Canadian Offshore: Arctic gasline rivals advance; exploration continues

TransCanada PipeLines Ltd. and its partners say they are ready to submit a proposal to Alaska producers to build an $8 billion natural gas pipeline from Prudhoe Bay, Alas., to Gordondale, in northwest Alberta, where it would tie into TransCanada's Nova pipeline system.

The 42-in. or 48-in. line would have an initial capacity of 2.5 bcfd. It would cost $7 billion to get the gas to Alberta and an additional $1 billion to expand pipeline facilities in Alberta.

CEO Hal Kvisle says TransCanada would extract liquids before shipping the gas from Alberta to markets in the US Midwest and making it available for petrochemical development. Partners in the proposal include Foothills Pipelines Ltd., which already has permits for an Alaska Highway line, and Westcoast Energy Inc. Six US pipeline companies also are partners in the Alaska Highway proposal.

Prospects for such a pipeline from Canada's Arctic to southern markets are better now than they have been in several decades, with a majority of northern residents now supporting development.

But an estimated $3 billion (Can.) proposal to ship 5.8 tcf of proven reserves in the Mackenzie Delta to southern markets still faces numerous hurdles.

They include economic, technical, and social challenges and the possibility that one project under study to move Alaskan gas south could strand the Mackenzie Delta reserves. Proponents of a Mackenzie line argue that it would be considerably cheaper than Alaskan alternatives (OGJ Jan. 7, 2002, p. 7 News letter).

And there is now solid support among aboriginal groups in the Northwest Territories (NWT) for the economic benefits of resource and pipeline development. That is a radical change since 1977 when a majority were opposed and a judicial inquiry panel recommended a 10-year moratorium on pipeline construction to settle land claims issues and address social and environmental concerns.

Momentum for pipeline development from the Arctic also is being fuelled by strong long-term growth forecasts for natural gas demand, particularly in US markets.

A producer group headed by Imperial Oil Ltd., which holds the anchor reserves, has been studying a development concept for a Mackenzie Delta pipeline since February 2000. It says it is beginning the $200-250 million (Can.) project definition phase and said it will begin preparing regulatory applications for filing in 2003. Other members of the producer group are Conoco Canada Ltd.-which acquired Gulf Canada-Shell Canada Ltd., and ExxonMobil Canada.

Gas sources

The project would be based on reserves totaling 5.8 tcf in three Mackenzie Delta area fields discovered in the 1970s.

Taglu, the largest field-with 3 tcf of recoverable reserves-was discovered in 1971 by Imperial, which fully owns and operates it. Parsons Lake field, which Gulf Canada discovered in 1972, has 1.8 tcf of reserves. Gulf (now Conoco and soon to be a subsidiary of ConocoPhillips) has a 75% interest and ExxonMobil Canada, 25%. The remaining 1 tcf of reserves are in Niglintgak field, which Shell Canada discovered in 1973 and where it holds 100% interest.

The National Energy Board estimates resource potential in the Mackenzie Valley-Beaufort Sea area at 64 tcf, with 9 tcf discovered and 55 tcf undiscovered. A more recent estimate, released last fall by the Canadian Gas Potential Committee, says 9 tcf of nominal market gas has been discovered, and there is an undiscovered potential of 21 tcf of nominal market gas. The nominal designation indicates that the recoverable size of the estimated resource is subject to such factors as economics and availability of infrastructure.

Concept conditions

K.C. Williams, senior vice-president of Imperial and a spokesman for the producer group, says the pipeline concept under study depends not only on solving technical and economic challenges, which in the past were viewed as major hurdles to be overcome, but socio-economic and regulatory challenges, including support of aboriginal peoples in the north (see associated article p. 67).

Williams says there are a number of key assumptions in the pipeline study:

- The development of Canadian onshore gas only.

- The use of proven technology and centralized facilities with concurrent production at the three fields. Initial production from the fields would be 800 MMcfd to 1 bcfd, with 11,000 b/d of condensate.

- A gas-gathering pipeline to the Inuvik area and gas processing near Inuvik to remove water and dehydrate the gas.

- The use of existing rights-of-way and common corridors to minimize the environmental footprint.

The concept assumes a single pipeline from the Mackenzie Delta via Imperial's existing infrastructure at Norman Wells, NWT, where it operates an oil field, and a gas pipeline route following the existing right-of-way south of Norman Wells through the Mackenzie Valley to mainline connections in northern Alberta. The existing right-of-way now serves a crude oil pipeline from Norman Wells to Alberta operated by Enbridge Inc.

