-2000, Saudi Aramco, Dhahran (www.saudiaramco.com.sa).

Al-Harazy, M., "Overview of the Saudi Gas Industry," presented at the Conference for Gas Utilization for Power & Industrial Development, Jubail, April 1995.

Al-Mady, M., "Natural Gas in Saudi Arabia: Coherent Industrialization Development," proceedings of World Energy, Vol. 2, 1999.

Aitani, A. "Current Portfolio of Saudi Petrochemicals," Oil & Gas European Magazine, September 2001, p. 15.

The author

Abdullah M. Aitani is a research scientist at the Center for Refining & Petrochemicals of the Research Institute, King Fahd University of Petroleum & Minerals, Dhahran. He holds a BS in chemical engineering from KFUPM and a PhD in industrial chemistry from City University, London. His research interests are applied catalysis, gas utilization, and refining process applications.