The pipeline would be accessible to other producers at commercial tariffs and terms, and would be flexible for future expansion or extension.

Williams said that, based on progress to date with the feasibility study, the producer group is selectively advancing activities such as conceptual engineering and gathering of baseline biophysical data.

He added that, before proceeding to the regulatory and project definition phase, the group would complete other aspects of the feasibility study, such as negotiation of necessary commercial agreements. The group will then begin work on the development of regulatory applications.

Pipeline support

The producer group took a major step forward Oct. 15 when it signed a memorandum of understanding (MOU) with the Mackenzie Valley Aboriginal Pipeline Corp., (APC) representing most of the aboriginal peoples of the NWT. Some members of the Deh Cho First Nation said they favored development but would not sign an agreement until their land claims issues are settled. Producers are continuing to work with them.

Williams said the MOU provides a framework for the parties to move forward on the economic and timely development of a Mackenzie Valley pipeline and lays the groundwork for a business relationship beneficial to the peoples of the north and to resource developers.

The memorandum outlines principles to address-such matters as education, training, employment and business opportunities, pipeline ownership, route selection, land access, support through the regulatory process, environmental assessments, and abandonment.

Under the MOU, the APC would have the right to acquire a one-third interest in the pipeline. Gas volumes to support the APC share of capacity would be sourced from other existing Mackenzie Delta and Mackenzie Valley discoveries or from new exploration activity currently under way.

Pipeline access for additional gas would be provided to other producers (see table) at commercial rates and terms that are subject to National Energy Board review and approval.

The proposed pipeline and the terms of the MOU do not apply to a natural gas transportation system that includes Alaska.

Nellie J. Cournoyea, chair of the APC and a former NWT premier, once opposed the pipeline but is now a strong advocate. Cournoyea praised aboriginal leaders for having achieved a common vision to support the initial agreement and producer group companies for their role in negotiations.

She called the MOU "an unprecedented demonstration of solidarity among northern leaders where development discussions in the past have often fragmented into competition for benefits among communities and groups."

Cournoyea called on Ottawa to provide financial support-not a subsidy-for the aboriginal group to assume its stake in the project. She suggested Ottawa could sell its stake in Hibernia oilfield offshore Newfoundland to help provide assistance and noted that the East Coast project received federal assistance when it was developed. She said APC needs $30-$50 million for the pipeline project definition stage as well as up to $1 billion in financial support.

The native leader says northerners and aboriginal people must work to define the environmental issues related to a pipeline.

"Definition of the environmental issues is a job for northerners, not for southern or international environmentalists who make a comfortable living on the expresso and gore-tex circuit opposing development," she said.

Cournoyea said there will come a time when the costs and risks of connecting Alaskan gas will become attractive, but a Mackenzie Valley pipeline to bring northern Canadian reserves into southern markets is a valuable intermediate step to provide supply flexibility in the medium term with less market risk, less supply risk, less financial risk, and less technological risk.

She said Mackenzie-Beaufort gas offers security, a reliable continental source of supply, and resource diversification, and it offers them at a moderate cost and risk at a time of great uncertainty.

The NWT government is also in support of a Mackenzie pipeline, and Premier Stephen Kakfwi, who opposed the original pipeline in the 1970s, is now one of its strongest advocates.

Kakfwi said the NWT is now ready for a pipeline that would provide jobs and opportunities for economic growth.

"We want it and we're going to get the benefit we want out of it. We can manage it to obtain the maximum benefit for ourselves. We won't be marginalized," he says.

While a pipeline project now has broad support in the NWT, it is still one of several competing proposals to move gas from the Arctic.

Competing pipelines

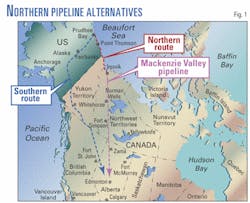

A producer group with 35 tcf of reserves at Prudhoe Bay on the Alaskan North Slope is studying several pipeline options to move gas to southern markets. Members of the group are BP PLC, ExxonMobil Corp., and ConocoPhillips, which is in the process of merging. Alaska-also a significant stakeholder- and the Yukon government support the southern pipeline route.

The 2,139-mile southern route would run south through Alaska and the Yukon to pipeline connections in northeast British Columbia. It would follow the existing right-of-way of the Alaska Natural Gas Transmission System (ANGTS), which has had regulatory approvals in place since 1977 from the US and Canada. Southern prebuild portions of the line were built in western Canada, but the project was never completed. Most observers expect that there would have to be some refreshment of regulatory approvals, which are several decades old and date back to the last stalled go-round on Arctic pipeline development.

A shorter, northern pipeline route would run 1,803-miles south from Prudhoe Bay via the Beaufort Sea to Inuvik in the Mackenzie Delta and south from there to connections in northwest Alberta. Alaska has passed legislation that would block a Beaufort Sea pipeline and has asked the US Congress for tax incentives and a streamlined regulatory process to assist the southern pipeline option. It is actively seeking congressional support for the southern option.

Preliminary cost estimates of a northern route are $15.1 billion and the southern route about $17.2 billion. The Alaskan producer group said last fall that neither route is economic, but it is continuing to seek ways to make the project feasible.

Jim Farnsworth, vice-president of North American Exploration for BP, said recently it is technically feasible to complete a large diameter line from Alaska by fourth quarter 2008-if it can be proved economically feasible.

Farnsworth said a pipeline could move 4-5 bcfd and could be easily expanded with additional compression to 6 bcfd if necessitated by exploration success or increased recovery from Prudhoe Bay. The line would be a 48-52 in. buried line with a pressure of 2,500-3,000 psi.

The BP executive said the producer group is still studying both routes. He said there would be an obvious synergy on the northern route with the Mack enzie Delta line under consideration by the Canadian producer group.

The complex pipeline debate has been given another twist by the Conoco-Phillips merger. Conoco is a member of the Mackenzie Delta group and a substantial acreage holder through its acquisition of Gulf Canada in 2001. Phillips, on the other hand, is a member of the Alaskan producer group. Archie Dunham, who will chair the merged company, has been a supporter in the past of the Mackenzie Valley pipeline.

Six US and three Canadian energy companies announced an MOU in November to develop a specific proposal for a pipeline from Prudhoe Bay via the southern route to parallel the Alaska Highway. They would present the proposal to the Alaskan producer group.

US firms include units of Williams Cos. Inc., Duke Energy Corp., Sempra Energy International, Enron Corp., PG&E Corp., and El Paso Natural Gas Co. Canadian companies are TransCanada PipeLines Ltd., Westcoast Energy Inc., and Foothills Pipe Lines Ltd. They have been partners in ANGTS since its inception in the 1970s.

The MOU sets principles for companies to rejoin in the Alaskan partnership to build the Alaskan part of the line to northern Alberta. A key element of the MOU is that current and re-enlisting parties are committed to eliminating historic and other commercial barriers to the project.

Enbridge says northern

Enbridge Inc., which operates the crude oil pipeline from Norman Wells, said the producer groups who own the reserves are the ones who will make the final decisions on pipeline options.

Wayne Sartore, Enbridge vice-president of Northern pipeline development, said some politicians and some media have translated the Mackenzie line into a project that's already a fait accompli.

"Hold on. This is working in an area that we've worked in for almost 20 years," Sartore said.

"The risks are higher in terms of construction and capital costs. The producers that are going to backstop this thing in one shape or another, depending on how commercial arrangements work, need to be able to calculate positive and very robust economics. You have to cover the life cycle of this particular area and say that it is going to result in a positive return."

He said producers are looking at a $3-3.50/MMcf of future gas price as providing "skinny" but reasonably positive economics for a pipeline. He says anything under $3 runs the risk of really carving into netbacks.

In addition to the core producer group on the Canadian side, Sartore notes, there is a large explorers group including such companies as Anadarko Canada Corp., Alberta Energy Co., Chevron Canada, Devon Energy Corp., Petro-Canada, and BP who will be active in the Mackenzie Delta (see table).

He says this group has captured the Delta acreage but does not have the development of the established producer group led by Imperial.

Sartore believes there is an application in the offing for a Mackenzie line, and it could be filed by midyear. At the moment, he says, the momentum seems to lie with an all-Canadian project.

"The fundamentals are absolutely in place today for a northern pipeline. That's the difference from 25 years ago. This time almost everything is leaning north," Sartore said.

"North American demand is creating a need for frontier gas from Alaska and the Delta. We all believe it will come, and there are tremendous social and political issues to this. The technology doesn't bother me at all."

Ken Vollman, chairman of Canada's NEB, said recently that the regulator is preparing to process an application and is also working with agencies in the NWT and Yukon to streamline and coordinate the regulatory process. He said the board is looking at a 2-year time frame to process an application.

Sartore says Enbridge is in touch with the players in the Arctic pipeline debate and the company has made a proposal to the Alaskan group for a pipeline alternative, which he says they are considering.

"Our job is to run pipelines. We want an invitation to the dance. There's no guarantee we'll get one and there's no guarantee we'll accept it," he says.

The Enbridge executive says his company has proposed a measured approach to pipeline development to the Alaskan group.

Sartore says a 52-in. line from Alaska is a "pretty difficult" project but is technically feasible. But he said concerns include the weight of the steel, the size of the equipment needed, and the fact that most of the steel would have to be sourced offshore.

"We have suggested building two sequential 36-in. lines using the same right-of-way with capacities of 2.5-3 bcfd. You would end up with the same volume capability as a 52-in. line," Sartore says.

"It is a bit more expensive, but there are savings on contractors, steel at a better price, and there would be more use of northern labor. They are studying this as a way to enhance project economics and also to look at a "made in North America" solution. Sourcing much more pipe in North America would be a positive thing to do."

Continued exploration

While the Arctic pipeline debate continues, companies in the Mackenzie Delta, meanwhile, are preparing to rekindle exploration efforts. The NEB estimates the total resource in the Delta-Beaufort Sea region at more than 64 tcf.

The first wildcat well in several decades was drilled in the Delta last winter by Petro-Canada and then-partner Anderson Exploration Ltd., which was taken over in 2001 by Devon Energy. Devon gained about 2 million acres in northern Canada with the Anderson acquisition, including lands in the Northwest Territories, Mackenzie Delta-Beaufort Sea, and the Yukon.

The Kurk M-15 test about 93 miles north of Inuvik encountered a number of sand zones with gas shows. It was drilled to 10,171 ft, which is 1,312 ft deeper than the original target depth.

Graeme Phipps, Petro-Canada vice-president of exploration and international operations, says gas-saturated sands encountered by drilling were confirmed by logs and are now safely behind pipe. Based on data evaluation, the company will test the zones this winter to determine reserve potential and productivity.

Phipps says the drilling effort in the Delta will gain momentum in the next several years, with industry spending commitments of more than $650 million (Can.) on the books, which would equate to about 22 wells in the region.

There are also about 20 seismic programs scheduled in the region for this winter as companies scout drilling locations.

Exploration plans for the region got a major boost in an August 2000 rights sale with successful bids of more than $467 million for 9 of 10 parcels offered. The largest bid was $81.8 million for 180,744 acres bid by the Petro-Canada-Anderson Exploration partnership. Anderson also participated in several other individual bids and with Petro-Canada.

Other successful bidders included Shell Canada, Amoco Canada, Burlington Resources Canada Energy Ltd., Chev ron Canada, and Anadarko Canada. Companies have been conducting extensive seismic work on the acquired acreage.

The Department of Indian and Northern Affairs planned a new call for nominations Dec. 17, 2001, and has scheduled another tentative call for bids this month.

Petro-Canada and Devon are planning three tests in the Delta this winter in the 10,000-ft range.

The Kurk M15 is the first test in a multiwell drilling program Petro-Canada and its partner plan. Petro-Canada holds about 1 million gross acres in the region, and shot more than 270 sq miles of 3D seismic last winter to provide data for future drilling operations.

Phipps said other operators are busy with intensive 2D and 3D seismic programs in preparation for drilling. He said Petro-Canada plans three to four wells per year, and activity by other companies, once drilling locations are selected, could increase activity level up to 10 wells per year in the short, 3-month winter drilling season.

Companies are expected to increase exploration with the probability of a Mackenzie pipeline. Phipps said companies have only about 3 years to get ready for a pipeline, prove up additional gas, and nominate to influence the size of a pipeline.

Phipps says he believes most of the major discoveries in the Mackenzie Delta-Beaufort Sea region have already been made, and his company is targeting prospects in the 1/2-1 tcf range.

The Petro-Canada executive says explorers face a number of operational challenges in the Arctic environment:

- Seismic costs are three to five times higher than in Alberta, and drilling costs, five to six times higher.

- A limited drilling season, the presence of permafrost and gas hydrates, quality of seismic shooting through ice, and overpressured formations.

- The logistics of working 1,400 miles north of Alberta's northern provincial boundary and in temperatures -30° to -40° C.

- Meeting the concerns of a large number of stakeholders, from governments to aboriginal and environmental groups.